Gold has become the first choice for safe haven, and funds continue to pour in.

The recent performance of the gold market can be described as "amazing".

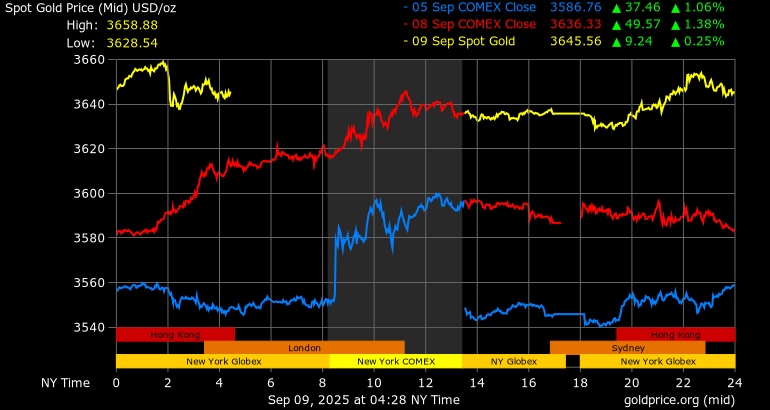

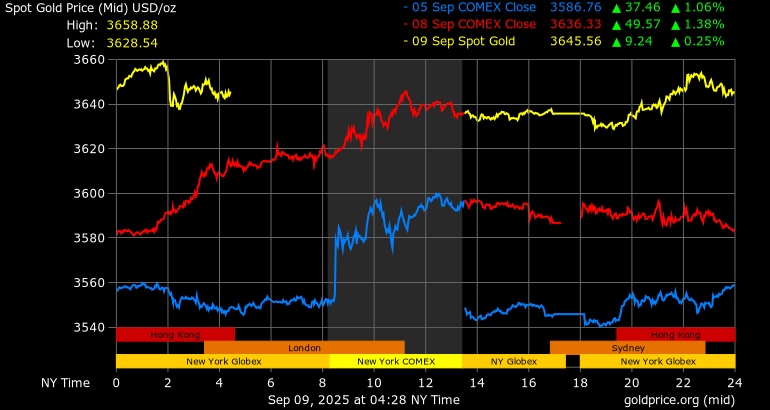

Since late August, spot gold has successively broken through key psychological barriers, rising from US$3500/ounce to US$3650 in just a few weeks, setting a record high.This trend has attracted great attention from the global financial market and also driven the Hong Kong stock gold sector to rise strongly. Chifeng Gold, Shandong Gold, Zijin Mining and other stocks simultaneously hit new highs.

As gold prices continue to rise, Goldman Sachs recently released a report stating that the current bullish sentiment on gold in the market is "the strongest ever". Gold has surpassed developed market stocks and become the most popular long-term trading product.Goldman Sachs further proposed three paths for gold prices: the baseline forecast is to rise to US$4000 in mid-2026, and the tail risk scenario may hit US$4500. In extreme cases, if only 1% of private U.S. debt funds turn to gold, the price of gold may soar to nearly US$5000.

What supports the rise in gold prices is not only emotions and expectations, but also macro and geographical resonances at a realistic level.First of all, from the perspective of monetary policy expectations, the market generally expects that the Federal Reserve will officially start the interest rate cut cycle in early 2025, when the decline in real interest rates will directly benefit the interest-free asset of gold.At the same time, the pressure on the U.S. fiscal deficit continues to intensify. The deficit in fiscal 2024 has approached US$1.8 trillion, and the total national debt has exceeded US$34 trillion. Fiscal sustainability issues have become increasingly prominent.Rating agencies have issued warnings that the market's confidence in the long-term credit of the United States is being challenged. Against this background, the "non-credit asset" attribute of gold is receiving increasing attention.

