Recently, many people consulted Weisheng Pharmaceutical and did an in-depth research to share with you.

company profile

Let me first introduce briefly. The code number of Weisheng Pharmaceutical is Weisheng Pharmaceuticals-B. This B refers to Biotechnology, which is a unique writing method for Hong Kong stocks, which means a biomedical company that is still in the research and development stage and has no revenue yet.

Let me first introduce briefly. The code number of Weisheng Pharmaceutical is Weisheng Pharmaceuticals-B. This B refers to Biotechnology, which is a unique writing method for Hong Kong stocks, which means a biomedical company that is still in the research and development stage and has no revenue yet.

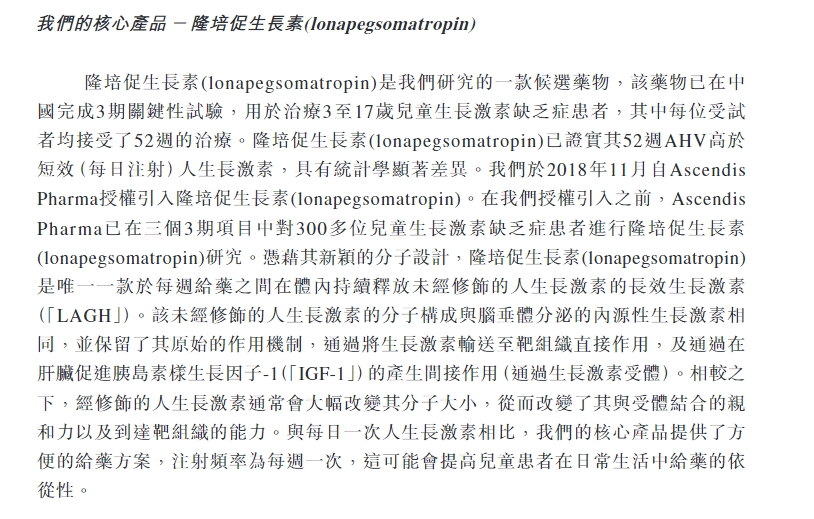

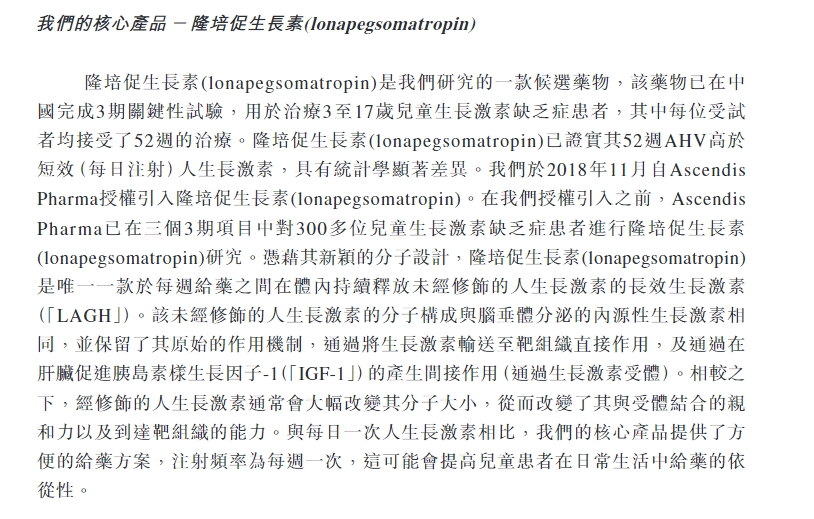

According to the prospectus, the company was established in November 2018. It is a biopharmaceutical company in the advanced stage of research and development and its products are close to commercialization. It focuses on providing treatment options for specific endocrine diseases in China.The company has a core product and two other drug candidates under development, all of which were authorized by Ascendis Pharma, one of the company's partners and controlling shareholders.Since its establishment until the date of this document, the company has been conducting further research and development on these drug candidates.

core products function approval status Longpei somatotropin Weekly long-acting growth hormone replacement therapy for the treatment of growth hormone deficiency in children. Approved in the United States and Europe; Marketing Authorization Application (BLA) submitted to China in January 2024 Navipertide For achondroplasia Phase 2 trials in China have been completed paropeteriparatide For chronic hypoparathyroidism In the Phase 3 trial in China, it is planned to submit a new drug application in 2025

The growth hormone track has been very popular in recent years.According to Frost and Sullivan data, the size of the human growth hormone market in China will be US$1.5 billion in 2021 and is expected to increase to US$2.6 billion by 2025. The compound annual growth rate from 2021 to 2025 is 15.6%, and will increase to US$4.7 billion by 2030, with a compound annual growth rate of 12.7% from 2025 to 2030.The current market is dominated by Jinsai Pharmaceutical, a subsidiary of Changchun High-tech, with a market share of over 75%, and Anke Biotech accounts for 14%, forming a duopoly pattern.

