Polymarket Tracker: Fed Set to Pause in June

As President Donald Trump intensifies calls for rate cuts ahead of the U.S. presidential election, markets and Federal Reserve officials appear united in resisting the pressure. Data from prediction m

As President Donald Trump intensifies calls for rate cuts ahead of the U.S. presidential election, markets and Federal Reserve officials appear united in resisting the pressure.

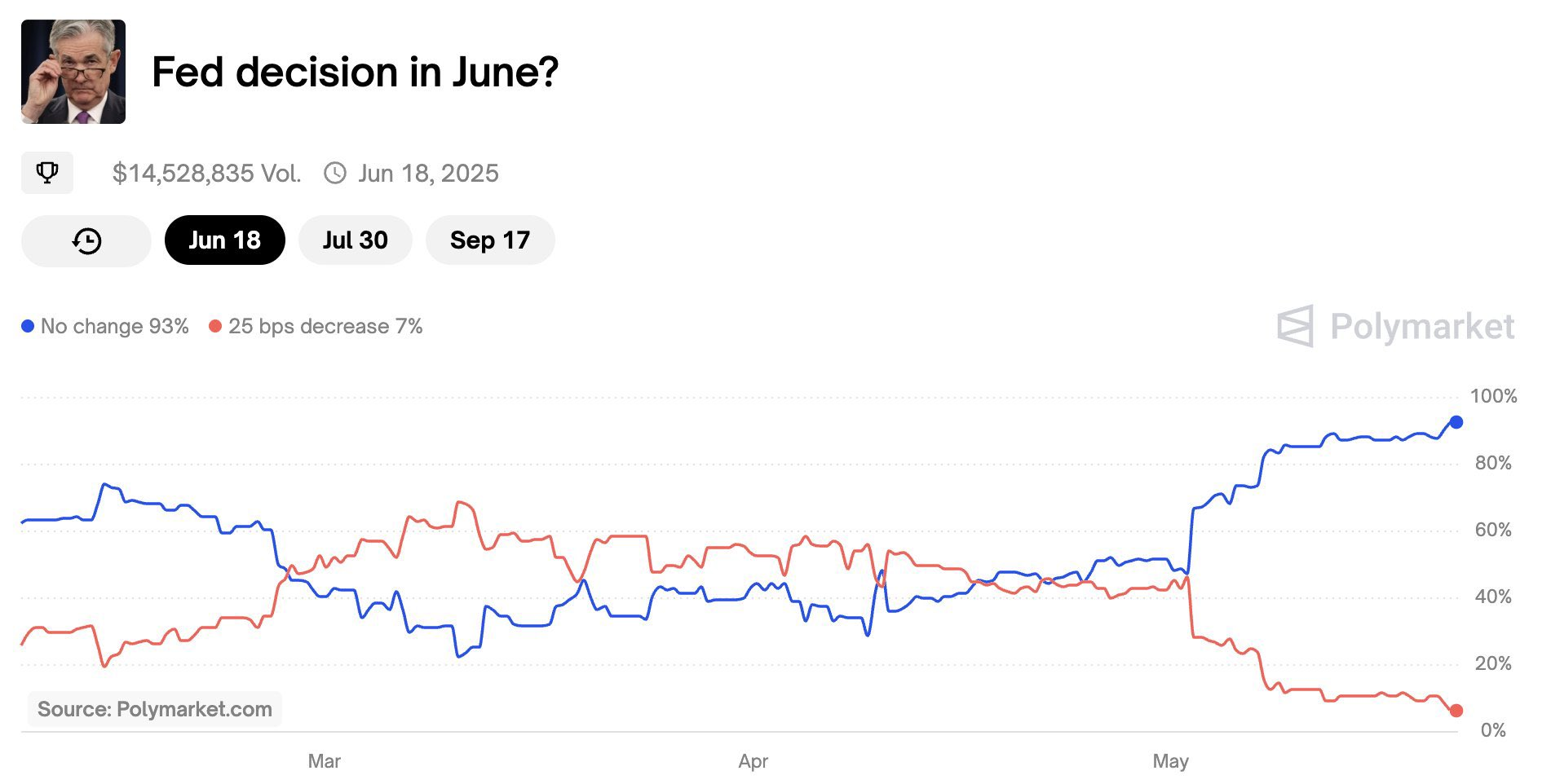

Data from prediction market Polymarket shows just a 7% probability of a rate cut at the June 18 FOMC meeting, with a staggering 93% likelihood that the Fed will keep rates unchanged. That’s a sharp signal of investor confidence in the Fed’s independence and patience.

Fed officials have consistently struck a cautious tone in recent weeks. New York Fed President John williams, in a notable speech, emphasized the foggy outlook for the U.S. economy, stating that uncertainty is not only clouding policymaking but also affecting household and business decisions, particularly amid the unpredictability of Trump’s trade agenda. Williams acknowledged that while inflation has cooled and the labor market is strong, risks from rising loan delinquencies and weakening consumer sentiment warrant continued vigilance.

Echoing this caution, Atlanta Fed President Raphael Bostic told CNBC he prefers to hold rates steady in the short term, warning that it could take "3 to 6 months" for sufficient clarity on inflation and growth trends to emerge. Similarly, Fed Vice Chair Philip Jefferson reiterated that the central bank’s current policy stance remains appropriate and any decisions must factor in the evolving global policy landscape—including Moody’s recent downgrade of U.S. credit outlook.

