The capital flow of the global technology industry has never been so highly concentrated on the same track-artificial intelligence.

The fallout from the earnings season in the first quarter of 2025 has not yet subsided. Microsoft, Meta, Amazon, Google and other giants have pushed the arms race in AI data centers to a climax with annual budgets of more than US$300 billion.

Microsoft & Meta & Amazon: Based in the United States, plans to build a very large data center

Microsoft's US$80 billion annual AI investment plan not only sets a new record for investment by a single company in this field, but also marks a new dimension in the competition for computing infrastructure.Its funds mainly flow to data center construction, NVIDIA GPU procurement and the expansion of the global cloud service network. More than half of them are concentrated in the United States, trying to solve the power demand for high-density computing power through energy innovation (such as restarting nuclear power plants).

Meta's US$65 billion budget highlights the hardware layer layout. It plans to deploy 1.3 million GPUs by 2025 to build a very large data center equivalent to the size of Manhattan's Urban area.Behind this "asset-heavy" model is the technology giant's prediction of the training and reasoning needs of AI models-iterations of hundreds of billions of parameter models such as OpenAI's GPT-5 and Google's Gemini Ultra are exponentially pushing up computing power consumption.

Amazon has broken down its $100 billion investment into three parts: 40% for generative AI application development (such as the AWS Bedrock platform), 30% for edge computing devices, and the rest for acquiring vertical AI start-ups.This "pyramid" investment structure reflects a shift in industrial logic-from simply pursuing computing power scale to building a full-chain ecosystem covering training, reasoning, and application.It is worth noting that with the rise of open source models such as DeepSeek, companies have begun to allocate 15%-20% of their budget to model optimization tool chain development, trying to reduce their reliance on hardware stacking through algorithmic innovation.

