Capital.com 2025 Review: Security Analysis, Legitimacy & MT4 Trading Guide

2025 Comprehensive Capital.com Review: Platform security audit, regulatory compliance, Singapore availability & step-by-step MT4 guide. Discover if this CFD broker is trustworthy for global investors.

In today's rapidly evolving financial markets, choosing a safe, reliable, and efficient trading platform is crucial for investors. Capital.com has emerged as a standout performer among the world's fastest-growing trading platforms, attracting significant investor attention. This article provides a comprehensive in-depth review of Capital.com, covering all aspects of the platform to offer valuable reference information and help investors better understand this trading venue.

I. Capital.com Platform Overview

1. Background and Development History

Since its inception, Capital.com has raced ahead like a dark horse in the financial trading platform market, with remarkable growth speed. In 2024, Deloitte Technology Fast 50 ranked it the fastest-growing company in the Middle East, demonstrating exceptional market competitiveness. Capital.com has expanded its operations to the Middle East, UK, Europe, Australia and other regions, serving investors globally and establishing itself as a significant force in financial markets.

2. Core Mission and Advantages

Capital.com adheres to its core mission: empowering traders to make wiser decisions in complex financial markets through intuitive technology, comprehensive educational resources, and dedicated support. The platform has won industry accolades including 2024 "Best Overall Trading Platform" (Online Money Awards) and 2023 "Best Trading App" (Good Money Guide). It also maintains an "Excellent" rating on Trustpilot, demonstrating widespread user recognition.

II. Is Capital.com Secure? Is It Legitimate?

1. Regulatory Compliance

Capital.com holds top-tier regulatory licenses from UK FCA, Cyprus CySEC, Australian ASIC, and others, requiring strict compliance with international standards including:

- Segregated Funds: Client funds are held separately in top-tier institutions like Barclays Bank, isolated from operational funds.

- Negative Balance Protection: Accounts won't fall below zero during extreme volatility.

- Transparency: Regular audited reports with traceable transaction data eliminate hidden practices.

2. Fund Security

Military-grade SSL encryption, two-factor authentication (2FA), and biometric login secure accounts. Additional insurance offers up to $1 million coverage per account for extreme scenarios.

3. Global Reach and Localization

For Singaporean users, Capital.com provides:

- Local Payment Methods: Supports PayNow, GrabPay and other quick deposit channels.

- Dedicated Support: 24/7 Chinese-speaking team with industry-leading response times.

- Regulatory Alignment: Complies with Singapore MAS framework and local AML regulations.

III. Trading Products and Instruments

1. Financial Market Trading

Capital.com offers extensive CFD products covering stocks, forex, indices, commodities (oil, gold), ESG products, and cryptocurrencies (Bitcoin, Dogecoin). Energy-focused traders can trade crude oil, while crypto enthusiasts access Bitcoin markets. Note: CFD trading involves high risk/reward characteristics, where leverage can amplify both profits and losses – trade cautiously.

| Asset Class | Leverage | Representative Products | Key Features |

|---|---|---|---|

| Forex/Commodities | Up to 200:1 | Crude Oil, Gold, Natural Gas | Low Spreads + Zero Commission |

| Indices/ETFs | Up to 200:1 | Nasdaq 100, Hang Seng Index | 30+ Global Indices |

| Stock CFDs | 1:1 | Tesla (TSLA), Apple (AAPL) | 0% Overnight Fees |

| Crypto CFDs | 1:1 | Bitcoin, Ethereum (40+ coins) | 24/7 Trading |

Withdrawal Efficiency: 94% processed within 1 hour (2024 data), supports Visa/bank transfer/e-wallets.

2. Trading Platforms

Capital.com supports major industry platforms. Its proprietary web platform and mobile app (award-winning) offer excellent performance. MT4, TradingView, and API access are also available, enabling algorithmic trading and strategy optimization for advanced users.

IV. Capital.com MT4/MT5 Support Guide

Full MT4 Functionality

1. Platform Advantages

Capital.com supports the MT4 platform, providing powerful trading tools and strategy execution:

- Advanced Indicators: 85+ built-in/custom indicators for market analysis.

- Automated Trading (Expert Advisors): Enables 24/7 programmatic trading.

- Comprehensive Analysis: Robust tools for informed decision-making.

