Is Your Broker FCA Authorised? 2025 Checklist for UK Brokers

Not sure if your broker is FCA authorised? Use this 5-step checklist to verify their status in 2025 and avoid scams. Essential guide for UK brokers.

Why FCA Authorisation Matters in 2025

The Financial Conduct Authority (FCA) is the UK’s financial watchdog, protecting consumers from fraud and ensuring brokers meet high regulatory standards. Trading with an FCA-authorised broker means your funds are safeguarded, and you have access to formal complaints procedures like the Financial Ombudsman Service (FOS).

Unfortunately, many scam brokers falsely claim FCA regulation. This guide gives you a practical, 5-step checklist to verify your broker's FCA status in 2025.

5-Step Checklist to Verify FCA Authorisation

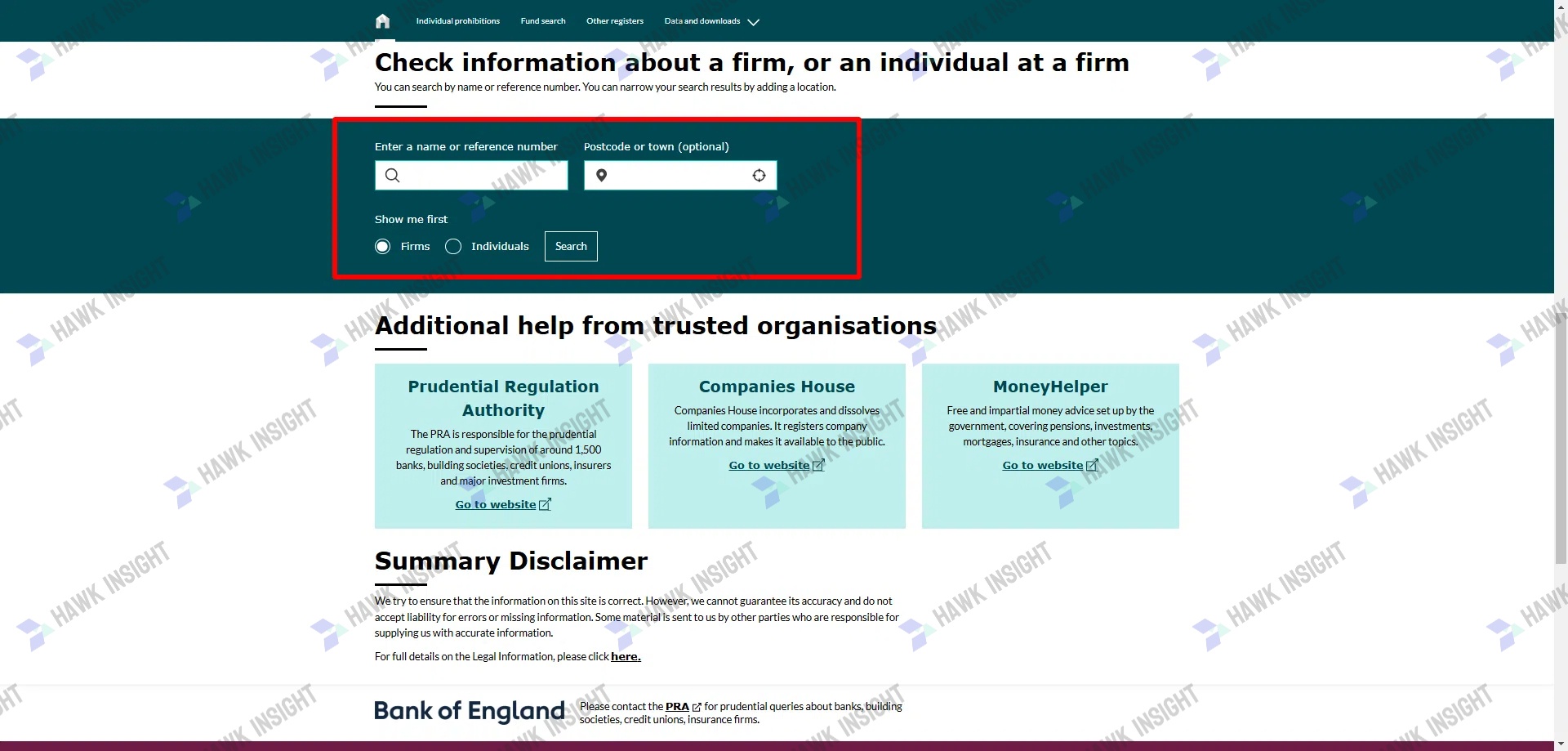

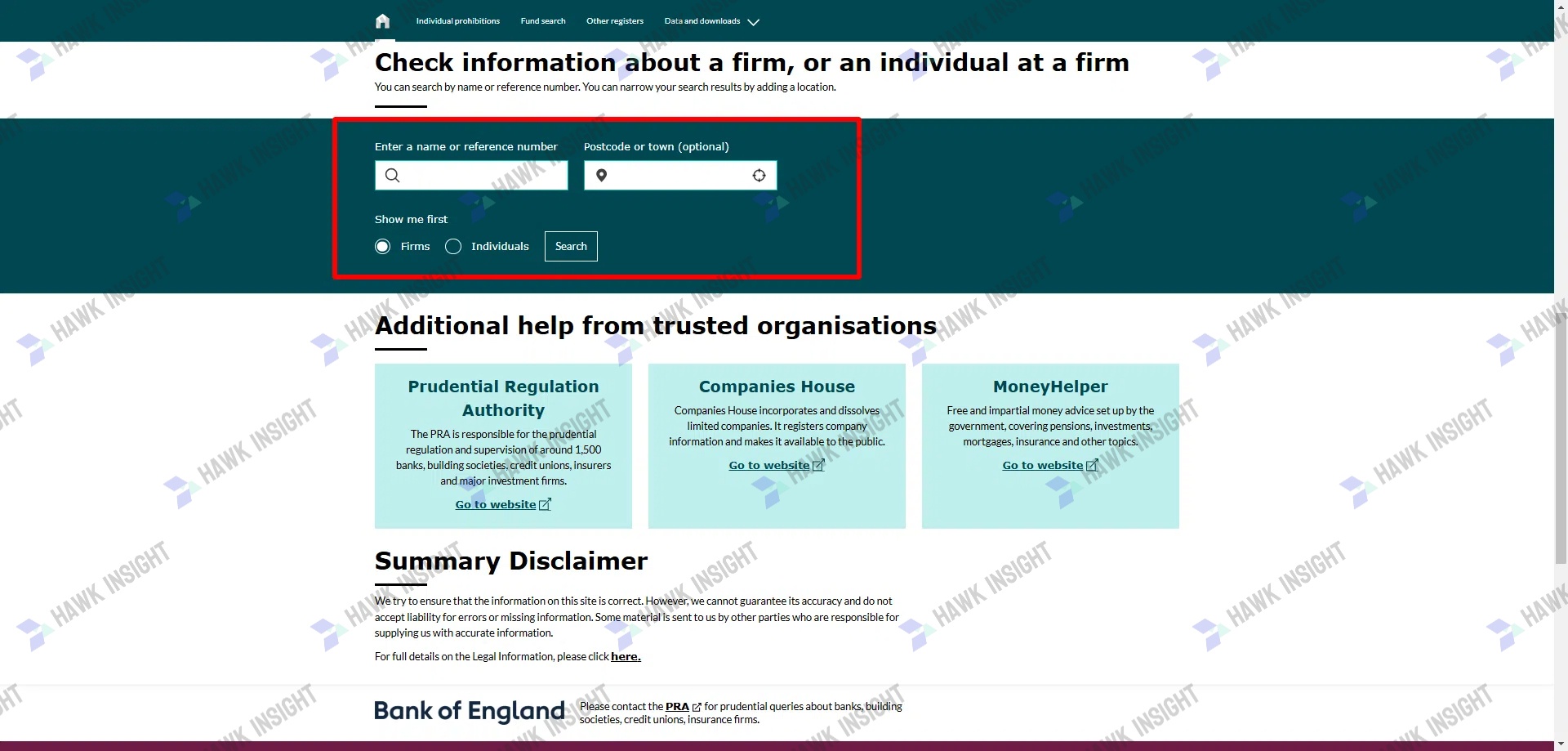

1. Search the FCA Register

Start by visiting the FCA Register.Enter the broker’s name or Firm Reference Number (FRN). If no results appear, the firm is likely not authorised.

Tip: Be cautious of companies with similar names—fraudsters often clone real firms.

