Trump's Bitcoin Advancement: A Potential $3 Billion Bet on Cryptocurrencies and The Upcoming Bitcoin Conference

The Trump family's growing involvement in the cryptocurrency space has taken a significant step forward with reports that trump media & Technology Group (TMTG), the company behind Truth Social, plans

The Trump family's growing involvement in the cryptocurrency space has taken a significant step forward with reports that trump media & Technology Group (TMTG), the company behind Truth Social, plans to raise $3 billion to invest in digital assets like bitcoin.

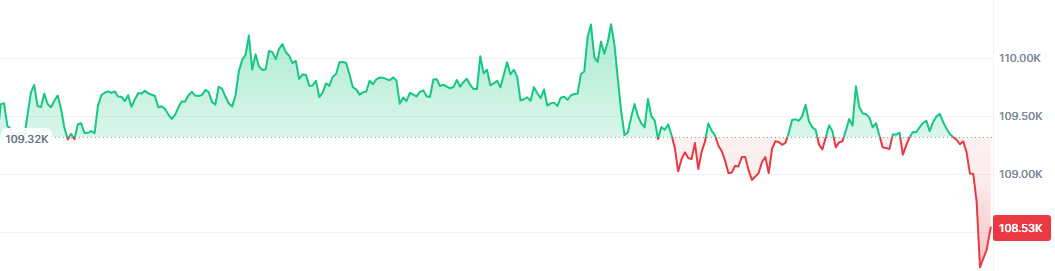

This move aligns with Trump’s vision of positioning the United States as the "crypto capital of the world" and comes at a time when bitcoin recently reached a record-high price of $112,000, hovering near $108,600 as of May 26th. As the crypto market gains momentum, TMTG’s ambitions have stirred both intrigue and skepticism, amplified by the company’s response and the backdrop of the upcoming Bitcoin 2025 Conference in Las Vegas.

TMTG’s $3 Billion Crypto Investment Plan

Trump Media & Technology Group, a publicly traded entity controlled by the Trump family, is reportedly preparing to raise $3 billion to purchase cryptocurrencies, with a focus on bitcoin.

According to six individuals briefed on the matter, the fundraising effort comprises $2 billion in fresh equity and $1 billion through a convertible bond. This substantial capital raise reflects a strategic bet on the digital asset market, which has seen renewed interest under the Trump administration’s pro-crypto stance.

The announcement of this initiative could coincide with a major gathering of cryptocurrency investors and advocates in Las Vegas, where prominent figures such as Vice President JD Vance, Donald Trump Jr., Eric Trump, and Trump’s crypto advisor David Sacks are slated to speak. While the terms, timing, and size of the capital raise remain subject to change, two sources familiar with the plans noted that the offering has been upsized in recent weeks due to strong investor demand. This flexibility underscores the dynamic nature of the deal and the enthusiasm surrounding it.

TMTG’s strategy echoes that of Strategy (formerly MicroStrategy), a company that transformed its market value—now exceeding $100 billion—by leveraging debt and equity to acquire tens of billions of dollars in bitcoin. For tmtg, the secondary share offering is expected to be executed on at-the-market terms, with shares priced near their closing value of $25.72 on Friday, May 23, 2025. This gives TMTG a market capitalization of nearly $6 billion, providing a solid foundation for its crypto ambitions. Brokers such as ClearStreet and BTIG are reportedly in line to underwrite the deal.

The Trump family’s crypto footprint extends beyond this planned investment. Previous ventures include an NFT trading card, two memecoins, and stakes in crypto mining company American Bitcoin and stablecoin issuer World Liberty Financial. Last week, President Trump hosted a private dinner for top memecoin investors at his Virginia resort. These activities highlight a broader push into the digital asset space, though they have raised questions about potential conflicts of interest, especially since Trump transferred his 53% stake in TMTG—valued at approximately $3 billion—to a revocable trust managed by Donald Trump Jr., who holds sole investment and voting power.

Trump Media’s Denial and the Bitcoin 2025 Conference

Despite the detailed reports, Trump Media & Technology Group has pushed back against the narrative.

In a statement on Monday, TMTG denied the Financial Times story, asserting, “Apparently there are dumb agencies with dumb writers listening to even dumber sources.” The company offered no additional clarification, leaving the status of the $3 billion fundraising effort uncertain. This dismissive response is consistent with TMTG’s approach to media scrutiny but does little to dispel the speculation surrounding its crypto plans. Representatives for Donald Trump Jr. did not respond to inquiries, and a White House spokesperson declined to comment.

Meanwhile, the cryptocurrency community is gearing up for the Bitcoin 2025 Conference, set to take place from May 27 to May 29, 2025, at the Venetian Convention and Expo Centre in Las Vegas. Now in its sixth year, the event is poised to be its largest yet, expecting over 30,000 attendees, 400 speakers, and 5,000 companies. The conference will serve as a critical platform for discussing bitcoin’s growth, technological advancements, and regulatory future—topics that resonate with TMTG’s reported ambitions.

The agenda is packed with forward-looking sessions. Bitcoin Layer 2 (L2) solutions, such as BitVM2 and cross-chain bridges, will explore how decentralized finance (DeFi) can be integrated into the bitcoin network. The Lightning Network, a second-layer scaling solution, will be highlighted for its role in making bitcoin transactions faster and cheaper, bolstered by innovations like Tether’s issuance of USDT via Bitcoin’s Taproot technology. Technical discussions will delve into mempool policy, new opcodes, and on-chain programmability, appealing to developers and enthusiasts alike.

Financial innovation will also take center stage, with talks on bitcoin ETFs, lending platforms, and their integration into traditional finance. Government officials and regulators will weigh in on the evolving legal framework for cryptocurrencies, while sessions on privacy, open-source development, and financial freedom will underscore bitcoin’s broader societal impact. Bitcoin mining, a perennial topic, will focus on energy efficiency and sustainability, with thought leaders presenting strategies to reduce its environmental footprint.

Conclusion

TMTG’s reported $3 billion cryptocurrency investment marks a bold escalation in the Trump family’s engagement with digital assets, capitalizing on a market buoyed by bitcoin’s recent surge and the administration’s pro-crypto rhetoric. While the company’s denial introduces ambiguity, the speculation alone reflects the growing convergence of politics and finance in

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.