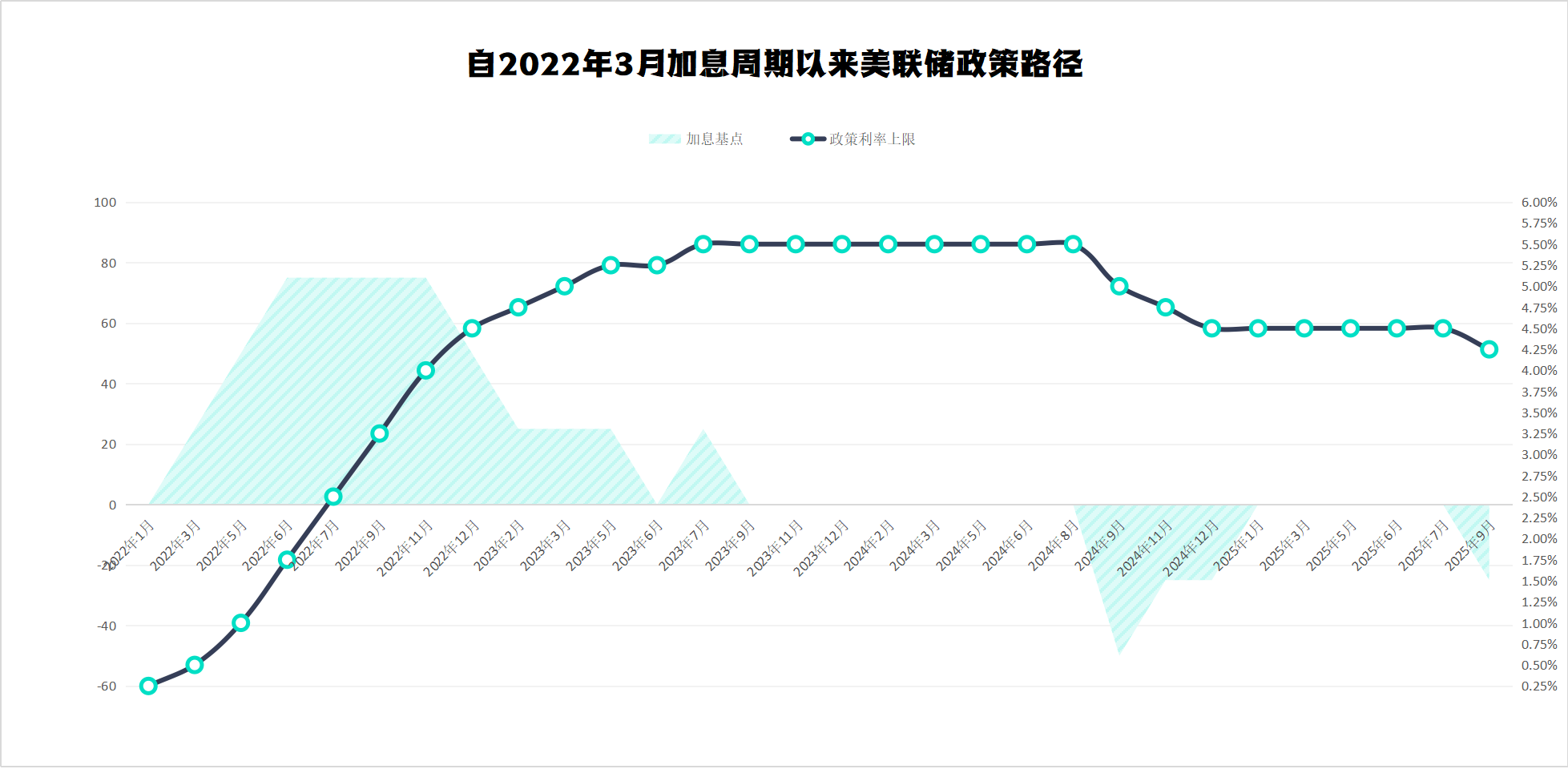

Federal Reserve's September interest rate decision: cut interest rates by 25 basis points as scheduled or cut interest rates twice during the year

No surprises.

