Intel's profits have been swallowed up, and the OEM business has a big problem.

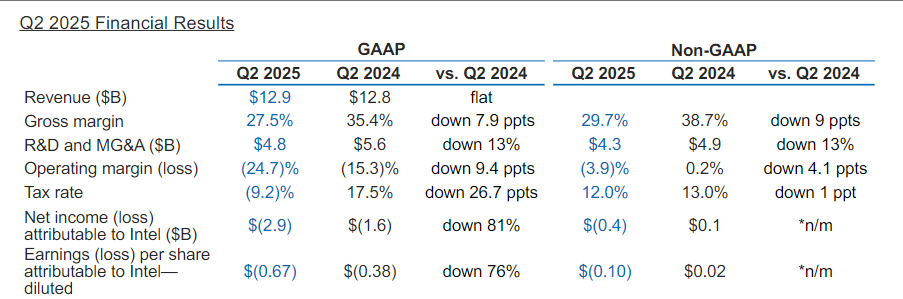

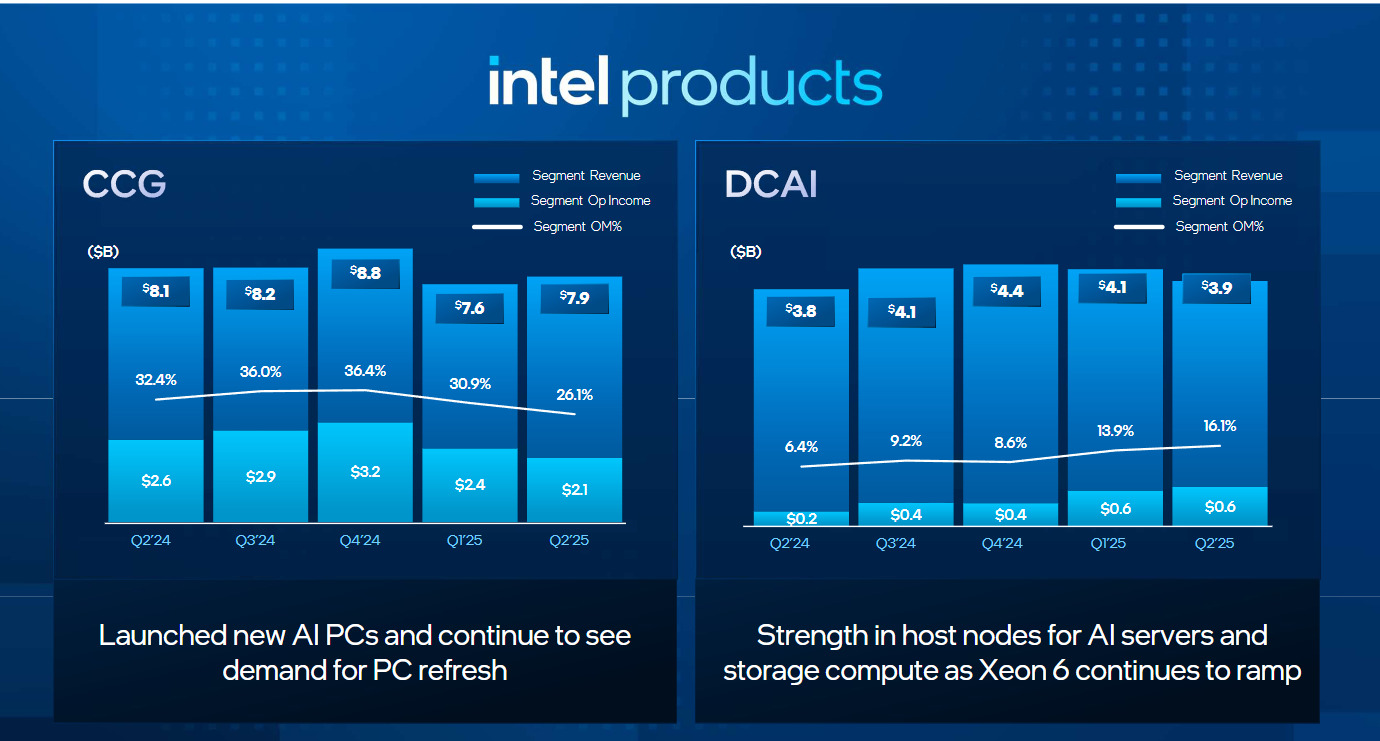

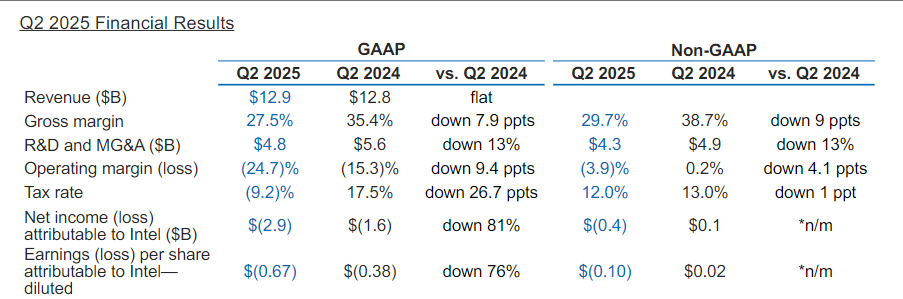

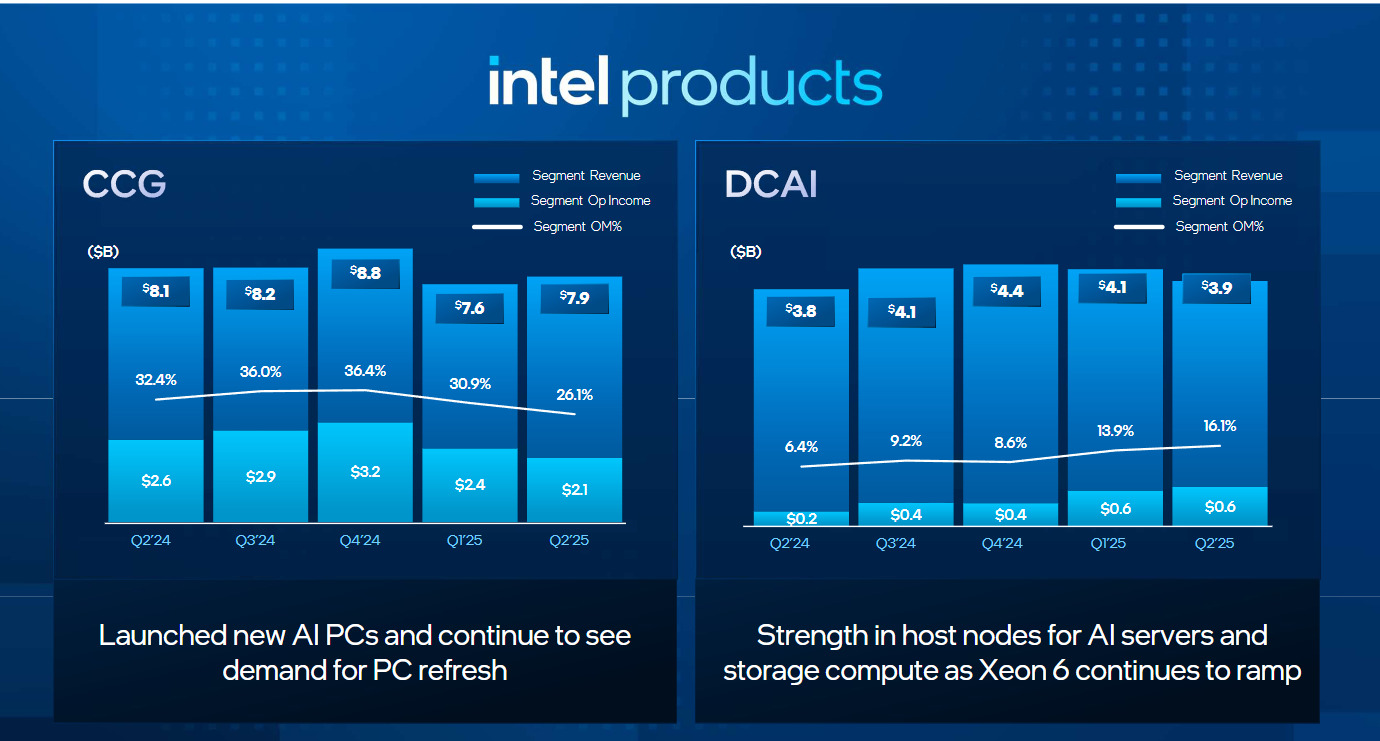

On July 24, Intel announced a disappointing financial report.Data shows that Intel's revenue of US$12.9 billion in the second quarter was bright on the surface, but it was difficult to hide the dazzling reality of a net loss of US$2.9 billion-which is equivalent to a loss of US$0.22 for every US$1 earned.Although data center and AI business revenue of US$3.9 billion exceeded expectations, compared with NVIDIA's data center revenue exceeding US$18 billion in the same period, Intel's market share is certain to shrink.What is even more serious is that the gross profit margin has shrunk to 30%, which is not only dwarfed by competitor Nvidia's gross profit margin of more than 70%, but even 20 percentage points lower than its own historical level, exposing the dual imbalance between product mix and cost structure.

Intel's profits have been swallowed up, and the OEM business has a big problem.

Behind the division's $4.4 billion in revenue was an operating loss of $3.17 billion, equivalent to a loss of $0.72 for every $1 in revenue.This unsustainable business model stems from two core contradictions: First, the limited production capacity of the 7-nanometer process led to a month-on-month decline in OEM revenue expectations in the third quarter; second, the former management's aggressive strategy of "building factories first