Buying on dips has become a new belief among retail investors.

On July 11, JPMorgan Chase issued its latest forecast, saying that in the second half of this year, nearly US$500 billion in funds will flood into the U.S. stock market, of which retail investors alone will contribute about US$360 billion, which may become the core engine that drives the S & P 500 index to rise another 5%-10%.

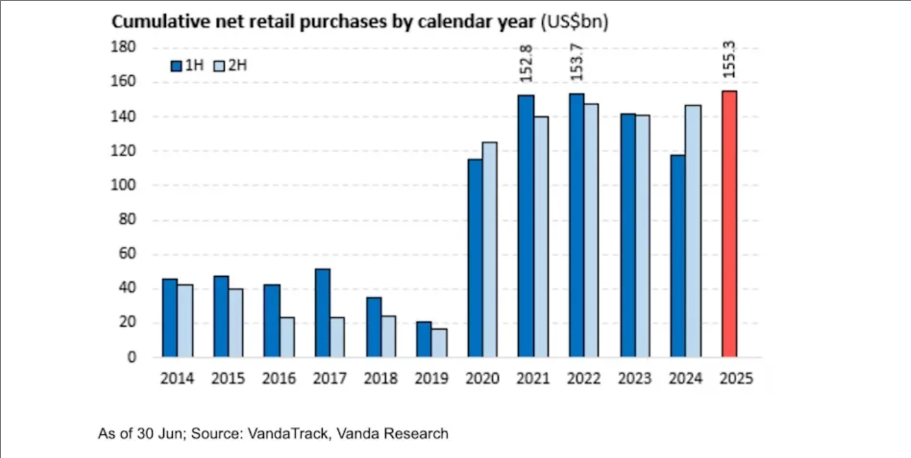

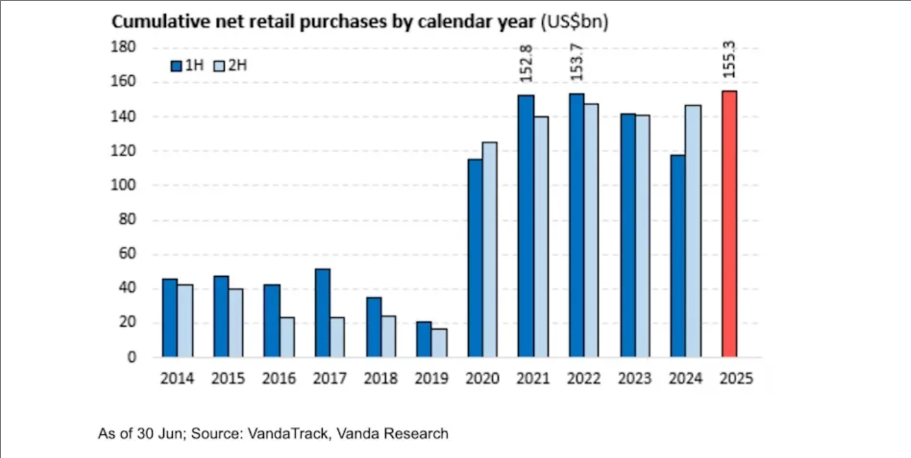

According to research firm VandaTrack, in the first six months of 2025, retail investors injected a net US$155 billion into individual stocks and ETFs, setting a record for at least a decade and even surpassing the enthusiasm during the epidemic.This force pushed the average daily trading volume of U.S. stocks to surge by 44.5% year-on-year, completely rewriting the market liquidity structure.

What are retail investors buying?

Technology giants have become the biggest beneficiaries-Nvidia has been the most popular stock among retail investors with a net inflow of US$19.3 billion, Tesla has followed closely with US$11.9 billion, and even the SPDR S & P 500ETF (SPY) has attracted US$6.3 billion.When the Trump administration threw out "Liberation Day" tariffs in April and triggered a market collapse, retail investors bucked the trend and increased their positions, adding an additional US$50 billion in funds in the following two months.

"Buying on dips has become a new belief among retail investors," said Mike Sigismund, co-head of trading and research at Visdom Investment Group, expressing the essence of this round of market.

Data analysis shows that for every 1% decline in the S & P 500 index, retail investors will invest a net US$1 billion to bottom.Although this is more restrained than the US$1.87 billion in the craze period in 2021, it is enough to build a solid bottom every time the market fluctuates.

Even more noteworthy is the evolution of retail investment strategies-they are moving towards wide-base ETFs to single-share leveraged products.The 2-leverage Tesla ETF (TSLL) ranked among the top 20 retail buyers for the first time, while the 3-leverage Nasdaq ETF was heavily bought during the April decline, and then almost doubled in price during the market's V-shaped rally, triggering natural profit-taking in May and June-a tactical retreat defined by JPMorgan as "phased profit-taking". With the arrival of July, retail investors have returned to "ammunition filling".

In dramatic contrast to the aggressive stance of individual investors is the collective absence of institutional investors.

Hedge funds 'equity beta exposure returned to high levels as early as April, and the S & P 500 and Nasdaq futures position indicators even exceeded their February highs this year, leaving little room for additional positions.Pension funds and insurance companies continue to act as structural sellers, with net sales of US$455 billion in stocks in 2024 and expected to net sales of US$360 billion in 2025.Wall Street analyst Tom Lee called the current rally "the most market-disgusted V-shaped recovery in memory."

Xiaomo also said that from now on, the real variables in the market may be lurking overseas.

For five consecutive months since February, foreign investors have implemented a "buyer strike" on U.S. stocks. This boycott seems logical against the backdrop of fluctuations in the dollar and a widening U.S. budget deficit.But JPMorgan pointedly pointed out that the nature of the strategy of avoiding the world's largest growth sectors (the S & P 500 and the technology giants) is unsustainable.As the US dollar index stabilizes at the 98 mark, it is expected that US$50 - 100 billion of overseas funds may flow back to U.S. stocks in the second half of the year.

What is more noteworthy are the other two types of "reserve forces": the stock beta of risk parity funds dropped from 0.35 in April to 0.2. If it returns to the historical average of 0.33, it will bring in US$45 billion in buying; balanced mutual fund beta also has room to return to the 0.6 average, which may trigger up to US$560 billion in purchasing power-once these potential energies are released, they may even surpass retail investors to become a greater thrust.

Morgan Stanley strategists added that foreign investors may want to see the dollar stabilize before becoming interested in U.S. stocks.

However, the bank said that this stabilization may have begun, with the dollar index stabilizing at around 98 in recent weeks.