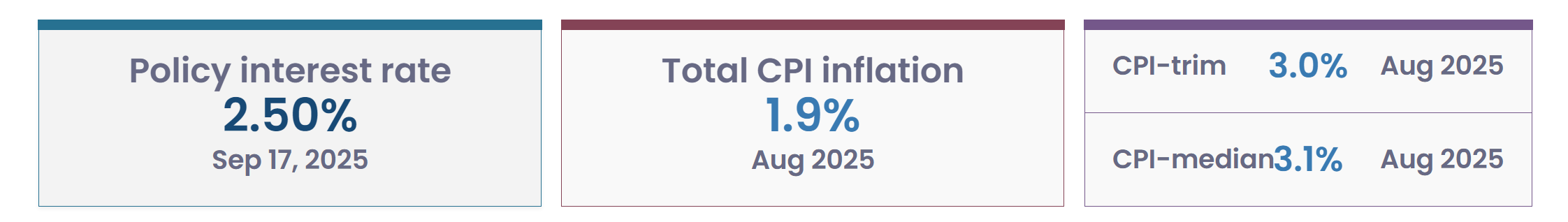

On September 17, the Federal Reserve cut interest rates by 25 basis points as scheduled, with no surprises.

The Federal Reserve cuts interest rates for the first time in the year and is expected to cut interest rates by 75 basis points during the year

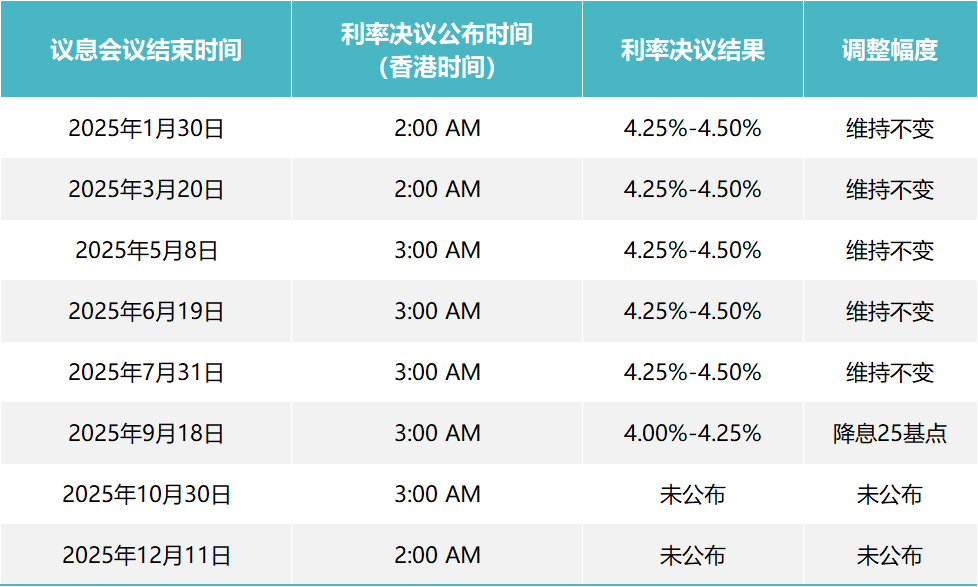

At the FOMC meeting in September, the Federal Reserve launched its first interest rate cut this year, lowering the target range of the federal funds rate from 4.25%-4.50% to 4.00%-4.25%, a decrease of 25 basis points, which was fully in line with previous market expectations.This is the first policy shift since the Federal Reserve suspended interest rates continuously since December last year, marking the end of the current tightening cycle and the beginning of a new round of monetary easing.

Although interest rate cuts are already on the ground, what is more noteworthy is the adjustment of policy logic behind them: the Fed's concerns about the deterioration of the job market have clearly overwhelmed its vigilance about the persistence of inflation.

In its statement at the meeting, the Fed made a rare and significant adjustment in its description of the current economic situation, especially in terms of the job market.Compared with the July meeting statement, the September statement deleted the statement that "the labor market remains solid" and instead pointed out that "employment growth has slowed and the unemployment rate has risen slightly."This is the first time in this cycle that the Fed has bluntly stated that the job market may face downward pressure.

