Bitcoin ETFs See Another $591.3M in Net Inflows, BTC Fluctuates Near $95,000 Bitcoin ETFs See Another $591.3M in Net Inflows, BTC Fluctuates Near $95,000

Key Moments:US-listed Bitcoin ETFs attracted more than $3 billion in net inflows last week.The momentum did not slow on Monday, as SoSoValue data suggests daily inflows reached $591.3 million.Bitcoin

Key Moments:

- US-listed Bitcoin ETFs attracted more than $3 billion in net inflows last week.

- The momentum did not slow on Monday, as SoSoValue data suggests daily inflows reached $591.3 million.

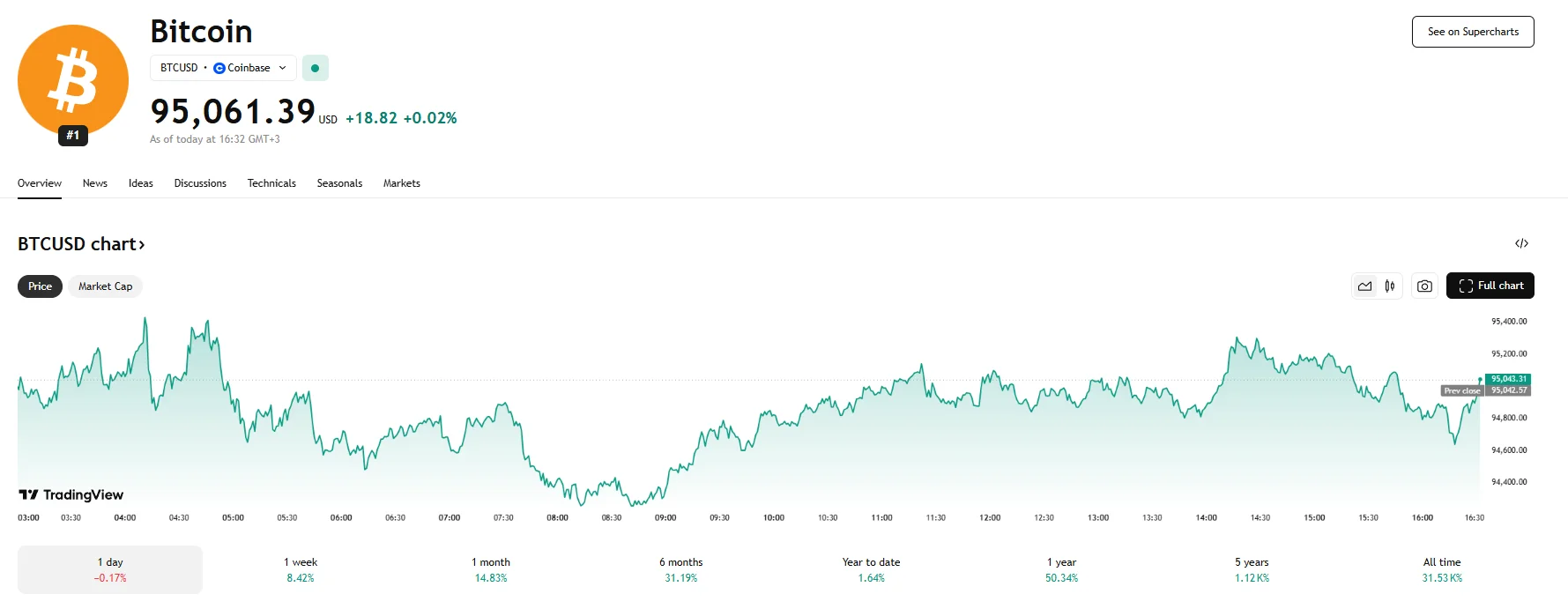

- Bitcoin was volatile on Tuesday, hovering around the $95,000 mark.

Institutional Demand Shows no Signs of Waning

A massive influx of institutional cash saw Bitcoin ETFs enjoy inflows of over $3 billion last week, second only to their launch week in terms of capital raised. BlackRock’s iShares Bitcoin Trust alone attracted nearly $1.5 billion, making it the week’s top performer in the segment.

Monday extended gains, with net inflows reaching a significant $591.3 million according to SoSoValue data. This marked the seventh consecutive day of positive investment in these digital asset vehicles, occurring as the price of Bitcoin traded above $95,000. Tuesday has thus far shown Bitcoin fluctuate around this same threshold.

Analysis of individual ETF performance revealed a notable concentration of this investment activity, with BlackRock’s Bitcoin ETF once again attracting the largest amount of new capital, totalling $970.9 million. In contrast, several competing ETFs experienced outflows during the same period, with Ark and 21Shares seeing a combined $226.3 million leave their funds and Fidelity’s ETF registering an $86.9 million departure.

Bitcoin’s ‘Digital Gold’ Narrative Gains Traction

As equities remain volatile amid market turmoil, Bitcoin has become increasingly appealing, stirring conversations comparing it to gold as a potential safe haven asset. While speaking with Bloomberg, eToro’s Simon Peters recently noted that investors may be seeing Bitcoin as a safe haven asset due to its gold-like scarcity. He also noted that net spot ETF inflows were a “barometer” that indicated institutional interest in Bitcoin and that they had ramped up.

Some analysts believe the continued surge in ETF-driven demand may push Bitcoin’s valuation much higher. MicroStrategy’s Michael Saylor has gone as far as to predict that IBIT could become the world’s largest ETF within a decade. Meanwhile, crypto commentator Willy Woo suggested that Bitcoin may be on track to test new all-time highs in the coming months, buoyed by these cash inflows.

Beyond Bitcoin: Emerging Projects Ride the ETF Momentum

While Bitcoin remains the centerpiece of this institutional revival, many investors are casting their nets wider, seeking altcoins positioned to benefit from fresh liquidity and growing retail attention. Three projects, including Bitcoin Pepe, CartelFi, and PepeX, are generating buzz by addressing critical limitations in existing crypto infrastructure.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.