In an uncertain environment, the trend of HSBC Holdings 'strategic focus shifting eastward becomes clearer.

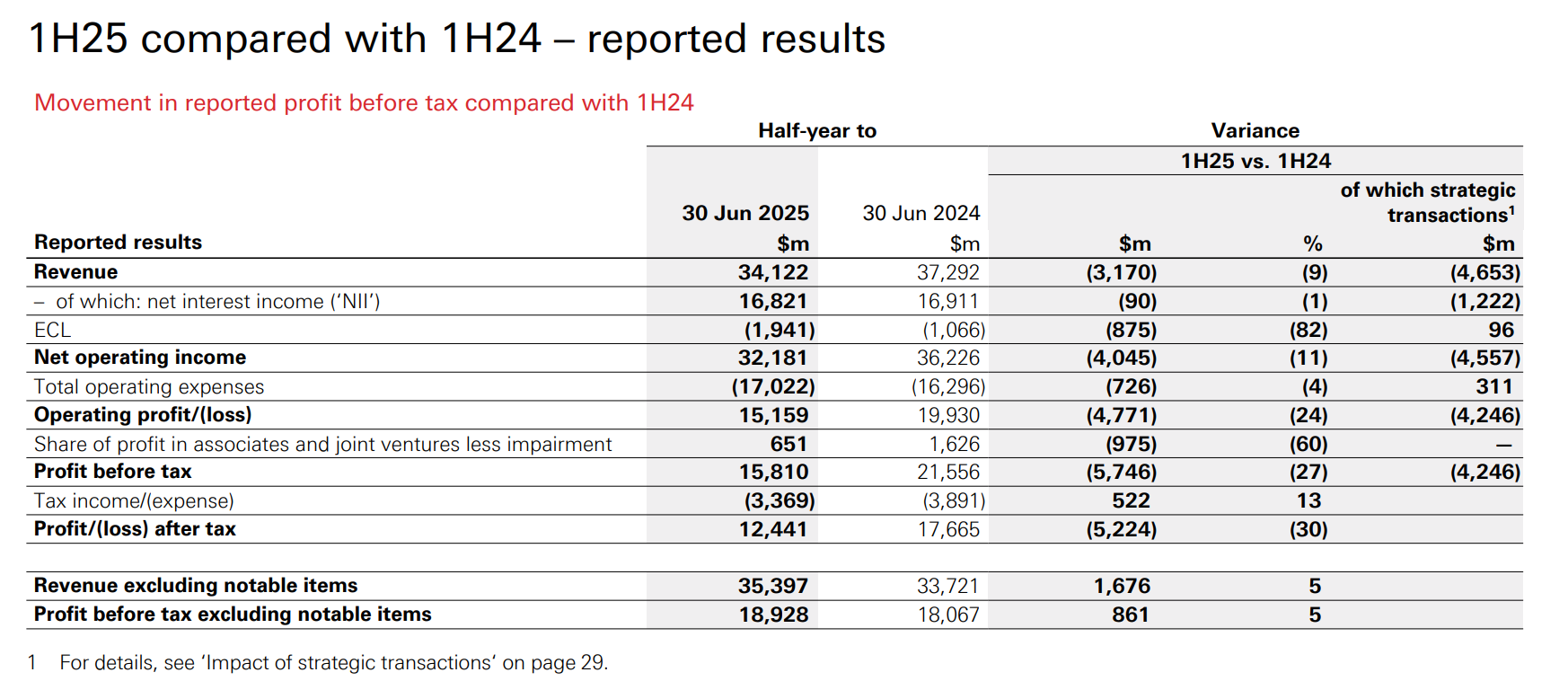

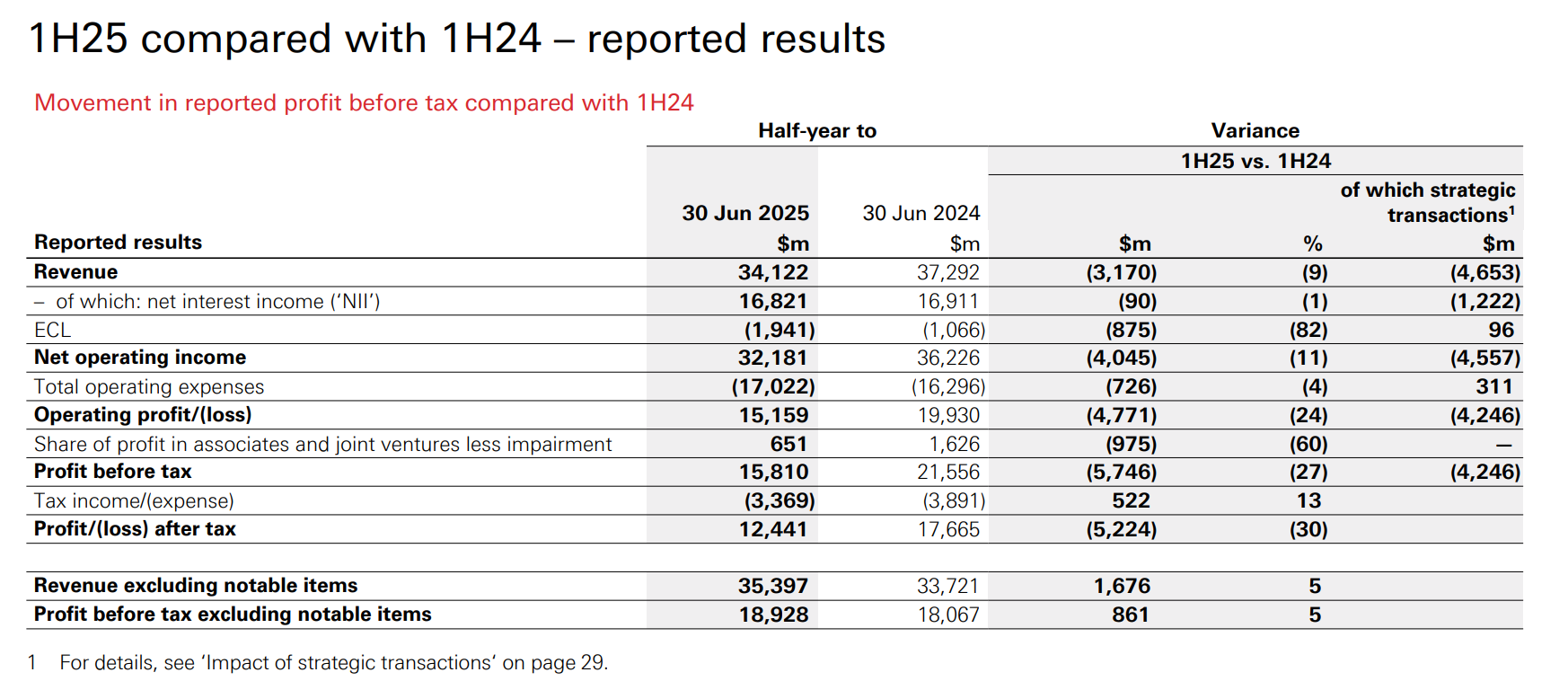

On July 30, HSBC Holdings announced its 2025 interim results.Data showed that in the first half of the year, the group's revenue was US$34.1 billion, down 9% year-on-year; profit after tax was US$12.4 billion, down 30% year-on-year; and earnings per share was US$0.65.However, after excluding uncomparable factors from the sale of Canadian and Argentine businesses and Bank of Communications impairment losses, actual revenue at fixed exchange rates increased by US$1.9 billion to US$35.4 billion, and all four major business segments achieved revenue growth.

Of the $5.7 billion decline in profits,$2.1 billion was due to accounting treatment of Bank of Communications 'equity dilution, and another $3.6 billion gap was due to unsustainable one-time gains from last year's sale of Canadian and Argentine operations.But the deeper pressure comes from the shift in global monetary policy-downward interest rates have reduced banks 'net interest income by US$900 million, and net interest margins have narrowed by 5 basis points to 1.57%.

