USD/JPY Rallies 0.6% to 143.66, 30-Year Japanese Bond Yields Tumble on Issuance Cut Speculation USD/JPY Rallies 0.6% to 143.66, 30-Year Japanese Bond Yields Tumble on Issuance Cut Speculation

Key Moments:The yen surrendered earlier gains against the dollar on Tuesday, with the USD/JPY jumping 0.6% to 143.66.The 30-year JGB yield dropped 12.5 basis points to 2.91%, hitting its lowest level

Key Moments:

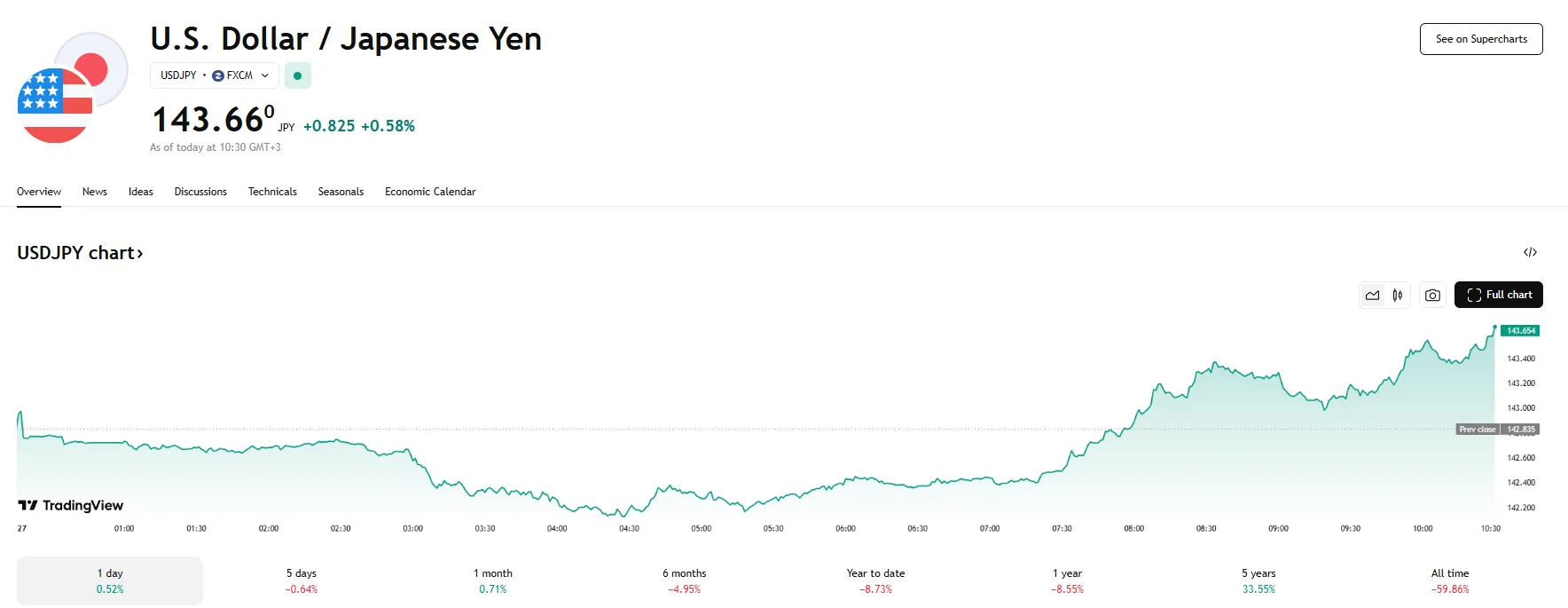

- The yen surrendered earlier gains against the dollar on Tuesday, with the USD/JPY jumping 0.6% to 143.66.

- The 30-year JGB yield dropped 12.5 basis points to 2.91%, hitting its lowest level since May 14th. Meanwhile, the 40-year yield fell to 3.435%.

- Japan’s Ministry of Finance is reportedly considering reducing the issuance of long bonds for the current fiscal year.

Yen Volatility Follows US Market Sentiment

In currency markets, the yen initially advanced to a four-week high against the US dollar, reaching 142.16, after remarks by Bank of Japan Governor Kazuo Ueda. Ueda suggested further interest rate hikes were possible if inflation remains stable, especially amid persistent food price pressures. Japanese government bond yields had also dropped significantly.

However, the yen later lost ground as US equity futures soared after the Monday market holiday. Improved risk appetite, fueled by President Trump’s recent decision to postpone the implementation of 50% tariffs on EU goods to July 9th, dulled demand for safe-haven assets. As a result, the USD/JPY pair rose by around 0.6% and hit 143.66.

Japanese Bond Yields Plunge on Reduced Issuance Outlook

Yields on Japan’s long government bonds fell sharply on Tuesday following reports that the Ministry of Finance may scale back issuance of those maturities. The 30-year Japanese government bond (JGB) yield shed 12.5 basis points and hit 2.91%, marking its lowest since May 14th.

Other figures followed suit, as the 20-year bond yields lipped 13.5 basis points to 2.37%, while a loss of 10 basis points saw the 40-year yield fall to 3.435%. Shorter benchmarks contracted as well, with the 10-year yield slipping to 1.46%.

| JGB Maturity | New Yield | Change (basis points) |

|---|---|---|

| 10-year | 1.46% | -4.5 |

| 20-year | 2.37% | -13.5 |

| 30-year | 2.91% | -12.5 |

| 40-year | 3.435% | -10 |

According to sources who reached out to Reuters, the Ministry of Finance is considering adjustments to its bond program during the current fiscal period. The potential shift would result in cutting back on long bond issuance.

The news came amid broader anticipation that the government might intervene to stabilize the bond market, which has been subjected to pressure from diminished Bank of Japan bond purchases and political debate around fiscal stimulus.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.