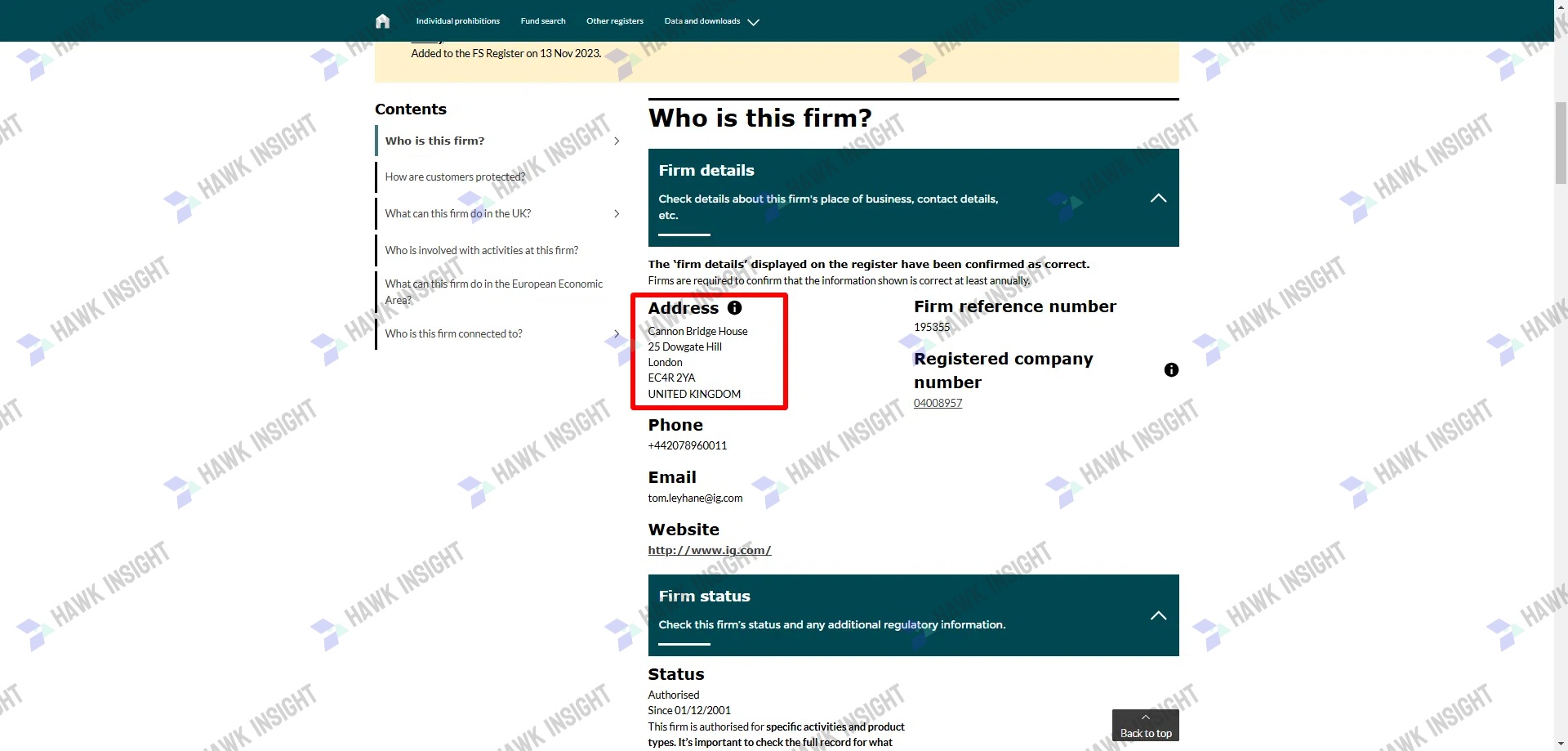

2. Check the Registered Address

Make sure the company’s listed address matches what's on their website or client documents.A UK-based broker should have a UK operational address. Many scams operate offshore but falsely claim FCA regulation.