Weisheng Pharmaceutical's core competitiveness is that Longpei Somatropin is the world's first approved long-acting growth hormone (injected once a week), which can improve patient compliance by 86% compared with traditional daily preparations and has been demonstrated in the Phase 3 trial in China (annualized growth rate of 10.66 cm/year versus daily preparation of 9.75 cm/year).If its BLA is approved in 2025, it will become the first foreign-funded long-term product to enter the China market, directly impacting the existing pattern.

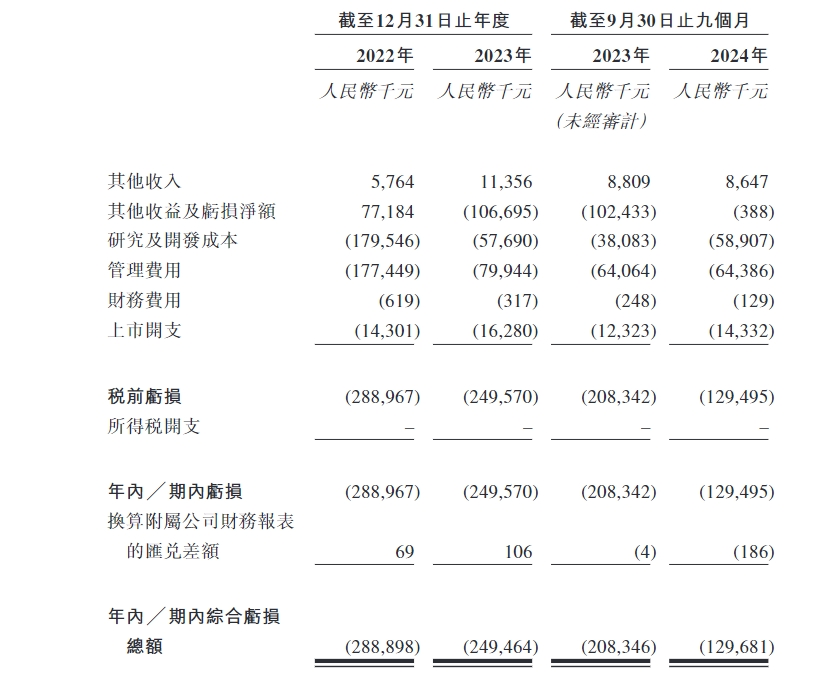

financial position

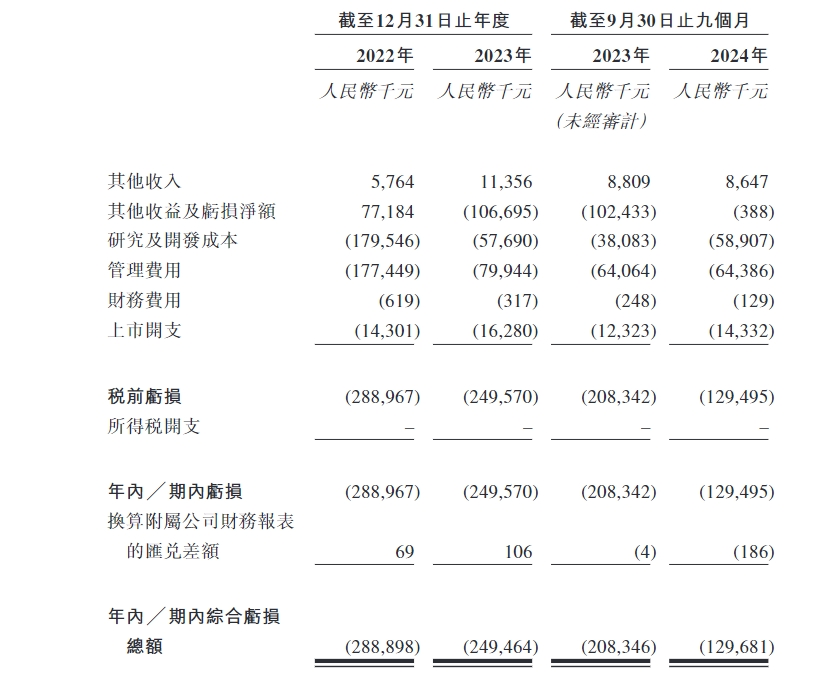

In a word, he is still burning money.

