On May 28, the last financial report of the "Seven Sisters" was announced, and Nvidia once again shocked the market with a burst financial report.

Data centers soar by more than 400% and customers in diversified industries rise

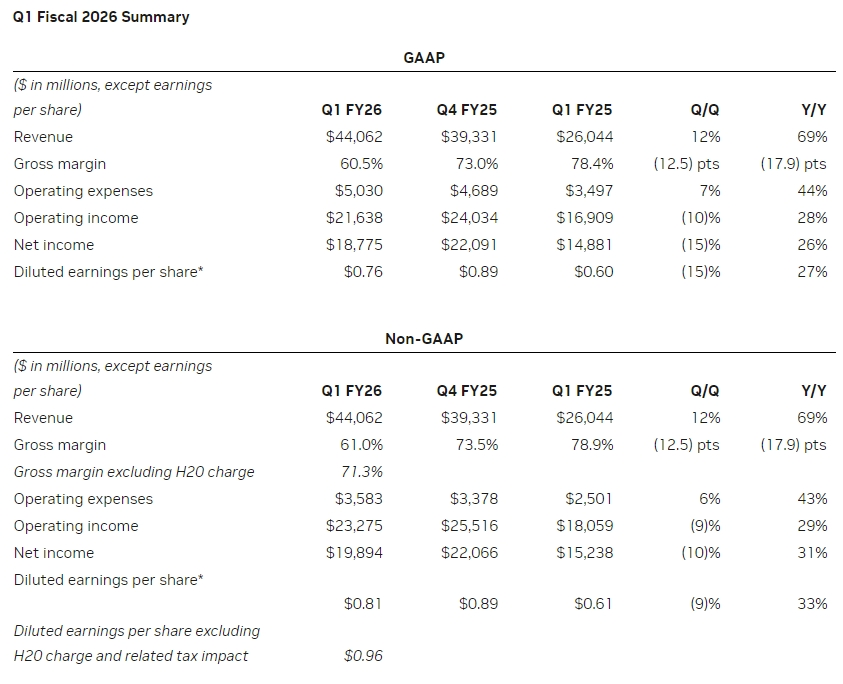

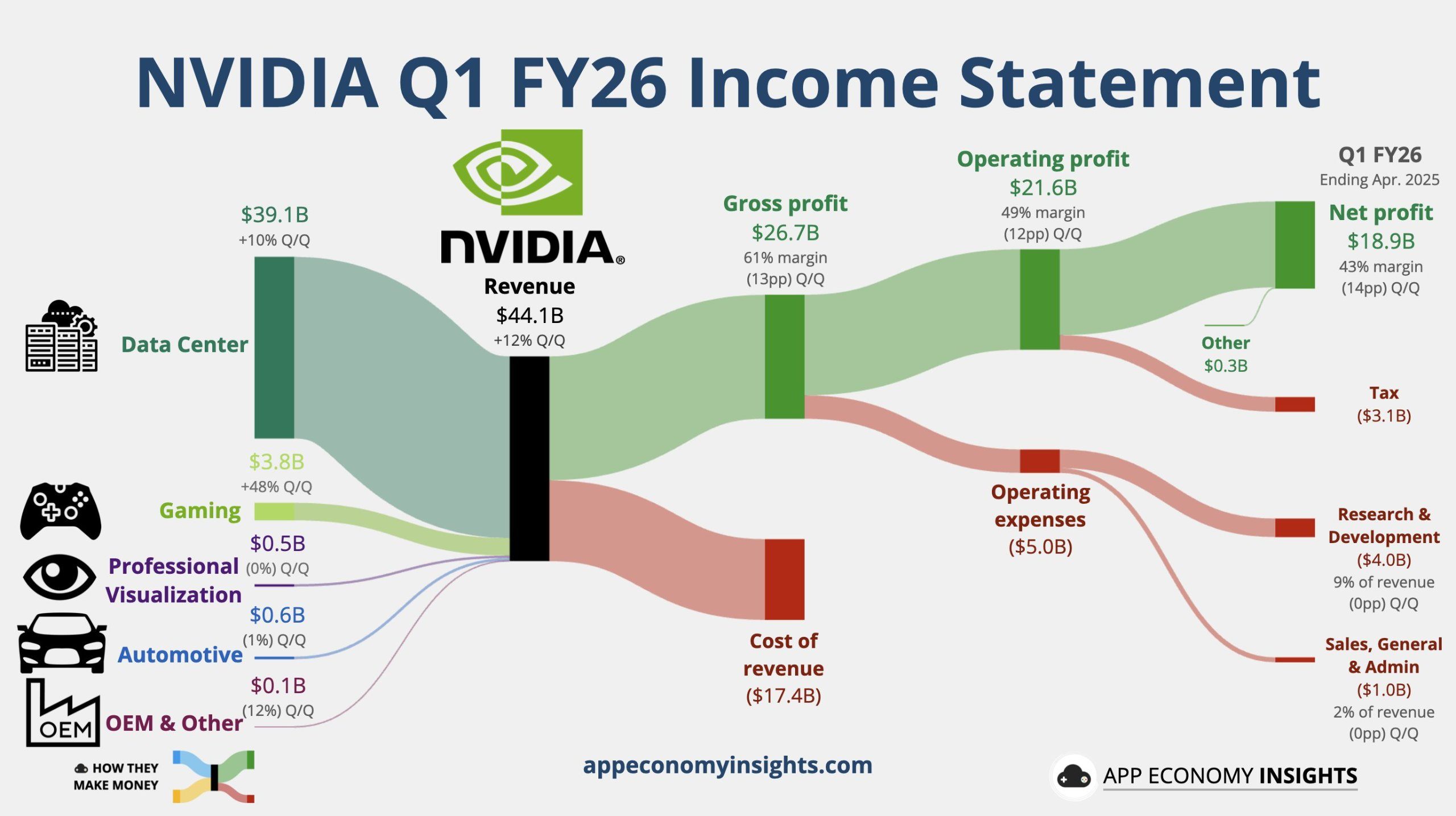

First quarter of fiscal year 2026 (as of April 2025):

Operating income was US$44.1 billion, a year-on-year increase of 69%. Analysts expected US$43.29 billion. Nvidia's own guidance was US$42.14 billion to US$43.86 billion, a year-on-year increase of 78%.

EPS: Adjusted earnings per share (EPS) under non-GAAP standards in the first quarter was US$0.81, a year-on-year increase of 33%. After excluding H20-related fees and tariff effects, EPS was US$0.96. Analysts expected US$0.93, a year-on-year increase of 71% in the previous quarter.

Gross profit margin:-The quarterly adjusted gross profit margin was 61%, down 17.9 percentage points year-on-year. After excluding the impact of H20, the gross profit margin was 71.3%. Analysts expected 71%. Nvidia's guidance was 70.5% to 71.5%, compared with 73.5% in the previous quarter, a year-on-year decrease of 3.2 percentage points.

Operating expenses: Adjusted operating expenses for the first quarter were US$3.58 billion, a year-on-year increase of 43%. Analysts expected US$3.63 billion, a 53% increase in the previous quarter.