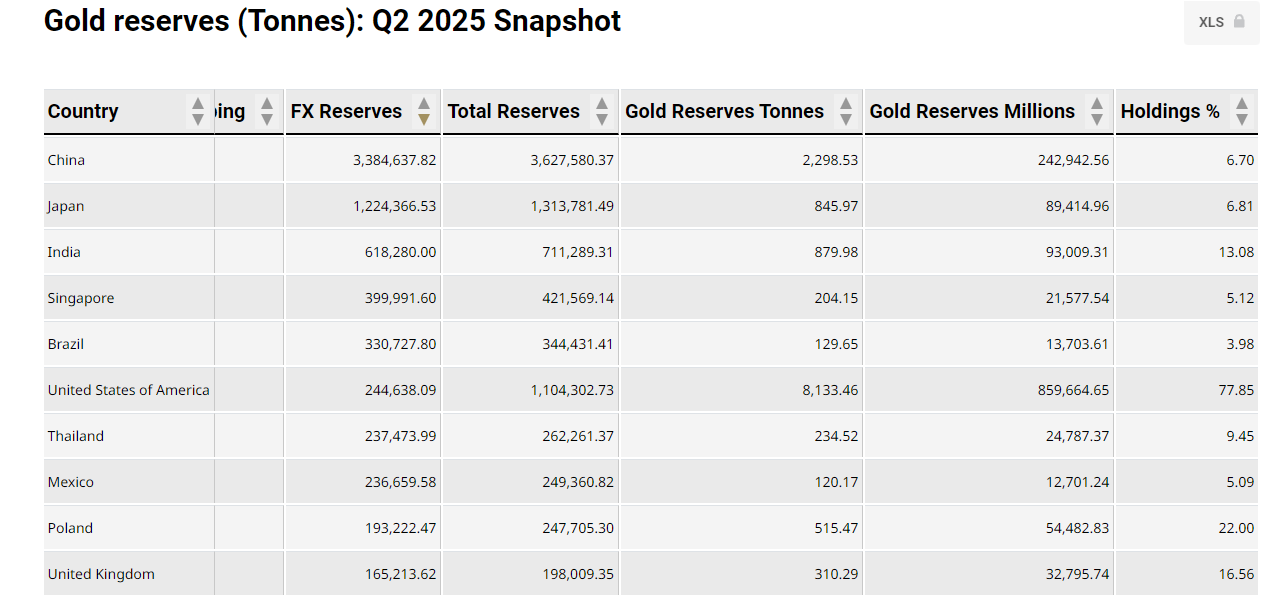

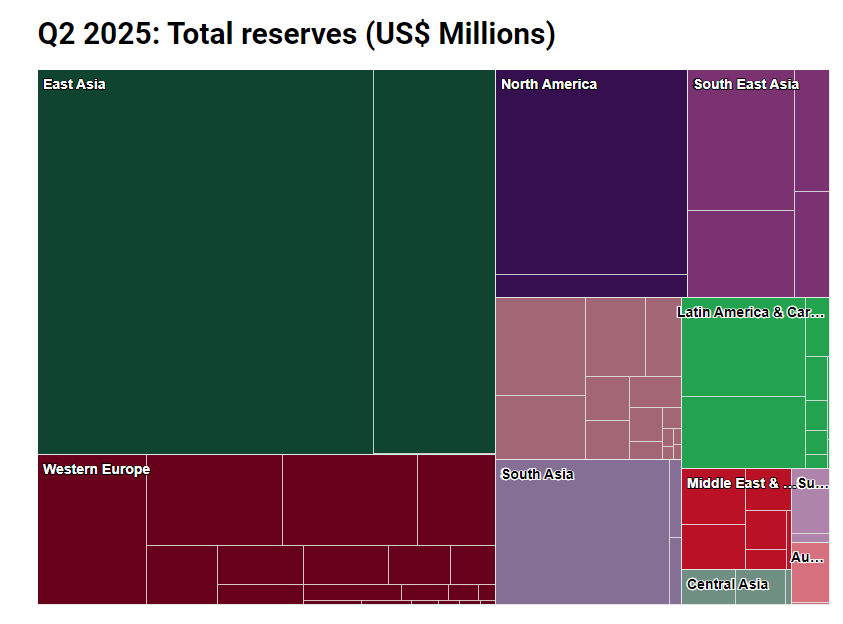

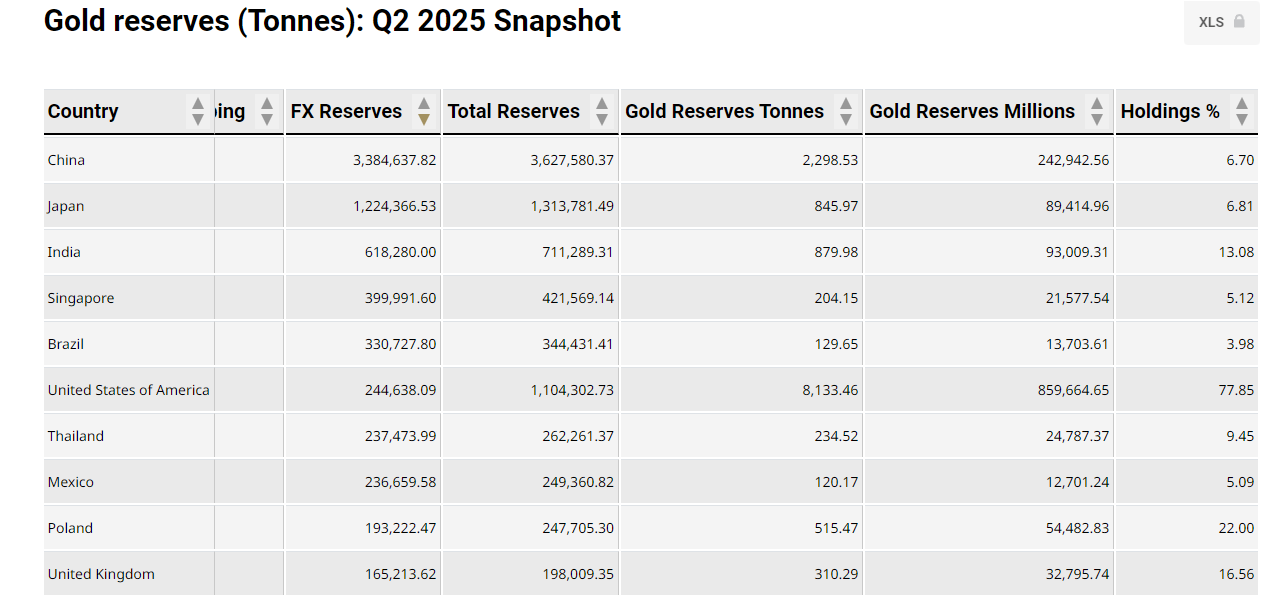

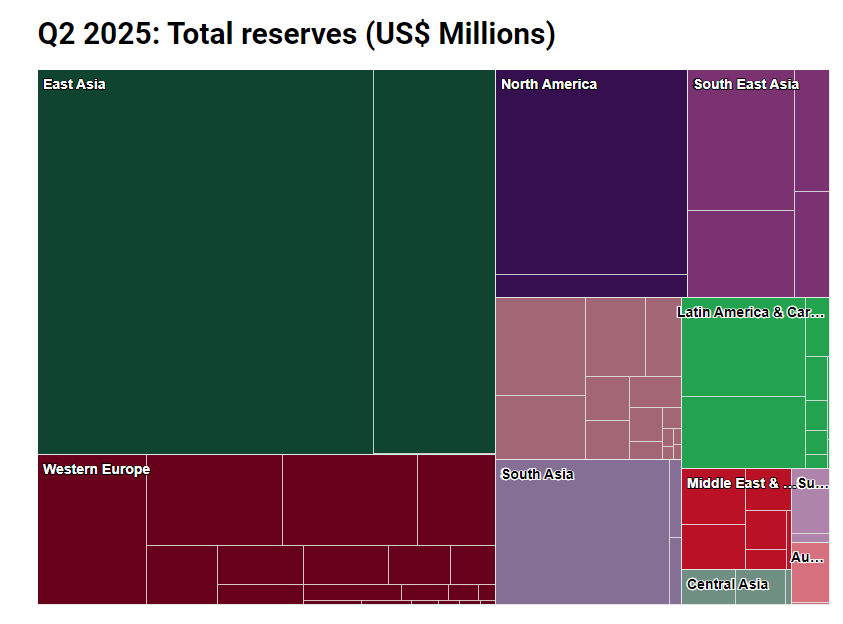

The geopolitical situation has also become an important driving force for the rise in gold prices.Multiple points of instability have become external variables in global capital allocation, further enhancing market demand for hedging.At the same time, central banks in major economies around the world continue to increase their holdings of gold reserves.According to data from the World Gold Council, China, Russia, India, Turkey and other countries have purchased net gold for several consecutive quarters.This structural buying reflects that countries are actively reducing their dependence on the US dollar system in their reserve asset diversification strategies, and the monetary attribute of gold is gradually returning to the core position of the central bank's balance sheet.