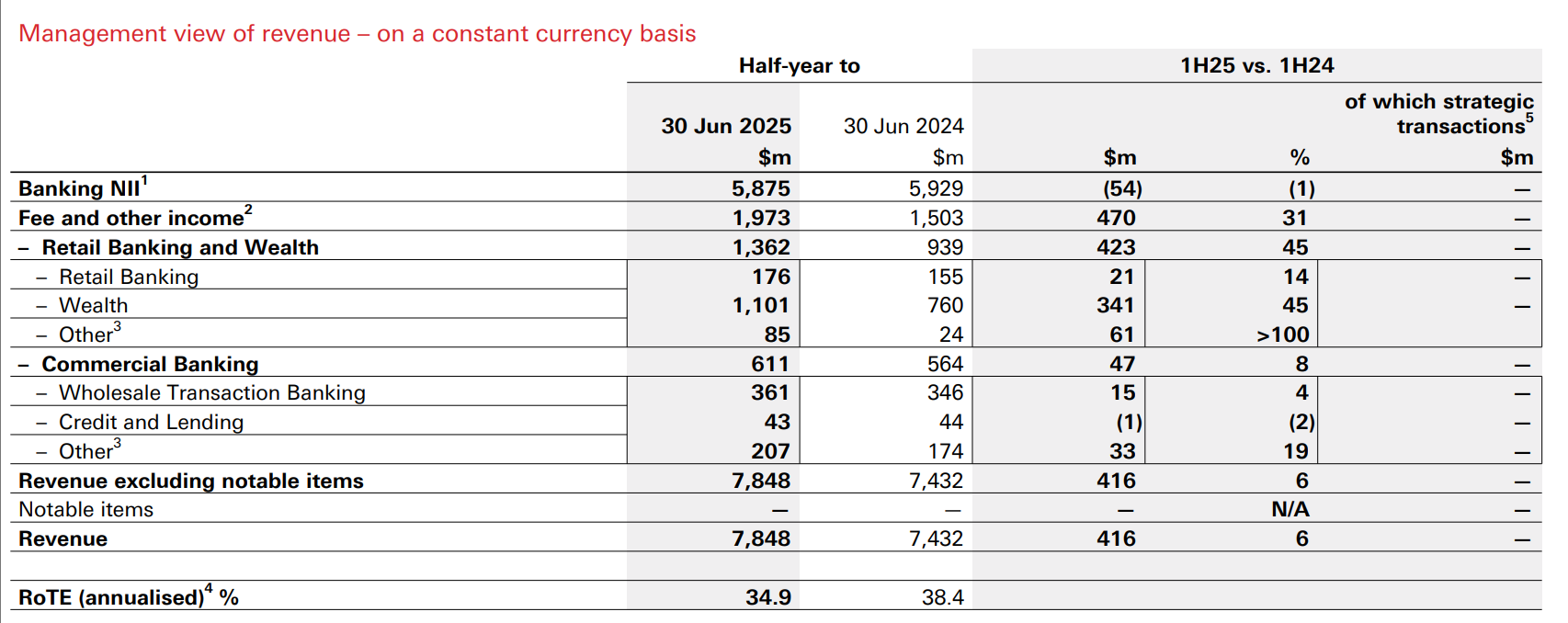

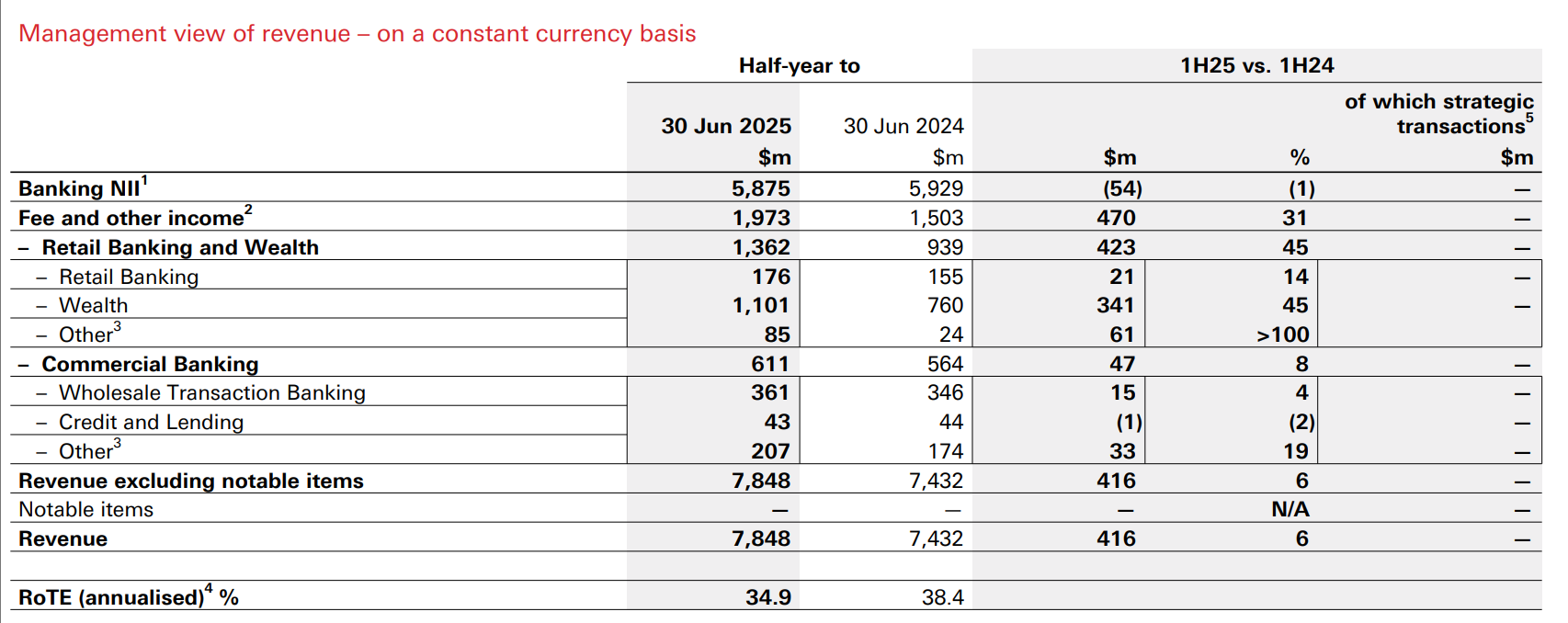

Wealth management became the biggest highlight, with revenue growing by 22% at constant exchange rates.Net new investment assets reached US$44 billion, of which Asia contributed US$27 billion, accounting for more than 60%.This achievement verifies the strategic correctness of the Group's listing of international wealth management as an independent business segment. The organizational restructuring launched last year integrates wealth management, originally scattered in various regions, into one of the four pillar businesses, under the unified leadership of Ou Baixian.At the same time, fee income from corporate and institutional wealth management business increased by 18%, of which wholesale transaction banking business contributed more than 40%, indicating that its corporate business remains competitive in an environment of fluctuating interest rates.

In the first half of the year, the Group saved US$700 million in costs through structural simplification, ahead of its progress in achieving the US$1.5 billion expenditure savings target by 2027.This allowed HSBC to maintain shareholder feedback despite pressure on profits: it announced a second dividend of US$0.1 per share and initiated a share repurchase of up to US$3 billion.It is noteworthy that the total number of shares has decreased by 13% since 2023. Although the common equity tier 1 capital ratio (CET1) has dropped by 0.3 percentage points month-on-month to 14.6%, it is still significantly higher than the medium-term target range of 14%-14.5%.

Macro risks are emerging on the balance sheet.Hong Kong's commercial real estate woes drove credit loss allowances up by US$900 million year-on-year to US$1.9 billion.The Group warns that broader macroeconomic deterioration may prevent the average tangible return on equity (RoTE) excluding special items from reaching the 15% target range in coming years.This risk has been incorporated into the stress-testing model-HSBC simulated "disruptive tariff scenarios" that included a sharp cut in policy rates and a broader recession.