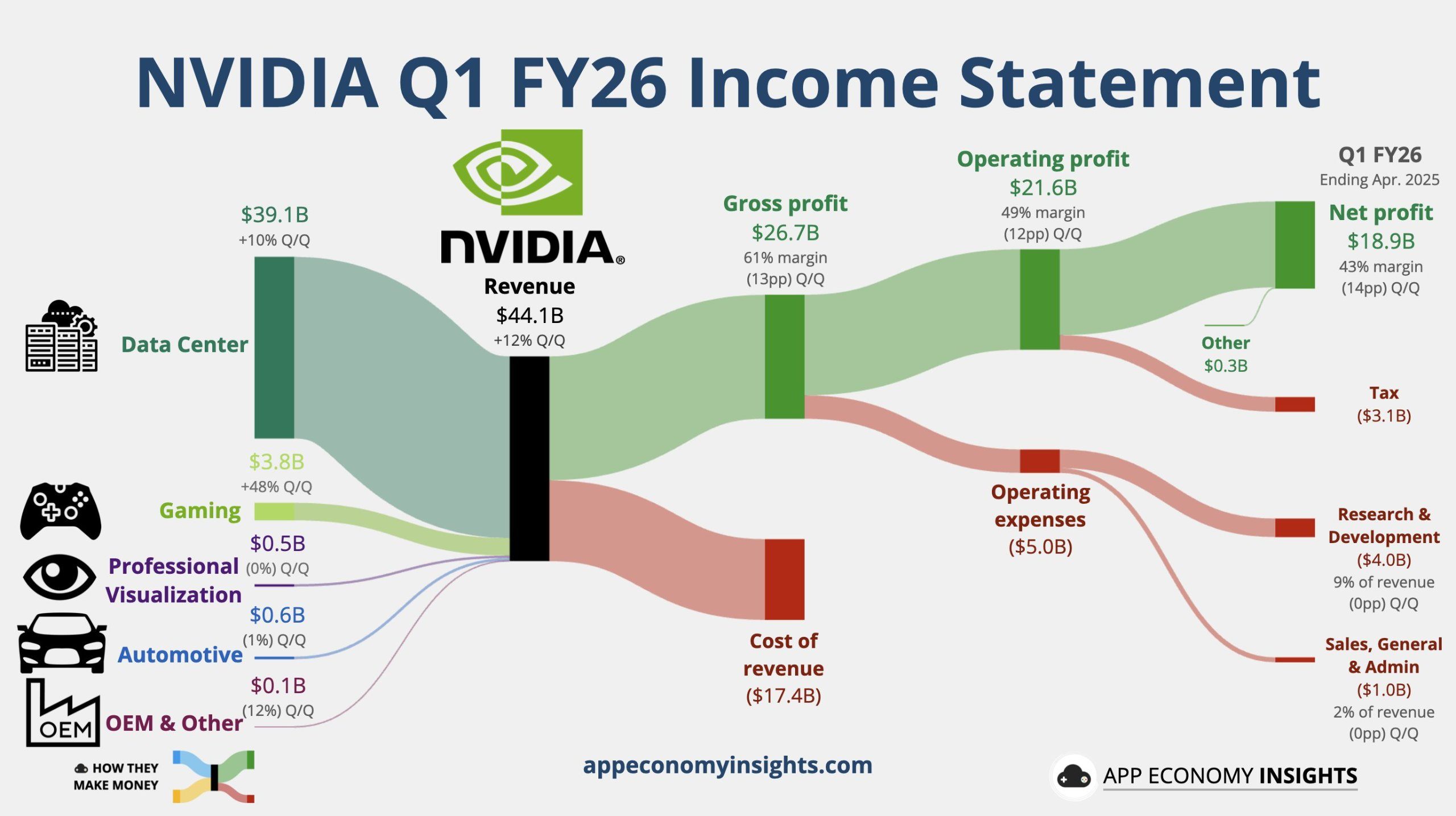

Under segmented business:

Data center: Data center revenue in the first quarter was US$39.1 billion, a year-on-year increase of 73%. Analysts expected it to be US$39.22 billion, a year-on-year increase of 93%.

Games and AIPC: Game and AIPC business revenue in the first quarter was US$3.8 billion, a year-on-year increase of 42%. Analysts expected US$2.85 billion, down 11% year-on-year in the previous quarter.

Professional visualization: Professional visualization revenue in the first quarter was US$509 million, a year-on-year increase of 19%. Analysts expected it to be US$505 million, a year-on-year increase of 10% in the previous quarter.

Automobiles and robots: Revenue from the automotive and robots business in the first quarter was US$567 million, a year-on-year increase of 72%. Analysts expected it to be US$579.4 million, a year-on-year increase of 27% in the previous quarter.

Surprisingly, Nvidia's growth is not only supported by cloud giants, but also the rise of diversified industry customers.

Large cloud service providers (CSPs) account for approximately 40% of data center revenue, while consumer Internet companies, enterprise software developers and emerging "sovereign AI"(national-level AI projects) contribute more than 50%.Tesla purchased 35,000 H100 GPUs to train the FSD V12 autonomous driving system;Meta used 24,000 H100 GPUs to train the Llama 3 model; and more than 100 customers around the world are cooperating with Nvidia to build an "AI factory" ranging from hundreds to tens of thousands of GPUs.What is more noteworthy is that inference loads (such as chat bots and recommendation systems) have accounted for 40% of data center revenue, marking that AI applications are evolving from training to large-scale implementation.

