Wall Street’s Safe-Haven Logic Just Broke

The long-held belief in the seesaw relationship between bonds and equities is deeply rooted in market thinking: when bonds are sold off, it's typically seen as a positive signal for stocks — a sign th

The long-held belief in the seesaw relationship between bonds and equities is deeply rooted in market thinking: when bonds are sold off, it's typically seen as a positive signal for stocks — a sign that investors expect economic growth to accelerate.

But this time, things may be different.

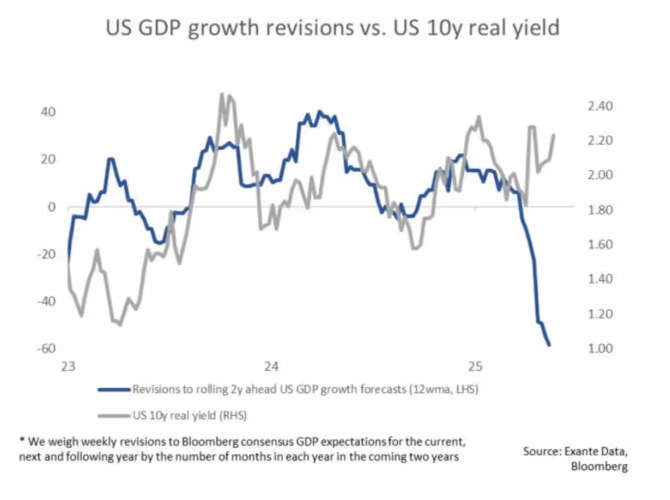

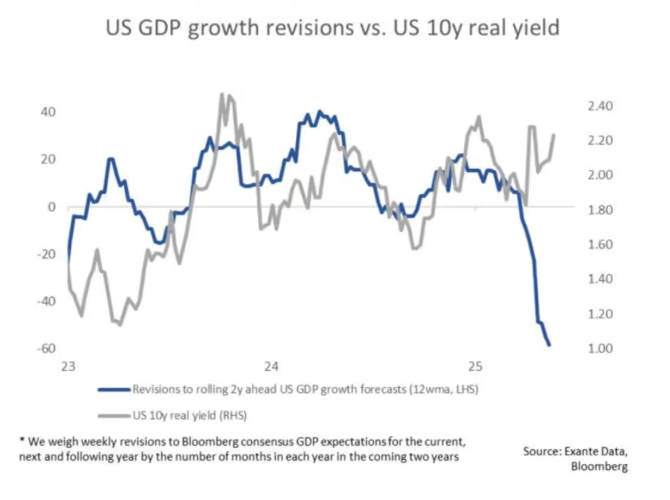

Jens Nordvig, a veteran currency strategist and economic researcher at Exante Data, has recently identified a worrying shift. Referencing specific charts, he noted that the historical correlation between U.S. 10-year Treasury yields and projected economic growth two years out has broken down.

More importantly, U.S. Treasury yields have been surging despite sharply declining growth expectations. This divergence is unprecedented. It suggests that bond investors are growing increasingly uneasy about the U.S. fiscal outlook. Considering weakening growth expectations and a Federal Reserve still in wait-and-see mode, the selling pressure on bonds may persist.

Deutsche Bank strategist George Saravelos adds that reforming U.S. fiscal policy is an extremely difficult task. In contrast to Europe, where governments can more easily adjust spending programs, the U.S. faces added challenges. “No matter what fiscal decisions a Republican-controlled Congress makes in the coming weeks, they are likely to be locked in for the remainder of the decade,” Saravelos explained.

The complexity of coordination — coupled with the possibility that Republicans could lose their majority in the midterm elections — means that the current Trump administration has only one real opportunity to enact major fiscal policy changes. Once that window closes, Saravelos believes further adjustments will be almost impossible for years to come.

Randy Flowers, a senior portfolio manager at Intelligent Wealth Solutions, warns that rising bond yields may soon weigh on equity performance. That’s one reason he expects U.S. markets to remain volatile through 2025. “I believe bond investors have taken back control of the market — at least in the short term,” Flowers said. “And when that happens, it’s usually bad news for everyone, including the stock market. We’ll have to see whether this persists.”

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.