2. Mac Setup Guide

Mac users can connect to Capital.com's MT4 via these steps:

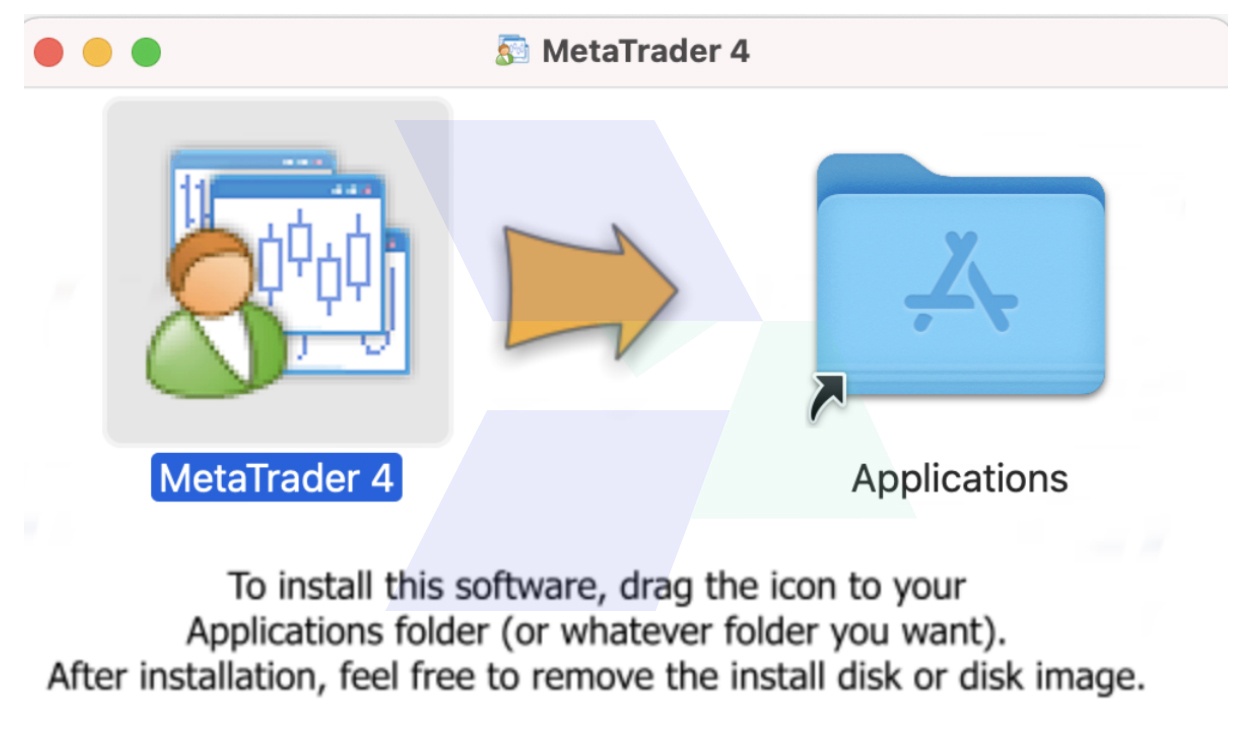

- Download MetaTrader4.dmg and install by dragging to Applications.

- Launch MT4 app and install Wine if prompted.