NVIDIA still faces three major challenges in the future

However, Nvidia's road to becoming king is not without challenges.

First of all, there is uncertainty about the mass production schedule of Blackwell chips and the pace of customer migration.

Although Huang Renxun announced that Blackwell will start production shipments in Q2, increase volume in Q3, and be available in the customer data center Q4, supply chain news shows that mass production has been postponed to the fourth quarter due to mask process adjustments.

This has triggered concerns in the market about the lack of business: some customers such as AWS have suspended orders for Grace Hopper and waited for Blackwell.Huang Renxun reassured that Hopper demand "will still exceed supply for some time," but investors are more wary of signs of slowing growth-data center revenue growth has dropped to 23% month-on-month from 140% in the same period last year.

Secondly, the cliff-like decline in China's market has become another pressure.

Affected by U.S. chip export restrictions, the proportion of data center revenue in NVIDIA's China region dropped sharply from the original 20%-25% to a "single-digit percentage."Although the company has launched a special version of the H20 chip, its performance has shrunk, making it less competitive than local alternatives such as Huawei Shengteng in China.Huang Renxun admitted that competition in the China market will be "more intense" and only said that "we will try our best to serve customers."This gap is difficult to make up in the short term, and the hundreds of billions of AI infrastructure investment that China is promoting may flow to competitors.

Finally, the competitive landscape is quietly splitting.

The process of self-developed chips by cloud manufacturers is accelerating: Google and Broadcom have cooperated to develop TPUs, Amazon has launched Trainium chips, and Microsoft has released its self-developed AI processors.While Nvidia maintains barriers with its CUDA ecosystem and network technologies such as the Spectrum-X Ethernet solution, the fragmentation of the reasoning market provides an incision for startups such as Groq that focus on low-latency.At the same time, AMD's MI300X accelerator card has increased penetration among some cloud customers and is eating into the mid-to-high-end market.

Faced with changes, NVIDIA is deploying multiple lines of defense.In terms of product rhythm, Blackwell Ultra has announced a roadmap of "launching a new architecture every year", and has been scheduled for the second half of 2025; in terms of technology integration, it deeply couples the CUDA software stack with network technology (InfiniBand/Spectrum-X) to reduce customer TCO (Total Cost of Ownership); in terms of ecological expansion, it launches NVIDIA NIM microservices to help enterprises deploy generative AI applications and extend their reach to the software layer.These initiatives aim to transform hardware advantages into more lasting platform control.

