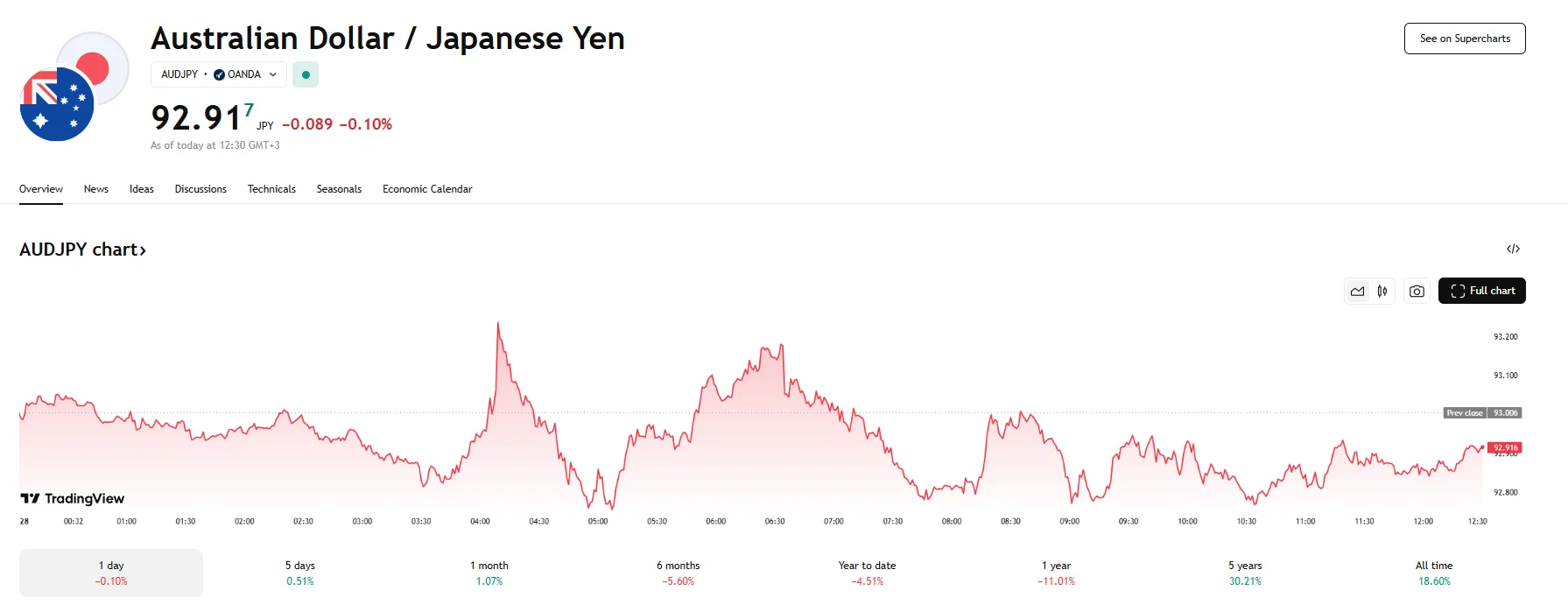

AUD/JPY Loses Momentum, Pair Slips 0.1% to 92.91 as BoJ Policy Speculation Lifts Yen AUD/JPY Loses Momentum, Pair Slips 0.1% to 92.91 as BoJ Policy Speculation Lifts Yen

Key Moments:AUD/JPY fell below the 93.00 mark on Wednesday.The yen rebounded amid expectations that the BoJ could pursue further rate hikes.NAB expects the RBA’s terminal cash rate to fall to 3.1% in

Key Moments:

- AUD/JPY fell below the 93.00 mark on Wednesday.

- The yen rebounded amid expectations that the BoJ could pursue further rate hikes.

- NAB expects the RBA’s terminal cash rate to fall to 3.1% in the upcoming months, up from an earlier forecast of 2.6%.

Yen Strengthens on BoJ Expectations

The AUD/JPY currency pair retreated below 93.00 on Wednesday, putting the brakes on a three-session streak of gains. The drop was attributed to positive sentiment surrounding the yen amid growing expectations that the Bank of Japan might continue to implement interest rate hikes in response to persistent inflationary pressures.

However, the yen may face pressure from Japan’s recent moves regarding its debt issuance strategy, which could limit AUD/JPY declines and even propel the pair upward. On Monday, Bloomberg reported that Japan’s Ministry of Finance sought market views on bond issuance and the current debt landscape. The following day, Reuters noted that the ministry was evaluating whether to reduce the issuance of long bonds as part of a shift in its current fiscal policy framework.

Adding to these developments, Wednesday saw Minister of Finance Shunichi Kato comment on the government’s concerns regarding the recent rise in yields. According to the finance minister, the government will continue to scrutinize the bond market.

Australian CPI Surprises, Yet AUD Faces Pressure

The Australian Dollar saw limited traction despite the local Consumer Price Index (CPI) beating expectations. As per figures released on Wednesday by the Australian Bureau of Statistics, monthly CPI posted a year-over-year increase of 2.4% in April, exceeding the anticipated 2.3%.

However, the Reserve Bank of Australia recently made the decision to slash interest rates by 25 basis points to 3.85%, which has weighed on the AUD. Further rate cuts may be on the horizon, according to the National Australia Bank (NAB), which projects the RBA to lower rates by an additional 25 basis points in the upcoming months. As a result, the terminal cash rate could fall to 3.1%, although this estimate is relatively higher than the NAB’s previous estimate of 2.6%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.