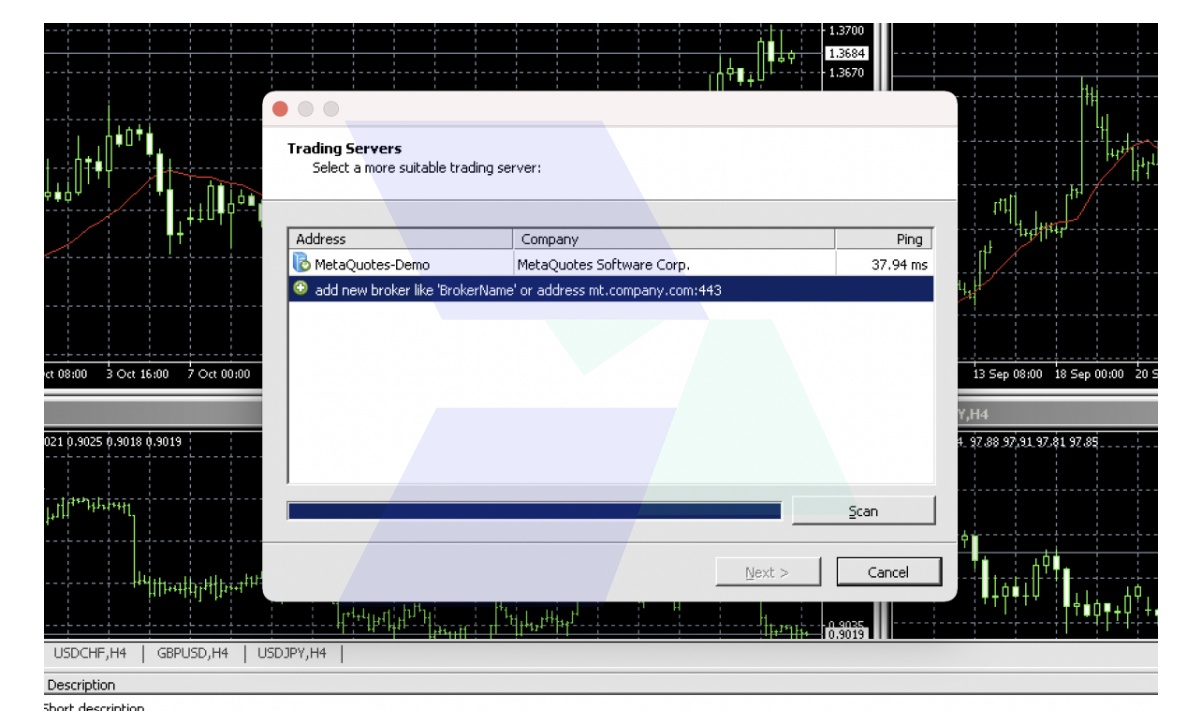

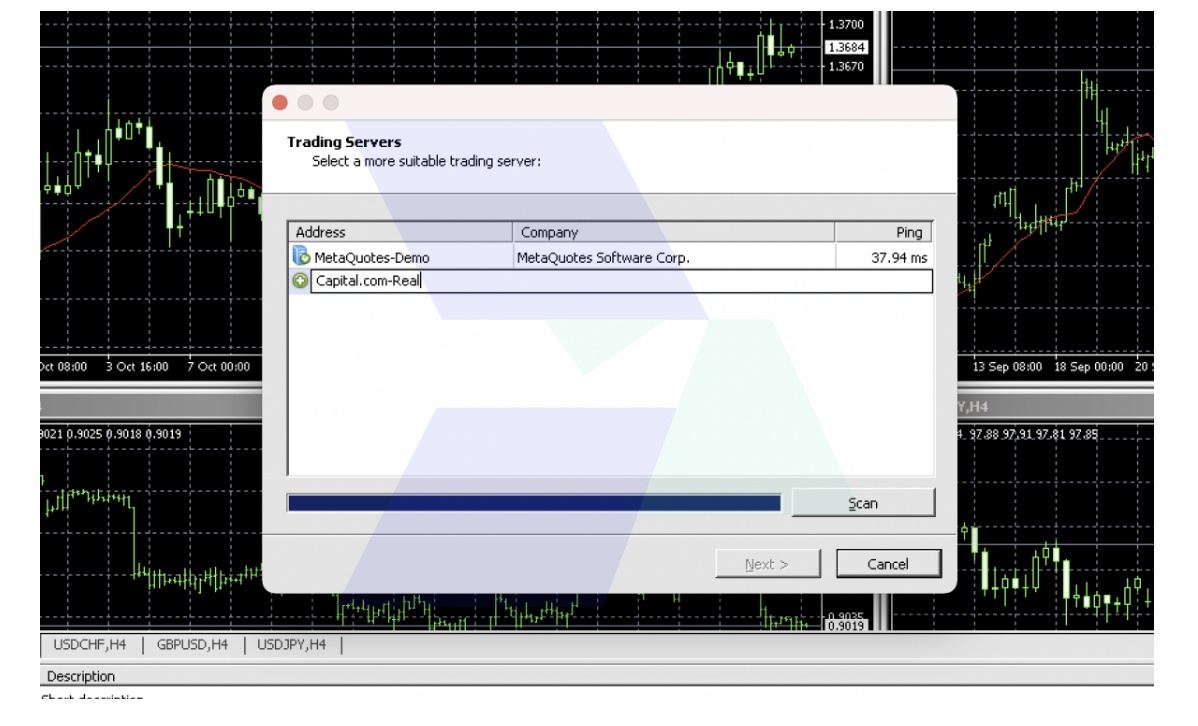

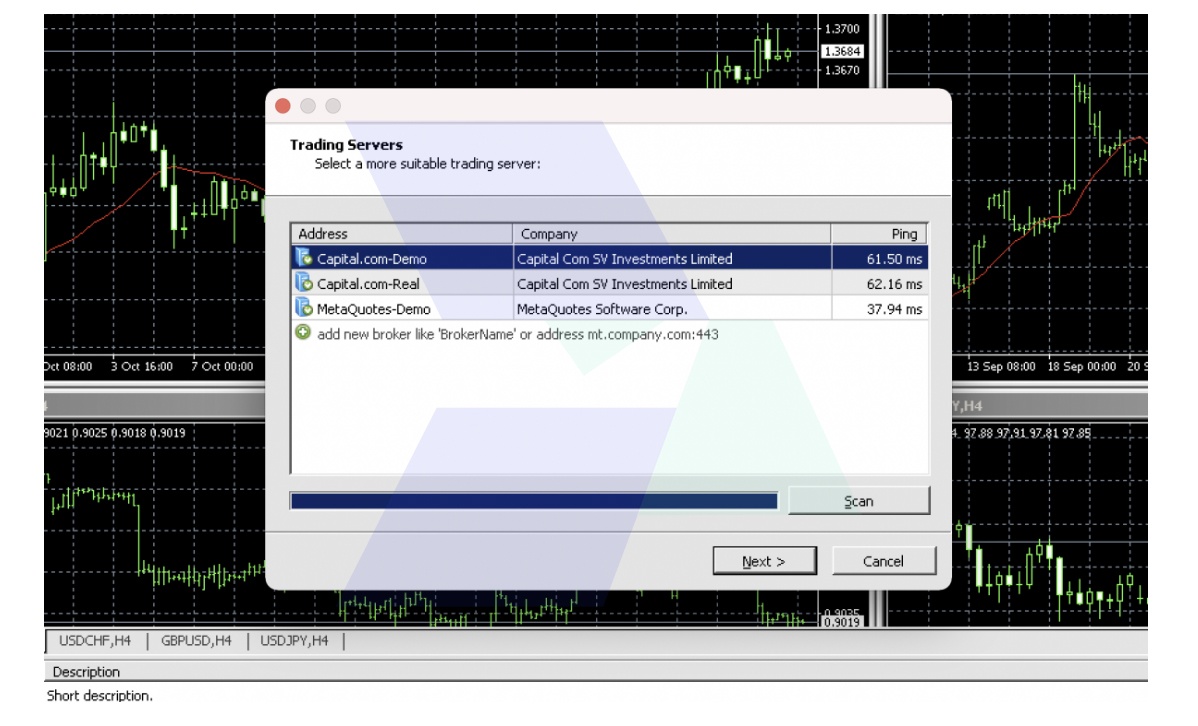

- In the MT4 terminal, open "Trading Servers", click "Add New Broker", and enter:

- Real Account:

Capital.com-Real Demo Account:Capital.com-Demo

- Real Account:

Press Enter to search automatically.

