Tesla Q2 Earnings Report: Margins, Robotaxi and Optimus

Tesla is set to release its Q2 earnings after the U.S. market closes on July 23, officially opening the earnings season for the “Magnificent Seven.”This year has been anything but smooth for Tesla, wi

Tesla is set to release its Q2 earnings after the U.S. market closes on July 23, officially opening the earnings season for the “Magnificent Seven.”

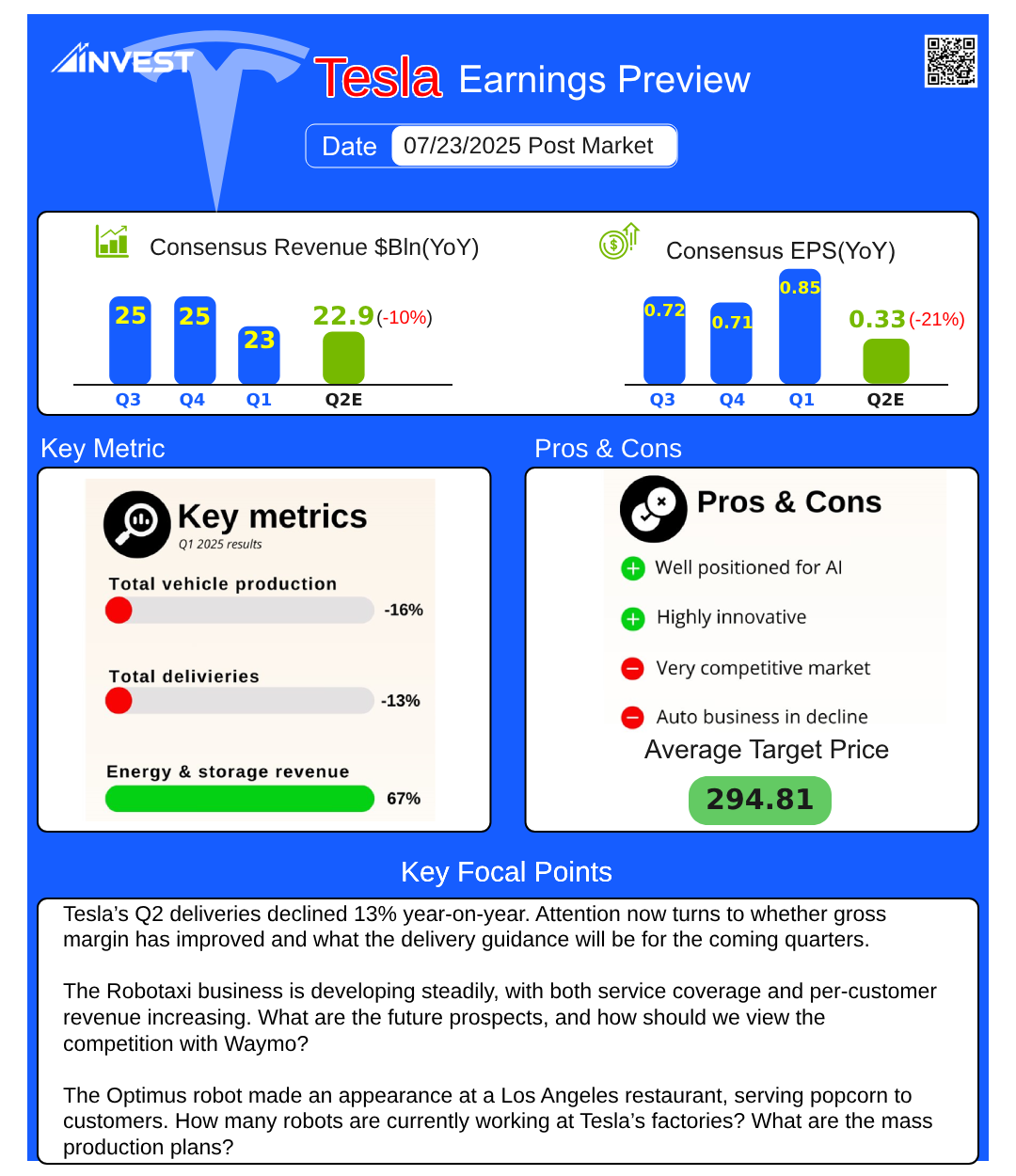

This year has been anything but smooth for Tesla, with the stock down 12% year-to-date—the weakest performer among the seven tech giants. Market estimates project Tesla’s Q2 revenue at $22.9 billion, a 10% year-over-year decline, and adjusted earnings per share (EPS) at $0.43, down nearly 20% from a year ago.

The most critical area of focus, of course, is Tesla’s core vehicle business. Due to intensified competition and Elon Musk’s tarnished public image, Tesla delivered 384,100 vehicles in Q2, down 13.5% year-on-year. While delivery figures are already known, investors will closely watch whether Tesla’s gross margin has improved, and how the company guides deliveries for the coming quarters.

Another headwind is the expiration of EV tax credits. With the passing of the “OBBB Act,” the U.S. will end its 17-year electric vehicle tax credit program on September 30. Tesla’s highly profitable carbon credit revenue—effectively a 100% margin income stream—will disappear.

Next, attention turns to Tesla’s two major growth engines: Robotaxi and the Optimus robot. Compared to the increasingly competitive EV market, these segments offer far more imagination and are a key reason behind Tesla’s premium valuation.

On June 22, Tesla officially launched its Robotaxi service in Austin, Texas, initially charging $4.20 per ride before expanding the service area and raising the fare to $6.90. Musk recently announced plans to expand the Robotaxi service to the San Francisco Bay Area in the next two months. As self-driving technology matures, it could significantly boost the commercial viability of Tesla’s Full Self-Driving (FSD) software.

However, Robotaxi faces fierce competition. Alphabet’s Waymo already leads Tesla in both technical maturity and commercialization. In China, competitors like Baidu’s “Apollo Go” are also eyeing the market aggressively.

Now, let’s look at the Optimus robot. On July 21, Tesla’s first restaurant opened in Los Angeles, where Optimus was seen distributing popcorn to customers—evidence that the robot can perform real tasks.

Still, serving snacks and working in a factory are vastly different. Musk once claimed that thousands of Optimus robots would be deployed in Tesla factories by the end of 2025. But Chris Walti, Tesla’s former robotics lead, has publicly stated that humanoid robots like Optimus are not suitable for factory environments. Who’s right? The earnings call may offer clues.

Turning to other segments, there are two areas worth watching: affordable vehicles and energy storage.

Musk has previously said Tesla plans to produce a budget model priced around $30,000 using existing production lines. However, this has been repeatedly delayed. As of now, Tesla has not released any renderings of the new model. Investors will look for updates on this during the earnings call.

Energy storage has been Tesla’s fastest-growing segment, but Megapack battery deployments have declined for two consecutive quarters. The energy business faces two major challenges. First, rising U.S. tariffs on imported batteries and components could hurt project economics. Second, policy uncertainty looms, as the “OBBB Act” has sharply cut clean energy subsidies. Under current conditions, it’s unlikely energy storage will return to its previous high growth trajectory.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.