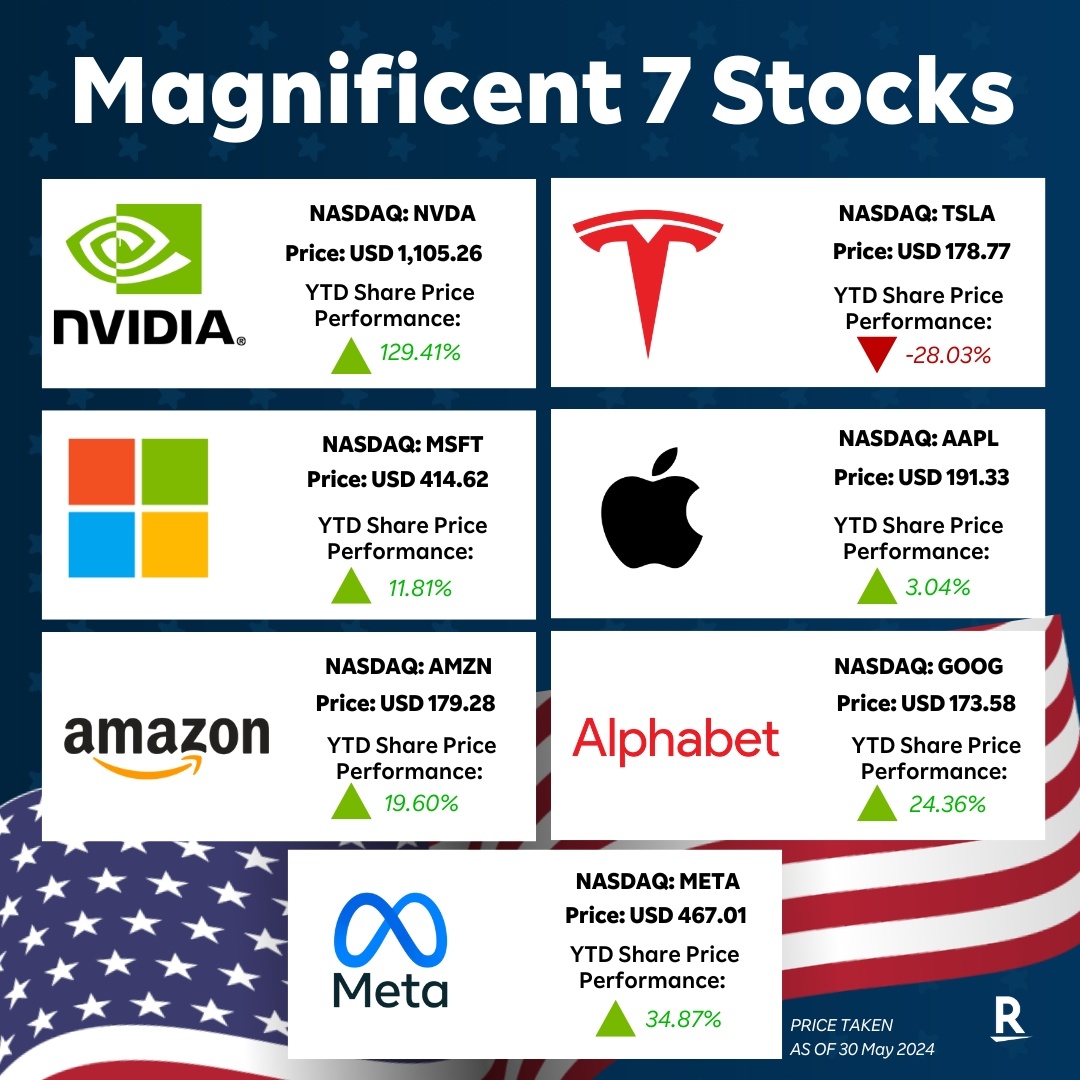

Market game: NVIDIA PE skyrocketed downstream valuations loosened domestic substitution rate increased

Wall Street's attitude towards this big gamble is subtly divided.Although Microsoft's share price rose 4.2% in a single day after its earnings report, Meta triggered a brief correction of 2.5% due to the increase in capital expenditure expectations, reflecting investors 'anxiety about short-term returns.Evercore ISI data shows that the capital expenditure growth rate of ultra-large cloud service providers has reached 71%, but the revenue contribution of cloud AI services is still less than 15%.

This divergence gave rise to a unique valuation logic: Nvidia's P/E ratio climbed to 65 times due to the shortage of Blackwell GPUs, while the valuation systems of downstream application vendors began to loosen-the PS multiple of some SaaS companies dropped from 12 times at the beginning of the year to 8 times.

Geopolitical factors are reshaping the competitive landscape.After the U.S. upgraded chip export controls to China, China companies turned to local chips such as Shengteng and Cambrian, pushing the domestic substitution rate to jump from 18% in 2024 to 35%.

This "dual-track" market has caused Nvidia's share of revenue in China to drop to 12%, but it has unexpectedly stimulated innovation in its edge computing products-the newly released RTX4080 Super has increased the reasoning speed of local large models by 150%.The DeepSeek-R1 model uses dynamic quantification technology to reduce the deployment cost of a 100 billion parameter model to 3.7% of OpenAI.

Faced with the surging wave of AI, how should we ordinary people invest?