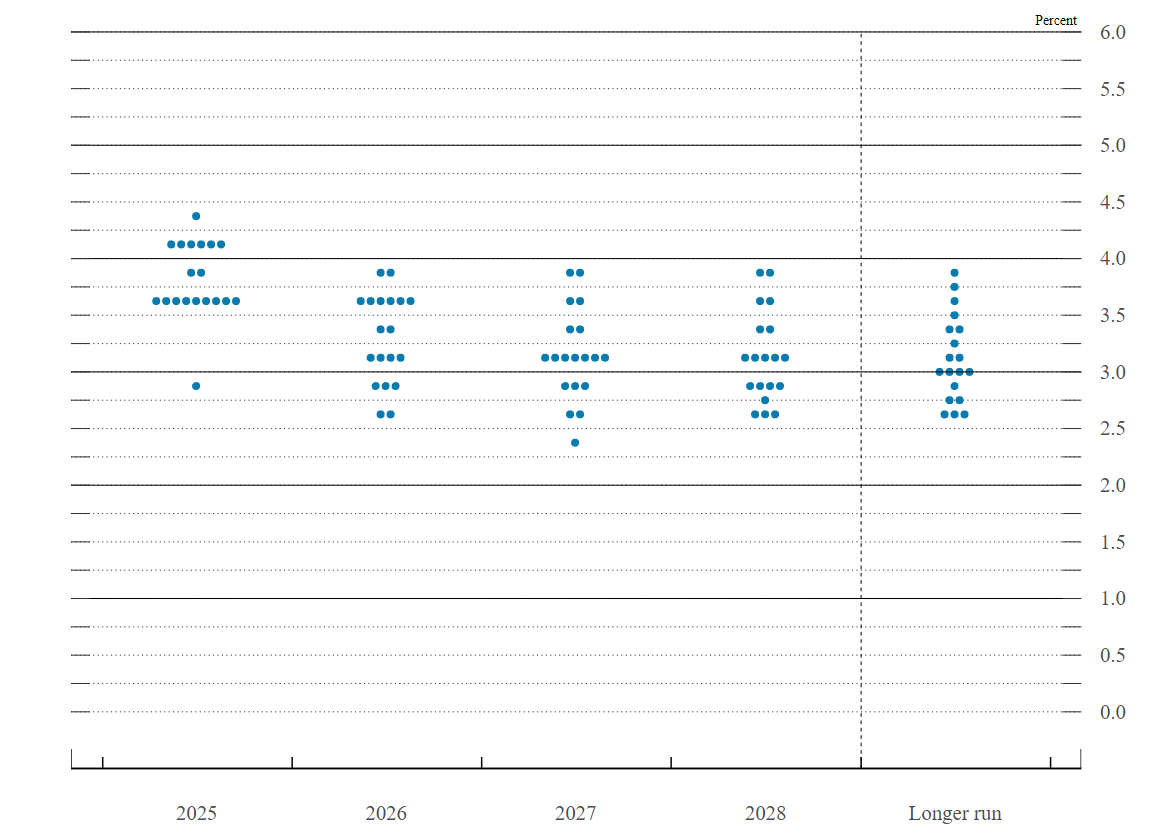

Milan votes to cut interest rates by 50 basis points, dot-plot hints at a "soft landing" for the United States

The voting results were basically uniform. Only one new director, Stephen Miran, nominated by Trump, opposed a 25 basis point rate cut and advocated a larger 50 basis point rate cut, showing that there have been no systemic differences within the Fed.This point is also confirmed by the side of the dot matrix diagram.Among the 19 FOMC members, 9 believe that two more interest rates should be cut this year, that is, three interest rates have been cut throughout the year, but the number has not yet reached half; 6 people do not expect another interest rate cut during the year, and 1 person advocates a total of five interest rate cuts during the year, showing the deep level of concern some members about the deterioration of the economy.