and then attracting investment" led to insufficient utilization of the factory and high depreciation costs.New CEO Chen Liwu bluntly said on a conference call: "In the past few years, the company has invested too much and too early-but there is not enough demand support."

Faced with losses, Intel is actively saving itself, and Chen Liwu's disruptive reforms have been fully rolled out.

First, he completely abandoned his predecessor's global expansion plan and cancelled the US$32 billion wafer fab in Magdeburg, Germany, and the Polish test facility, projects once known as the "cornerstone of European chip autonomy."At the same time, it slowed down the construction of a $20 billion factory in Ohio and moved its Costa Rican packaging business to Asia.Its new investment philosophy is extremely cold: "There are no more blank checks, every expenditure must be economically reasonable."Even key 14A advanced process technologies need to wait for "confirmed customer orders" before they can be put into production, marking Intel's fundamental shift from technology-oriented to customer-oriented.

Secondly, Intel began to make drastic cuts in layoffs, reduce costs and increase efficiency.The company confirmed it would lay off 15% of its workforce and plans to reduce its total workforce by more than 20% from the end of the second quarter to approximately 75,000 by the end of the year.It aims to achieve the goal of reducing operating expenses to US$17 billion in 2025.The company said people optimization will make the organizational structure "flatter and more agile."In line with the goal of reducing operating expenses from US$17 billion in 2025 to US$16 billion in 2026, Intel is undergoing a financial downsizing unseen in a decade.

Finally, Chen Liwu announced that he would find new growth points on the technical route.Take advantage of the return of Hyper-Threading Technology (SMT) to rectify the technical roadmap.Chen Liwu admitted that abandoning SMT resulted in a competitive disadvantage and is now re-enabled in Granite Rapids data center processors, aiming to improve the efficiency of each core.At the same time, the strategy focuses on the fields of AI reasoning and intelligent agents, rather than comprehensively benchmarking Nvidia's AI training chips-the latter has been internally assessed by Intel as a "difficult market to turn over."This strategy of doing something and not doing something reflects the new management's clear understanding of its own capabilities.

Although it actively saved itself, the financial report that fell short of expectations still pushed market confidence into the abyss-Intel's share price fell more than 4% in late trading.Investors 'doubts are concentrated on three points: First, the profit guidance for breakeven in the third quarter was significantly lower than the market expectation of 4 cents per share; second, there are still doubts about whether the OEM business can attract external customers after it is operated independently; third, although the 18A process technology is emphasized to have "reasonable returns", its main customer is still Intel itself, and the scale of external orders is limited.