Core Inflation in May Ticks Up as Fed’s Worries Materialize, Flashing Economic Warning

The Fed’s preferred inflation indicator for May ticked higher just as President Trump’s tariff campaign fully kicked in, suggesting the U.S. economy could be headed for rougher waters.The Personal Con

The Fed’s preferred inflation indicator for May ticked higher just as President Trump’s tariff campaign fully kicked in, suggesting the U.S. economy could be headed for rougher waters.

The Personal Consumption Expenditures Price Index, the central bank’s primary inflation gauge, rose a seasonally adjusted 0.1 % for the month, lifting the yearly rate to 2.3 %. Core PCE—the figure policymakers watch even more closely—also nudged upward. Notably, durable-goods orders posted their first increase since June 2023.

In addition, personal income fell 0.4 % in May, with disposable income down 0.6 %. Consumer spending slipped 0.1 %, driven by lower purchases of goods.

These inflation prints arrived on the heels of disappointing economic data. The Commerce Department on Thursday revised first-quarter GDP to –0.5 % quarter-over-quarter, down from –0.2 % and well below the +2.4 % logged in Q4 2024.

Price pressures are accelerating as well. The Q1 PCE Price Index was revised up to +3.7 % (from +3.6 %), far above the prior quarter’s +2.4 %. Core PCE climbed to +3.5 %, versus an earlier +3.4 % and +2.6 % in Q4.

The latest data validate Fed Chair Jerome Powell’s warning that inflation could re-accelerate as companies pass higher costs to consumers. “If we make a mistake here, people will pay the cost for a long time,” Powell cautioned earlier this week.

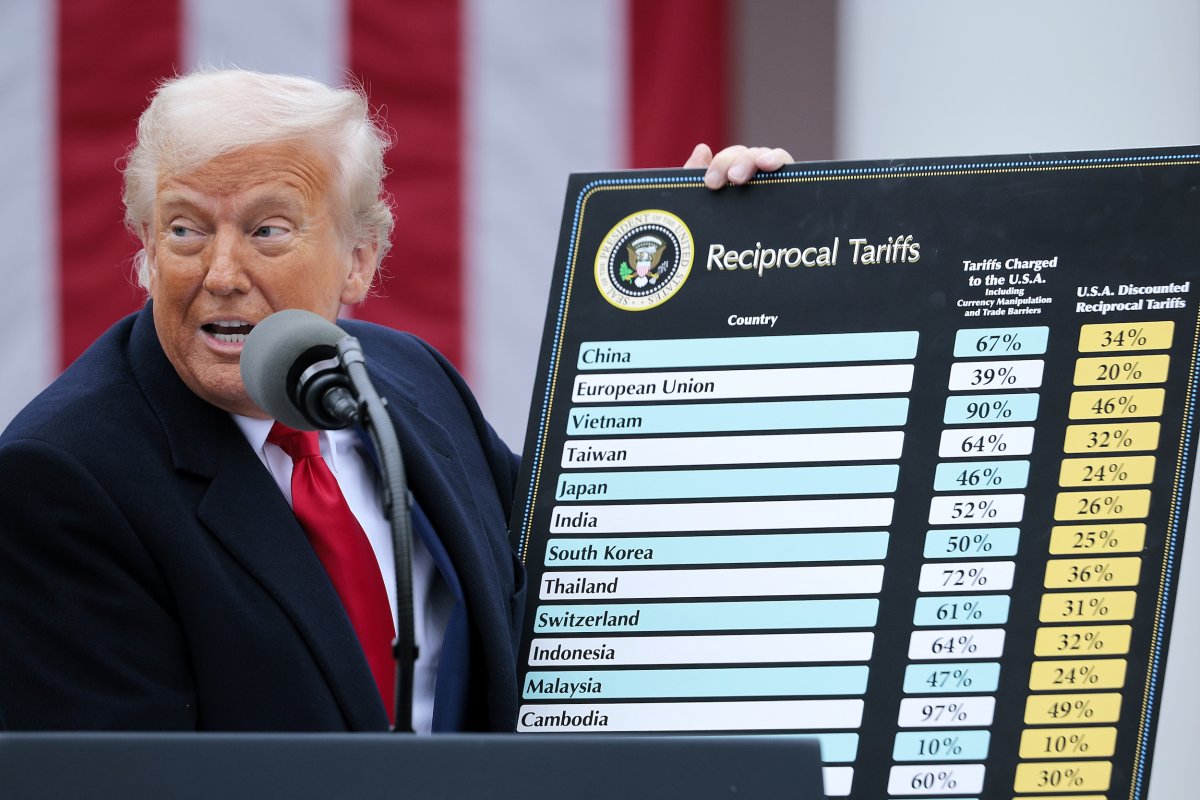

For now, President Trump has imposed a baseline 10 % tariff on most imports and levies exceeding 55 % on Chinese goods (including a 20 % fentanyl-related surcharge plus the 10 % base duty). The baseline tariff is set to expire in two weeks, after which Trump may strike new trade deals—or reimpose duties once again.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.