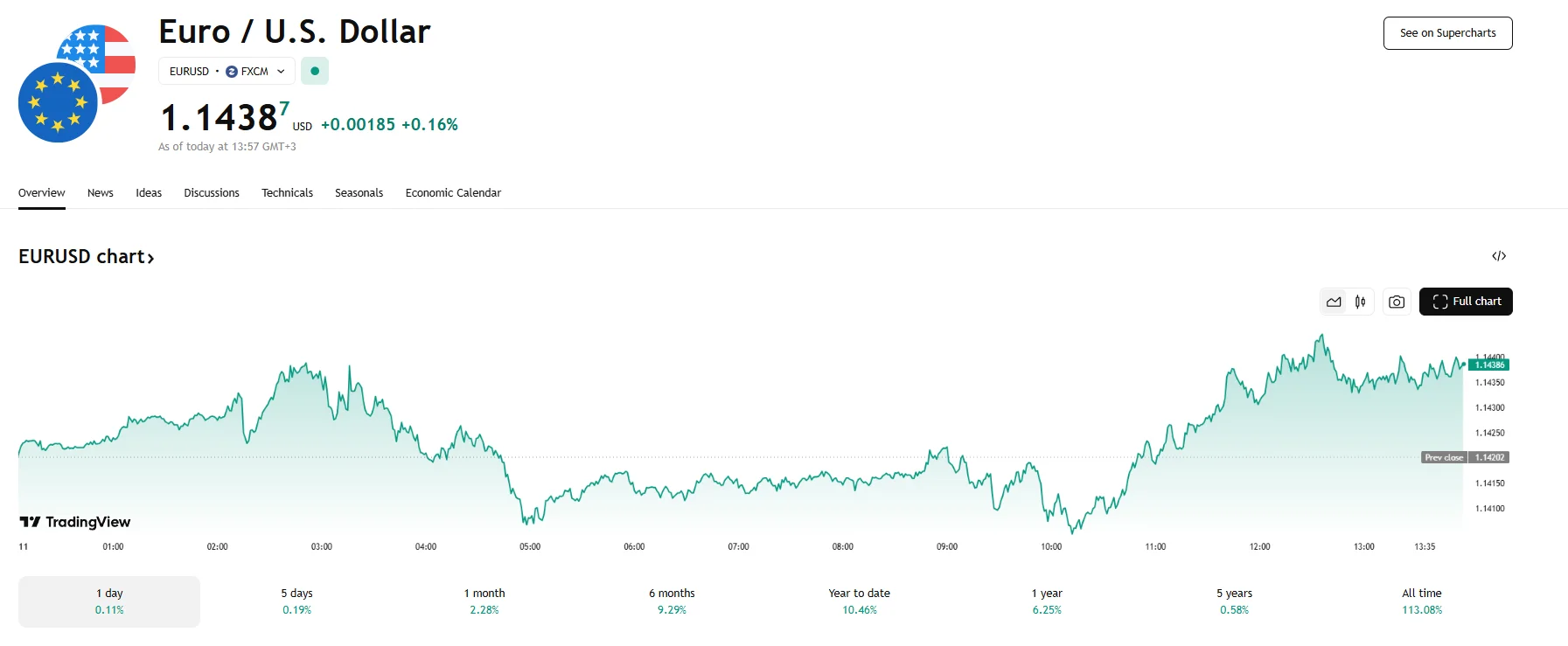

EUR/USD Climbs 0.16% to 1.1438 EUR/USD Climbs 0.16% to 1.1438

Key Moments:EUR/USD edged higher to 1.1438 on Wednesday.The US dollar weakened as optimism around the US-China tariff deal started to fade.Markets eyed May’s US CPI data for clues on inflation and pot

Key Moments:

- EUR/USD edged higher to 1.1438 on Wednesday.

- The US dollar weakened as optimism around the US-China tariff deal started to fade.

- Markets eyed May’s US CPI data for clues on inflation and potential Fed policy shifts.

Euro Advances Amid Cautious Market Tone

The euro recovered ground against the greenback on Wednesday, with EUR/USD rising 0.16% to 1.1438. The move came as the US dollar gave back gains previously driven by upbeat headlines on the framework agreement between the US and China.

The proposed tariffs deal, which effectively returns the two sides to the consensus reached during last month’s talks in Geneva, still needs to be greenlit by both US President Donald Trump and Xi Jinping. However, the lack of additional information led to a waning enthusiasm shortly after the framework’s announcement.

Legal and Economic Developments Weigh on Sentiment

In a separate development, Trump’s broad-based tariffs, which were recently struck down by a US federal court before being reinstated after an appeal, will remain in place until a decision is reached on the validity of the previous ruling. This served to prolong uncertainty about US trade policies and continues to influence market behavior.

Investors were also turning their attention to May’s US Consumer Price Index (CPI), which is scheduled to be published on Wednesday. The data is expected to reflect a modest 0.2% acceleration in inflation and will shape expectations for the Federal Reserve’s next steps.

Positive Eurozone Indicators and ECB Commentary

As for Europe, broad Eurozone sentiment has shown signs of improvement as data released on Tuesday revealed that investor confidence rose to 0.2 this month. This reflected a reversal from May’s -8.1 reading.

Meanwhile, European Central Bank policymaker Olli Rehn recently stressed the necessity of maintaining inflation at 2%. He also warned against the ECB becoming complacent in terms of inflation prospects, further reinforcing expectations that the bank will not proceed with further rate cuts in July.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.