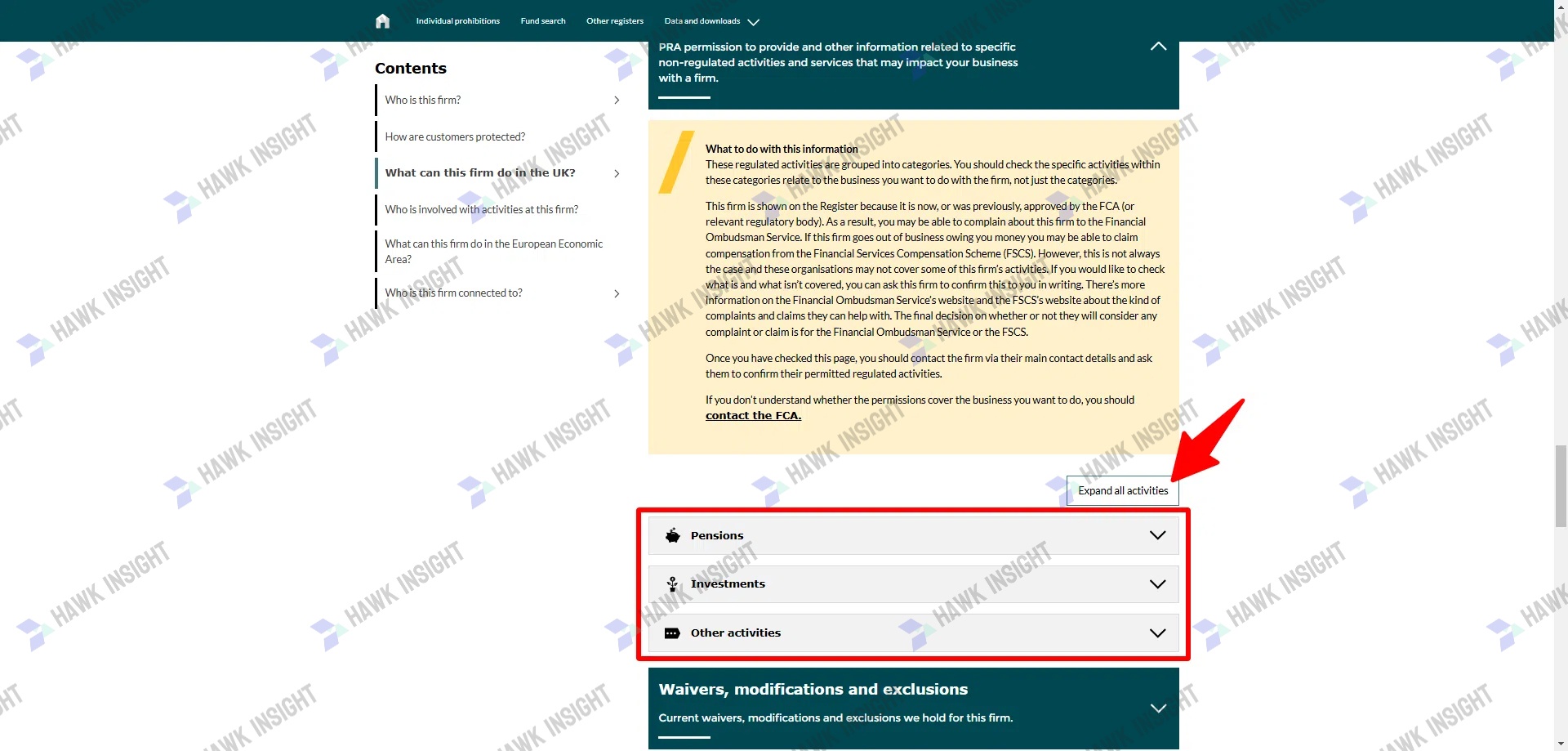

3. Verify the Services They're Authorised to Offer

Not all FCA-regulated firms are licensed to provide the services you’re using (e.g. CFDs, forex trading, crypto derivatives).Check under “Permissions” on the FCA register whether they’re authorised for the products they advertise.