Minneapolis Fed President Neel Kashkari went further, citing the Trump administration’s erratic trade policies as a significant drag on business investment and hiring, despite what had been a strong start to the year. “Market turmoil and corporate hesitancy are direct consequences of political uncertainty,” he warned.

History Favors a Prolonged Hold

Since December 2024, the Fed has held rates steady—a five-month pause that could stretch much longer. Historical precedent suggests such periods aren’t unusual. From September 1992 to February 1994, the Fed left its policy rate unchanged for 17 consecutive months, a move that ultimately fostered a period of economic stability and robust equity market performance. Should the current cycle mirror that, markets may interpret it as a green light for risk assets, even without immediate easing.

Inflation: A Threat Reawakens?

While the April CPI surprised to the downside, underlying signals suggest that disinflationary momentum may stall. U.S. manufacturing PMI input prices have surged, pointing to rising import costs.

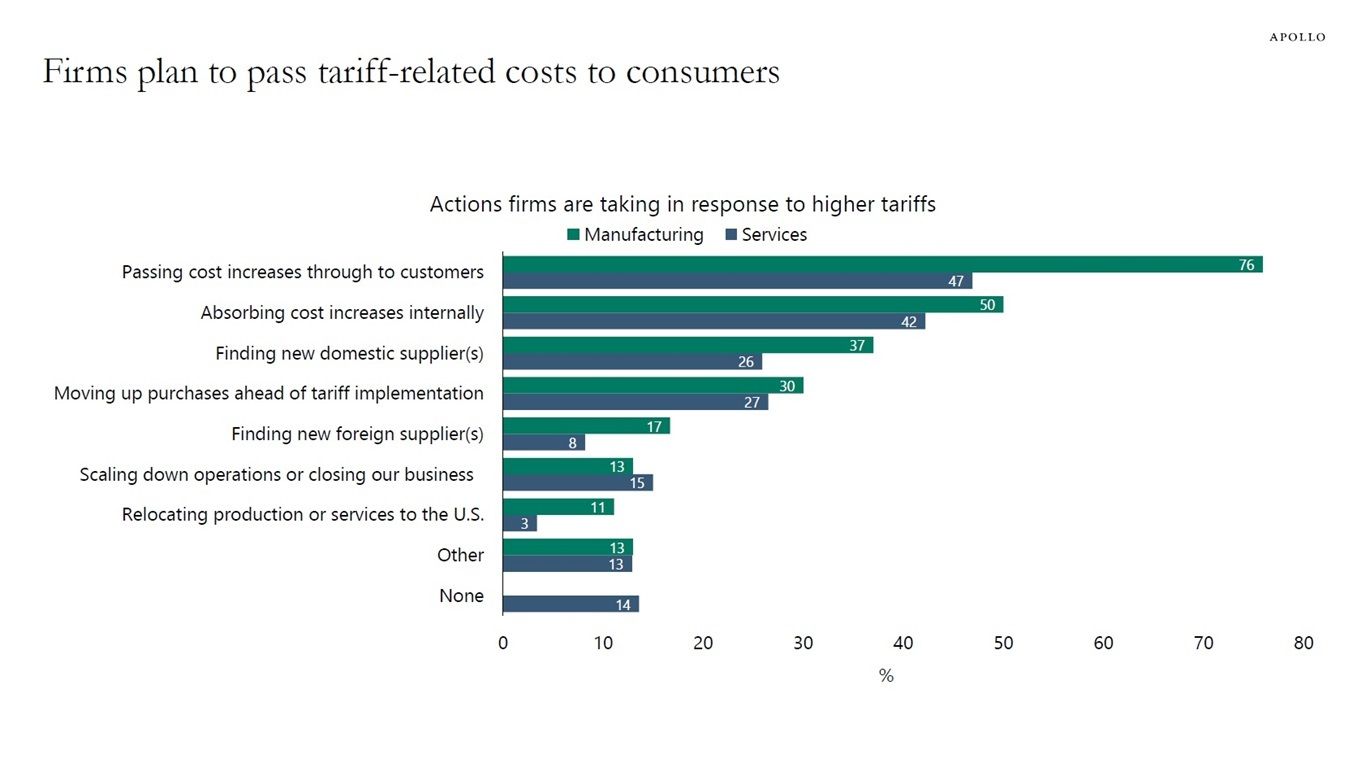

According to the Dallas Fed’s latest survey, both manufacturing and service-sector firms are increasingly passing costs on to consumers—a potential sign that CPI figures in May and beyond could rebound.

Globally, the inflation narrative is also turning. The UK reported an unexpected jump in April inflation, with regulated prices for energy and water lifting the CPI from 2.6% to 3.5%, well above both economist and Bank of England forecasts. The sharp repricing of rate cut expectations in the UK may serve as a cautionary tale for the U.S., where similar dynamics—energy, tariffs, and sticky services inflation—could delay the Fed's pivot even further.

Conclusion: Fed Patience vs. Political Pressure

Despite Trump’s vocal demands, the Fed appears firmly committed to data dependence, not politics. With three policy meetings before the September election—June, July, and September—the window for any meaningful rate cuts is narrowing fast. Unless inflation breaks meaningfully lower or the labor market shows signs of stress, the base case remains: the Fed stays on hold.

For investors, this means preparing for a higher-for-longer rate environment and focusing on sectors resilient to interest rate shocks, while keeping an eye on CPI and employment data for any signs that could shift the narrative.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.