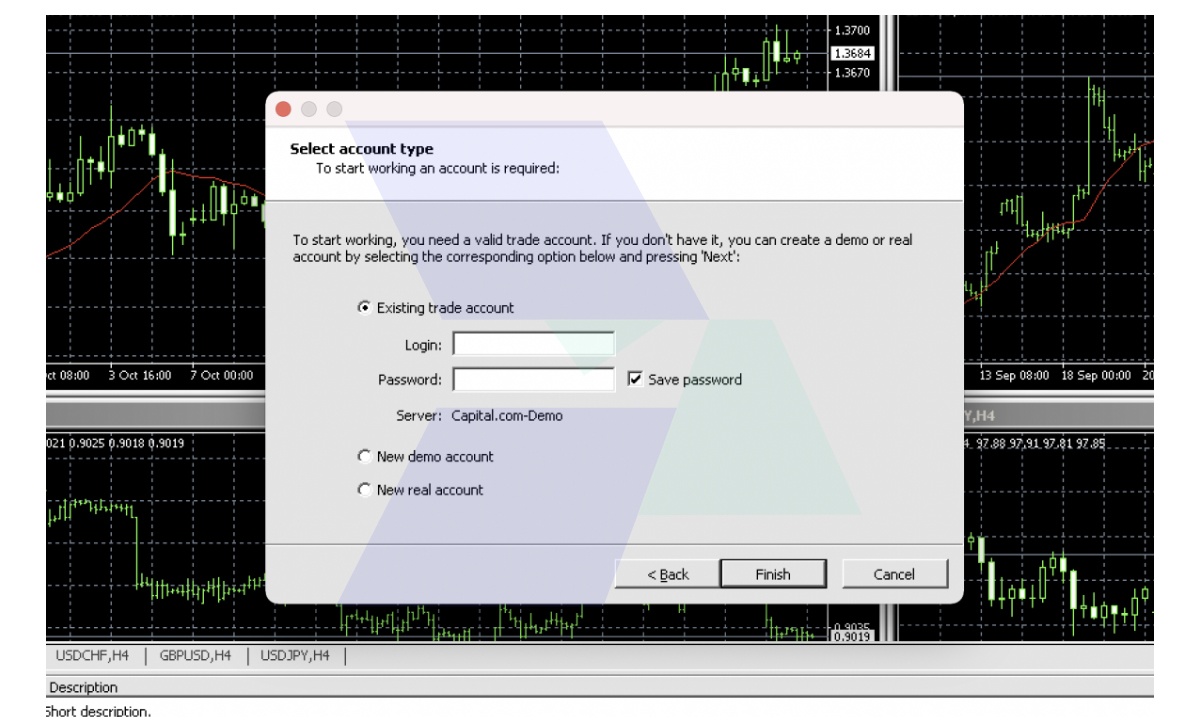

- Select your Capital.com MT4 account type (Real/Demo), click "Next".

- Select "Existing Trade Account", enter MT4 credentials obtained from Capital.com, and finish setup.

Note: Create your MT4 account first in Capital.com's "My Accounts" section if none exists.

3. Account Login & Linking

- Retrieve Credentials: Find MT4 login details in Capital.com under "Settings" → "My Accounts".

- Portfolio Linking: Connect your MT4 account to MyFxBook. Generate an Investor (Read-Only) Password in MyFxBook and follow linking steps.

4. Market Coverage

Capital.com's MT4 covers:

- Commodities: Orange Juice, Brent Crude, Copper.

- Cryptocurrencies: Bitcoin, Ethereum.

- Forex Pairs: AUD/CAD, GBP/USD.

- Stocks: Apple, Amazon, Tesla.

Diverse assets cater to varied trading preferences.

MT5 Compatibility Status

Capital.com currently does not support MT5 integration. While MT5 offers upgrades, the platform hasn't implemented connectivity based on strategic priorities. MT4 remains the primary solution for third-party platform users.

V. Is Capital.com Legal in Singapore?

Current Regulatory Status: Capital.com does not hold a direct license from Singapore's Monetary Authority (MAS). However, this does not equate to illegality. Its compliance involves multiple dimensions:

1. Cross-Border Regulatory Framework

Regulated by CySEC (#319/17), ASIC (#513393), FCA (#793714), and SCB, Capital.com typically serves international clients under established financial conventions, adhering to local laws (e.g., AML) even without direct MAS authorization.

2. MAS Framework

MAS requires financial service providers to meet specific conditions but doesn't mandate direct licensing for all international platforms. Users can check MAS's Financial Institutions Directory (www.mas.gov.sg). As of June 2025, Capital.com is not listed.

3. User Agreement & Restrictions

Capital.com's Terms explicitly list restricted countries (e.g., US, Canada). Singapore is not restricted, allowing registration – though users assume compliance responsibility.

Action Recommendations

- Risk Assessment: Singapore residents should prioritize MAS-licensed platforms (e.g., IG, City Index).

- Verification: Contact Capital.com's Chinese support to confirm Singapore service applicability.

- Legal Counsel: Consult a Singapore lawyer for significant transactions to clarify obligations.

4. Global Services Localized for SG

Capital.com offers Singapore users:

- Local Payments: PayNow, GrabPay integration.

- Dedicated Support: 24/7 Chinese service with rapid response.

- Regulatory Compliance: Adheres to MAS AML framework requirements.

VI. FAQ

Q1: Is Capital.com safe?

A: Yes. Regulated by FCA, CySEC, etc. Segregated funds, negative balance protection, and supplementary insurance ensure industry-leading security.

Q2: Which platform: MT4 or MT5?

A: Beginners should start with MT4 for simplicity. Advanced traders may prefer MT5 for multi-asset/strategy support.

Q3: How long do withdrawals take? Any fees?

A: 94% processed within 1 hour (2024 data). No platform fees (bank charges may apply).

Q4: How to open a demo account?

A: On Capital.com web: "Settings" → "My accounts" → Select "Demo accounts". Get $100k virtual funds instantly.

Q5: Can I use MT4 with a demo account?

A: Yes! After demo creation, use MT4 server Capital.com-Demo.

Q6: Are Capital.com's fees high?

A: Forex spreads from 0.6 pips, stock CFDs are commission-free. Monitor crypto spreads. Optimize costs via cashback promotions.

Conclusion

Capital.com stands as a secure, comprehensive platform catering to diverse trading needs. Both novice and experienced traders can find suitable strategies here. If you seek diverse instruments paired with robust security, consider Capital.com. Remember: While the platform is secure, CFD trading inherently carries high risk – always prepare thoroughly before investing.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.