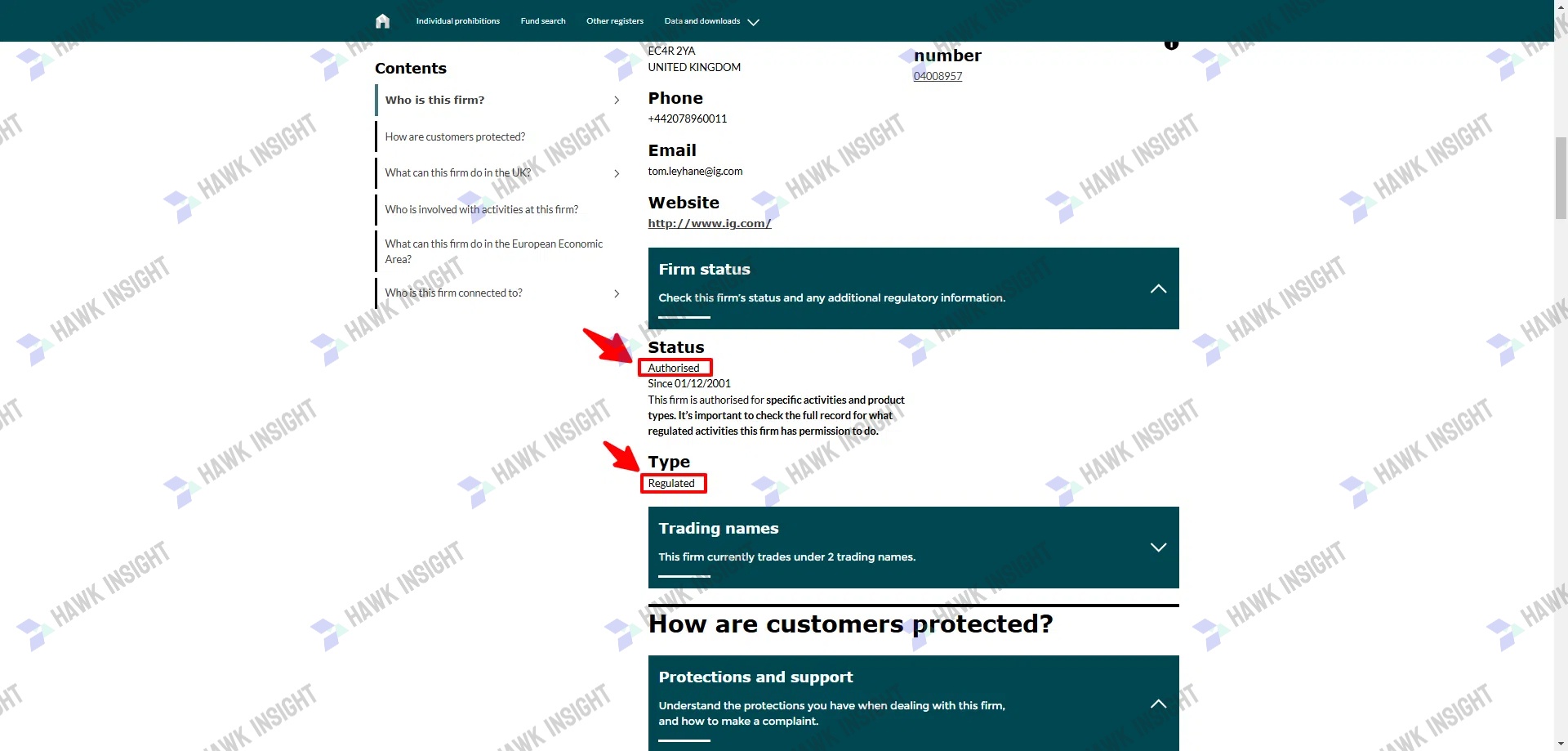

4. Look for the “Authorised” Status, Not “Appointed Representative”

Firms listed as “Appointed Representatives” are not directly regulated — they operate under another firm's licence.Prefer brokers listed as “Authorised” and “Regulated”.