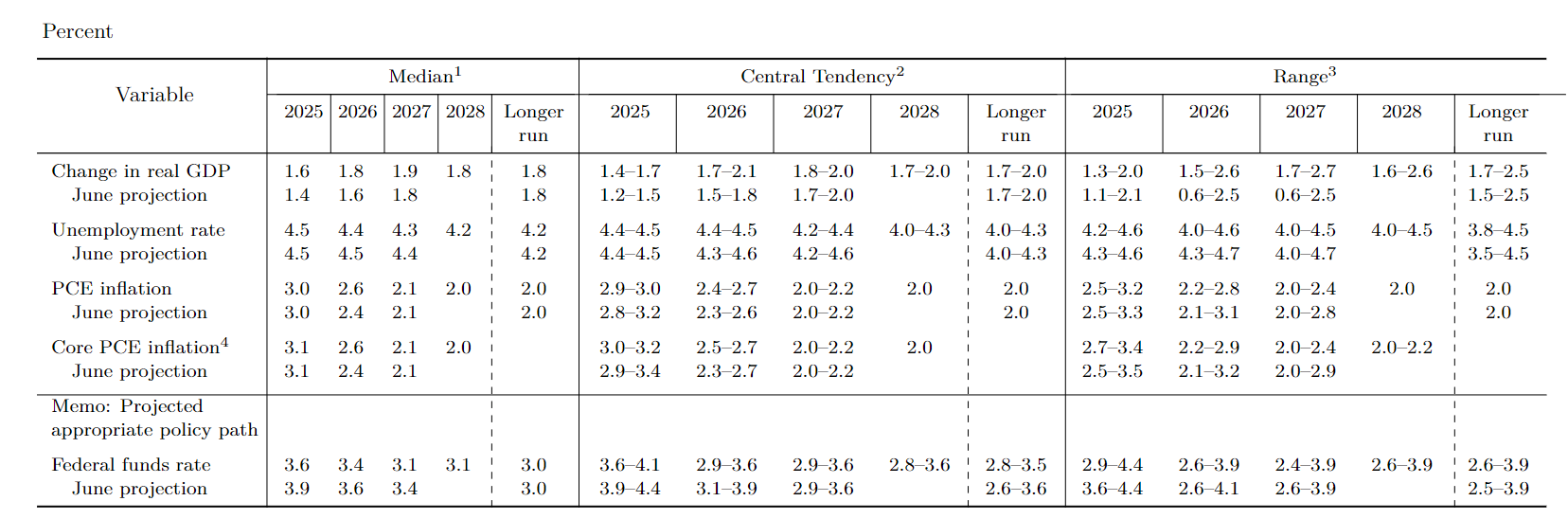

The Federal Reserve's interest rate outlook also shows that an easing trend is taking shape in the medium and long term.The median federal funds rate is expected to be 3.6% at the end of 2025, 3.4% in 2026, and 3.1% in both 2027 and 2028.In other words, in the next three years, the Federal Reserve is expected to cut interest rates by at least 125 basis points, entering a moderate but continuous cycle of interest rate cuts.This expectation echoes the current potential growth rate and inflation trend of the U.S. economy.

In terms of economic forecasts, the Federal Reserve has raised its GDP growth forecast for the next three years this year and next. This adjustment reflects that despite the pressure on the job market in the short term, the overall economic resilience remains strong.GDP growth is expected to be 1.6% in 2025, 1.8% and 1.9% in 2026 and 2027 respectively, slightly higher than previous expectations.The unemployment rate forecast is relatively stable, at 4.5% in 2025 and 4.2% in 2028.This shows that the Fed believes that interest rate cuts will not trigger an uncontrolled rebound in inflation and is unlikely to cause a sharp rise in unemployment.

