Nvidia Surpasses $4 Trillion Market Cap — Why, and What Could Be Next?

Despite facing challenges from DeepSeek and ongoing export restrictions this year, Nvidias stock continues to hit new highs amid the AI frenzy. The company has just achieved a historic global mileston

Despite facing challenges from DeepSeek and ongoing export restrictions this year, Nvidia's stock continues to hit new highs amid the AI frenzy. The company has just achieved a historic global milestone: becoming the first tech company ever to surpass a $4 trillion market cap, overtaking both Microsoft and Apple.

During Wednesday's trading session, Nvidia — the ultimate “pick-and-shovel” player in the AI gold rush — hit a $4 trillion market cap, setting a new record. In comparison, Microsoft and Apple are currently valued at $3.75 trillion and $3.14 trillion, respectively, widening the gap and reflecting the market’s strong conviction in Nvidia's value and bold AI vision. Although the stock gave back some of its early gains after hitting the milestone, the achievement underscores investor confidence.

As the backbone of AI infrastructure, Nvidia’s valuation now far exceeds that of major clients such as Microsoft, Amazon, Oracle, and OpenAI. This suggests that investors are placing greater value on the "shovel seller" in the AI boom — the company that provides the essential tools for a rapidly expanding market.

Historically, Nvidia first crossed the $1 trillion mark on May 30, 2023, hit $2 trillion on March 1, 2024, and $3 trillion on June 5, 2024. Now, just over two years later, the AI GPU giant has quadrupled in value.

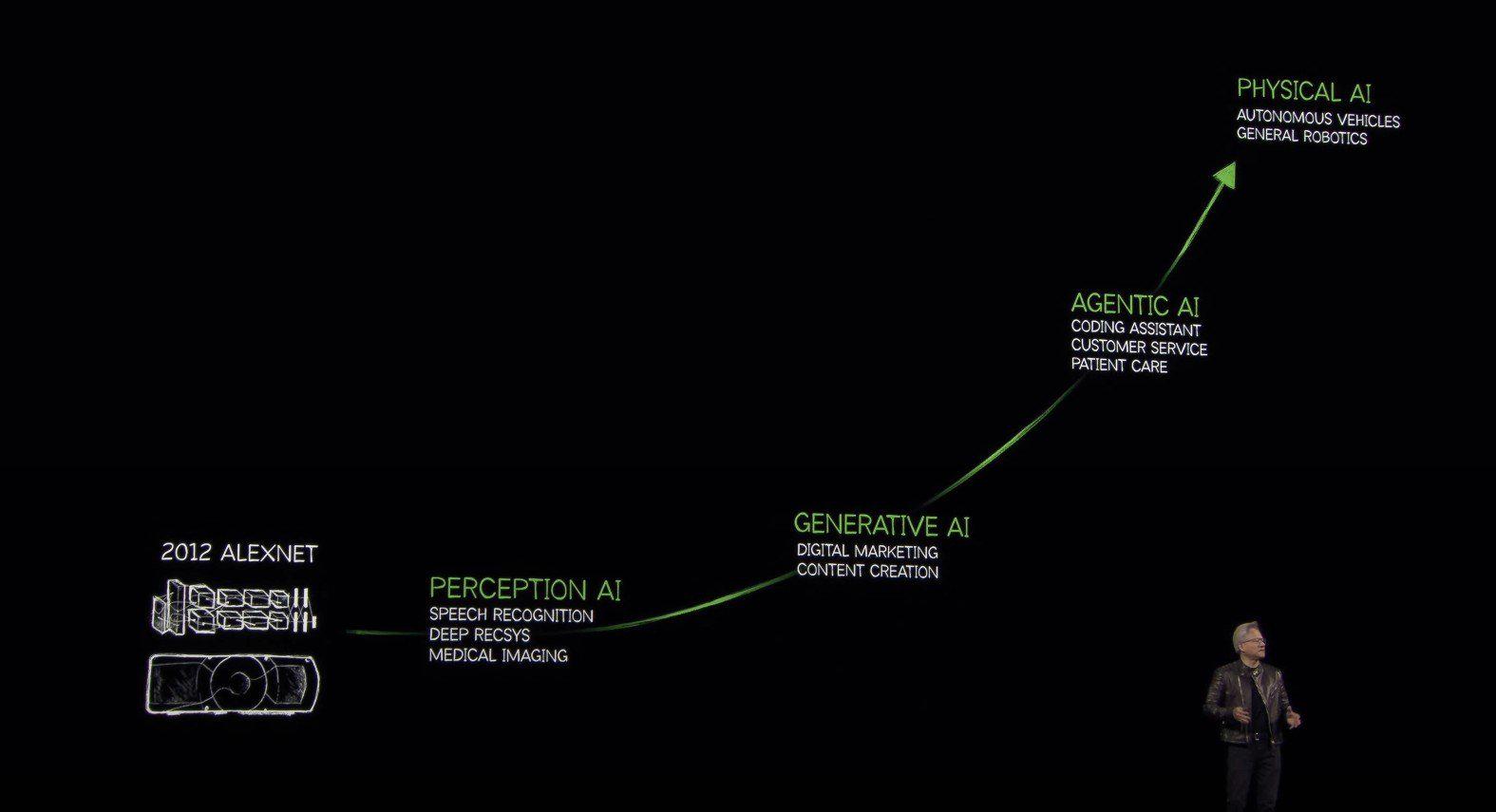

Much of this meteoric rise is attributed to the launch of OpenAI's ChatGPT in November 2022, which ignited the generative AI revolution. As major tech firms raced into the space, generative AI, inference models, and AI agents have evolved from simple chatbots into tools capable of generating images, videos, and powering enterprise-level applications. These technologies are becoming an integral part of daily life and productivity.

All of these rely heavily on Nvidia's AI chips — essential for training models on massive datasets and powering diverse applications. Nvidia holds a dominant position in this market, with gross margins approaching 80%. While many companies are trying to develop their own GPUs to bypass Nvidia, none have matched its performance. As the AI arms race accelerates, so too does the demand for Nvidia’s hardware.

However, the release of the DeepSeek R1 model earlier this year introduced a potential challenge. The model offered inference capabilities comparable to OpenAI’s at a fraction of the cost, sparking concerns over possible compute overcapacity. Still, Nvidia CEO Jensen Huang has repeatedly pushed back on those fears, emphasizing that as more users adopt large-scale inference models, the demand for compute power will only grow — a trend that continues to benefit Nvidia.

On another front, despite U.S. government restrictions on high-end chip exports, Nvidia continues to see strong demand both domestically and internationally. Additionally, President Donald Trump’s recent visit to the Middle East secured over $1 trillion in AI chip export deals — many of which are expected to benefit Nvidia. This also symbolizes the formal beginning of sovereign AI infrastructure development in several nations.

Meanwhile, Nvidia is also poised for further growth in consumer electronics (GPUs), autonomous driving, and robotics. Many car manufacturers are prioritizing Nvidia’s automotive-grade chips for training self-driving systems, while AI-trained robots are becoming increasingly capable of everyday mobility and cognitive tasks. As AI becomes embedded into every aspect of life, Nvidia is positioned to leave its mark across all next-generation technologies.

Viewed in this context, Nvidia’s $4 trillion valuation isn't all that surprising. While each trillion-dollar milestone has historically brought resistance, the company’s long-term prospects continue to expand. With just a 25% gain from here, $5 trillion might be the next stop.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.