Federal Reserve's May interest rate resolution: Recession risks have been noted but have not yet been reflected in the economy

Powell bluntly said at the press conference that the impact of the Trump administration's tariff policy on inflation was "more significant than expected."

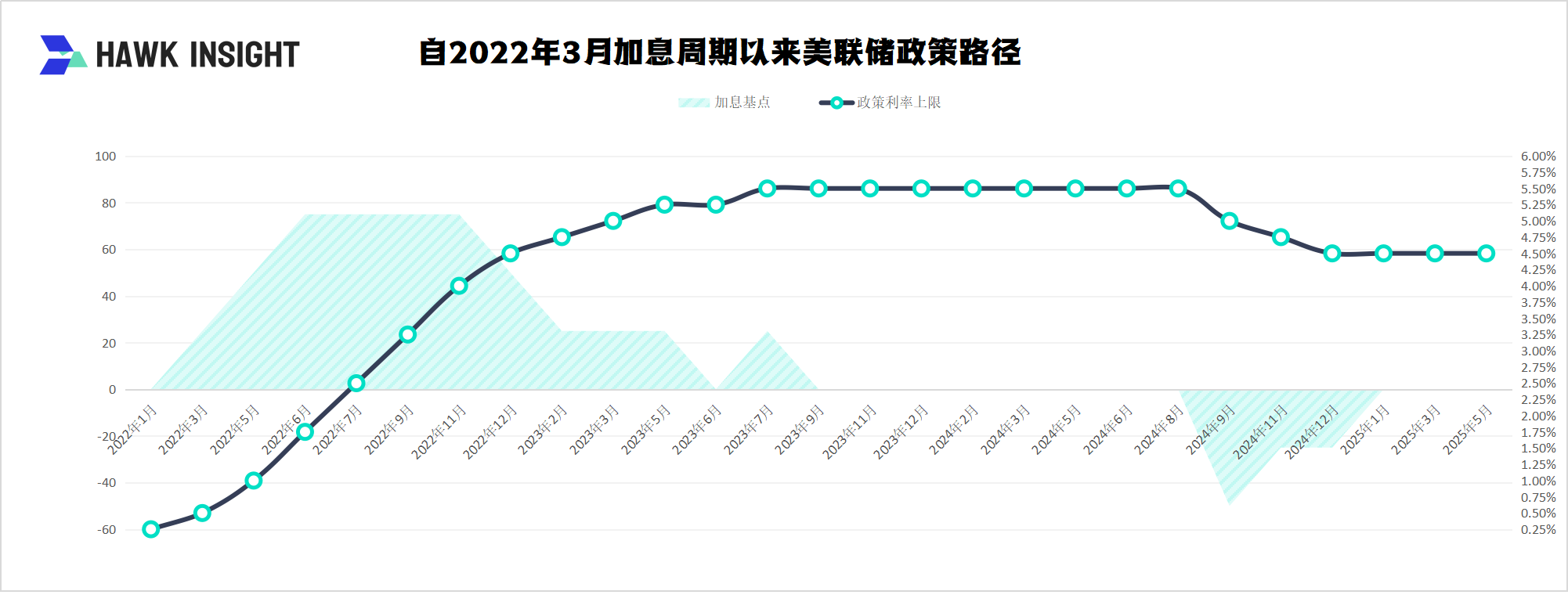

On May 8, the Federal Reserve announced that it would keep the target range of the federal funds rate unchanged at 4.25%-4.50% for the third consecutive time. Although this decision was within market expectations, it triggered in-depth interpretation because of the rare warning in its policy statement that "inflation and unemployment rates are rising."

1. Tariff shocks: from "expected disturbances" to "substantial threats"

Powell bluntly said at the press conference that the impact of the Trump administration's tariff policy on inflation was "more significant than expected" and emphasized that "if the announced large-scale tariffs continue to be implemented, it may lead to increased inflation, slower economic growth and increased unemployment."This statement marks that the Fed's assessment of the impact of tariffs has been upgraded from early "short-term disruption" to systemic risk.

