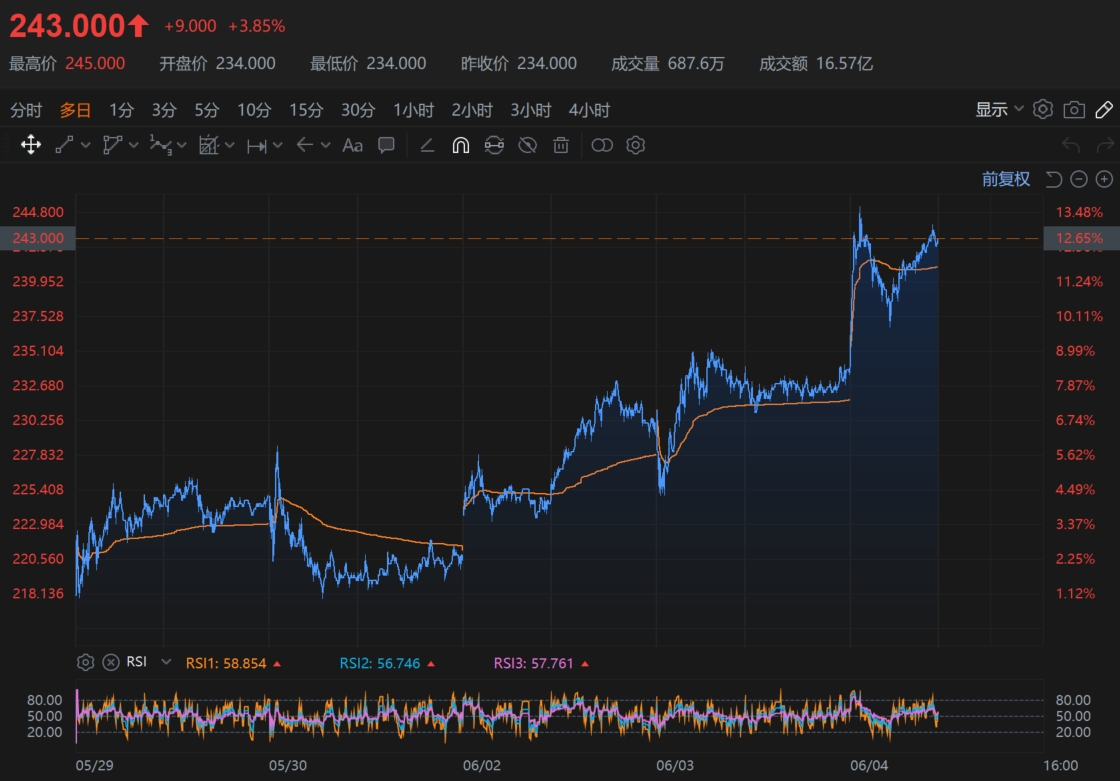

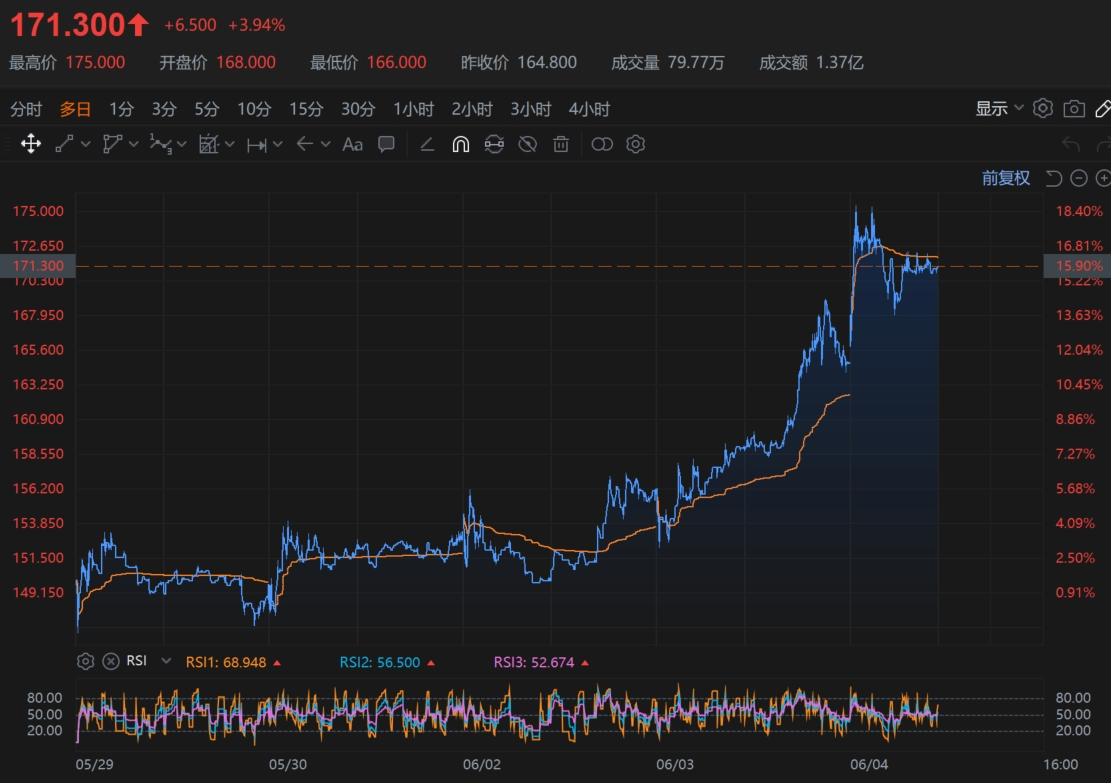

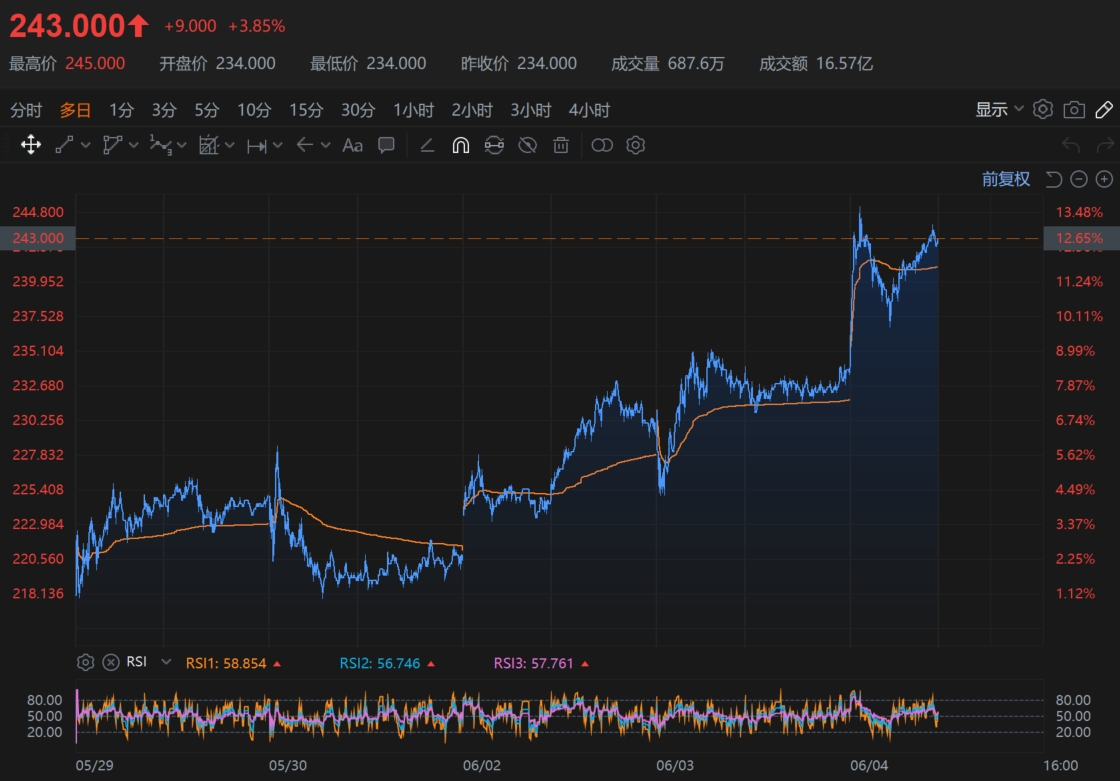

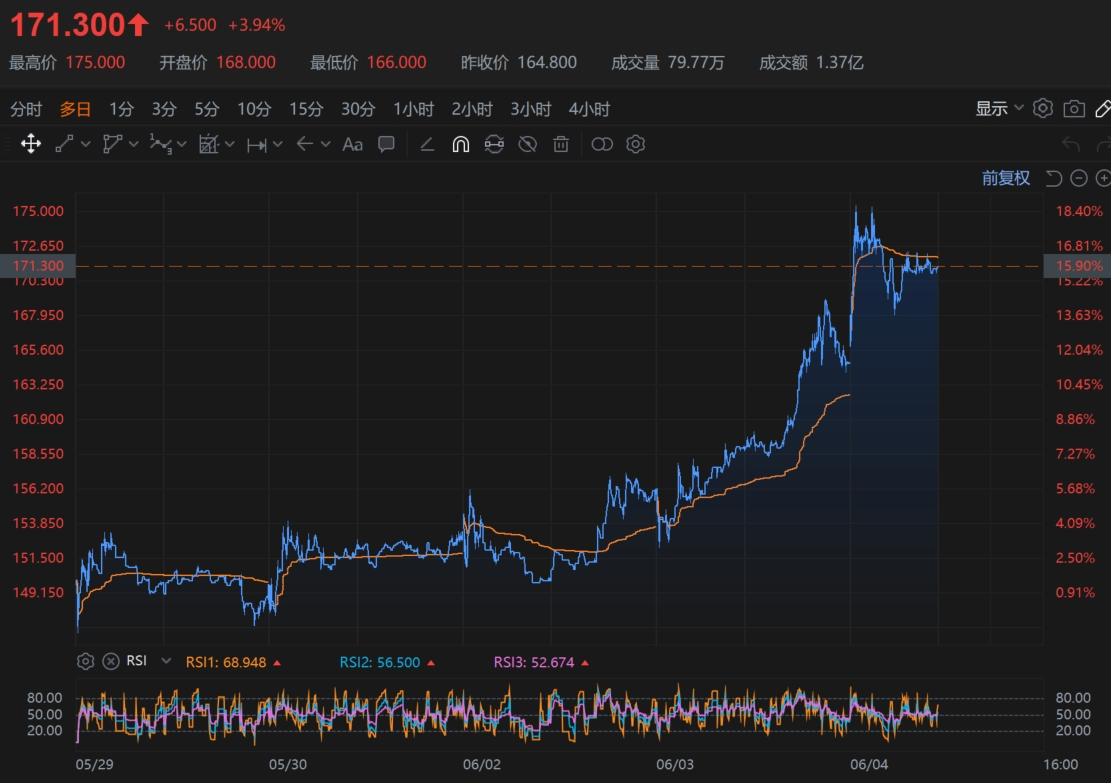

Bubble Mart and Bruco have increased year-to-date by 173% and 187% respectively, and their market values have both exceeded historical peaks.

On June 4, the Hong Kong stock consumer sector continued to explode-trendy toy giants Bubble Mart and Brooke have increased year-to-date by 173% and 187% respectively, and their market values both exceeded historical peaks.

Bubble Mart and Bruco are experiencing explosive growth, which is not simply a financial hype: in 2024, the scale of China's pan-entertainment toy market will exceed 101.8 billion yuan, and will rush to 2029 with a compound annual growth rate of more than 10%. 212.1 billion yuan.The underlying logic of capital carnival is actually the result of the resonance between Generation Z's emotional consumption and global IP operations.

Bubble Mart aims at IP matrix Bruco sinks low prices and increases volume

Bubble Mart's high-growth narrative is based on its "IP industrialization" capabilities.