In 2022, 2023 and the first three quarters of 2024, the company's net losses were RMB 289 million, RMB 250 million and RMB 129.7 million respectively, and the losses have been decreasing year by year.The narrowing of losses was mainly due to the phased decline in R & D expenditure.As of the end of September 2024, there was only 348 million yuan in cash on the account, while a net outflow of cash flow from operating activities during the same period was 271 million yuan-this may be the main reason why Weisheng is eager to list and raise funds.

The company will continue to burn money in the future.Weisheng Pharmaceutical said that as the company will further carry out clinical research and development activities in the future, continue clinical development of candidate drugs and seek regulatory approval, commercialize pipeline products, and hire additional necessary personnel to operate the business, it is expected that the loss situation will continue in the next few years. -If you want to make new friends, you must make psychological expectations.

Let's take a look at the R & D data. During the reporting period, the majority of the company's R & D was on Longpei.Put all your eggs in the same basket and see whether this future flagship product can become a hit.

"During the reporting period, Weisheng Pharmaceutical's research and development costs were 65.19 million yuan, 274 million yuan, and 78.14 million yuan respectively.Among them, the research and development costs of the company's core product, Longpei Growth Promotion Factor, were RMB 49.7 million, RMB 194.2 million, and RMB 37.4 million respectively, accounting for 76.2%, 70.8%, and 47.8% of the total research and development costs for the same period respectively.”

