U.S. Economy Flashing Warning Signs as Q1 GDP Revised Sharply Down, May Exports Tumble

The latest batch of economic indicators points to a deeper deterioration in the U.S. economy than previously expected, as President Trump’s tariff-driven policies stoke inflation and heighten uncertai

The latest batch of economic indicators points to a deeper deterioration in the U.S. economy than previously expected, as President Trump’s tariff-driven policies stoke inflation and heighten uncertainty.

The Commerce Department reported Thursday that first-quarter GDP was revised down to –0.5% quarter-over-quarter, compared with an earlier estimate of –0.2% and a robust +2.4% in Q4 2024. The sharp downgrade signals that underlying momentum has turned negative.

Inflation is also accelerating. The Q1 PCE Price Index was revised up to +3.7% (from +3.6%), far above the +2.4% recorded in the prior quarter. Core PCE, which excludes food and energy, rose to +3.5%, versus a prior estimate of +3.4% and +2.6% in Q4.

These figures echo recent warnings from Federal Reserve Chair Jerome Powell, who cautioned that inflation could re-accelerate later this year as companies pass higher costs to consumers. “If we make a mistake here, people will pay the cost for a long time,” Powell said earlier this week.

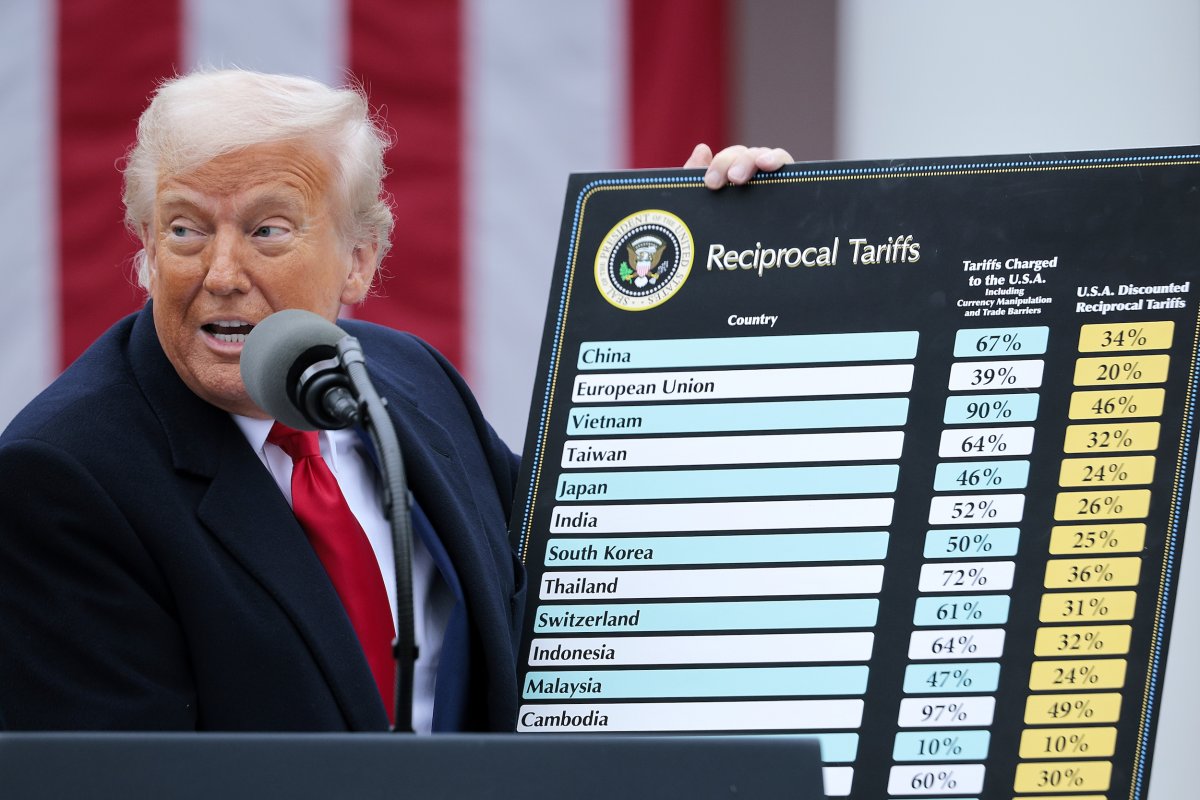

The trade picture is equally bleak. U.S. goods exports fell 5.2% month-over-month in May, the sharpest drop since 2020. Analysts say many trading partners are pulling back amid fears of reciprocal tariffs and an increasingly fraught global trade environment.

The labor market still appears resilient, but cracks are emerging. The Labor Department said initial jobless claims fell by 10,000 to 236,000 in the week ended June 21, beating expectations. Holiday-week data are often noisy, however, and layoffs are beginning to mount. Economists note that Trump’s sweeping import tariffs are making it harder for firms to plan ahead. While layoffs remain near historic lows, persistent hiring weakness is making it tougher for the unemployed to find new work. Continuing claims rose by 37,000 to 1.974 million—the highest since November 2021. With continuing claims trending higher, some economists expect the June unemployment rate to edge up to 4.3% from 4.2% in May.

Taken together, the data underscore growing risks to both growth and price stability, sharpening scrutiny of the Federal Reserve’s policy path and casting a shadow over the near-term economic outlook.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.