In 2024, its revenue soared 106.9% year-on-year to 13.038 billion yuan, and its net profit increased by as much as 185.9%.The core driving force comes from the precise operation of the IP life cycle: the revenue of the LABUBU series increased by 726% year-on-year to 3.04 billion yuan, accounting for 23.3% of total revenue, while the 19-year-old classic IP MOLLY has been co-branded in space and continues to be renewed across intangible cultural heritage.This dual-engine model of "preservation of old IP + fission of new IP" has pushed the gross profit margin to 66.8%, nearly double that of traditional consumer goods companies.More critical is its tiered pricing strategy-from 59 yuan blind box to 5999 yuan collectible MEGA series, covering the full spectrum demand from impulse consumption to investment collection. Some co-branded models have a second-hand premium of more than 10 times, forming a unique "Plastic Moutai" financial attributes.

Globalization has become an important footnote to the second growth curve.

Bubble Mart's overseas revenue in 2024 will surge 375% to 5.07 billion yuan, accounting for nearly 40%.The key to its success lies in the depth of localization: signing contracts with local artists in Thailand to develop CRYSTABY IP, launching joint derivatives of LABUBU and famous paintings at the Louvre in Paris, and even designing limited Thai clothes for the Southeast Asian market.This cultural adaptation triggered phenomenal consumption-British consumers lined up all night to snap up new products, and the LABUBU co-branded model was spontaneously posted on North American social media by celebrities such as Rihanna and Beckham.The management's declaration of "recreating a Bubble Mart overseas" has been initially fulfilled.

The rise of Bruko reveals the survival law at the other pole of the industrial chain.

Although it belongs to the trendy entertainment camp, its model of relying on authorized IP+ low-cost and high-volume volume is in sharp contrast to Bubble Mart.In 2024, Ultraman's single IP will contribute 48.9% of revenue, but this copyright will expire in 2027, and core IPs such as Transformers will also face renewal risks from 2025 to 2028.In order to hedge the uncertainty, the company adopted a radical low-price strategy: the average product price dropped from 89 yuan in 2021 to 16.3 yuan in 2024, and the 9.9-yuan blind box captured the sinking market, driving sales to 135 million units.Although revenue increased by 155.6%, the gross profit margin under the OEM model was only 52.6%, and the proportion of distribution channels exceeded 90%, reflecting weak control over channels and supply chains.

The logic behind the explosion of trendy toys

The essence of the trendy entertainment industry is the monetization of emotional economy.

Credit Suisse Bank predicts that in 2025, there will be 40 million paying users for trendy games in China, with per capita monthly consumption of 194 yuan, and consumption behavior is shifting from "experiential purchasing" to "habitual repurchase purchasing."Supporting this trend is the industrial chain advantage of Dongguan's "trendy entertainment capital"-4000 toy companies contribute 1/4 of the world's animation derivatives, and the revenue of companies above the scale will increase by 19% in 2024.Technological innovation is also reshaping the industry: 3D printing reduces high-end product development costs, AI design tools improve IP incubation efficiency, and XR technology is giving trendy toys the possibility of virtual interaction.

However, the hidden worries behind prosperity cannot be ignored.Brooke's dilemma reveals a common problem in the industry: when Ultraman's IP revenue fell by 17.6% month-on-month in the second half of the year, it exposed the vulnerability of the authorization model before the IP popularity fluctuates.Li Ying, an analyst at Wanlian Securities, warned that the demand for trendy toys has distinct intergenerational characteristics-"The trendy toys that the post-00s are keen on may be replaced by new forms as the main consumer groups change, just like 'CDs collected by the post-1980s are ebbing.'"At the same time, 22,300 trendy toy companies across the country have accelerated their involvement, and the number of registrations in the first four months of 2025 has surged by 42.3% year-on-year. Homogeneous competition has led to the risk of slow sales of some products.

The capital story of trendy toys is far from over.With its IP autonomy and overseas gross profit margin of 71.3%, Bubble Mart is expected to continue to reap dividends in the rise of Kidult culture in Europe and the United States; if Bruco can build a self-operated factory in 2026 and accelerate its own IP incubation, you may get rid of "OEM dependence".