Qiaoshui's position adjustment in the first quarter was driven by triple macro logic.

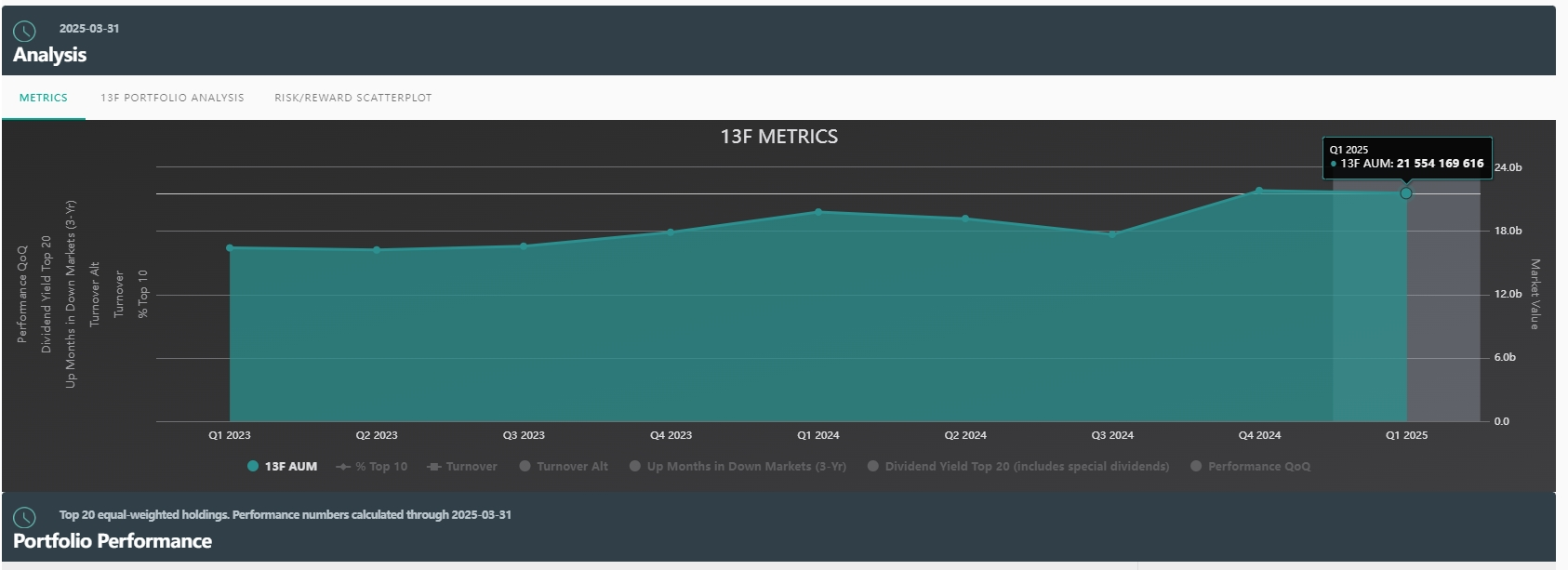

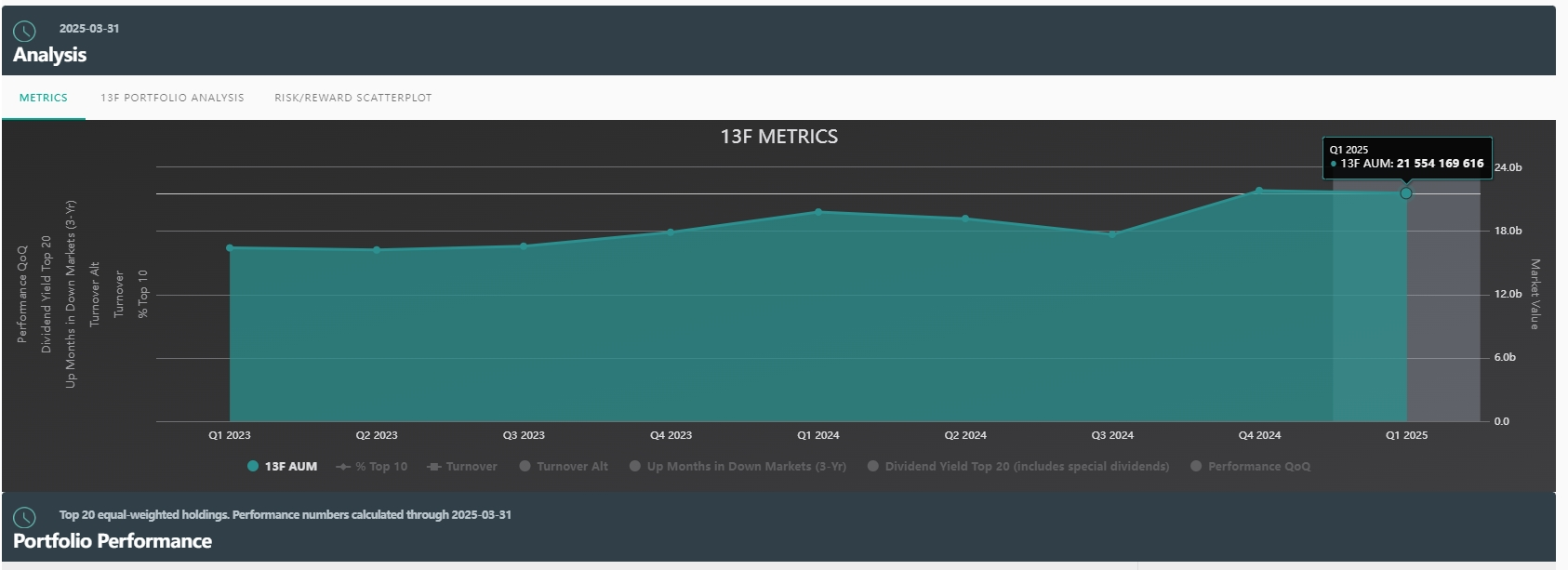

On May 15, Bridge Water Fund announced its 13F report for the first quarter of 2025, and the adjustment of its position showed a significant structural shift.

