A closer look at this employment report that exceeded expectations, and there are still many shortcomings.

On July 3, the most important recent U.S. labor data-June non-agricultural data was released.After ADP was cold, the market was particularly looking forward to this report.

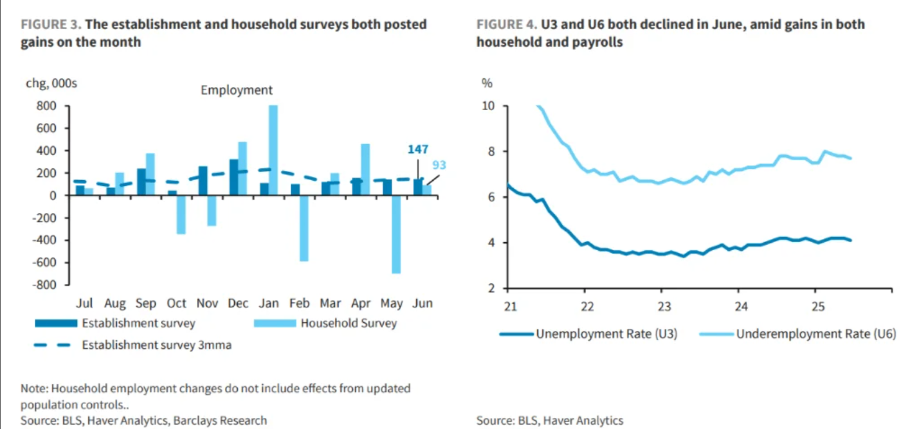

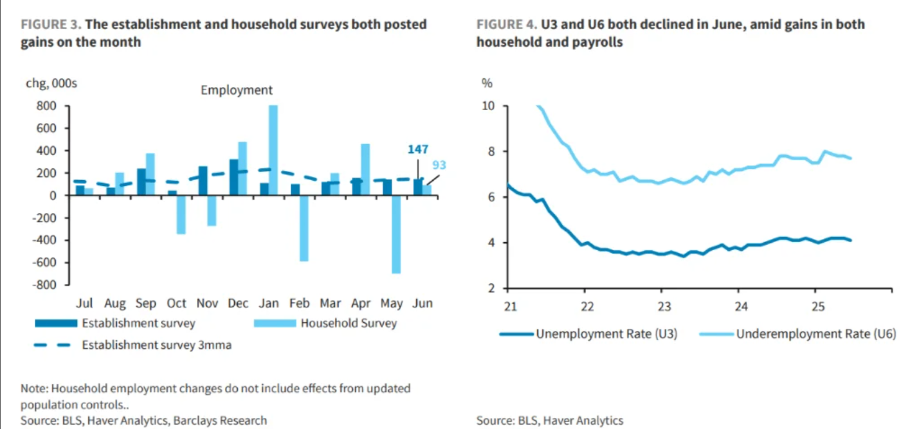

According to a report released by the U.S. Bureau of Labor Statistics, the U.S. non-farm employment increased by 147,000 in June, with an expected 106,000. The total number of non-farm employment in April and May was revised up by 16,000.

