The public offering is only 10%. If the callback mechanism is triggered, concentration of chips will easily push up the stock price.

The Hong Kong Stock Exchange's queuing for listings is accelerating, and another bioinnovation company is about to be launched.Everything you want to know about Peg Biology is here.

1. Company Profile

Founded in 2008 and headquartered in Suzhou, Jiangsu Province, Peger Biomedic-B is a biotechnology company focusing on the research and development of innovative therapies for chronic diseases in the field of metabolic disorders. Its core direction is the development of peptide and small molecule drugs.

Peige Biotech's core product PB-119 is a long-acting GLP-1 receptor agonist. It has submitted a new drug marketing application (NDA) in China for type 2 diabetes (T2DM) and obesity and is expected to be approved in 2025.

The hypoglycemic and weight-loss track has been very popular in recent years.According to incomplete statistics, the global scale is expected to reach US$77 billion in 2030, of which China's obesity drug market may reach 49.2 billion yuan.The 24-week clinical trial data of PB-119 showed that the patient's HbA1c (blood sugar indicator) was reduced by 1.37%, and the body weight was reduced by 8.0%. Although the efficacy was not as good as Novo Nordisk's semigroutide (weight loss by 15%), the side effects were controllable and had localized cost advantages.InvalidParameterValue

In addition to PB-119, Paiger has also differentiated its products., the company has laid out candidate products such as PB-718 (GLP-1/GCG dual-target agonist for obesity and NASH) and PB-1902 (the only oral clinical drug in China for opioid constipation).Phase Ib/IIa clinical data of PB-718 shows that its weight loss effect is better than that of single-target drugs, and it plans to expand to the U.S. market, but its progress lags behind domestic competitors such as Hengrui Pharmaceutical.InvalidParameterValue

2. Financial situation

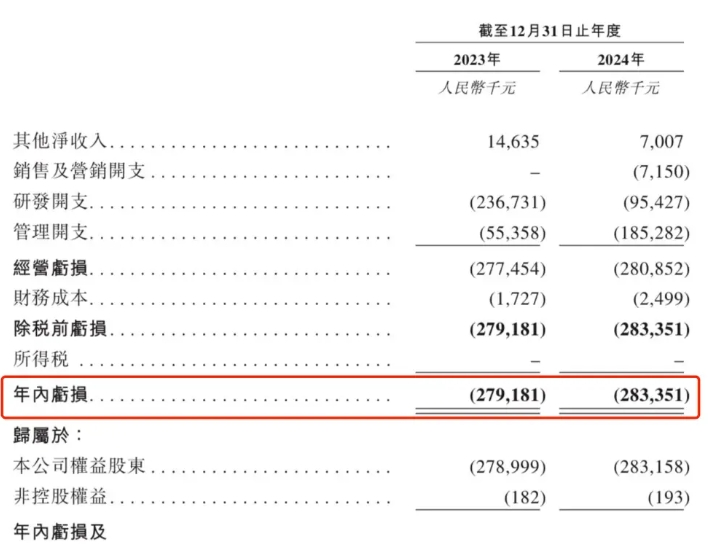

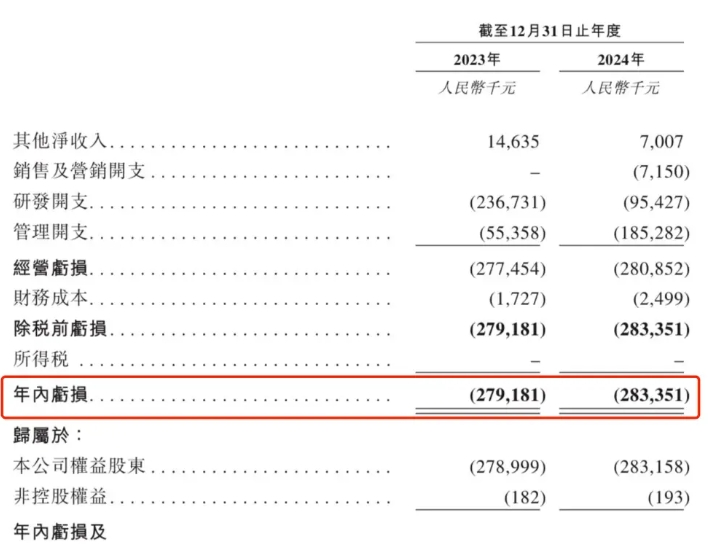

Like most listed biopharmaceutical companies, Paiger has not yet achieved commercial revenue.

The net loss in 2023 will be 279 million yuan, and the loss will expand to 283 million yuan in 2024, with R & D expenditure accounting for more than 90%.As of the end of 2024, the cash on the account was only 28.39 million yuan. Based on the current loss rate, it is only enough to support operations for three months. Even if the IPO raises HK$301 million, it will only maintain operations for the next year. It is estimated that if we don't raise funds, life will not last.

But don't think that companies that lose money cannot be listed, because this situation is acceptable under the 18A Rule of the Hong Kong Stock Exchange, because the 18A Rule is tailored for biotechnology companies and allows unprofitable biotechnology companies to go public.

