US Treasury Yields Reverse Course Amid Mixed Housing Activity, Dollar Index Reclaims 101.00 US Treasury Yields Reverse Course Amid Mixed Housing Activity, Dollar Index Reclaims 101.00

Key Moments:Benchmark 10-year Treasury yield declined to 4.394%.April witnessed US single-family housing starts slip 2.1% due to tariffs and elevated mortgage rates. Multi-family construction picked u

Key Moments:

- Benchmark 10-year Treasury yield declined to 4.394%.

- April witnessed US single-family housing starts slip 2.1% due to tariffs and elevated mortgage rates. Multi-family construction picked up, however, climbing by 10.7%.

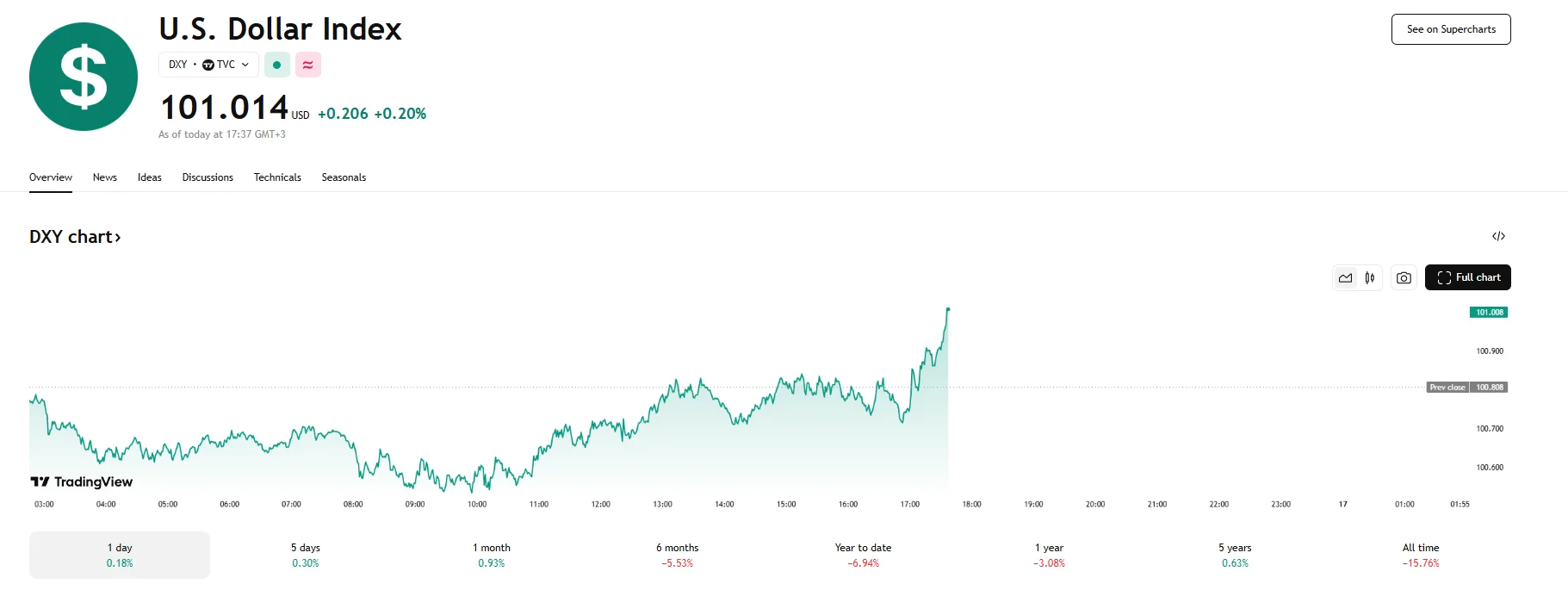

- The US Dollar Index recovered to 101.014, poised for a weekly gain.

Bond Market Reacts to Housing Weakness

US Treasury yields dropped on Friday, with the 10-year yield declining by 6.1 basis points to reach 4.394%, while the two-year yield fell by 4.1 basis points and hit 3.932%. This decline was attributed to economic data that pointed to softening momentum in the housing sector, as April’s single-family housing starts suffered a 2.1% drop, weighed down by persistently high mortgage rates and the continued impact of tariffs on construction materials not sourced from the US. Building permits for this type of housing also fell by just over 5%.

The dip in activity prompted investors to adjust their outlooks for the pace of economic growth and potential Federal Reserve actions. Janney Montgomery Scott’s chief fixed income strategist, Guy LeBas, pointed out that an apparent rise in housing inventory might also be easing market conditions.

It should be noted, however, that multi-family construction did pick up significantly, jumping by 10.7%. The building of new residential constructions rose by 1.6% overall. The uptick in multi-family housing occurred amidst a backdrop of rising import prices, which edged 0.1% higher in April. This marked a rebound from a 0.4% decline in the prior month.

Fed Rate Cuts Still on the Horizon, Dollar on Track for Weekly Gain

Despite the increase in import prices, the overall sentiment leaned toward expectations that the Federal Reserve might reduce interest rates at least twice this year. This belief has been reinforced by a broader collection of weaker-than-anticipated indicators across the consumer and producer inflation gauges, as well as retail sales figures earlier in the week.

Meanwhile, the greenback has managed to trim losses suffered earlier in Friday’s trading session. The US Dollar Index rose 0.2%, once again managing to climb above the 101.00 mark.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.