Stock Market Rallies After US-China Talks, Gold Slumps

U.S. Treasury Secretary Scott Bessent said on Sunday that the United States made “substantial progress” during two days of trade negotiations with Chinese officials in Geneva. This is the first sign t

U.S. Treasury Secretary Scott Bessent said on Sunday that the United States made “substantial progress” during two days of trade negotiations with Chinese officials in Geneva. This is the first sign that Washington and Beijing may begin to de-escalate their deepening economic tensions.

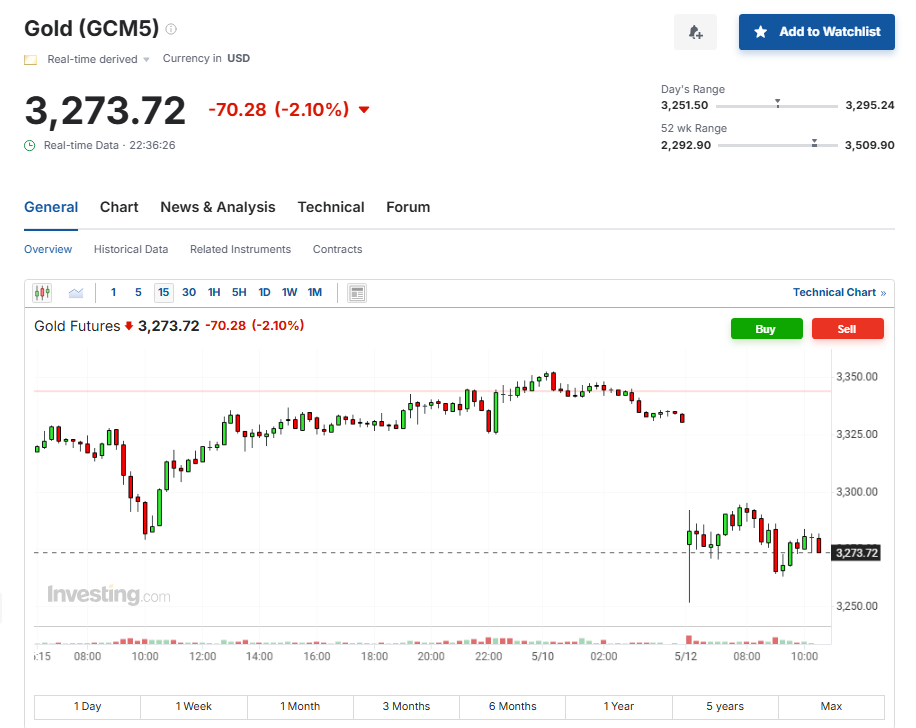

As risk sentiment improved, global equity index futures surged at the open, while gold prices gapped lower, reflecting a shift away from safe-haven assets.

Market analysts speculate that President Trump and his economic advisers were responding to urgent appeals from executives in the U.S. retail sector. Retail leaders warned that sustained high tariffs could trigger supply shortages and disruptions similar to those seen during the early COVID-19 period. Panic buying among consumers has already left many supermarket shelves empty, adding urgency to reach a trade accord.

“While we remain skeptical that anything of substance could be agreed upon after only two days of talks, it’s clear that both sides are looking to de-escalate the situation,” wrote Win Thin, Global Head of Markets Strategy at brown brothers Harriman & Co.

Sources familiar with senior Chinese officials' thinking said Beijing viewed the talks more as a chance to gauge the Trump administration’s intent than a turning point in bilateral relations. One source noted that Beijing’s aim is to continue dialogue in order to lower current tariff levels.

Neither side has yet disclosed details of the negotiations. The full market impact will depend on the specific terms of any future agreement.

📈 Potential Opportunities in Chinese Equities

According to a research note from CITIC Securities, if the U.S. and China enter a substantive negotiation phase, Trump may push for so-called "structural reforms" and reductions in "non-tariff barriers" as key conditions in talks with Beijing.

Under CITIC's neutral scenario, U.S. tariffs on Chinese goods could be reduced to around 60% from mid-year through the end of 2025, with further flexibility in granting sector-specific exemptions. China’s exports to the U.S. in April declined less than expected, driven in part by accelerated shipments in sectors that received reciprocal exemptions and China’s strong re-export capabilities.

Historically, during the Trump 1.0 trade conflict, several rounds of product exemptions were granted, primarily in sectors where the U.S. had high dependence on Chinese imports and where China had strong competitive advantages. As of 2023, China’s global market share in telecom equipment, electronic data processing and office machines, and apparel stood at 37.4%, 30.2%, and 30.1%, respectively—signaling robust international competitiveness.

By 2024, U.S. import dependency on China remained high in several key industries: 21.3% for office machinery and automatic data processing equipment, 39.4% for telecom recording and playback devices, and 22.7% for apparel and accessories. These sectors are therefore more likely to benefit from future U.S. tariff exemptions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.