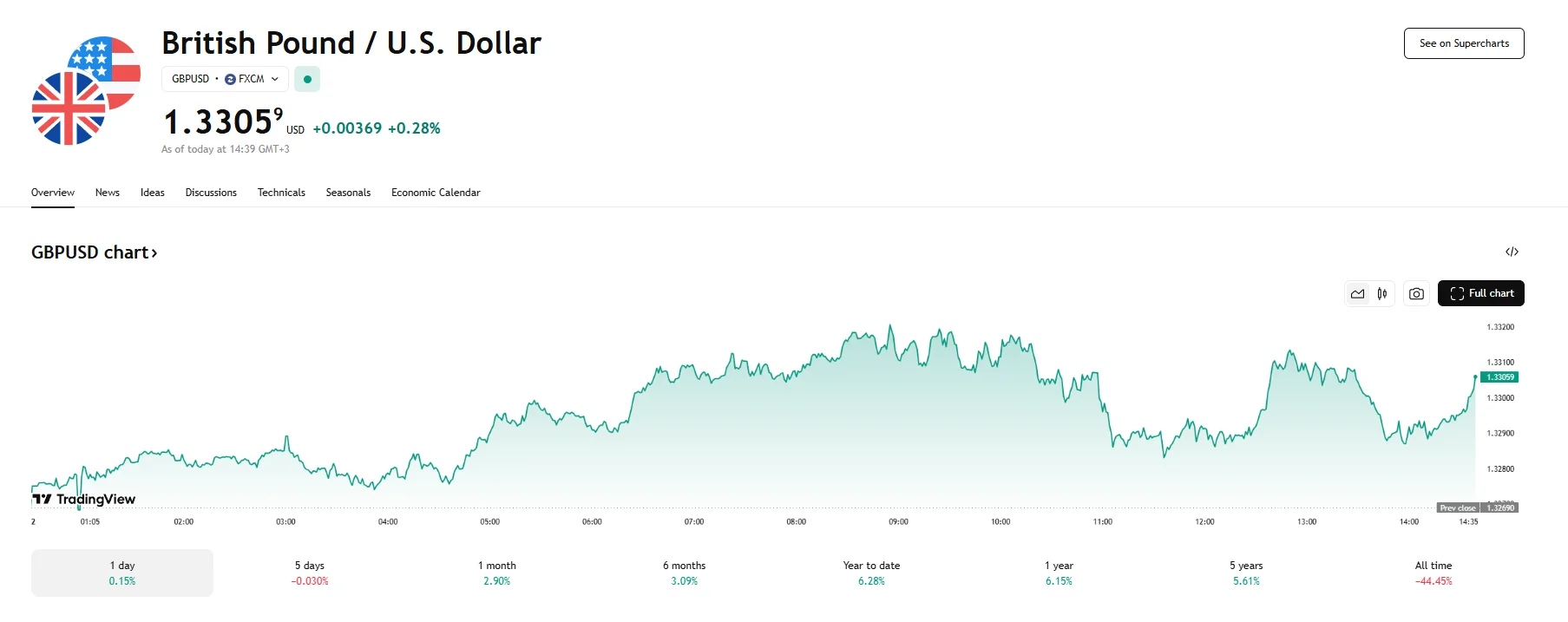

GBP/USD Hits 1.3305 as Dollar Index Retreats Below 100 GBP/USD Hits 1.3305 as Dollar Index Retreats Below 100

Key Moments:The Pound Sterling rebounded 0.28% to 1.3305 against the US Dollar.The Federal Reserve is expected to hold interest rates steady, while a Bank of England rate cut is anticipated next week.

Key Moments:

- The Pound Sterling rebounded 0.28% to 1.3305 against the US Dollar.

- The Federal Reserve is expected to hold interest rates steady, while a Bank of England rate cut is anticipated next week.

