Triple Witching Day Coming: What Traders Should Prepare for and Stocks with Strategies

Friday could mark the arrival of Triple Witching Day, a highly anticipated trading session known for elevated stock market volatility—and potentially lucrative opportunities. In today’s retail-driven

Friday could mark the arrival of Triple Witching Day, a highly anticipated trading session known for elevated stock market volatility—and potentially lucrative opportunities. In today’s retail-driven environment, this volatility may be amplified further by speculative flows. Here’s everything investors should keep in mind, along with actionable strategies to navigate the day effectively.

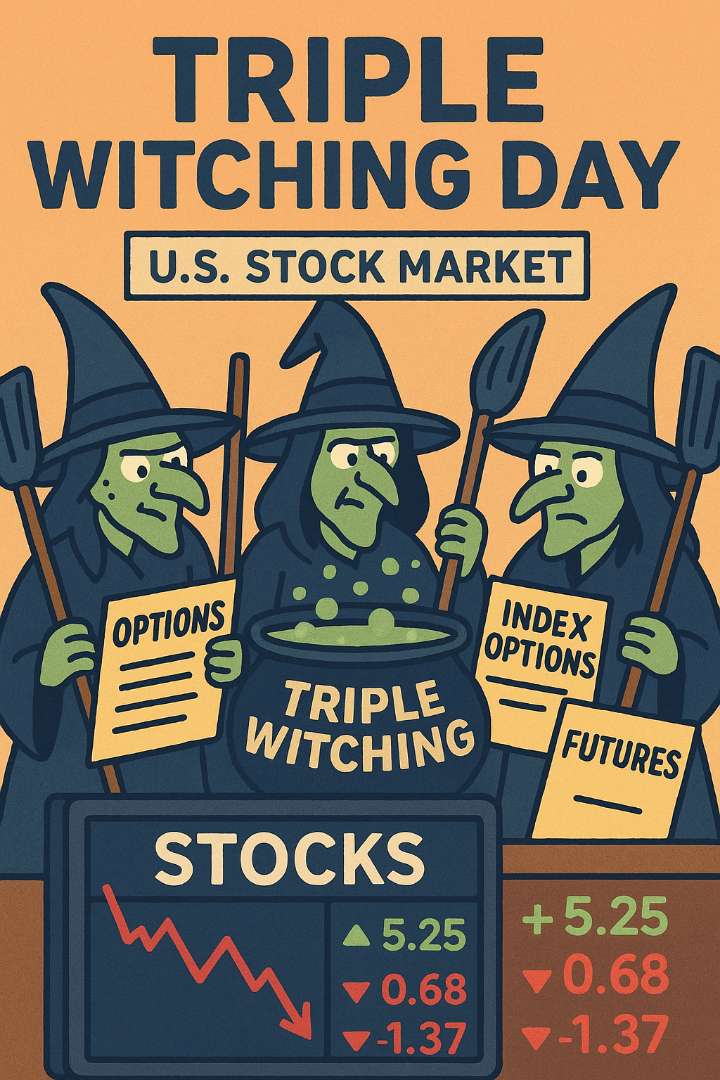

To begin with, Triple Witching Day refers to a major event in the U.S. stock market when stock options, index options, and index futures all expire simultaneously. This phenomenon takes place four times a year, specifically on the third Friday of March, June, September, and December. The term “Triple Witching” is derived from the notion of the "witching hour," a reference to a time of heightened energy and activity. On this day, traders must choose whether to close, roll over, or exercise their expiring contracts, often creating a surge in trading volume and unusual price movements. While “Quadruple Witching” was once a commonly used term—accounting for the expiration of single-stock futures as well—those instruments were phased out in 2020, making "Triple Witching" once again the standard phrase.

This year’s June 20 Triple Witching Day may be one of the most consequential in recent memory. Over $6 trillion in options tied to stocks, ETFs, and indexes are set to expire. Of that, $3.2 trillion in index options—mostly linked to the S&P 500—will expire at the market open, while another $1.9 trillion worth of single-stock and ETF options will expire at the close. Uniquely, this Triple Witching Day falls on the day after a market holiday, the first such occurrence since 2000. This timing could further intensify both volume and volatility.

Several key stocks are drawing attention ahead of the event.

Circle (CRCL), the issuer of the USDC stablecoin, has quickly become one of 2025’s most impressive IPO stories. Since debuting on June 5 at $31, its shares have skyrocketed over 540%, now trading near $200. On June 18 alone, the stock jumped 34% to $199.59, a new all-time high. The rally was fueled by Senate approval of the GENIUS Act, a regulatory framework for stablecoins that significantly boosted investor confidence. The company’s market capitalization now approaches $50 billion, putting it just behind Coinbase’s $75 billion and Strategy’s $103 billion.

