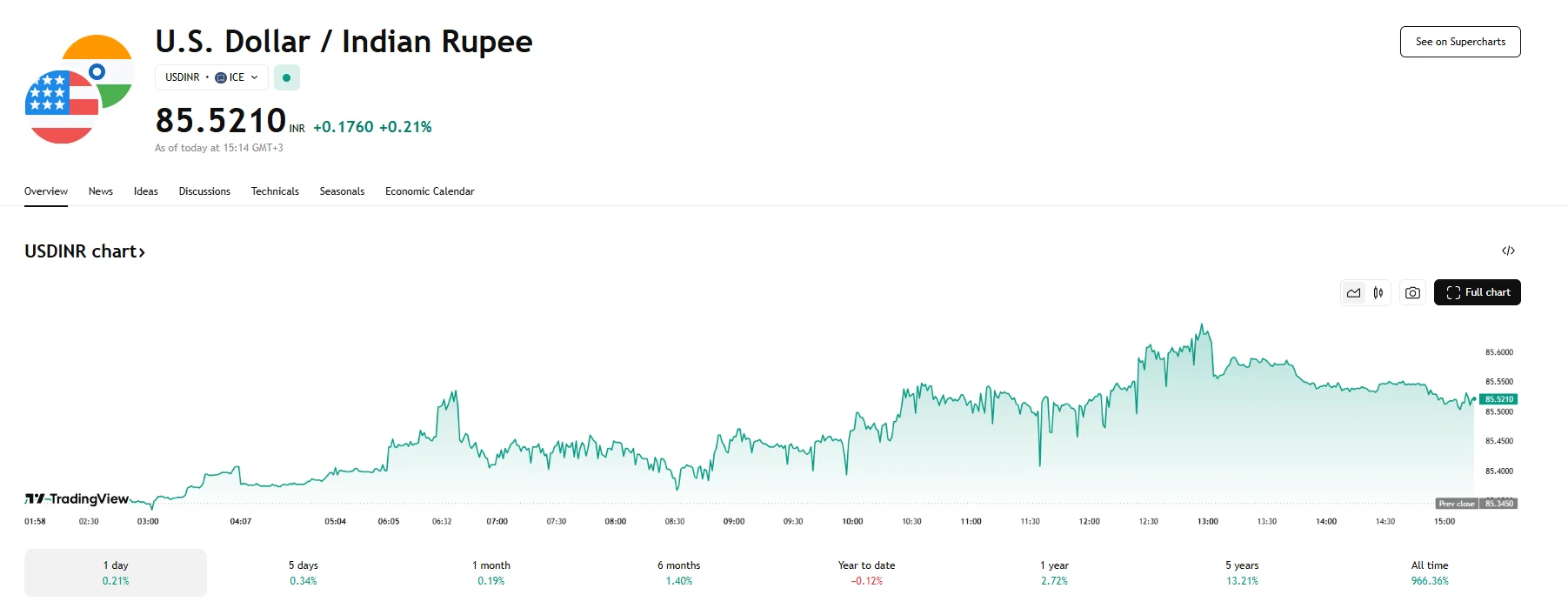

USD/INR Reaches 85.5210 as India’s Infrastructure Output Growth Slows to 0.5% USD/INR Reaches 85.5210 as India’s Infrastructure Output Growth Slows to 0.5%

Key Moments:The rupee traded 0.2% weaker on Tuesday at 85.5210 per USD amid dollar bids from foreign banksIndia’s infrastructure output rose just 0.5% year-over-year in April, the slowest increase in

Key Moments:

- The rupee traded 0.2% weaker on Tuesday at 85.5210 per USD amid dollar bids from foreign banks

- India’s infrastructure output rose just 0.5% year-over-year in April, the slowest increase in eight months.

- Declines in the crude oil (down 2.8%) and refinery (down 4.5%) sectors dragged down overall output.

Rupee Slips on Dollar Demand and Equity Weakness

The Indian rupee declined on Tuesday, pressured by demand for the dollar from foreign banks, likely executing trades on behalf of custodial clients. The USD/INR pair settled at 85.6350, representing a 0.3% drop on the day. Adding to the downward momentum, Indian equities also registered losses of around 1%, prompting more dollar demand that contributed to the rupee’s weakness. Meanwhile, India’s infrastructure output came to a crawl in April, rising by a mere 0.5% year-over-year, a low unseen since October.

Volatility and Risk Sentiment Shift

Today’s figures still represented a recovery from the level observed in February, when the rupee touched an all-time low of 87.95. Sudden currency swings have been attributed to fluctuations in US trade policy and geopolitical developments such as the India-Pakistan conflict.

On the broader outlook, the US Dollar Index was trading relatively low today, but managed to reach flat levels of around 100.38. Factors such as trade policies, fiscal challenges, and weakening confidence in the resilience of US assets made it difficult for the greenback to regain ground. According to CFTC data, speculators held net short positions on the dollar totaling $17.32 billion, approaching the most pessimistic bet on the US currency since July 2023.

Core Infrastructure Output Sees Slowdown

According to government data released May 20th, India’s infrastructure output in April grew just 0.5% year-over-year, marking its softest expansion in eight months. The performance was pulled down by weakness in the crude oil and refinery product segments. The former fell by 2.8% YoY versus March’s decline of 1.9%, while the latter slid 4.5%, a far steeper fall compared to the 0.2% drop observed in March. Fertilizer and cement production also disappointed.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.