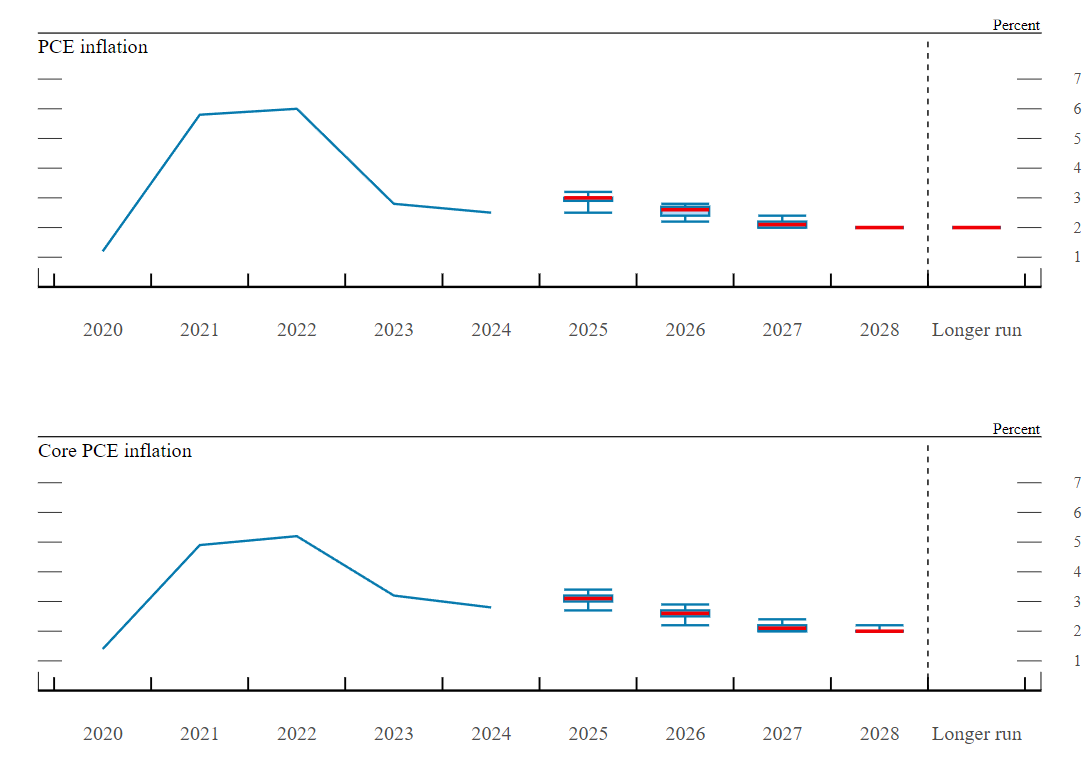

More importantly, the Federal Reserve raised its forecast for PCE inflation in this economic forecast.It is expected to be 3.0% in 2025, 2.6% in 2026, and will return to 2.0% of the target level by 2028.This shows that although the recent upward trend in energy prices and service industry inflation remain stubborn, the trend of overall inflation falling has become clear.Core PCE forecasts also show a similar path, with the long-term target of 2.0% also reached by 2028.In other words, the Fed is expected to achieve a "soft landing" in the next three years to be more likely.

For financial markets, this series of signals released by the Federal Reserve is of great guiding significance.First, the confirmation of the shift in monetary policy means that risk appetite in asset markets is expected to increase in the short term, benefiting both stock markets and bond markets.In reality, the S & P 500 and Nasdaq both rose slightly after the announcement of the interest rate decision, while the 10-year U.S. bond yield fell slightly.The US dollar index showed a slight correction due to weakening expectations of interest rate cuts.The market generally expects the Federal Reserve to continue to cut interest rates in its remaining two meetings in October and December, thus completing the path of three interest rate cuts throughout the year.

Secondly, although this rate cut is a "technical turn", the logic behind it is worth pondering.The Federal Reserve has long been accused of being "too persistent" in fighting inflation, but now it is the first time that it has clearly expressed concern about "employment risks."This shift in stance may signal that the end of the "era of high interest rates" is approaching.The recent performance of the U.S. labor market also supports this view: new non-agricultural jobs slowed to 187,000 in August, the unemployment rate rose slightly to 3.9%, and the labor force participation rate rose, but a trend of declining employment momentum is taking shape.

Changes in the international environment are also one of the catalysts for the Federal Reserve to adjust its policies.The European Central Bank and the Bank of Canada have already begun to signal a moratorium on interest rate hikes or are about to cut interest rates, while emerging markets such as China have already launched a new round of easing cycles.Against the backdrop of tightening global financial conditions, if the United States continues to maintain excessively high interest rates, it will face the risks of trade and financial imbalances brought about by the return of capital markets and an excessively strong US dollar.

It is noteworthy that the Federal Reserve did not adjust the pace of its quantitative tightening at this meeting.Since April, the Federal Reserve has significantly slowed down the pace of shrinking its balance sheet, but it is still maintaining a maximum monthly redemption of US$5 billion in treasury bonds and US$35 billion in MBS redemption.The continuation of the policy of shrinking the balance sheet means that the Federal Reserve has not completely abandoned its tightening tools, but has chosen a mixed strategy of "interest rate cuts + shrinking the balance sheet" to maintain its ability to check and balance on medium-and long-term inflation.