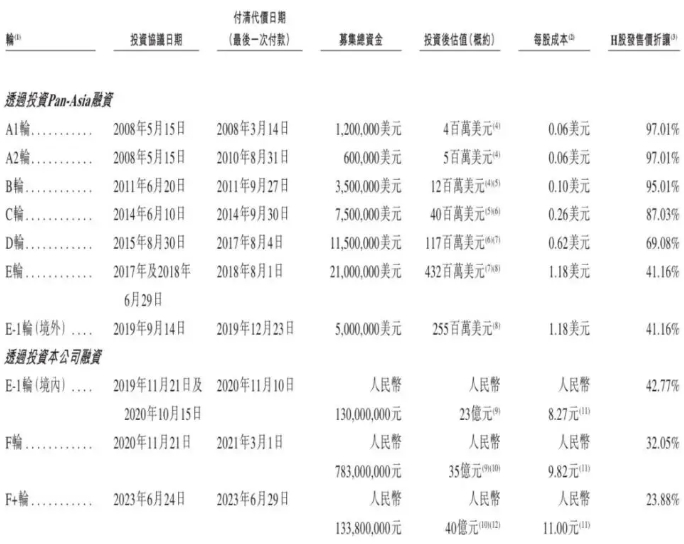

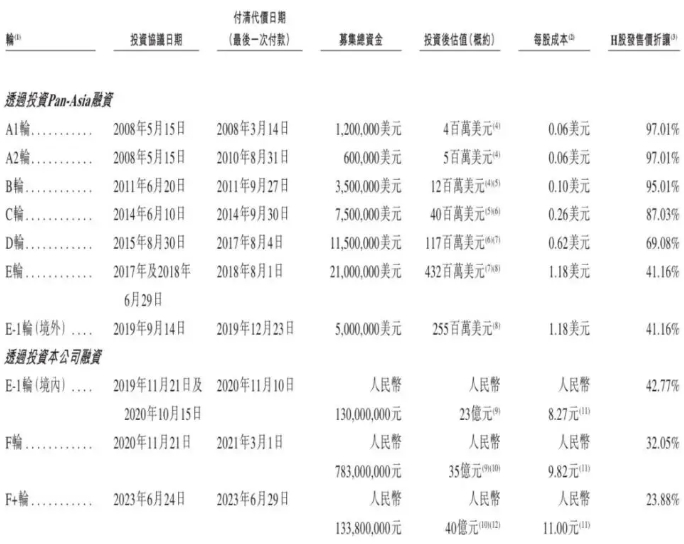

3. Valuation situation

Let's take a look at the valuations that everyone cares about.In a word, purchase carefully.

First, the offering price corresponds to a market value of HK$6 billion, a 37% premium to the final round of financing valuation in 2023 (4 billion yuan). The price-to-sales ratio (PS) is significantly overestimated against Standard Cinda Biotech (PS8x), lacking a margin of safety.InvalidParameterValue

Second, Paiger's subsequent commercialization capabilities are still in doubt.The company has no self-built sales team, relies on third-party cooperation (for example, Tasly cooperation has been terminated), has weak channel control, and has a high risk of price reduction in medical insurance negotiations.InvalidParameterValue

Third, market share is exhausted.Novo Nordisk and Lilly account for 90% of the global market share. Domestic companies such as Hengrui Pharmaceutical and Cinda Biological are leading the way in GLP-1 drugs, and PB-119 is facing pressure from price wars.InvalidParameterValue

Fourth, there is no green shoe mechanism.This is also the most worrying point. Although there is a high proportion of cornerstones to support the foundation (Yizekang Pharmaceutical, a subsidiary of Hangzhou Gongshu District State-owned Assets Corporation, subscribes 65.82% of the shares), there is no over-allotment rights in the issuance structure, and there is a lack of protective power after listing, which may increase the risk of stock price fluctuations.

The only bright spot is that the mobile disk is scarce, so you can try to call back.The public offering is only 10%. If the callback mechanism is triggered (overpurchased by more than 15 times), the outstanding market value may be less than HK$100 million, and the concentration of chips will easily push up the stock price.

project content company name Peige Biomedicine-B industry biopharmaceutical IPO date May 19-May 22 number of shares issued A total of 19.2835 million shares issued (10% public offering/90% international placement) offer price 15.6 HK $ board lot 500 shares company's market value HK$6.021 billion price-earnings ratio loss Minimum subscription amount 7878.66 HK $ Announcement of the winning vote May 26 listing date May 27 sponsor CICC (high probability of project failure in the past two years) green shoe mechanism no cornerstone investors 1 company (subscription accounted for 65.82%) Margin situation As of 3 pm on May 19, the margin margin was 1.94 times, with a total of 58.55 million, which was lower than expectations.InvalidParameterValue

4. Develop new strategies

The issue price is HK$15.6, the admission fee is HK$7,878.66, and each lot is 500 shares. The retail allocation rate is expected to be less than 10%(if overpurchased by more than 50 times).

If you want to purchase, it is recommended to use multiple securities firms to purchase in cash (to avoid loss of financing interest), focusing on the margin ratio: if the overpurchase is 50 times + high market sentiment (such as driven by Hengrui Pharmaceutical at the same time), you can test the water in a small position.

Steady investors suggest avoidance: no profit + no green shoes + sponsor CICC's historical break rate of 66.7%(Hong Kong stocks 18A biomedical project), with a high probability of break.

Recently, the pace of listings of Hong Kong and the United States stocks has been too fast. Didi has not prepared an account under WeChat. There is no limit to the number of securities firms to open accounts in Hong Kong stocks, and there are many benefits for wool.