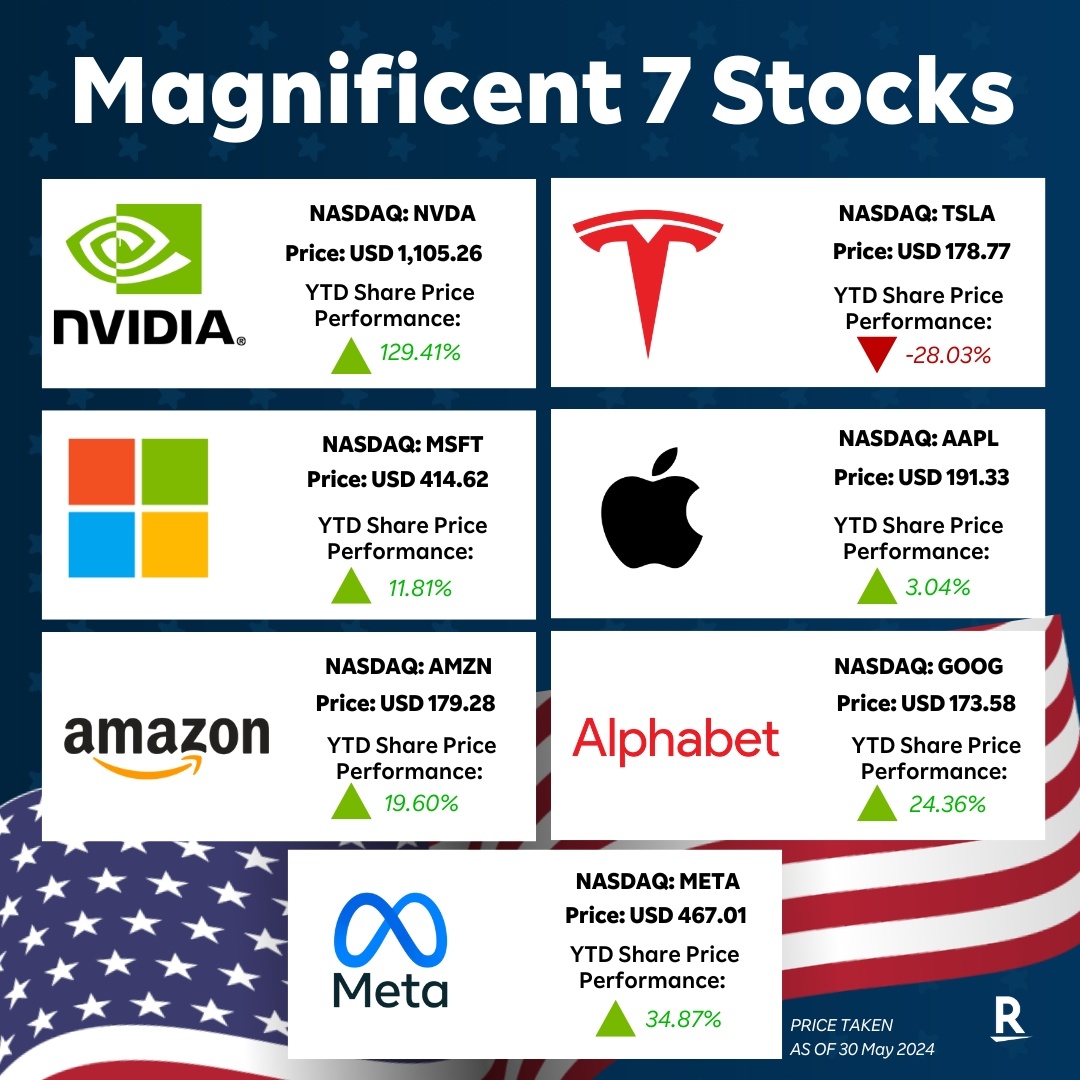

The stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc. The capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

