US Loses Last Top Credit Rating: What History Tells Us After the Downgrade and How Markets Will React?

On May 17th,The United States has been stripped of its last top credit rating by Moody’s Ratings, a move that underscores growing concerns about the nation’s fiscal health. This downgrade reflects dee

On May 17th,The United States has been stripped of its last top credit rating by Moody’s Ratings, a move that underscores growing concerns about the nation’s fiscal health.

This downgrade reflects deepening worries that ballooning debt and deficits will erode America’s status as the preeminent destination for global capital and increase the government’s borrowing costs.

The Downgrade: A Blow to US Fiscal Credibility

On Friday, Moody’s lowered the US credit score to Aa1 from Aaa, joining Fitch Ratings and S&P Global Ratings in grading the world’s largest economy below the top, triple-A position. This one-notch cut comes more than a year after Moody’s shifted its outlook on the US rating to negative. The credit assessor now maintains a stable outlook.

Moody’s pointed to a decline in fiscal metrics as the primary driver of the downgrade. "While we recognize the US’ significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics," the agency stated. Successive administrations and Congress were blamed for swelling budget deficits showing little sign of abating. The federal budget deficit currently stands near $2 trillion annually, or over 6% of gross domestic product (GDP). This is worsened by a weaker US economy amid a global tariff war, which typically increases government spending as economic activity slows.

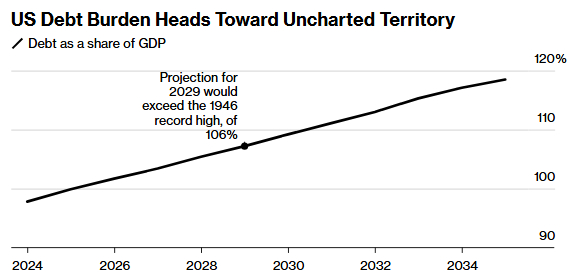

The US debt has already surpassed the size of its economy. Rising interest rates in recent years have further escalated debt servicing costs. Moody’s projects federal deficits to widen to nearly 9% of GDP by 2035, up from 6.4% in 2024, fueled by higher interest payments, growing entitlement spending, and stagnant revenue generation.

Immediate market reactions were notable: Treasury yields on the 10-year note climbed to 4.49%, while an exchange-traded fund tracking the S&P 500 dropped 0.6% in post-market trading. Tracy Chen, a portfolio manager at Brandywine Global Investment Management, warned, "The downgrade may indicate that investors will demand higher yields on Treasuries," potentially challenging the haven status of US assets.

The White House dismissed the downgrade as politically motivated. Steven Cheung, a spokesman for President Donald Trump, criticized Moody’s Analytics economist Mark Zandi on social media, though Moody’s Ratings operates independently from its analytics arm.

Historical Context: A Pattern of Fiscal Erosion

This downgrade is not a standalone event but part of a broader trend. Moody’s had signaled potential trouble in November 2023, when it lowered the US rating outlook to negative while retaining the Aaa rating. Typically, such a shift precedes a rating action within 12 to 18 months.

Fitch Ratings downgraded the US to AA+ in August 2023, citing political brinkmanship over the debt ceiling that nearly triggered a default. S&P Global Ratings took the first major step in 2011, stripping the US of its AAA rating amid fiscal concerns, a move met with sharp Treasury criticism at the time. These actions highlight a consistent erosion of fiscal discipline.

According to the Congressional Budget Office (CBO), US debt is projected to exceed post-World War II records, reaching 107% of GDP by 2029. This forecast excludes the impact of a proposed GOP tax cut, which could add trillions to the debt over the next decade. Long-term pressures from Social Security and Medicare spending, driven by an aging population, combined with elevated interest rates, further compound the challenge.

Wall Street’s Reaction: Caution Amid Uncertainty

Wall Street responded swiftly to the downgrade, with US stocks declining and Treasury yields rising. The Invesco QQQ Trust Series 1 ETF dropped 1.3% on Friday. Treasury futures hit session lows, reflecting heightened market sensitivity.

US government debt may come under more pressure this week after the credit ratings agency Moody’s stripped the US of its top-notch triple-A rating.

“Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher. The US’s fiscal performance is likely to deteriorate relative to its own past and compared with other highly rated sovereigns.”

The US treasury secretary, Scott Bessent, tried to brush the downgrade aside on Sunday, telling NBC’s Meet the Press show: “Moody’s is a lagging indicator.”

Stock markets fell heavily in 2011 after S&P became the first big credit agency to strip the US of its credit rating, with the S&P 500 index dropping more than 6% the next trading day.

Markets also fell in 2023 when Fitch lowered its rating on the US by one notch, from triple-A to AA+.

This time, the IG market analyst Tony Sycamore reported there were “only minor risk aversion via IG’s weekend markets, with gold trading 0.27% higher at $3210 and Nasdaq futures down -0.38%” after Moody’s announcement.

The downgrade could have far-reaching effects on the U.S. economy beyond the immediate reaction in financial markets. If the government faces higher borrowing costs, this could lead to a general increase in interest rates across the economy. For consumers, this might mean higher rates on mortgages, making home-ownership less affordable and potentially leading to a slowdown in the housing market. Higher car loan rates could reduce auto sales, impacting the automotive industry and related sectors.

Credit card interest rates might also rise, increasing the cost of consumer debt and potentially leading to higher default rates. Businesses could face higher costs to borrow for investment or operations, which might lead to reduced capital expenditures, slower expansion, and potentially job losses.

Additionally, the downgrade could weaken the U.S. dollar against other currencies. While this might make U.S. exports more competitive, boosting industries like manufacturing and agriculture, it could also make imports more expensive. This could lead to higher prices for goods and services, potentially fueling inflation. The psychological impact of the downgrade should not be underestimated.

A loss of confidence in the U.S. economy could lead to reduced investment and spending, further slowing economic growth. This could create a vicious cycle, where reduced economic activity leads to lower tax revenues, exacerbating the fiscal challenges that led to the downgrade in the first place. Policymakers will need to address these concerns to restore confidence and stabilize the economy.

A Call for Fiscal Prudence

Moody’s downgrade marks a critical juncture, spotlighting the US’s fiscal vulnerabilities. While immediate market reactions have been tempered, the long-term risks—higher borrowing costs, a weaker dollar, and less attractive equities—loom large. Lawmakers’ ongoing push for a tax-and-spending bill, estimated at $3.8 trillion over a decade by the Joint Committee on Taxation, faces resistance, as seen in a key House committee’s failure to advance it due to cost concerns.

US Treasury Secretary Scott Bessent has warned of an "unsustainable trajectory," emphasizing the need to avert a credit crisis. Yet, optimism persists in some quarters. Joseph Lavorgna, SMBC Nikko Securities chief US economist, argued the downgrade’s timing is "very strange" given the US’s growth and productivity advantages.

Ultimately, this downgrade serves as a stark reminder of the need for fiscal responsibility. Whether it catalyzes action or merely adds to mounting concerns depends on Washington’s next steps.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.