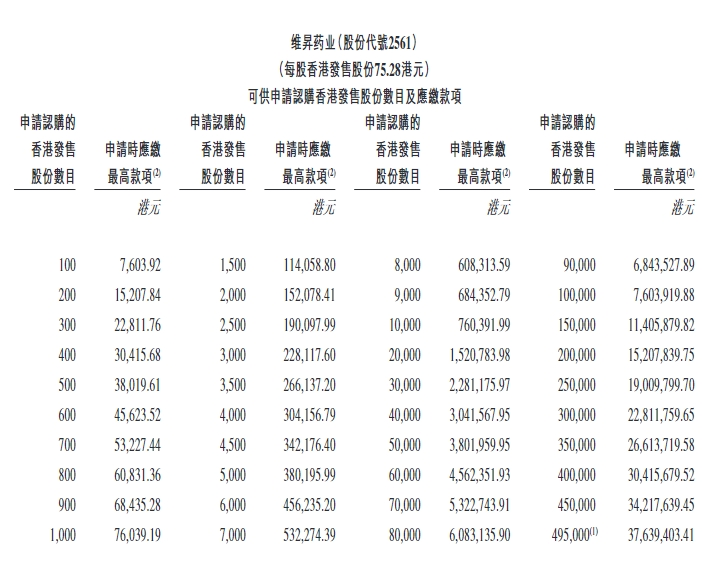

Issuance and valuation

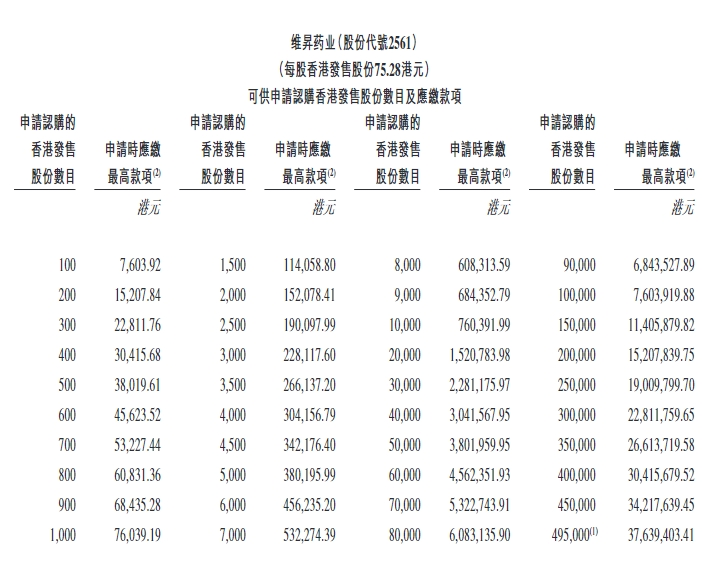

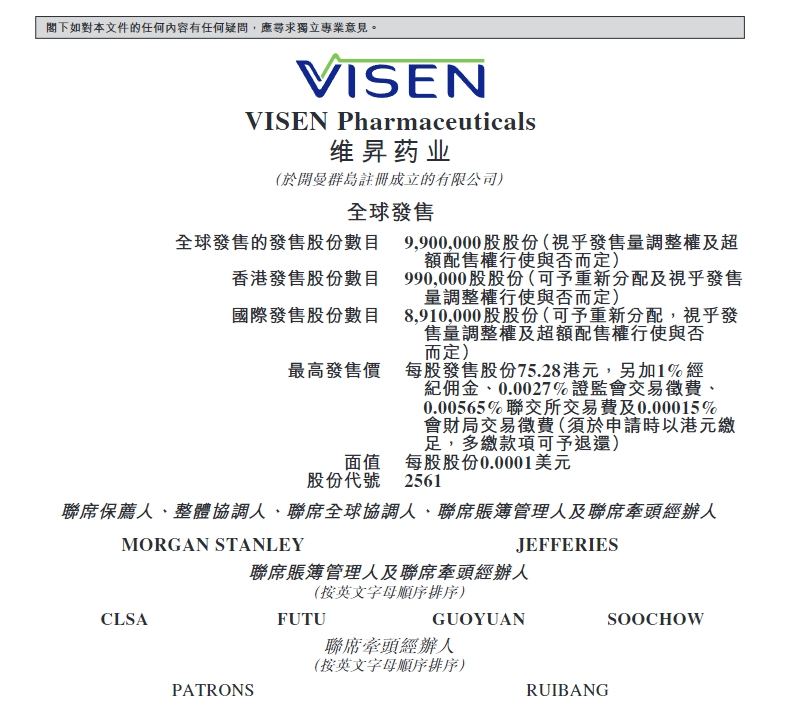

Weisheng Pharmaceutical plans to sell 9.9 million shares globally (accounting for approximately 8.80% of the total shares after the completion of the issuance, with 15% of the offering volume adjustment rights), of which 90% will be international offerings, 10% will be public offerings, and another 15% will be over-allotment rights.The offer price per share ranges from HK$68.44 to HK$75.28, with 100 shares per lot, raising up to approximately HK$678 million.If the cap pricing, offering volume adjustment rights and over-allotment options are all exercised in full, the fundraising will reach up to HK$986 million.

At the valuation level, based on the median issue price of HK$71.86, the market value of Weisheng Pharmaceutical after its issuance is approximately HK$8.08 billion (total share capital of 112.5 million shares).Compared with peers, Changchun High-tech's P/E ratio (TTM) is about 25 times and Anke Biotech is about 35 times, but both have achieved stable profits.

For unprofitable biotechnology companies, the price-to-sales ratio (PS) is more instructive: assuming that Longpei Somatropin will achieve revenue of 500 million yuan in China in 2026 (accounting for about 16% of the forecast market), the corresponding PS will be about 16 times, which is higher than the average range of 10 - 12 times for Hong Kong stock 18A companies, reflecting the market's premium recognition of its differentiated products.If the DCF model is adopted, calculated using a discount rate of 15% and a 10-year growth period, the reasonable valuation center is HK$7.5 - 8.5 billion, which is close to the current pricing upper limit.

What is more interesting is the ultra-high proportion of cornerstones.With a market of 700 million yuan, the cornerstone accounts for as much as 78%, which is still something.

Five cornerstone investors were introduced: a total of US$72 million in offering shares, of which Anke Biotech subscribed US$30 million, Yuanfeng, a subsidiary of Suzhou Industrial Park Industrial Investment Fund, subscribed US$18 million (including brokerage commission transaction levies, etc.), and existing shareholders Vivo Capital subscribed US$10 million, WuXi Biologics, a subsidiary of WuXi Biotech, subscribed US$10 million, and Raynold Lemkins, a subscription of US$4 million.

The sponsors brought in Morgan Stanley and Furui Financial.The past performance of Morgan Stanley's sponsorship is not bad, and this time it is equipped with a 15% green shoe, which is one of the few highlights.

Finally, let's talk about the subscription time. The IPO will start from today (March 13) to next Tuesday (March 18) and is expected to be listed on the Hong Kong Stock Exchange on March 21, 2025.Interested friends can take a look.

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

If you think the article is good, you are welcome to forward and share it.

Let me first introduce briefly. The code number of Weisheng Pharmaceutical is Weisheng Pharmaceuticals-B. This B refers to Biotechnology, which is a unique writing method for Hong Kong stocks, which means a biomedical company that is still in the research and development stage and has no revenue yet.

Let me first introduce briefly. The code number of Weisheng Pharmaceutical is Weisheng Pharmaceuticals-B. This B refers to Biotechnology, which is a unique writing method for Hong Kong stocks, which means a biomedical company that is still in the research and development stage and has no revenue yet.