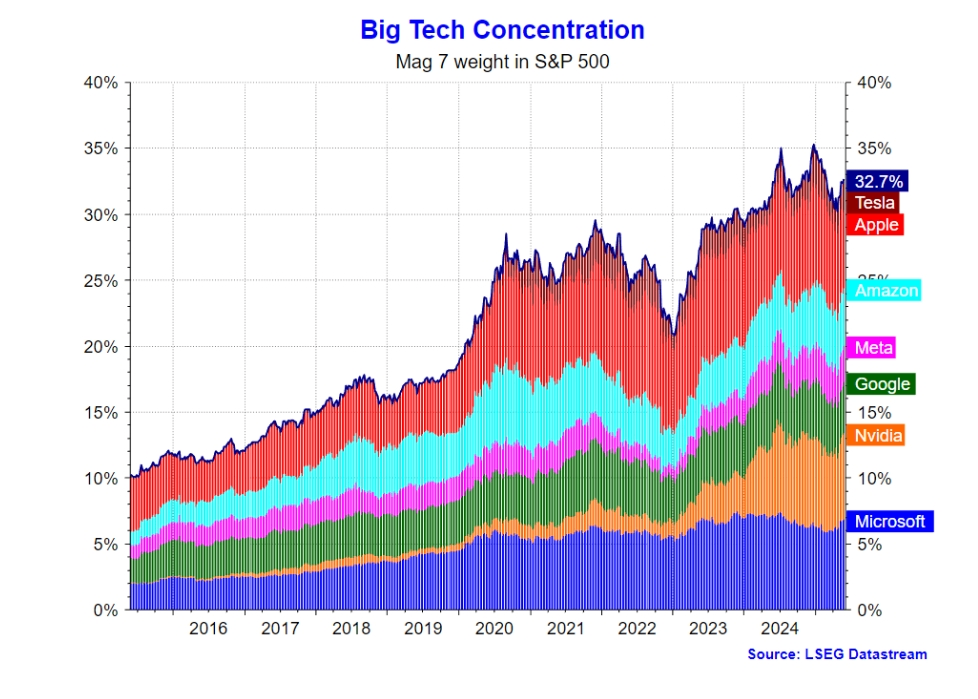

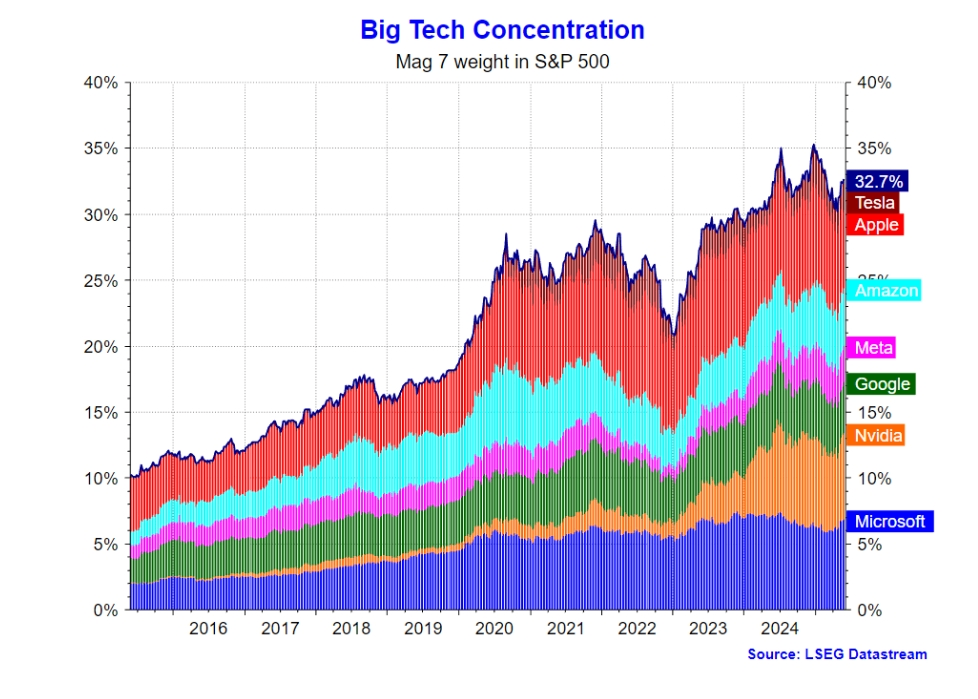

The wealth of the "seven sisters" of U.S. stocks is still highly concentrated

Currently, savings in the S & P 500 index are climbing, just one step away from a record high.Nvidia's share price has also rebounded nearly 50% from its April 7 low, outperforming the rest of the Mag6s.The total market value of the above technology giants reached an astonishing US$17.8 trillion at the end of 2024, accounting for about 33% of the total market value of the entire S & P 500 index.Although this ratio is lower than the peak of 35% at the end of 2023 and has rebounded from its low in April 2025, the structural risk of market wealth being highly concentrated in a few stocks remains significant.

The core factor supporting this high concentration is Mag7 's continued profit advantage.In the fourth quarter of 2024, despite conservative market expectations, the profit growth of Mag7 still reached 26% year-on-year, far from the average growth rate of 8% for the Standard and Standard 500 Index; while the profit growth of the other 493 companies excluding Mag7 was only 5%.

Goldman Sachs analyst David Kostin pointed out in the report: "The excellent performance of the Big Seven has historically reflected their earnings advantages."This continued profitability has given them a "safe haven" status in turbulent markets-when Nvidia is frustrated by short-term shocks, giants such as Meta and Apple can still stabilize market confidence by relying on super-expected growth in their advertising business or record high service revenue.

However, the historical dimension provides another perspective.Some studies have pointed out that the current concentration is not the highest in history-in the 1950s and 1960s, IBM, AT&T and General Motors alone accounted for about 28% of the total market value of the U.S. stock market.In 1960, AT&T alone accounted for 13% of the total market value, but today Apple, the largest market value, accounts for only 7% of the S & P 500.