Trump's Threat to Powell: A Perfect Storm for Dollar Sell - Offs

The financial markets have been sent into a tailspin as President Donald Trump's consideration of firing Federal Reserve Chairman Jerome Powell has emerged as the latest and most potent catalyst for t

The financial markets have been sent into a tailspin as President Donald Trump's consideration of firing Federal Reserve Chairman Jerome Powell has emerged as the latest and most potent catalyst for the sell - off of US assets. This move has not only sown seeds of doubt about the future of the US economy but has also triggered a massive exodus from the dollar, stocks, and Treasuries, with far - reaching implications for global financial markets.

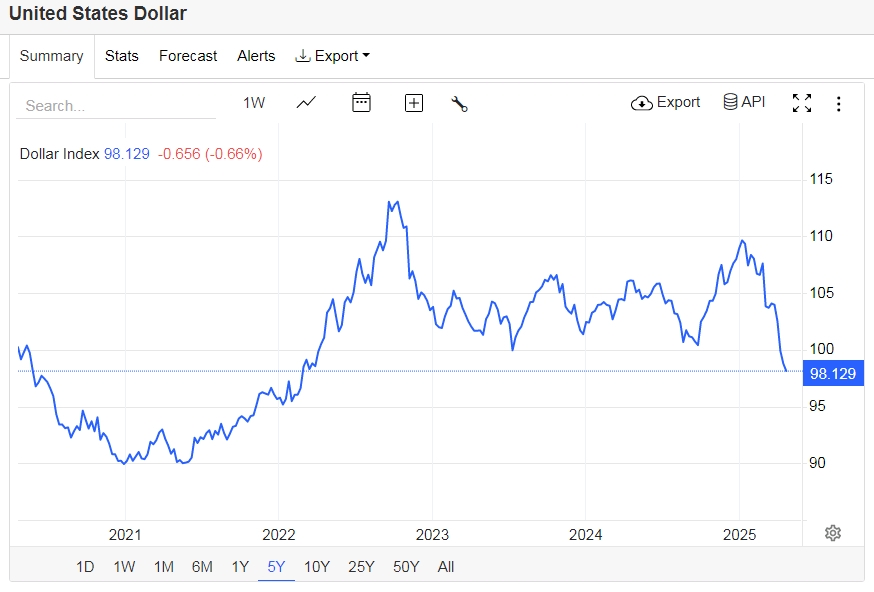

The threat to Powell's position has significantly undermined the confidence in the Federal Reserve's independence. As Christopher Wong, a strategist at Oversea - Chinese Banking Corp. in Singapore, aptly put it, If the credibility of the Fed is called into question, it could severely erode confidence in the dollar. This loss of confidence has been palpable in the markets. On Monday, the Bloomberg Dollar Spot Index plunged as much as 0.9% to its lowest level since January 2024. The dollar weakened against every major currency, with the yen strengthening to a level last seen in September and the euro rallying to its highest in more than three years. Hedge funds, reacting to comments from National Economic Council Director Kevin Hassett that Trump was studying Powell's dismissal, were among the major sellers of the dollar. According to Commodity Futures Trading Commission aggregated data, hedge funds are now the least bullish on the greenback since October.

The impact of Trump's actions extends beyond the currency market. US stock futures dropped by as much as 1%, reflecting investors' concerns about the economic implications of a potential change at the helm of the Federal Reserve. Benchmark 10 - year government bond yields climbed, and the Treasury yield curve steepened. The extra yield investors demand to own 30 - year Treasuries over two - year maturities had increased for nine straight weeks, a phenomenon rarely seen in history. Wall Street equity strategists have also sounded the alarm. Citigroup Inc. lowered its view on US equities, joining bank of america Corp. and blackrock Inc. in turning bearish on US stocks, citing the cracks in US exceptionalism caused by Trump's trade policies and the current Fed turmoil.

However, the sell - off of US assets is not solely due to the threat to Powell. Trump's aggressive trade tariffs have already been a major factor fueling fears of a recession and casting doubts on the status of Treasuries as a safe - haven asset. His repeated calls for a cheaper dollar to boost US competitiveness have added further pressure on the greenback. As Gareth berry, a strategist at Macquarie in Singapore, noted, The latest catalyst for dollar selling might have been pressure on Powell, but the reality is that no further justification for USD selling is needed. What has already happened over the past three months is justification enough to warrant ongoing USD selling, perhaps for months to come.

The situation has also led to a reallocation of investments away from the US. Deutsche Bank AG reported that Chinese clients have reduced their Treasuries holdings in favor of European debt. Japanese super - long government bonds saw a record foreign inflow last month. Emerging market currencies and stocks have benefited from the dollar's weakness, with the Bloomberg Asia Dollar Index rising and emerging - market stocks posting gains. However, analysts at Brown Brothers Harriman & Co., Win Thin and Elias Haddad, cautioned that while the dollar weakness may continue, the global growth outlook is set to deteriorate sharply this year, casting a shadow over the sustainability of recent gains in growth - sensitive and emerging market assets.

In conclusion, Trump's threat to Powell has added a new and highly volatile element to the already precarious situation of US assets. The attack on the Fed's independence, combined with existing trade - related concerns, has created a perfect storm for the sell - off of US assets. As the markets await further developments, including potential trade talks and a Supreme Court ruling that could impact Trump's power to fire Powell, the future of the dollar, US stocks, and Treasuries remains highly uncertain. The reverberations of these events are likely to be felt not only in the US but across the global financial landscape for some time to come.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.