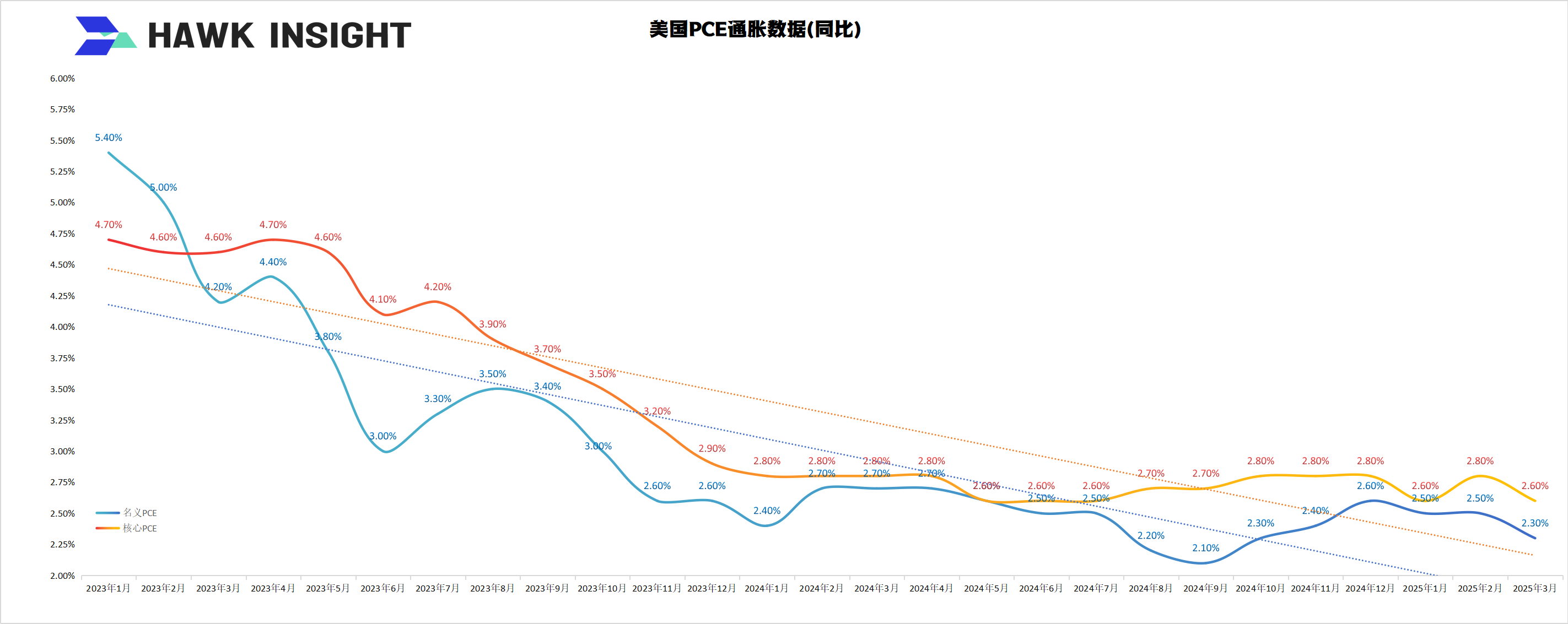

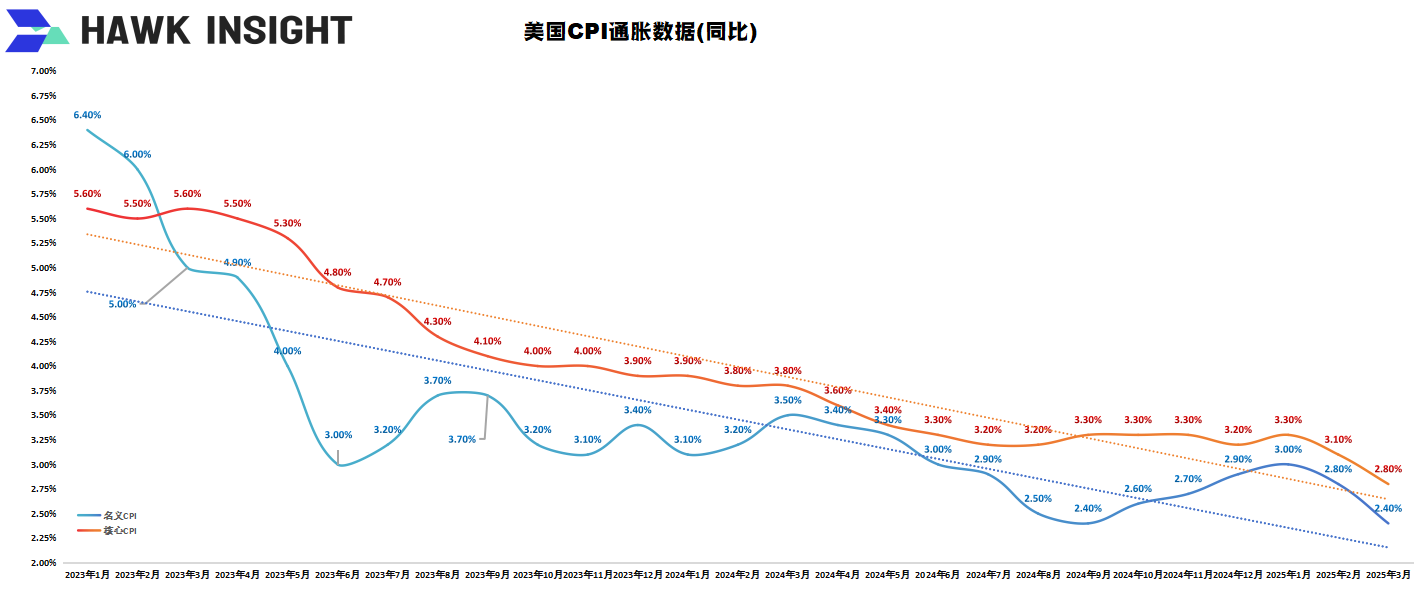

Data shows that the 145% tariff imposed by the United States on China goods has led to a significant increase in import costs. Industries such as automobiles and electronics that rely on global supply chains bear the brunt. Companies are forced to pass on costs to consumers, pushing the core PCE price index. The year-on-year increase is close to 3%.What is more serious is that the policy uncertainty caused by tariffs has curbed companies 'willingness to invest. The manufacturing PMI has fallen for three consecutive months, the number of initial jobless claims has quietly risen, and "hidden cracks" in the labor market have begun to emerge.

2. Stagflation crisis

The Federal Reserve described the economic outlook as "further uncertainty" and explicitly mentioned for the first time "the risk of rising unemployment and inflation." This statement was interpreted by the market as a worry about the stagflation crisis of the 1970s.

The contradictory nature of current economic data has exacerbated the complexity of policy formulation: on the one hand, GDP experienced a technical decline in the first quarter due to a surge in imports caused by companies hoarding ahead of schedule, but domestic demand indicators (such as personal consumption expenditures) remained resilient; on the other hand, fluctuations in energy prices and the restructuring of supply chains pushed up production costs, while although the job market is generally stable, shortening weekly working hours and increasing part-time jobs suggest potential weakness.Analysts at Goldman Sachs pointed out that this divergence of "solid hard data and weak soft data" has forced the Fed into a dilemma between "preventive interest rate cuts" and "anti-inflation priority"-loosening policies too early may reignite inflation, but Excessive tightening may trigger a jump in unemployment.

3. The market begins to rush policy actions

Although Powell emphasized that "there is no need to rush to act," the interest rate futures market still priced interest rate cuts three times during the year, which was a sharp departure from the Federal Reserve's expectation of two interest rate cuts shown in the March dot chart.This divergence stems from different judgments on the persistence of tariff shocks: if Sino-US trade negotiations achieve a breakthrough this weekend, inflationary pressures may ease as tariffs fall, opening up space for interest rate cuts; on the contrary, if the trade war escalates, the Federal Reserve may be forced to launch interest rates after