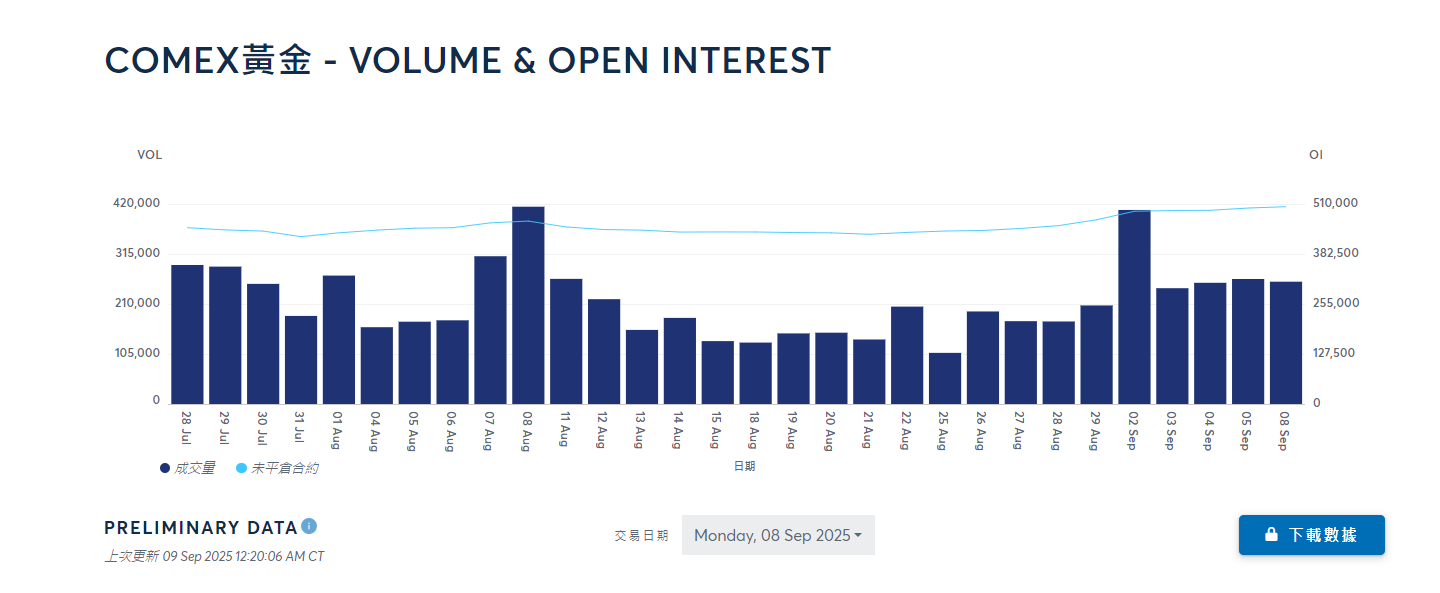

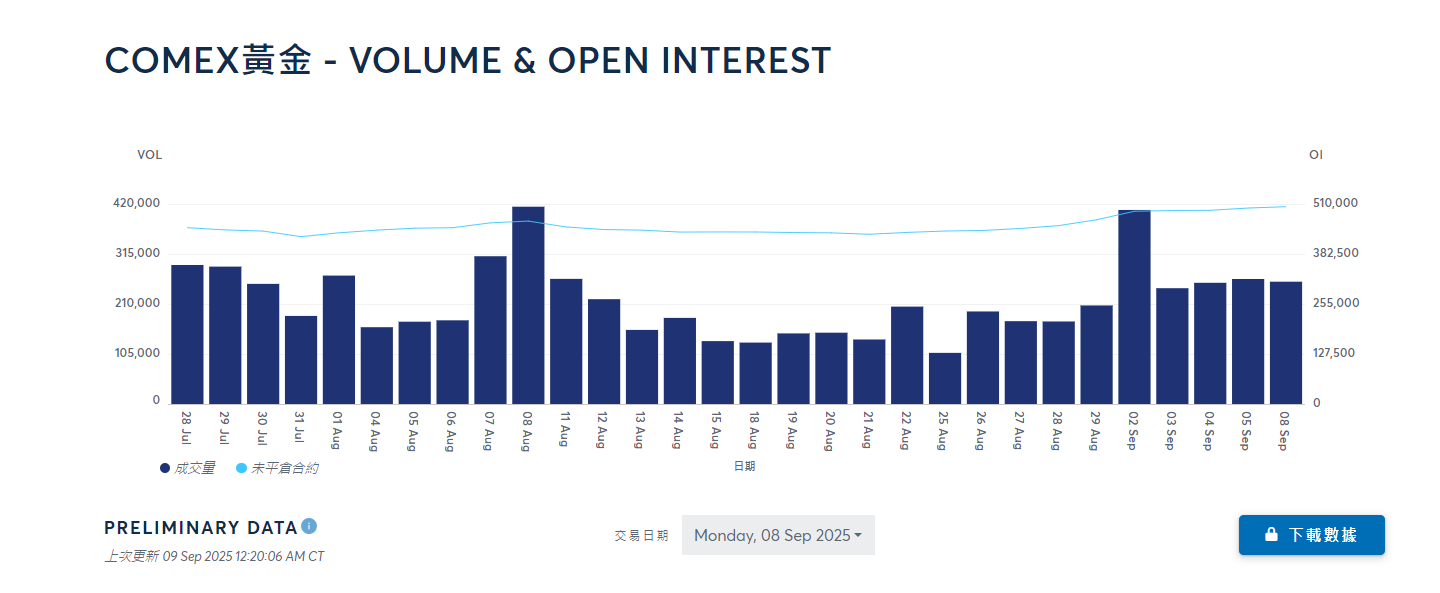

Changes in investor behavior have further amplified the trend effect of this wave of gold market.Judging from ETF market data, mainstream gold ETFs such as SPDR Gold Trust (GLD) and iShares Gold Trust (IAU) have continued to receive net inflows of funds in the near future.Institutional investors have significantly increased their allocation efforts, not only due to short-term interest rate expectations, but also due to the increasingly prominent strategic role of gold in hedging systemic risks in asset portfolios.In addition, open interest in COMEX gold futures continued to rise, reflecting the market's high consensus on the medium-term rise in gold prices.The Hong Kong stock market also responded quickly, with many gold stocks reaching historical highs. With the increase in trading volume, funds no longer regard gold as a tactical allocation tool, but are clearly included in the scope of medium-and long-term allocation.

Doo Financial believes that unlike previous inflation-driven rising cycles, the deep logic of this round of strong gold rise is a concentrated response to institutional risks and asset credit issues.Gold is gradually shifting from a safe-haven variety in the traditional sense to a core asset for hedging "structural risks of the credit system."Its rise is not only a reaction to short-term market changes, but also a precursor to the process of restructuring the global asset allocation system.In this process, investors 'behavioral patterns are undergoing qualitative changes.Gold is no longer just a defensive option in the economic cycle, but is increasingly seen as a strategic asset to hedge against "central bank failure","sovereign credit risk" and even "institutional uncertainty."