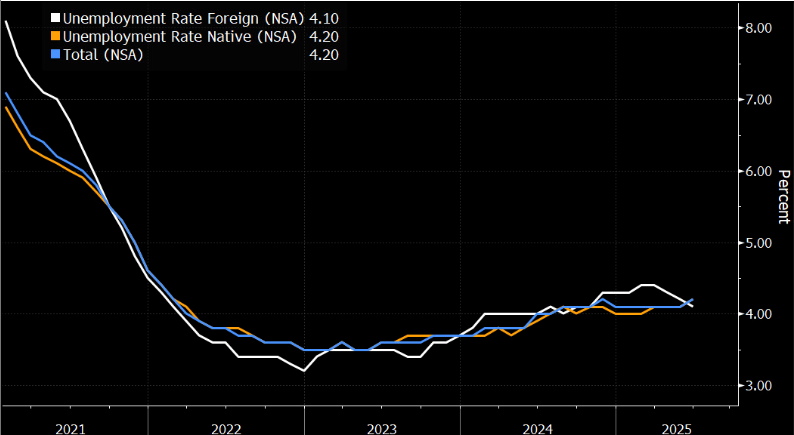

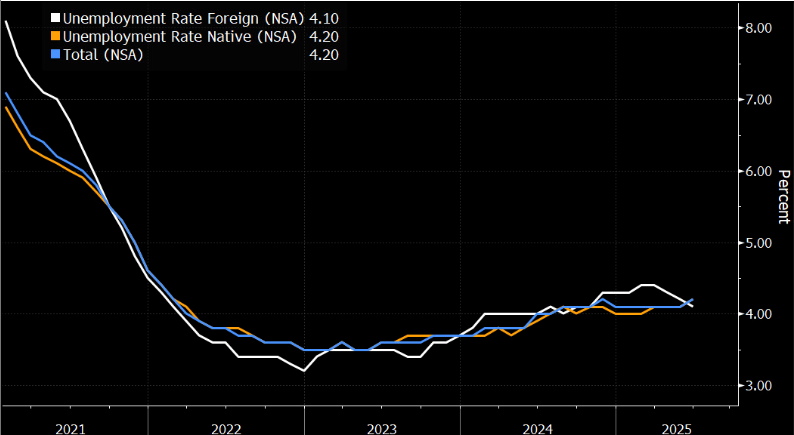

The unemployment rate unexpectedly fell to 4.1%, with an expected 4.3%, compared with a previous value of 4.2%.

After the data was released, gold plunged and U.S. bond yields rose in the short term.

How surprising is this data?Among the 79 economists surveyed by the media, only Derek Holt of Scotiabank predicted a higher number (160,000), and all other forecasts were below 147,000.

However, a closer look at this employment report that exceeded expectations shows that there are still many gaps.

