Duan Yongping seized the opportunity of low-level layout and significantly added positions in some core technology stocks.

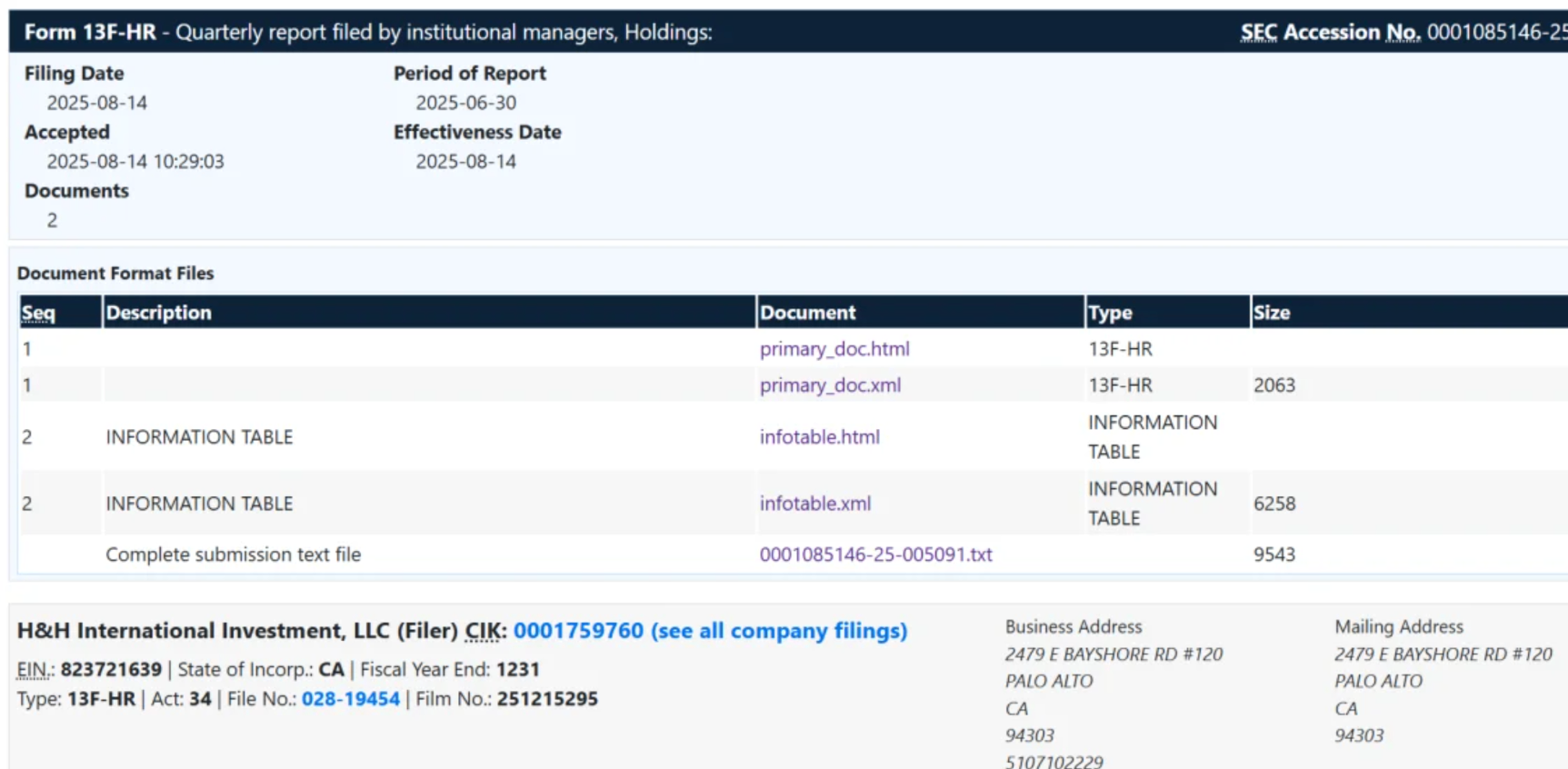

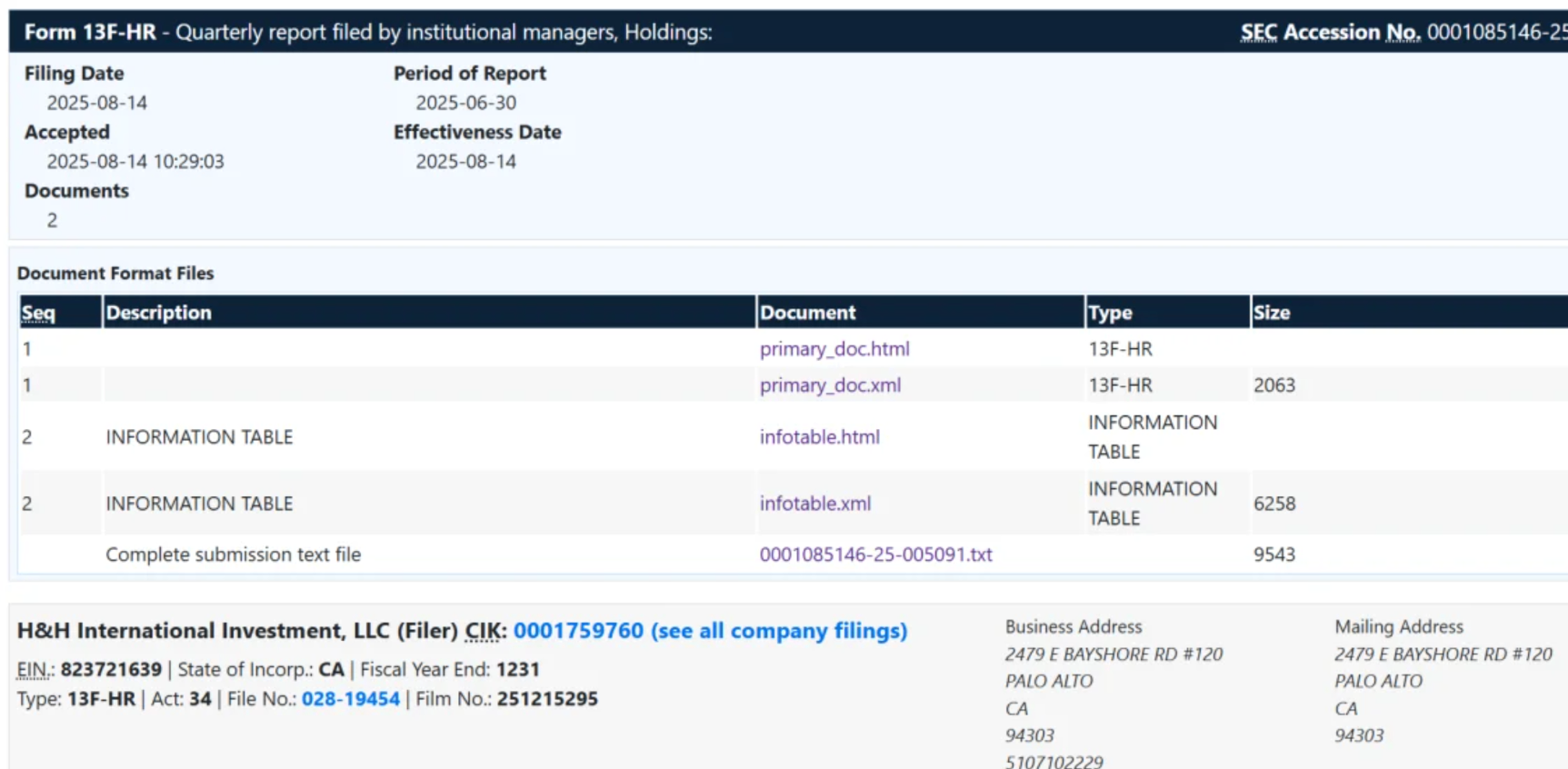

On August 14, H\&H International Investment, which is managed by Duan Yongping, submitted its latest 13F document to the U.S. Securities and Exchange Commission (SEC).Data shows that the market value of H\& H's total holdings in the second quarter was approximately US$11.5 billion, and the overall structure was relatively stable. However, against the background of intensified fluctuations in the global economy and capital markets and significant shocks in U.S. stocks, Duan Yongping seized the opportunity of low-level layout and significantly added positions in some core technology stocks.

Duan Yongping's most eye-catching operation this season was his replenishment of Apple.In the past four consecutive quarters, H\&H has been gradually reducing its holdings of Apple, but in the second quarter, it bucked the trend and increased its holdings of 890,000 shares.This strategic move is closely related to the trend of Apple's share price during the current quarter-in early April, the impact of "reciprocal tariffs" between the United States and China caused Apple's share price to fall to a nearly two-year low.However, after Apple CEO Cook recently visited the White House, market sentiment reversed significantly. Apple's share price rose nearly 15% in just two weeks, completely recovering the decline in the second quarter.

Duan Yongping adopted a differentiated strategy in the operations of the "Three AI Musketeers"-Nvidia, Microsoft and TSMC.Microsoft and TSMC reduced their positions slightly, while Nvidia gained significant increases.Nvidia's share price entered a adjustment period after DeepSeek released its R1 model in late January and hit bottom in early April during a tariff shock.In the following four months, benefiting from the explosion in AI demand and the global data center investment boom, Nvidia's share price doubled and ranked first in the world in market value.