September to hedge against downward pressure on the economy.It is worth noting that cracks have emerged within the Federal Reserve. Some hawkish members question the need to cut interest rates, while doves are worried about the fragility of the corporate bond market. Currently, the proportion of non-financial corporate debt in the United States has reached 78% of GDP, and maintaining high interest rates may trigger a wave of defaults.

4. Powell: U.S. debt is unsustainable

Powell specifically warned that "U.S. debt is on an unsustainable path." This statement directly pointed to the synergy dilemma between fiscal policy and monetary policy.Although the Trump administration's threat to suspend the firing of the Federal Reserve chairman has been suspended, its political stance of continuing pressure to cut interest rates sharply conflicts with the Federal Reserve's emphasis on the principle of "data-driven" independence.The more far-reaching risk is that the interaction between debt monetization pressure and inflation expectations may weaken the credibility of the dollar. The recent US dollar index fell below the 100 mark and gold exceeded US$2500 per ounce, reflecting the market's deep anxiety about "fiscal led monetary policy."

5. The world faces a new round of monetary policy spillover

The Fed's wait-and-see stance is triggering a chain reaction among central banks around the world.The European Central Bank postponed interest rate cuts in the face of inflation stickiness, the Bank of Japan was forced to reduce the scale of bond purchases due to pressure from the depreciation of the yen, and emerging market central banks struggled to weigh between capital outflows and imported inflation.This policy divergence has exacerbated the volatility of global asset prices: although U.S. stocks closed higher after the announcement of the resolution, the Volatility Index (VIX) remained at a high level for the year; the 10-year U.S. bond yield curve showed a "bear-flat" pattern, implying market concerns about long-term growth prospects.

Economists at the Pacific Investment Management Corporation (PIMCO) said that policy choices in 2025 may define the central bank paradigm of the "post-globalization era"-when supply-side shocks become the norm, does the monetary policy framework need to be restructured?When political interference becomes increasingly frequent, can the bottom line of central bank independence be adhered to?These issues may have more historical weight than the technical debate over the timing of interest rate cuts.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.