HBAR Set for $70 Million Liquidations as Uptrend Hints At Price Rise

HBAR’s price rise, fueled by strong investor inflows, could trigger up to $70 million in short liquidations, potentially pushing it upwards.

- HBAR has experienced positive inflows, with the Chaikin Money Flow (CMF) indicator reflecting bullish sentiment and potential for sustained growth.

- Short traders could face up to $70 million in liquidations if HBAR breaches the $0.22 resistance, adding upward pressure on the price.

- A successful break above $0.200 could trigger a rally toward $0.220, but a failure to hold key support levels could result in a drop to $0.167.

HBAR, the native token of Hedera, has been experiencing a steady uptrend recently, attracting the attention of investors. The price surge has contributed to increased trading activity, but for traders, especially those holding short positions, this could lead to significant liquidations.

While the altcoin is expected to continue its rise, the situation may become challenging for those who bet against it.

HBAR Traders Are In Danger

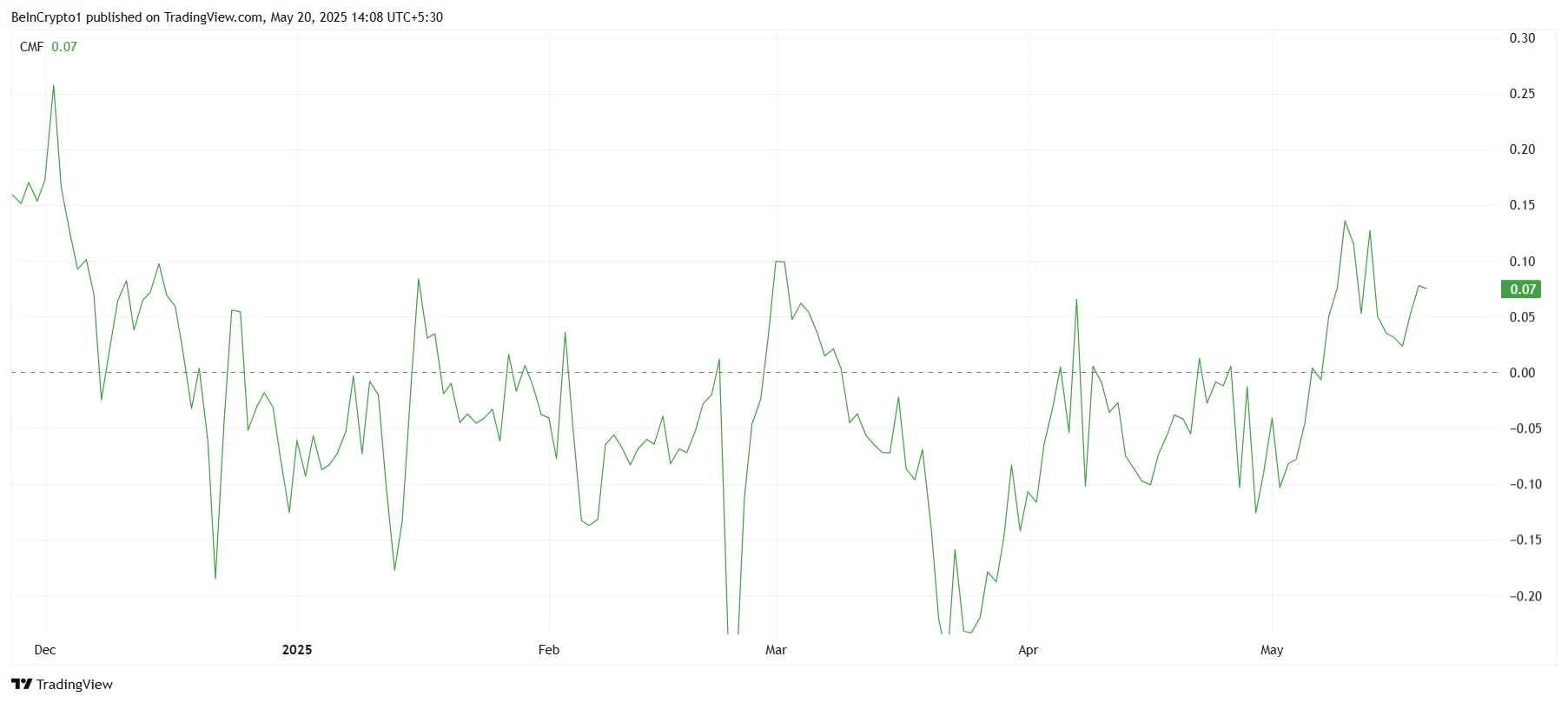

The Chaikin Money Flow (CMF) indicator shows strong inflows into HBAR, signaling that investor sentiment is bullish. The CMF has bounced above the zero line for the first time since December 2024, showing strong demand.