Despite this, the group maintains its guidance of net interest income from banks of approximately US$42 billion in 2025, but is cautious about loan demand and expects "loans to remain sluggish for the rest of 2025."

In an uncertain environment, the trend of HSBC Holdings 'strategic focus shifting eastward becomes clearer.The Hong Kong market added 600,000 new bank customers in the first half of the year, and deposits increased by 9% year-on-year; Asia contributed 61% of new assets under wealth management.This regional advantage echoes the reorganization of the group's structure: the newly established "Eastern Market" covers the Asia-Pacific and the Middle East, is juxtaposed with the "Western Market" dominated by Europe and the United States, and is co-managed by Liao Yijian and Surendra Rosha.

Citigroup released a report saying that HSBC Holdings 'basic pre-tax profit (excluding special items) in the second quarter reached US$9.2 billion, 10% higher than the market consensus. Among them, revenue was 5% higher than expected, costs were in line with expectations, and impairment losses were lower than expected. 12%.Revenue exceeded expectations from banks 'net interest income (2% higher) and non-interest income (13% higher).Pre-tax profit was US$6.3 billion, 9% lower than the market consensus, mainly because Bank of Communications 'US$2 billion impairment charge exceeded expectations, but the impact on capital was slight.

As of the end of June, HSBC's core tier 1 capital ratio was 14.6%, a quarter-on-quarter decrease of 10 basis points. However, in line with market consensus, the quarterly dividend and repurchase plans remained unchanged at US10 cents and US$3 billion respectively.The guidance for the whole year of 2025 will remain basically unchanged, but the guidance for loan loss ratios will be slightly raised.Overall: Basic financial reports are solid, wealth management business performance is particularly strong, strategies continue to take shape, and cost savings and business simplification have achieved significant results.The bank reiterated its "buy" rating and target price of 10.1 pounds on London-listed HSBC (HSBA.L).