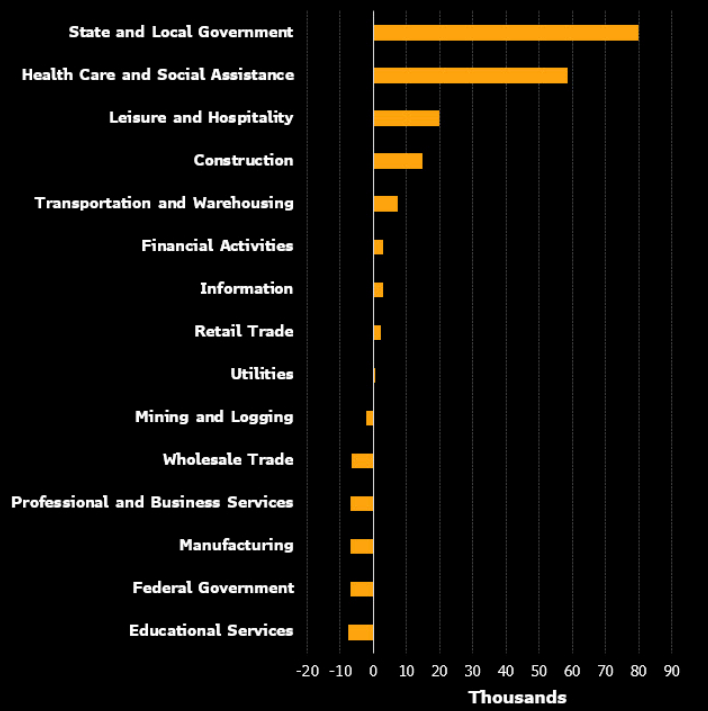

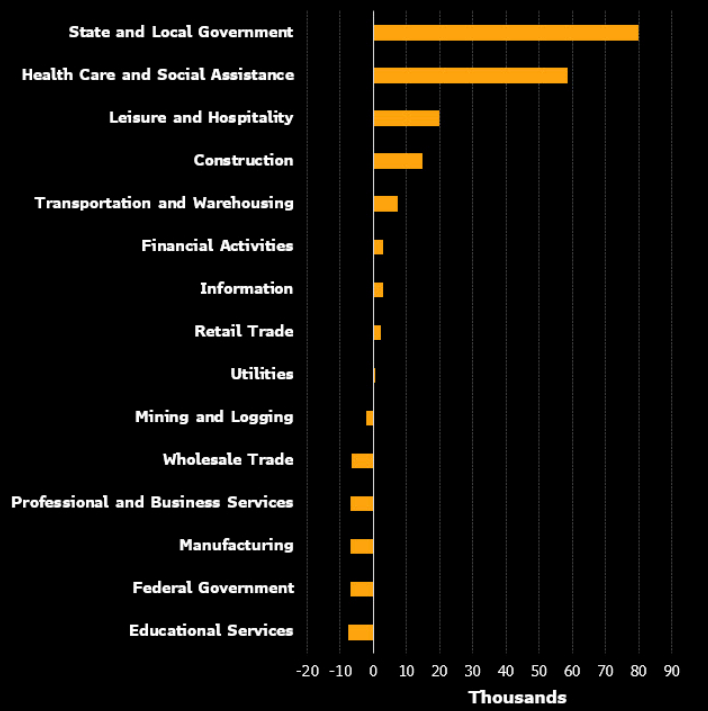

First, under the appearance that non-agricultural data in June exceeded expectations, the sudden rise of government employment contributed nearly half of the country (an increase of 73,000 people), while private sector employment only increased by 74,000 people-the weakest performance since October 2024.

This divergence exposes a serious imbalance in economic momentum: while state and local education sectors (especially state governments with an increase of 47,000 people and local government education with an increase of 23,000 people) have become employment engines, jobs have been lost in manufacturing and professional services, highlighting the over-reliance of economic growth on public spending.Even more alarming is that private sector employment growth has been below its average of 128,000 for three consecutive months, and services have slowed across the board except retail and transportation-a structural fragility that may not support a sustainable recovery.

Second, the unemployment rate fell from 4.24% to 4.12%, but this was not a sign of a job boom, but a result of a decline in labor participation.

The tightening of the Trump administration's immigration policies is having a "chilling effect" on the labor supply: the risk of deportation has reduced the willingness of foreign workers to participate, and the decline in labor participation rates in May and June was mainly due to this group.This distorting effect has even changed the balance point of the job market-Morgan Stanley pointed out that the number of new jobs needed to maintain the unemployment rate stable has dropped from 210,000 a month last year to 140,000 a month, and is expected to fall further by the end of the year. 70,000 a month.

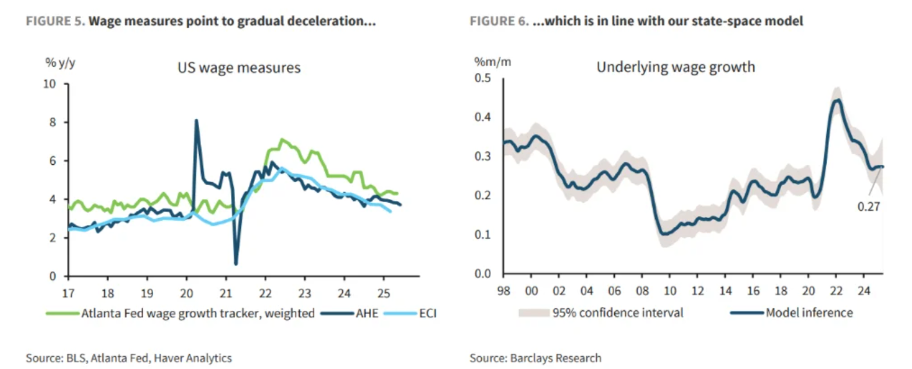

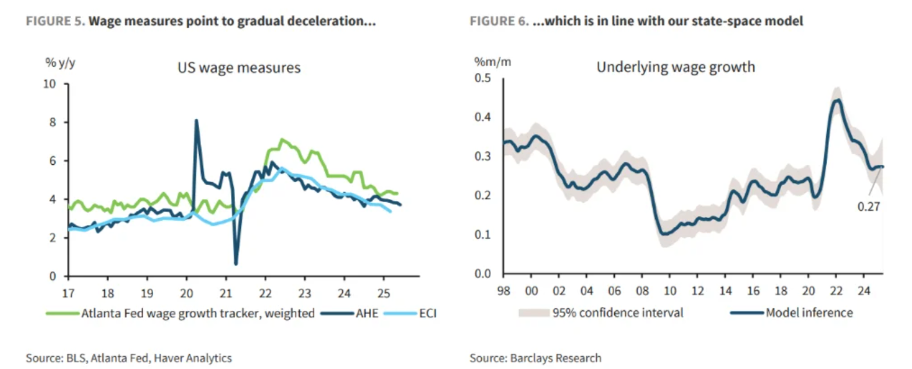

Third, the number of non-agricultural workers has increased, but wage growth has slowed down and working hours have slowed down.