Google's operations are also worthy of attention.In the previous quarter, H\&H significantly reduced its holdings of 2.65 million shares of Google's Class C shares, but quickly replenished 830,000 shares in the second quarter, demonstrating Duan Yongping's recognition of the company's medium and long-term growth prospects.With the continued expansion of generative AI, cloud computing and digital advertising businesses, Google is expected to maintain solid growth among technology stocks.

In terms of Chinese stocks, Pendoduo has continued to increase its positions, with its latest shareholding reaching 8.66 million shares.The analysis believes that behind this strategy is a judgment on the changes in the competitive landscape of local e-commerce in China-Pinduo has maintained a high growth rate at home and abroad based on its cost-effectiveness and sinking market advantages.In contrast, Alibaba suffered a reduction of more than 20%, reflecting Duan Yongping's cautious view of its growth momentum, especially in the context of a macroeconomic slowdown and intensified competition.

In terms of energy stocks, H\&H slightly reduced its holdings in Western Oil.This position was previously a typical case of "buying with Buffett". However, in an environment of fluctuating oil prices and accelerating global energy transformation trends, a small reduction in positions not only reflects flexibility, but also retains long-term allocation to the energy sector.In addition, Duan Yongping also completely cleared Modena, which is regarded as his judgment that the dividends of the COVID-19 vaccine are gradually fading and the returns of the biopharmaceutical sector are periodically weakening.