Policy press conference Powell rarely mentions "moderate long-term interest rates"

In a statement issued after the meeting, the Fed removed the phrase "the labor market is solid" from the statement for the first time and replaced it with a warning that "employment growth has slowed and the unemployment rate has increased slightly."This change in wording is not a semantic detail, but a prelude to a change in policy direction.Federal Reserve Chairman Powell also made it clear at a subsequent press conference: "The committee is concerned about the risks faced by its dual mission and determines that downside risks to employment have increased.This means the Fed is reassessing its policy balance between "full employment and price stability."

In fact, the market is already ready for this interest rate cut.According to the FedWatch tool of the Chicago Mercantile Exchange (CME), the day before the Fed meeting, the market had calculated a 96% probability that the Fed would cut interest rates by 25 basis points, and even expected as high as 74% that interest rates would continue in December.This highly consistent expectation reflects the market's basic consensus on slowing economic growth and falling inflation.

But in addition to regular employment and inflation analysis, this conference also triggered a new round of discussions on the "Federal Reserve's third mission."In response to a reporter's question, Powell rarely mentioned the Federal Reserve's "moderate long-term interest rate" directive-the third mission stipulated in the Federal Reserve Act, but it has been diluted or even ignored within the Federal Reserve for a long time in the past.Powell said: "The third mission does exist, but we believe it is the natural result of low inflation and maximum employment and does not require separate measures.”

The Federal Reserve has always emphasized that its operation of short-term interest rates is the main policy tool, while long-term interest rates are seen to be determined by multiple non-policy factors such as markets, fiscal policies, and the global savings-investment balance.However, this distinction has been challenged over the past two decades.Especially since the 2008 financial crisis, the Federal Reserve has substantially lowered long-term interest rates through two rounds of large-scale asset purchase programs (QE), affecting many areas such as government financing, housing loans, and corporate capital expenditures.

This also exposes a "paradox" of long-term interest rates: the Federal Reserve on the surface claims that it cannot effectively control long-term interest rates, but in fact it actively intervenes in their movements at multiple stages by purchasing long-term treasury bonds and mortgage-backed securities.Director Christopher Waller has publicly stated that the core mechanism of quantitative easing is to drive up prices and lower yields by purchasing long-term assets, thereby stimulating the economy.But he also warned that the stimulus effect was far less significant than directly regulating short-term interest rates.

Now, with former Trump economic adviser Stephen Milan becoming the new governor of the Federal Reserve, the political color of the so-called "third mission" has resurfaced.Milan voted only against a 25 basis point interest rate cut at this meeting and advocated a 50 basis point interest rate cut. The logic behind this did not rule out the sensitive relationship between government financing costs and long-term interest rate trends.The Trump administration has repeatedly publicly urged the Federal Reserve to cut interest rates sharply to reduce financing pressure on federal government debt.Now, this idea may once again affect the FOMC's decision-making atmosphere through new directors.