According to data from the Ministry of Labor, the average hourly wage increased by only 0.2% month-on-month in June, and the year-on-year growth rate dropped from 3.8% to 3.7%. Although the annualized wage income growth rate remained at 5.1%, the reduction in working hours caused total income growth to stall.

This stagnation occurs against the backdrop of tariffs pushing up prices-although the wage growth rate of 3.7% has dropped significantly from the high of nearly 6% in 2022, it is still not enough to offset the erosion of inflation on real purchasing power.When consumer spending accounts for about 70% of the U.S. economy, this race between wages and inflation will directly determine whether the economy moves towards recession or a soft landing.

Historical experience shows that weak real income growth is often a precursor to a contraction in consumption, and the unexpected decline in consumer spending in May has already sounded the alarm. If the momentum of summer service consumption weakens (although education and medical care increased by 87,000 and accommodation and catering increased by 31,000), the U.S. economic engine may face the risk of stalling.

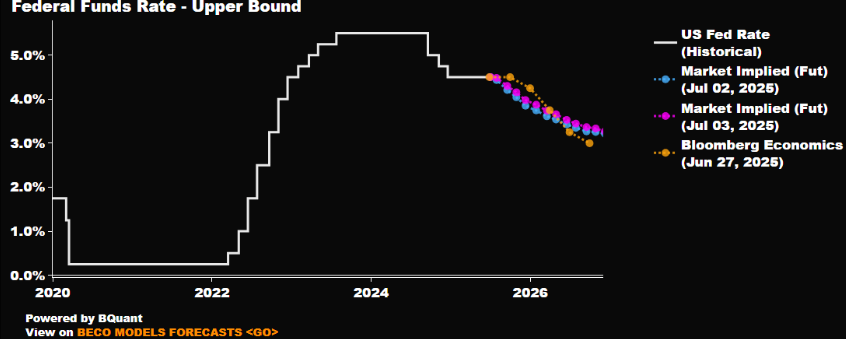

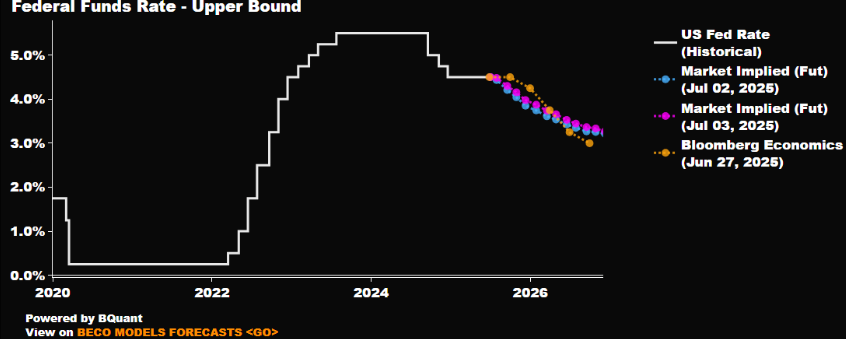

Interest rate futures traders dropped bets on the Federal Reserve's interest rate cut in July after the non-farm payrolls report was released.

In addition, expectations for interest rate cuts in September have begun to waver. The current market forecast that the probability of the Federal Reserve cutting interest rates in September is about 80%, which is lower than the 98% before the release of the non-farm employment report.

Despite the recent weakening of a series of soft economic data, this strong employment report completely breaks pessimistic expectations.Jack McIntyre, a fund manager at Brandywine Global, said: "In the battle between hard data and soft data, hard data wins, which means the Fed is right to continue to sit tight.”

Gregory Faranello, head of U.S. interest rate trading and strategy at AmeriVet Securities, said: "The biggest problem is unemployment, which was ruled out in July and the Fed will take a break this summer.Employment data gives Powell reason to continue to "wait and see."”