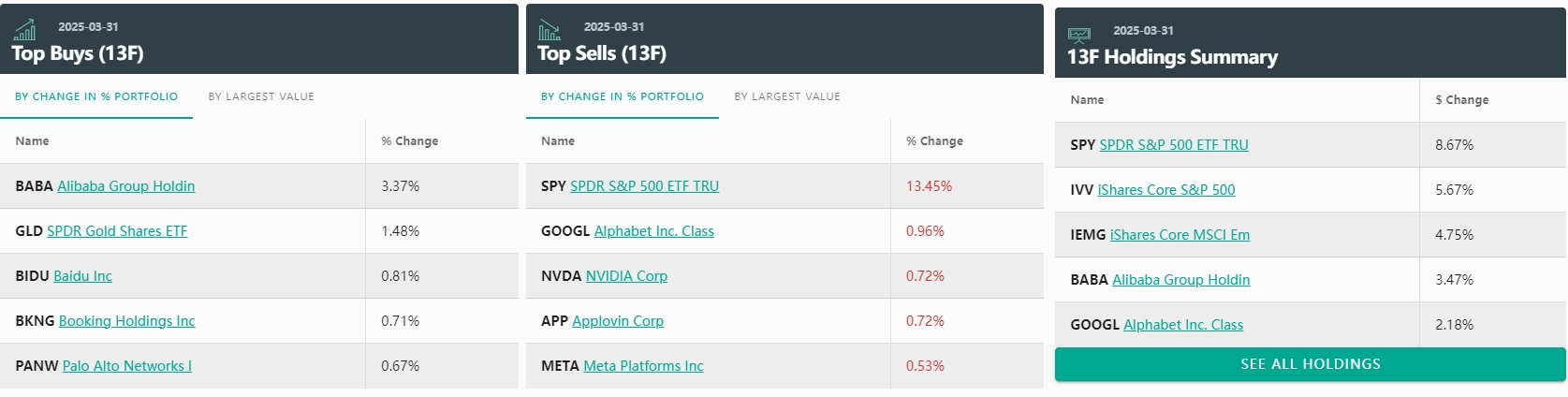

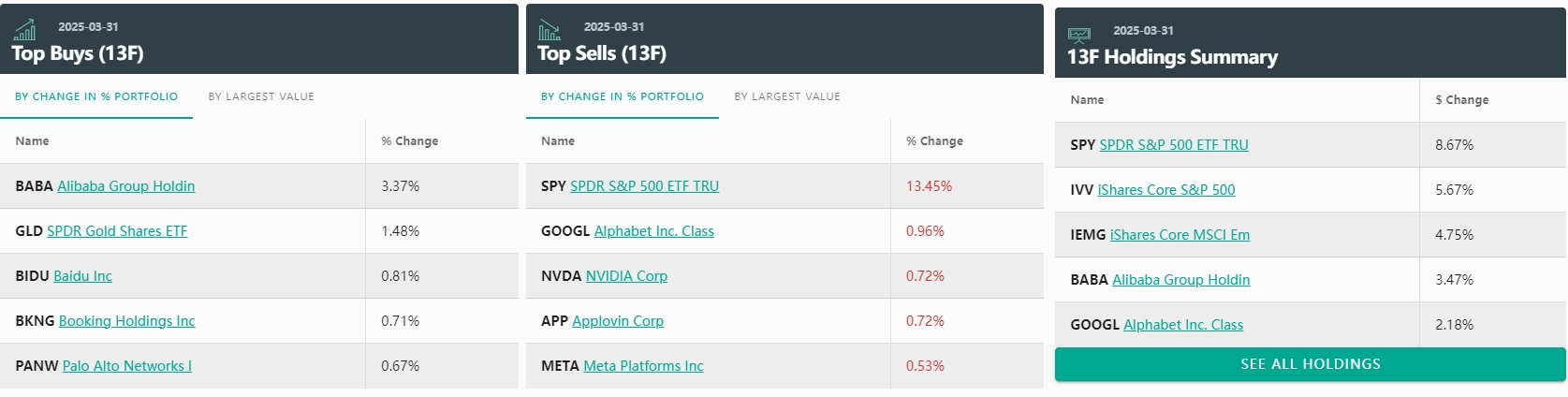

Specifically, in the first quarter, Bridgewater held the Standard & Poor's 500 ETF (SPY) and technology leaders such as Google, Nvidia, and Meta, and cleared 19 stocks such as ON Semiconductor and Modna; at the same time, it significantly increased its holdings of gold ETF (US$319 million), China-owned shares Alibaba (holding US$750 million) and Baidu, and established new positions in Jingdong (US$105 million), Chubb Insurance and Goldman Sachs Group.