Tesla (TSLA) also continues to dominate the options market, especially during periods like Triple Witching. As of June 16, Tesla’s $330 call options expiring on June 20 saw unusually high activity, with 40,739 contracts traded in a single day—equivalent to 7.2% of the company's total options volume. Implied volatility dropped sharply from 63.5 to 53.0, while 67.3% of the contracts were bought, indicating robust participation from retail investors. Remarkably, 80% of the volume came from small accounts. Despite this, Tesla’s fundamentals have weakened. The company’s first-quarter deliveries declined by 13% to 336,681 vehicles, and analysts are generally bearish for the remainder of 2025. Wall Street’s median 12-month price target now stands at $286.14, well below previous highs.

Another standout name is CoreWeave (CRWV), a rising powerhouse in AI infrastructure. Since its IPO in March, the stock has surged 340%. The company plans to invest a staggering $23 billion in capital expenditures in 2025, catching Wall Street off guard. Although revenue growth has impressed investors, concerns remain over its heavy debt burden. Historically, 85% of its capital expenditures have been financed through debt. On June 17, Bank of America downgraded CoreWeave to neutral but simultaneously raised its price target from $76 to $185—the highest on the Street.

Triple Witching Days are historically accompanied by spikes in trading volume. On June 21, 2024, total share volume across U.S. exchanges surged to 18 billion, 55% above the three-month average. Intraday volume for the S&P 500 was 30% higher than usual. This effect tends to be more pronounced in individual stocks than in broader indexes. While indices often cluster around major strike prices, individual equities can see far more dramatic price swings.

In 2021, for instance, the average daily volume of the S&P 500 nearly doubled on Triple Witching Days, increasing from 2.1 million to 4 million shares. Intraday price ranges widened by nearly 7%, and average returns dropped by 0.72% compared to normal trading days. In the most recent Triple Witching Day on March 21, 2025, major indices posted a 60% probability of closing higher—an insightful reference point for traders looking for historical patterns.

As options near expiration, market makers are forced to adjust their hedging positions, and this can significantly influence the prices of underlying assets. These adjustments tend to intensify during the final hour of trading—often referred to as the actual “witching hour.” One phenomenon commonly observed is known as "pin risk," where a stock’s price settles near a key strike price due to hedging flows aimed at avoiding assignment on in-the-money options. At the same time, brief price inefficiencies can emerge between underlying securities and their derivatives, creating arbitrage opportunities. However, these pricing gaps typically close quickly and require rapid execution and deep market knowledge to exploit effectively.

Different trading strategies can be employed to capitalize on the unique environment of Triple Witching. Momentum trading is particularly well-suited to the day’s heightened volatility, allowing traders to ride strong upward or downward intraday moves. Scalping is another effective tactic, capitalizing on quick price discrepancies in high-volume names, though it demands technical precision and a strong understanding of market microstructure. Pairs trading may also work well in this environment. For instance, if the broader tech sector is under pressure, traders could long stronger names while shorting weaker peers, taking advantage of temporary dislocations.

Certain names may warrant more tailored strategies. For Circle, with its explosive price action and high volatility, investors might consider selling out-of-the-money calls to collect premium, or deploying a straddle to benefit from large moves in either direction. For Tesla, the $330 level stands out as a critical technical zone. Traders might explore underpriced options given the recent drop in implied volatility. For CoreWeave, long-term investors may want to focus on monitoring its partnerships with major AI players like OpenAI, while keeping a close eye on the execution of its capital plan and progress on reducing debt.

Despite the potential, Triple Witching is not without risks. Liquidity can dry up toward the close, leading to wider bid-ask spreads and greater execution challenges. The temptation to use excessive leverage can backfire easily, especially during volatile sessions. For options buyers, time decay accelerates as expiry approaches, which can quickly erode the value of positions if the market doesn't move decisively in their favor.

The June 20, 2025, Triple Witching Day presents a unique setup—historic in scale and made even more significant by its timing after a market holiday. From regulatory momentum lifting Circle, to intense options activity around Tesla, and the ongoing AI-driven rally benefiting CoreWeave, each of these stocks offers a distinct thesis and risk-reward profile.

Ultimately, while short-term trading gains may capture headlines, the greater value of Triple Witching lies in the insights it offers into how derivatives shape market behavior. For investors looking to deepen their understanding of financial markets, observing how these dynamics play out can prove more valuable than any single Friday in June.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.