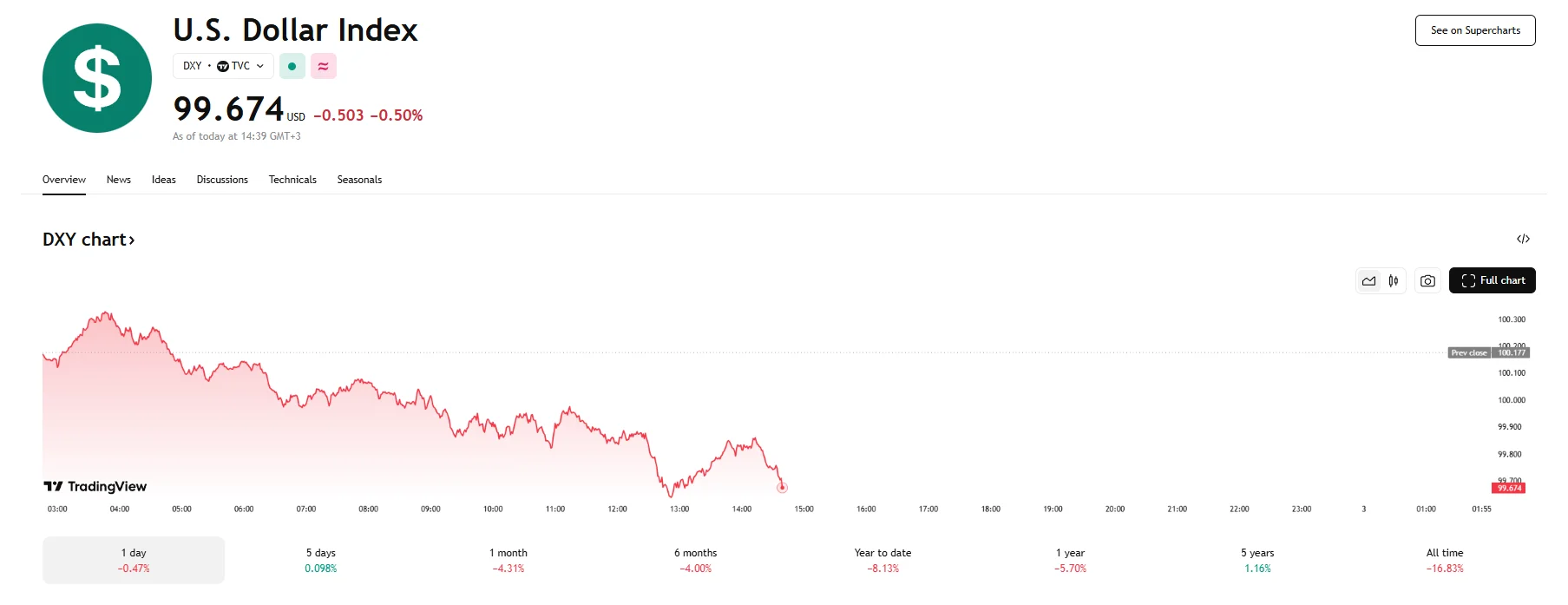

- On Friday, the US Dollar Index fell 0.5% after a brief rebound above the 100 threshold.

GBP Rebounds

Friday saw the British Pound Sterling manage to appreciate by 0.28% against the US Dollar, reversing a recent three-day downward streak. This upward momentum allowed the USD/GBP pair to reach the 1.3305 mark while the dollar pulled back ahead of the release of the closely watched US Nonfarm Payrolls (NFP) report for April.

The DXY, which gauges the Greenback’s performance against six major peers, managed to hit and even climb past the 100 mark on Friday. However, it has since cooled off, falling 0.5% to 99.74.

NFP in Focus Ahead of Fed Decision

Traders are keeping a close eye on the NFP numbers to assess how President Donald Trump’s trade policies may be impacting job creation. Thus far, the US economy is projected to have added 130,000 new jobs in April. The figure would fall far below the 228,000 recorded in March. The Unemployment Rate is expected to remain unchanged at 4.2%, while Average Hourly Earnings will increase by 3.9% YoY, according to forecasts.

The next significant development for the US Dollar comes on May 7, when the Federal Reserve is set to announce its interest rate decision. CME FedWatch data indicates markets are largely predicting that rates will stay capped at 4.50%.

As long as hiring continues at a steady pace, the Federal Reserve is not expected to adjust its policy stance and will instead focus on managing elevated inflation expectations. Moreover, Thursday’s ISM Manufacturing Prices Paid Index indicated a continued rise in input costs, a development that could feed into consumer prices and restrict the Fed’s room to ease policy further. However, if employment data points to a slowdown, the central bank may shift its focus from inflation to supporting the job market.

Trade Optimism Lifts Risk Assets

The Pound also benefited from a rise in market risk appetite following recent reassuring comments from China’s Commerce Ministry. According to a Bloomberg report, Thursday saw the ministry signal openness to engaging in negotiations with Washington, emphasizing that any discussions should be rooted in “sincerity.”

These remarks were received positively by investors, who interpreted them as a constructive sign amid the ongoing trade tensions between the US and China. The resulting optimism spurred fresh demand for risk-sensitive currencies, including the Pound.

Market participants are also speculating that if US-China trade relations improve, China will not need to redirect its exports to other global markets. This, in turn, reduces the likelihood of product dumping in Europe and Asia.

BoE Rate Cut Expectations Limit GBP Upside

Despite its gains against the US Dollar, the Pound lagged behind other major currencies as investors increasingly expect the Bank of England to lower interest rates in its upcoming policy meeting. At present, market participants are anticipating a cut of 25 basis points, which would place the interest rate at 4.25%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.