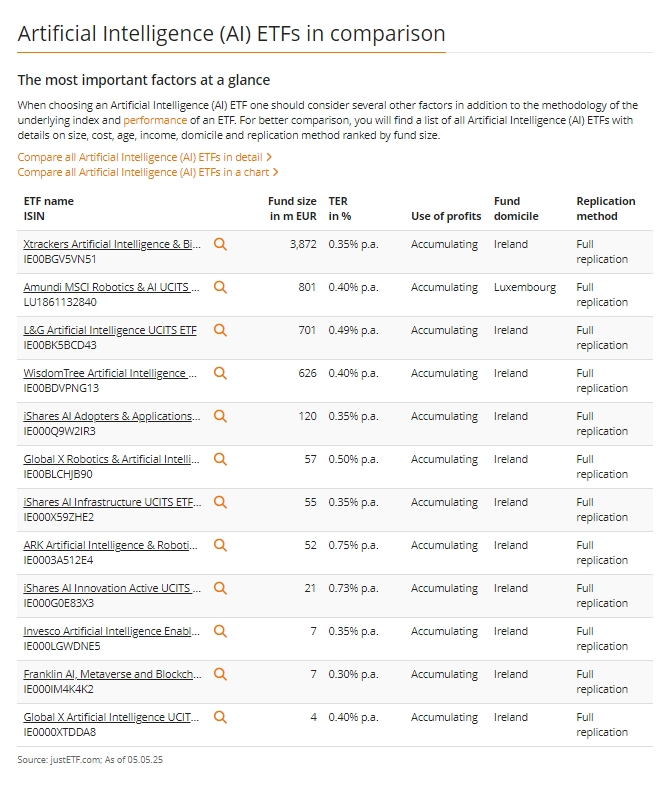

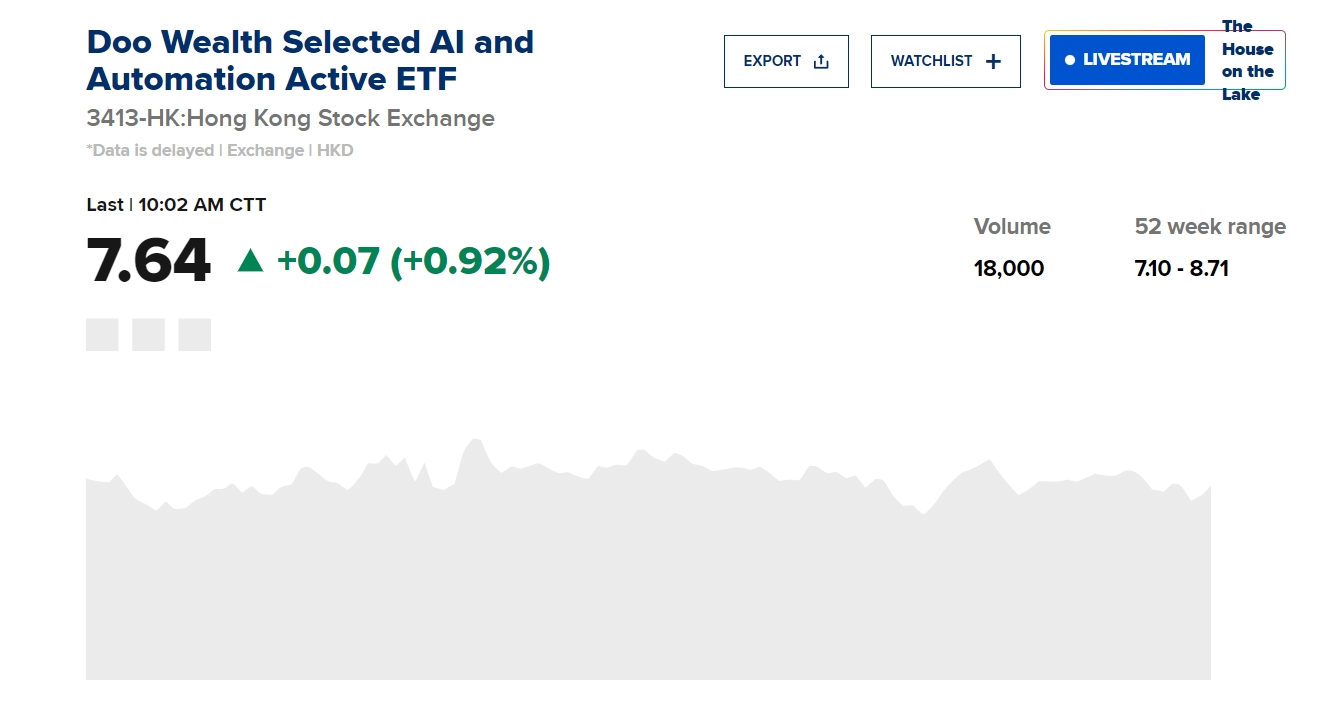

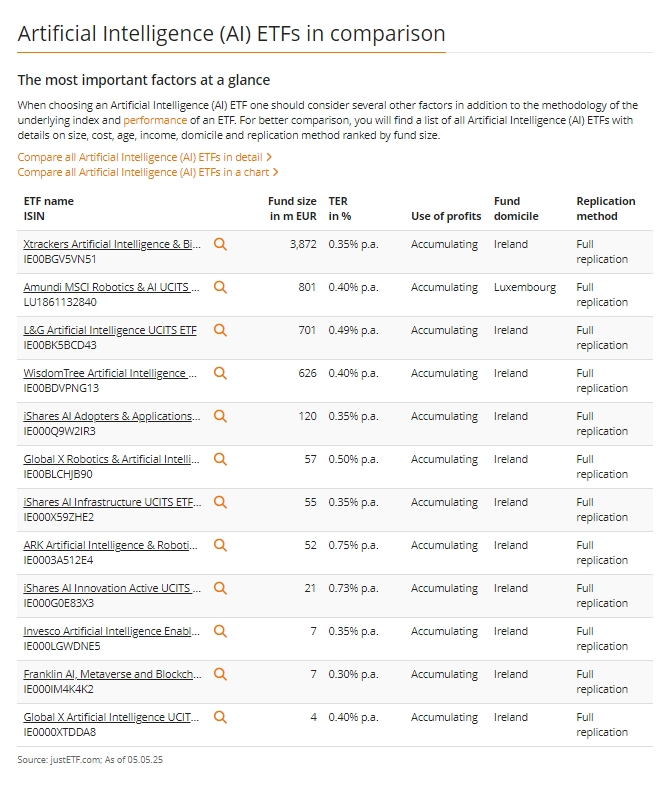

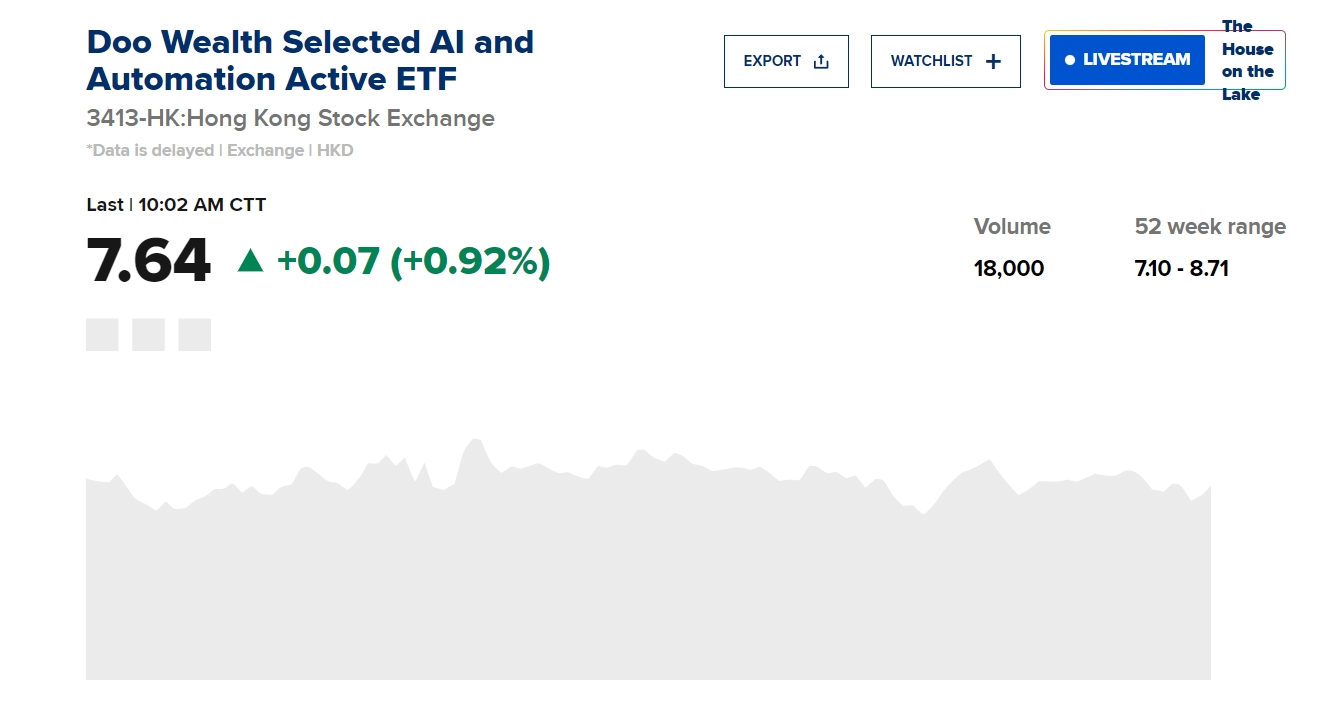

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

When Microsoft invested 50% of its data center budget in liquid cooling systems, and when Amazon signed a 20-year power purchase agreement with nuclear power companies, technology giants were already laying out for the era of Zetta (10^21) computing power. Historical experience shows that The technological revolution has never been a linear evolution-the popularity of personal computers has spawned the Internet bubble, and the explosion of smartphones has been accompanied by the restructuring of the mobile ecosystem.Venture capitalist Tomasz Tunguz said investors and large technology companies are betting that demand for AI models could increase by a trillion times or more over the next decade due to the rapid spread of inference models and AI.

I wish you all a smooth investment ~