Q1 Earnings Boost Bullish Case for European Stocks

European companies displayed strong earnings resilience in the first-quarter reporting season, reinforcing the bullish case for European equities. According to Bloomberg Intelligence, Q1 brought risin

European companies displayed strong earnings resilience in the first-quarter reporting season, reinforcing the bullish case for European equities.

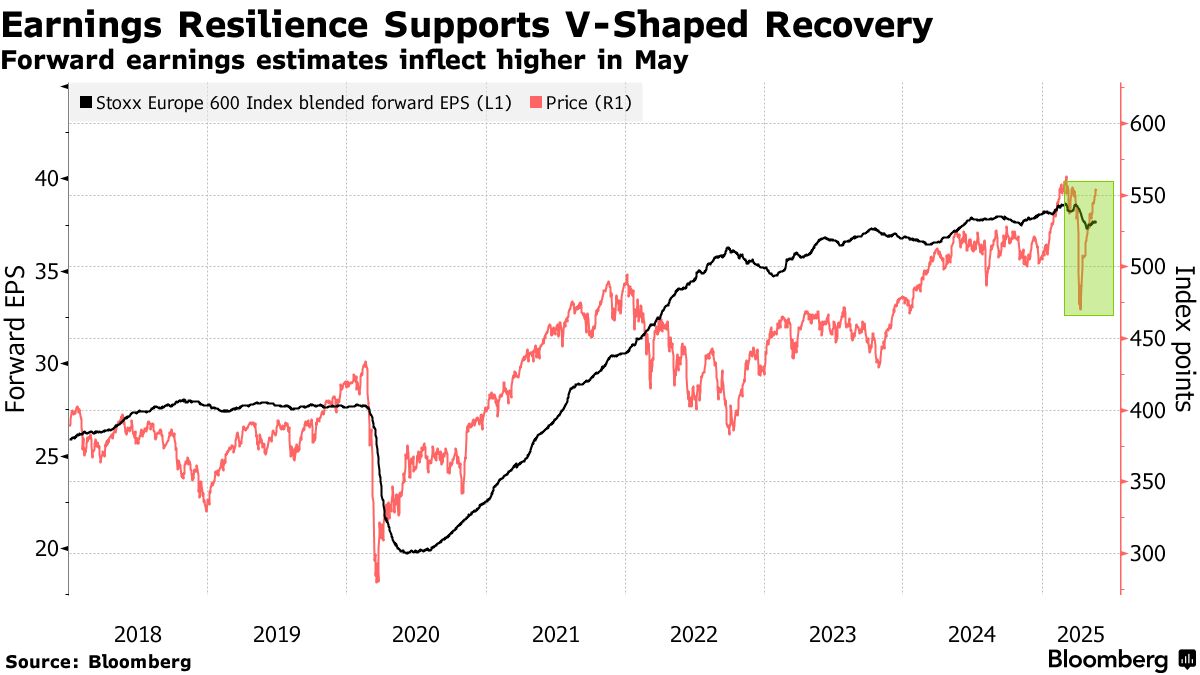

According to Bloomberg Intelligence, Q1 brought rising sales and improved margins across most sectors, with earnings growth running at 5% year-on-year—sharply outperforming consensus expectations of a 1.5% decline.

Chief executives broadly struck a confident tone while addressing the tariff storm, choosing instead to emphasize prospects for future trade agreements. The combination of solid financial results and optimistic commentary has prompted upgrades from some Wall Street strategists.

Citigroup strategists led by Beata Manthey noted: “Just weeks ago, analysts had significantly downgraded earnings-per-share forecasts for European equities due to heightened macro and policy uncertainty. Yet Stoxx 600 companies delivered a surprisingly strong Q1, with earnings largely unaffected by tariff headwinds. Both the beat ratio and magnitude were in line with historical averages.”

Last week, goldman sachs revised its 2025 EPS forecast for Stoxx 600 components from a 7% decline to flat (0% growth), and now expects a 4% rise in 2026 (previously no growth). The goldman team highlighted robust Q1 earnings, a brighter European economic outlook, and supportive factors like German fiscal stimulus and lower interest rates.

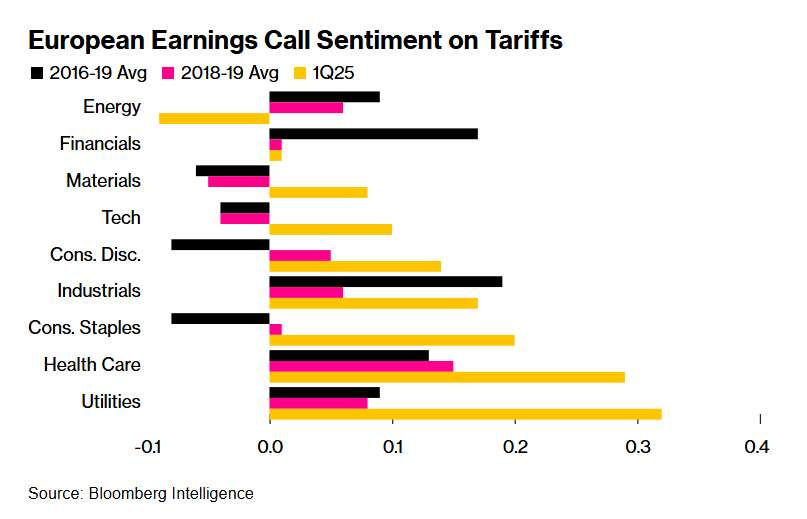

Data compiled by Bloomberg Intelligence shows that most industries are more confident in handling the impact of tariffs than during former President Trump’s first term. This indicates that global trade and consumer demand are proving more resilient compared to previous periods of trade tensions. The energy and financial sectors showed the most concern about tariff risks, while consumer staples, healthcare, and utilities expressed the highest levels of confidence.

Deutsche Bank strategist Maximilian Uleer added that Trump’s unpredictability has not rattled executives as much as expected. Some of the recent policy reversals and downgrades have been more constructive than anticipated. Since Trump’s latest announcement of a 90-day delay on tariffs, “the tone around tariffs has softened, and the market reaction has clearly been supportive.”

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.