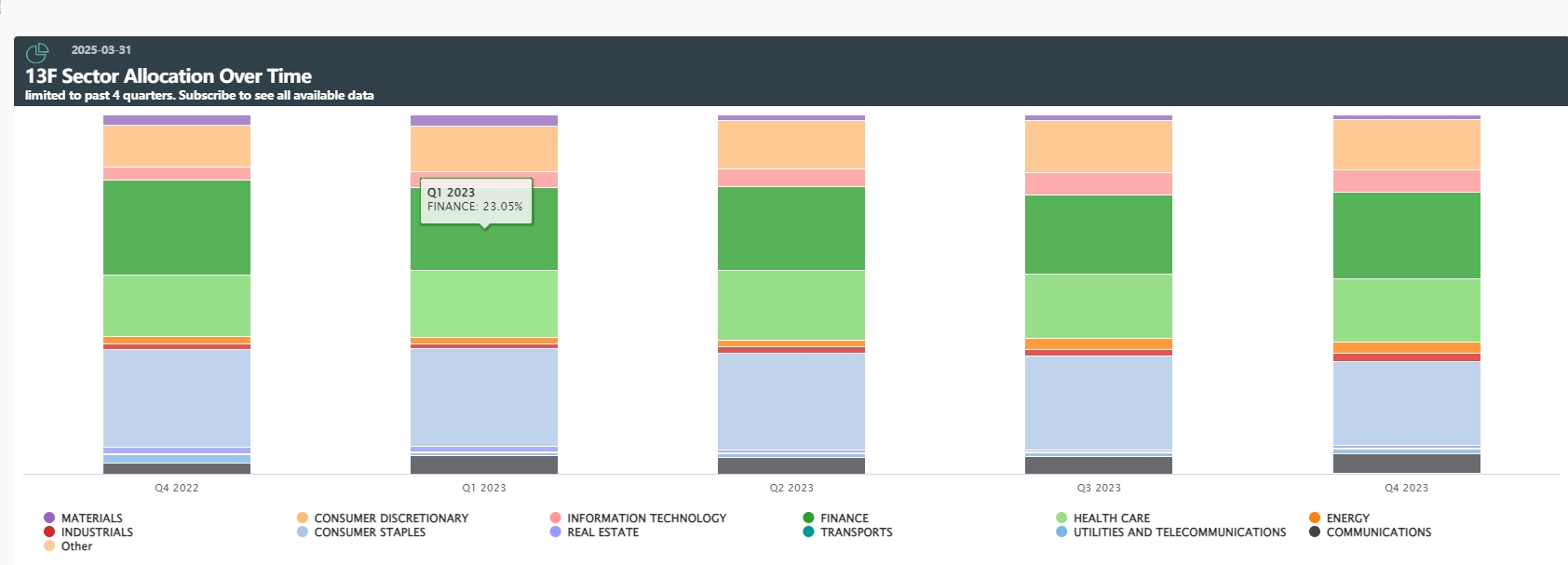

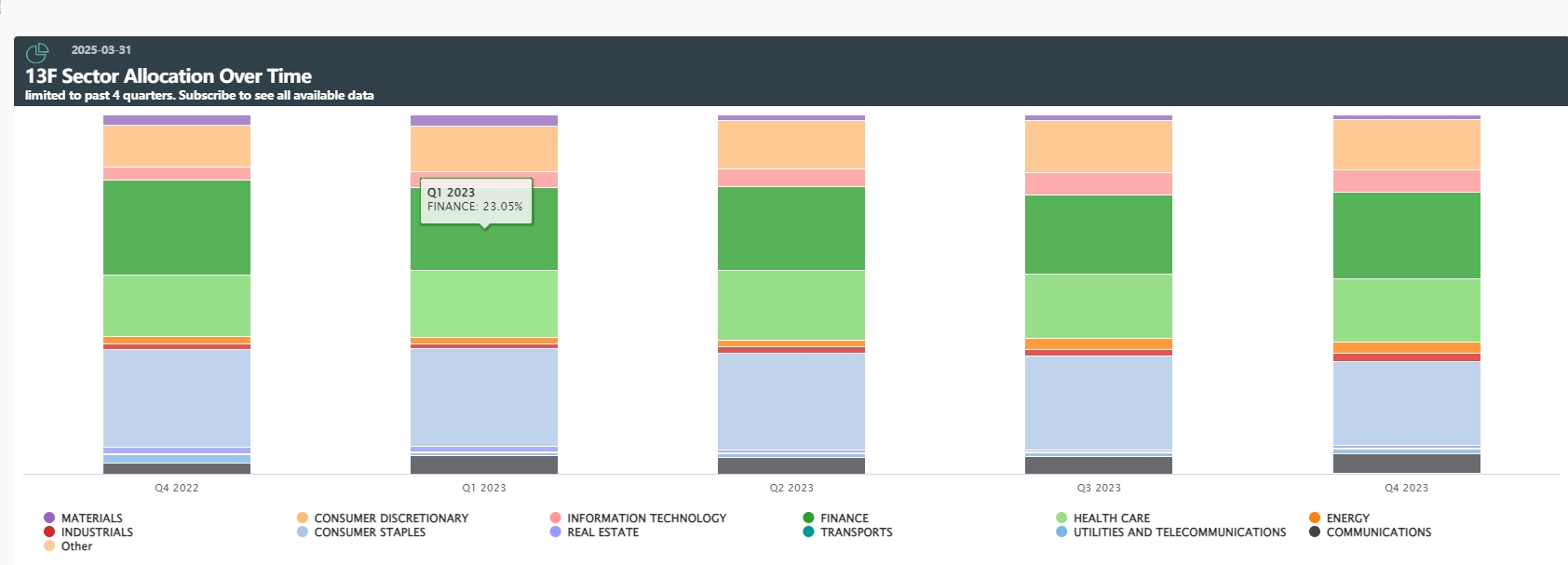

The overall market value of Bridge Water's portfolio fell slightly by 1.2% to US$21.6 billion in the first quarter, but the weight of the industry changed profoundly-the allocation of the financial sector rose to the top, and medical care suffered the largest reduction.

Observing this position, there are many highlights in the Qiashui operation.

First, the SPDR Gold ETF (GLD) became the largest new position opening target during the quarter, accounting for 72% of Qiaoshui's commodity holdings.This operation coincided with a 19% rise in gold prices in the first quarter, the largest single-quarter increase since 2020.InvalidParameterValue

Second, the reverse layout of Qiaoshui has attracted attention.Alibaba's holdings increased by 22%, Baidu increased its holdings by 35%, and Jingdong added to the top 20 new positions.During the same period, the MSCI China Index rebounded by 14% in the first quarter, outperforming the S & P 500 by 10.3%.InvalidParameterValue

Third, Bridge Water has significantly reduced its position in technology leaders and focused on the financial sector.The reduction in holdings in six major technology stocks, including Google, Nvidia, and Meta, was between 12 and 28%. During the same period, the CBOE NDX Volatility climbed to 25.6, a new high for the year. In addition to new positions Chubb (the world's largest property and casualty company) and Goldman Sachs, they increased their holdings in Bank of America and Citigroup, and the total weight of financial stocks increased by 4.3 percentage points compared with the previous quarter.InvalidParameterValue

Fourth, cyclical stocks are rebalanced.Liquidated semiconductor company On Semiconductor Company (inventory turnover days reached 127 days) and biotechnology stock Modena (mRNA vaccine demand fell 67% year-on-year), but newly established positions joined Continental Airlines and Delta Air Lines (industry passenger return increased 6.2% year-on-year).