The inflows indicate that investors continue to pour money into the asset, bolstering the price movement. With the CMF turning positive, the likelihood of sustained growth for HBAR increases, as long as the broader market maintains its bullish tone.

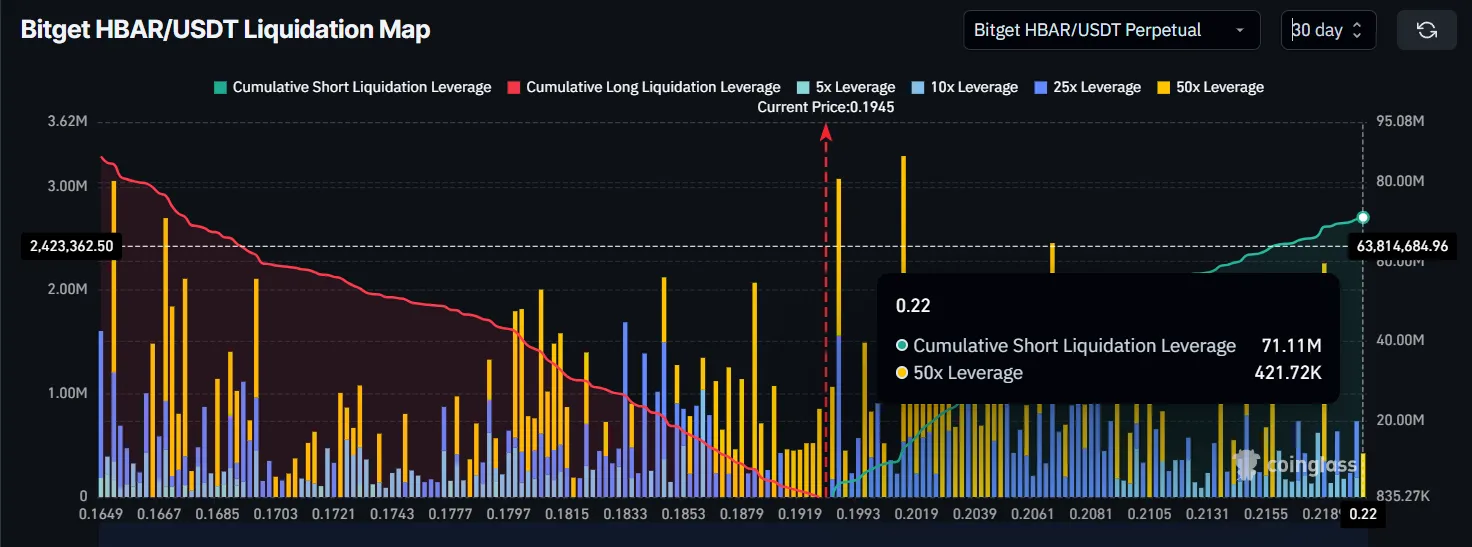

The liquidation map for HBAR, which tracks short positions, indicates that traders betting against the asset could face significant losses if the price continues to rise. HBAR’s current price sits at $0.19, not far from the key resistance level of $0.22. If HBAR breaches this resistance, approximately $70 million worth of short positions could be liquidated, leading to further upward pressure. This scenario highlights the intense battle between bullish investors and bearish traders.

Short traders who bet against HBAR are now at risk, as the broader market sentiment pushes the altcoin higher. The increasing momentum fueled by the strong inflows will likely catch many short positions off guard, forcing them to liquidate. If this liquidation occurs, it could lead to a sharp rise in the price of HBAR, further solidifying its bullish outlook.

HBAR Price Continues Its Incline

HBAR is currently trading at $0.194, just below the significant resistance level of $0.200. The altcoin has shown consistent growth over the past month, and with the current positive market sentiment, it is likely to continue rising. A successful break above $0.200 could confirm the bullish momentum and open the path for further gains.

Should HBAR manage to flip $0.200 into support, a rise to $0.220 would likely follow, triggering the $70 million in short liquidations. This would create additional upward pressure, accelerating HBAR’s price move and potentially pushing it higher in the short term.

However, if HBAR fails to maintain its upward trajectory and falls below the uptrend line, the price could slip under the $0.182 support level. Such a decline would likely bring HBAR to around $0.167, invalidating the current bullish outlook. Therefore, traders should closely monitor these key levels to determine the next steps for HBAR’s price action.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.