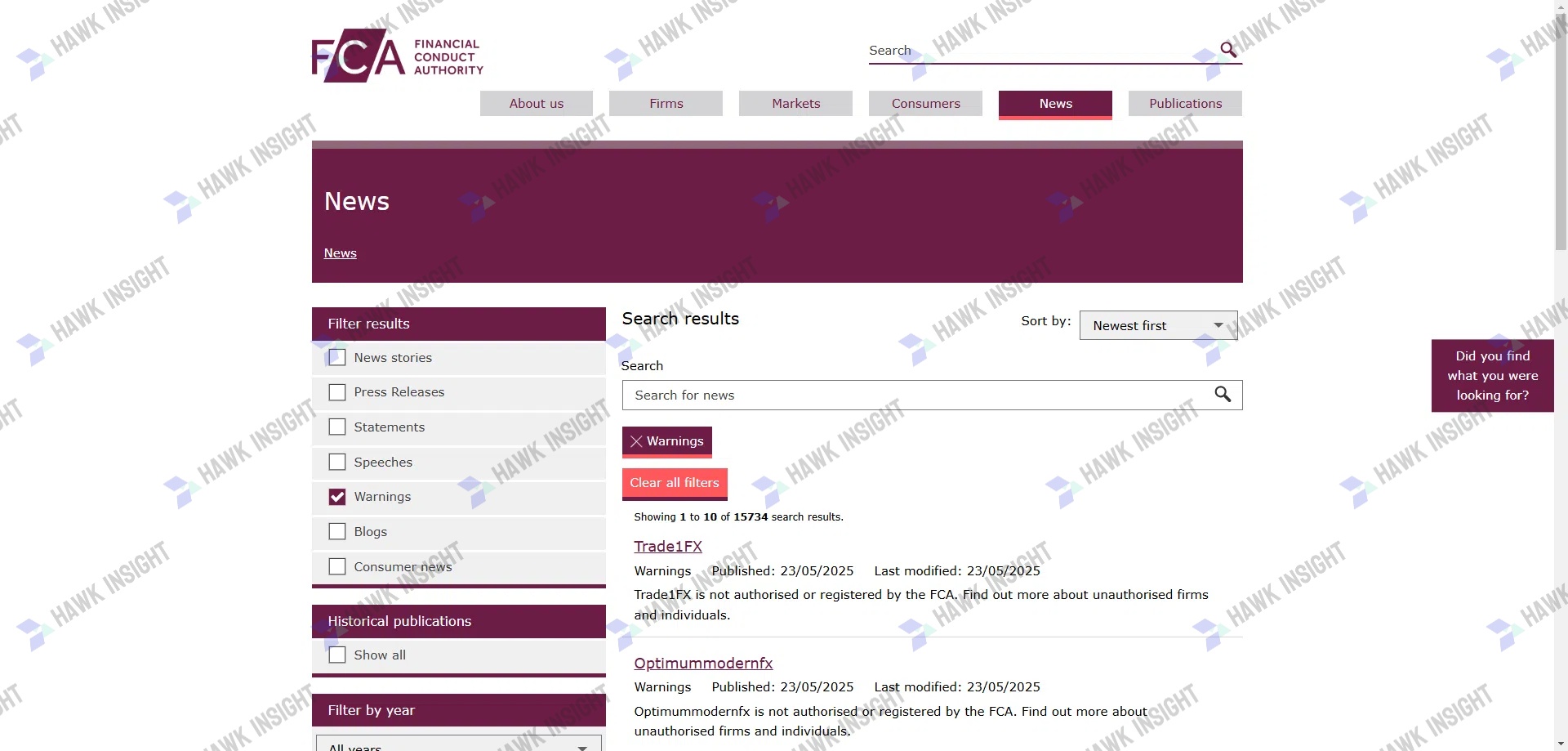

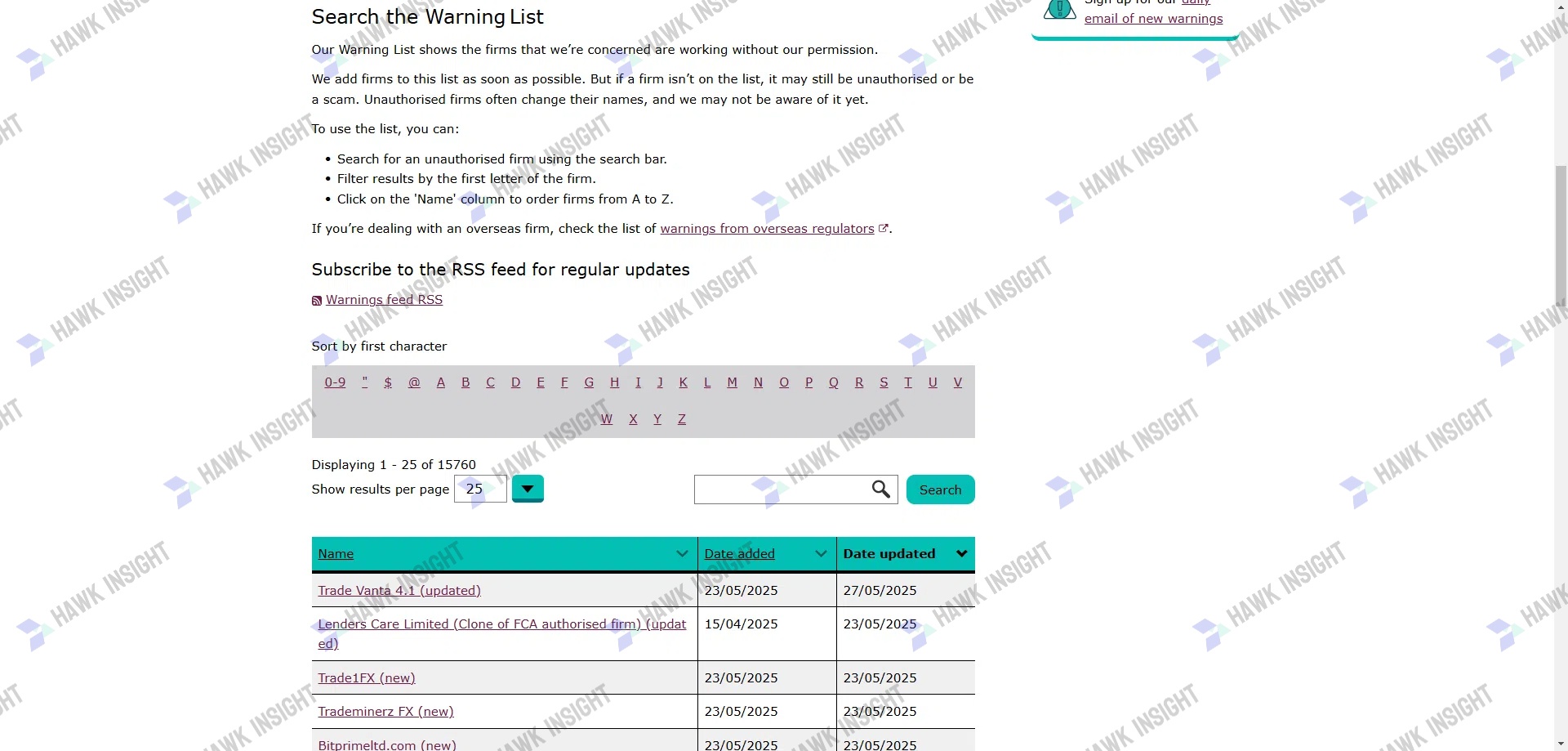

5. Review Warnings and Enforcement History

Search the在FCA Warnings or FCA Warning List of unauthorised firms FCA Warning List to see if the firm has been flagged.Also look for press releases about enforcement actions, fines, or public censures on the FCA site.

Common Scams: How Fake Brokers Fake FCA Status

-

Cloned Firms: Scammers copy names and FRNs from real firms.

-

False Licensing Claims: Some brokers display fake licence images or reference unrelated entities.

-

Regulation Confusion: Brokers regulated elsewhere (e.g. Mauritius, Vanuatu) may falsely suggest UK coverage.

Always double-check on the official FCA Register.

What to Do If Your Broker Isn’t FCA Authorised

-

Withdraw your funds immediately.

-

Avoid further deposits.

-

Report the broker to the FCA.

-

If you’ve lost money, check with the Financial Ombudsman Service to see if recovery is possible.

FCA Regulation Trends in 2025

-

Tighter CFD leverage caps remain in effect.

-

Cryptoasset firms must meet new UK anti-money laundering (AML) rules.

-

FCA prioritises investor protection and continues action against unauthorised firms.

FAQ

1. How do I check if my broker is FCA authorised?

Go to the official FCA Register and search by company name or Firm Reference Number (FRN). Verify that the firm is listed as "Authorised" and check its permissions and address.

2. What does FCA regulation mean for brokers?

FCA regulation ensures your broker follows UK financial rules, segregates client funds, and provides access to the Financial Ombudsman Service in case of disputes.

3. What is a clone firm?

A clone firm is a scam operation that copies the identity of a legitimate FCA-authorised broker. Always cross-check contact details and avoid suspicious links.

4. Can an offshore broker claim FCA regulation?

No. Only UK-based firms or those with FCA-authorised UK branches are allowed to claim FCA regulation. Offshore firms making such claims are likely fraudulent.

5. What should I do if I’m scammed by an unregulated broker?

Report the broker to the FCA and Action Fraud. If they falsely claimed UK regulation, you may also escalate the issue to the Financial Ombudsman Service.

Conclusion

FCA authorisation is non-negotiable for UK brokers.Use this checklist regularly—especially if you're opening a new account or switching brokers. Remember: if it’s not on the register, it’s not FCA authorised.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.