According to the analysis, Qiashui's first quarter transfer of positions was driven by triple macro logic.

First, in the first quarter, the contraction of the Federal Reserve's balance sheet plunged by 50% to US$60 billion. Coupled with the fact that the issuance of treasury bonds by the U.S. Treasury Department surged by 32% year-on-year, the credit margin of the U.S. dollar weakened.World Gold Council data shows that global central banks purchased 228 tons of gold in the quarter, 34% higher than the five-year average, which is in synergy with Qiaoshui's gold ETF opening positions.Dalio bluntly said in his quarterly report: "Gold is the only asset that can hedge sovereign currency risk, and its 90-day correlation with the S & P 500 has dropped to-0.18.”

Secondly, the strengthening of the allocation of financial stocks reflects forward-looking judgments on the interest rate environment.Chubb Insurance's underwriting profit margin rose to 16.2% from 14.6% in 2023, indicating a restoration of property insurance pricing capabilities; Goldman Sachs 'FICC business revenue increased by 21% year-on-year in the first quarter, benefiting from the interest rate volatility (MOVE index) remaining at a high of 120.Bridge water may bet that under the Federal Reserve's "higher for longer" policy, the net interest margin and trading income of financial institutions will be sustainable.Looking at the health care sector, the forward P/E ratio of the S & P 500 medical index reached 18.7 times, higher than the ten-year average of 14%. Valuation pressure triggered a reduction in holdings.

Finally, the overallocation of Chinese stocks implies a re-pricing of geopolitical risk discounts.Alibaba's price-to-book ratio is at a historical low of 1.2 times, and its free cash flow yield of 9.2% is 320 basis points higher than the average of Nasdaq components. Jingdong's price-to-sales ratio of 0.4 times hit a new low on the market, but the revaluation value of its logistics assets reached 38 billion US dollars (accounting for 54% of the total market value).