Hedge Funds Tiptoe Back Into Asia Amid U.S.-China Tariff Turmoil

After a brutal selloff triggered by President Trump’s April “Liberation Day” tariff announcement, which reignited fears of a full-blown U.S.-China trade war, hedge funds are quietly staging a return t

After a brutal selloff triggered by President Trump’s April “Liberation Day” tariff announcement, which reignited fears of a full-blown U.S.-China trade war, hedge funds are quietly staging a return to select Asian markets, according to a Morgan Stanley report released on April 30.

📉 From Panic to Repositioning

In early April, Trump imposed sweeping retaliatory tariffs on Chinese goods, raising rates to 145%, while Beijing responded in kind with 125% tariffs on U.S. imports. This sudden escalation sparked a wave of capital flight from Asia, sending regional equity markets tumbling and damaging investor confidence.

However, morgan stanley notes that Asian hedge funds—after sharply cutting exposure earlier in the month—began cautiously re-entering markets last week, particularly in Japan and India. Their positioning reflects a pivot from risk aversion to selective opportunity.

🧨 China Faces Structural Pressures

China, however, continues to bear the brunt of the trade conflict. According to Goldman Sachs, Chinese equities—particularly U.S. and Hong Kong-listed stocks—led net outflows from Asian hedge funds in the month ending April 24.

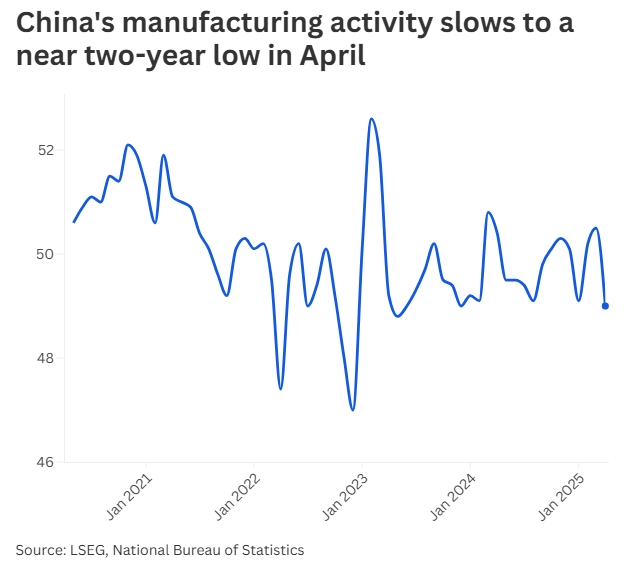

Morgan Stanley believes that China's Q2 macro data will likely weaken under the weight of punitive tariffs and sluggish export demand. The April official manufacturing PMI, released by the National Bureau of Statistics, fell to 49.0, entering contraction for the first time since January and marking a near two-year low.

Meanwhile, the Caixin/S&P Global PMI dipped to 50.4, signaling a slowdown in private-sector manufacturing. Analysts had expected it to slip below 50.

“The sharp drop in PMI likely exaggerates the impact of tariffs due to sentiment effects,” noted Capital Economics, “but the data still reflect mounting pressure from softening external demand.”

⚠️ Hedge Fund Caution Persists

Despite signs of re-entry, Morgan Stanley emphasizes that hedge fund leverage remains well below pre-tariff levels, underscoring lingering uncertainty. Investors remain wary of further policy shocks, particularly as Trump’s rhetoric becomes more unpredictable in an election year.

As Asia navigates a landscape shaped by geopolitical friction, divergent growth paths, and uneven capital flows, hedge fund behavior offers an important window into where capital is willing to return—and where it still fears to tread.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.