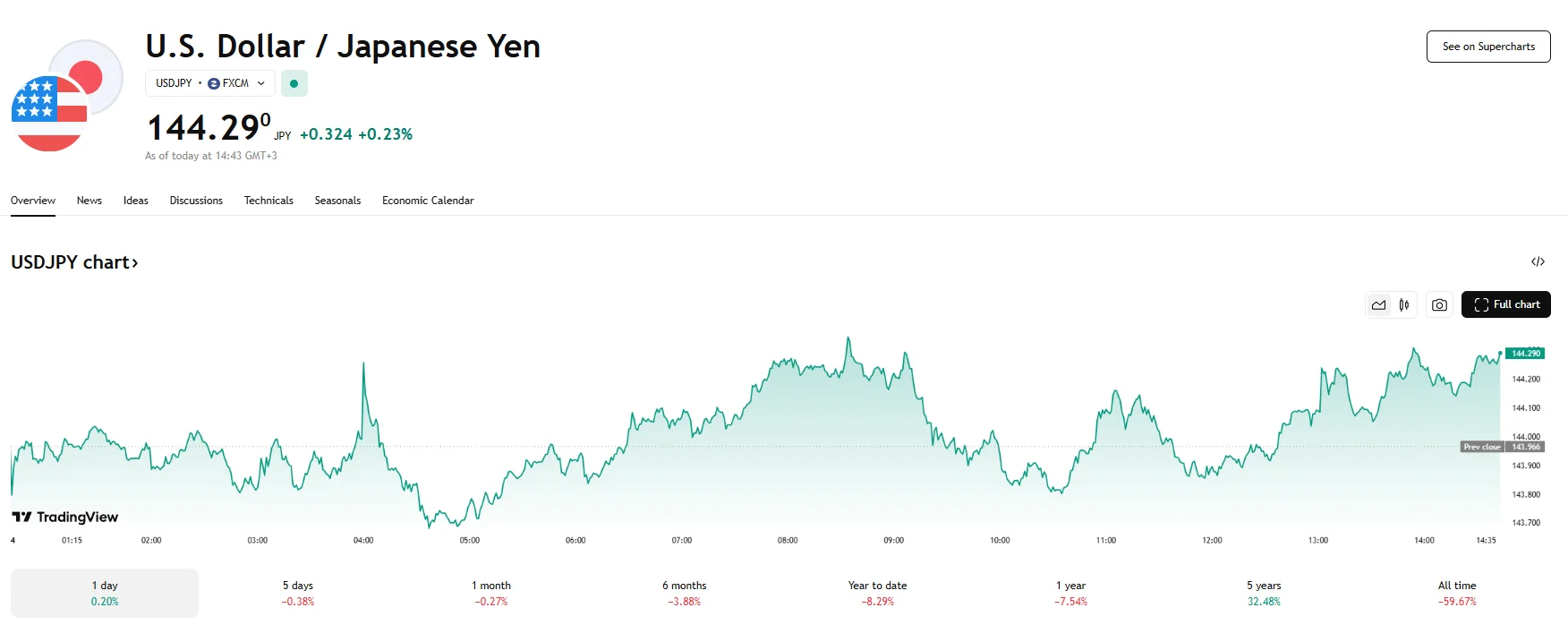

USD/JPY Rebounds 0.23% to 144.29

Key Moments:BOJ Governor Ueda reaffirmed the bank’s plans to continue bond tapering but signaled a delay on rate hikes.Rising Japanese inflation and fragile domestic demand complicate the BOJ’s policy

Key Moments:

- BOJ Governor Ueda reaffirmed the bank’s plans to continue bond tapering but signaled a delay on rate hikes.

- Rising Japanese inflation and fragile domestic demand complicate the BOJ’s policy outlook.

- USD/JPY managed to climb above 144.20.

BOJ Maintains Cautious Stance

Wednesday saw the USD/JPY pair fluctuate as markets assessed recent commentary from Bank of Japan Governor Kazuo Ueda. The pair retreated to around 143.68 earlier, but it later recovered and managed to hit 144.29.

Ueda has told lawmakers that borrowing costs would only increase if the Japanese economy can demonstrate continued momentum in a higher interest rate environment. He added that the central bank plans to proceed with its bond tapering program.

April’s headline inflation reading stood at 4.6%. Import cost pressures and a notable increase in rice prices have both contributed to elevated inflation, presenting a policy dilemma for the BOJ. However, although inflation levels remain above target, consumer demand within Japan appears shaky. Ueda also cautioned future wage negotiations and corporate bonuses in Japan could be undermined as a result of the Trump administration’s tariff policies.

Markets Turn Focus to Upcoming US Reports

The US dollar’s appreciation against the yen was, in part, attributed to the latest JOLTS Job Openings report. According to the data, the figure came in at 7.39 million in April, exceeding the 7.1 million analysts had expected. This helped counterbalance a larger-than-forecast drop in Factory Orders and disappointing manufacturing activity data from earlier in the week, both of which were viewed within the context of worsening effects from Trump-era tariffs.

Investor attention is now shifting to the upcoming ADP Employment report for May, along with the ISM Services PMI. Both releases are set to show notable improvement according to forecasts, and their outcomes may influence the dollar’s next move.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.