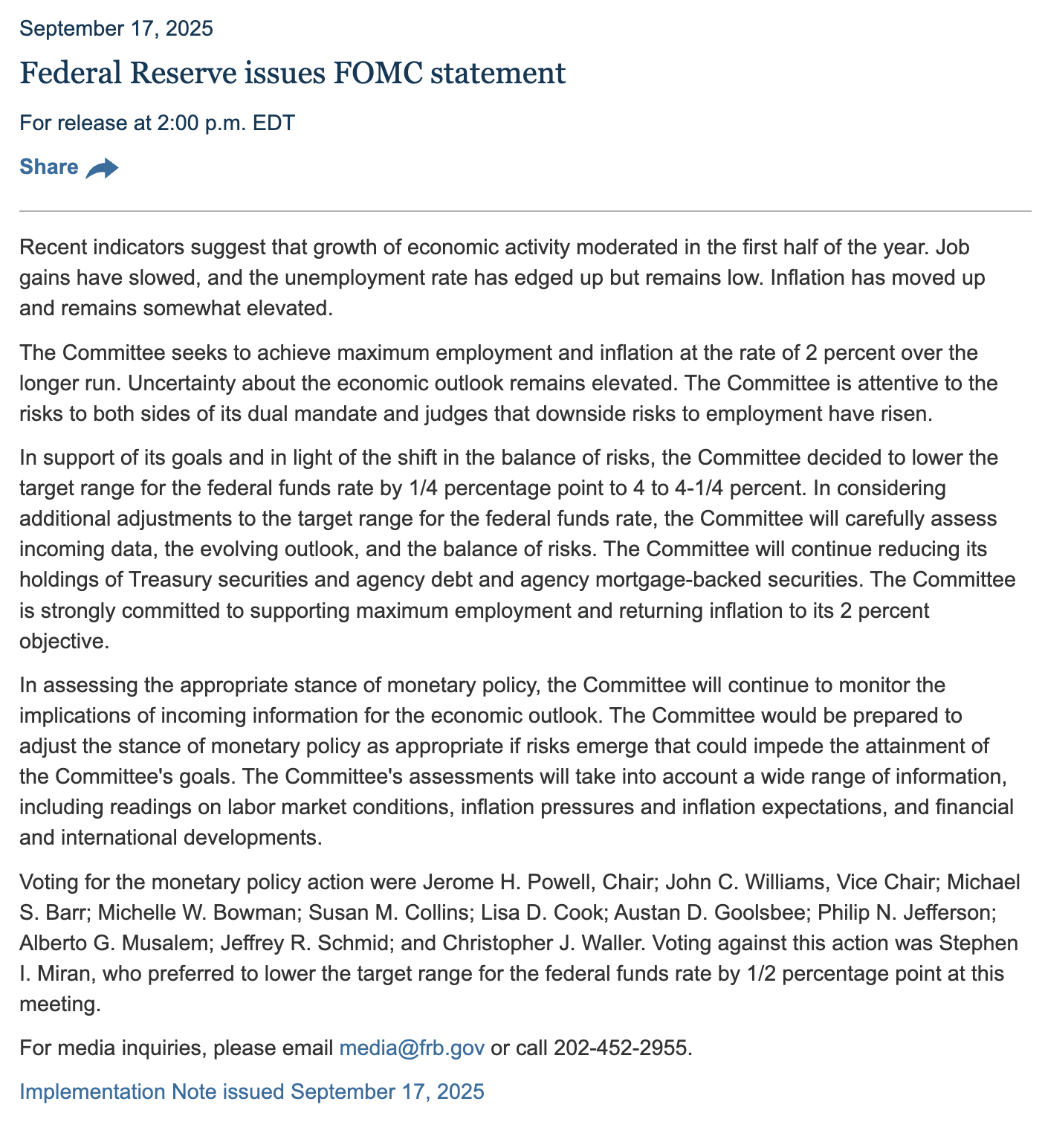

Attachment: Full text of the Federal Reserve's statement at the September 2025 interest-rate meeting:

The latest indicators show that growth in economic activity slowed in the first half of this year.Employment growth slowed down and the unemployment rate rose slightly, but remained low.Inflation rebounded and remains high.

The committee's goals are maximum employment and long-term inflation of 2%.Uncertainty about the economic outlook remains high, and the committee is concerned about the risks to its dual mission and believes that downside risks to employment have increased.

In support of the established goal and in view of changes in the risk balance, the committee decided to lower the target range for the federal funds rate by 25 basis points to 4%-4.25%.When considering whether to further adjust the target range for the federal funds rate, the committee will carefully evaluate the latest data, changes in the outlook and the balance of risks.The committee will continue to reduce its holdings of U.S. Treasurys, agency debt and agency mortgage-backed securities.The committee is firmly committed to supporting the goal of maximizing employment and restoring inflation to 2%.

In assessing appropriate monetary policy positions, the Committee will continue to monitor the impact of the latest information on the economic outlook.If risks arise that may hinder the achievement of the Committee's goals, the Committee is prepared to adjust its monetary policy stance in an appropriate manner.The committee's assessment will take into account a wide range of information, including labor market conditions, inflationary pressures and inflation expectations, as well as financial and international developments.

Those who voted in favor of the monetary policy action were Chairman Jerome H. Powell. Powell, Vice Chairman John C. Williams Williams, Michael S. Barr Barr), Michelle W. Bowman, Susan M. Collins Collins, Lisa D. Cook Cook), Austan D. Goolsbee, Philip N. Jefferson Jefferson, Alberto G. Musalem Musalem, Jeffrey R. Schmid. Schmid) and Christopher J. Waller.Those who voted against it were Stephen I. Miran), who prefers to cut the target range for the federal funds rate by 50 basis points at this meeting.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.