Tesla Q2 delivers its worst earnings report in a decade, revenue plummets 12%, and operating profit halved

Tesla's survival paradox is that cars are still the only cash cow right now, but resources are being diverted towards future bets.

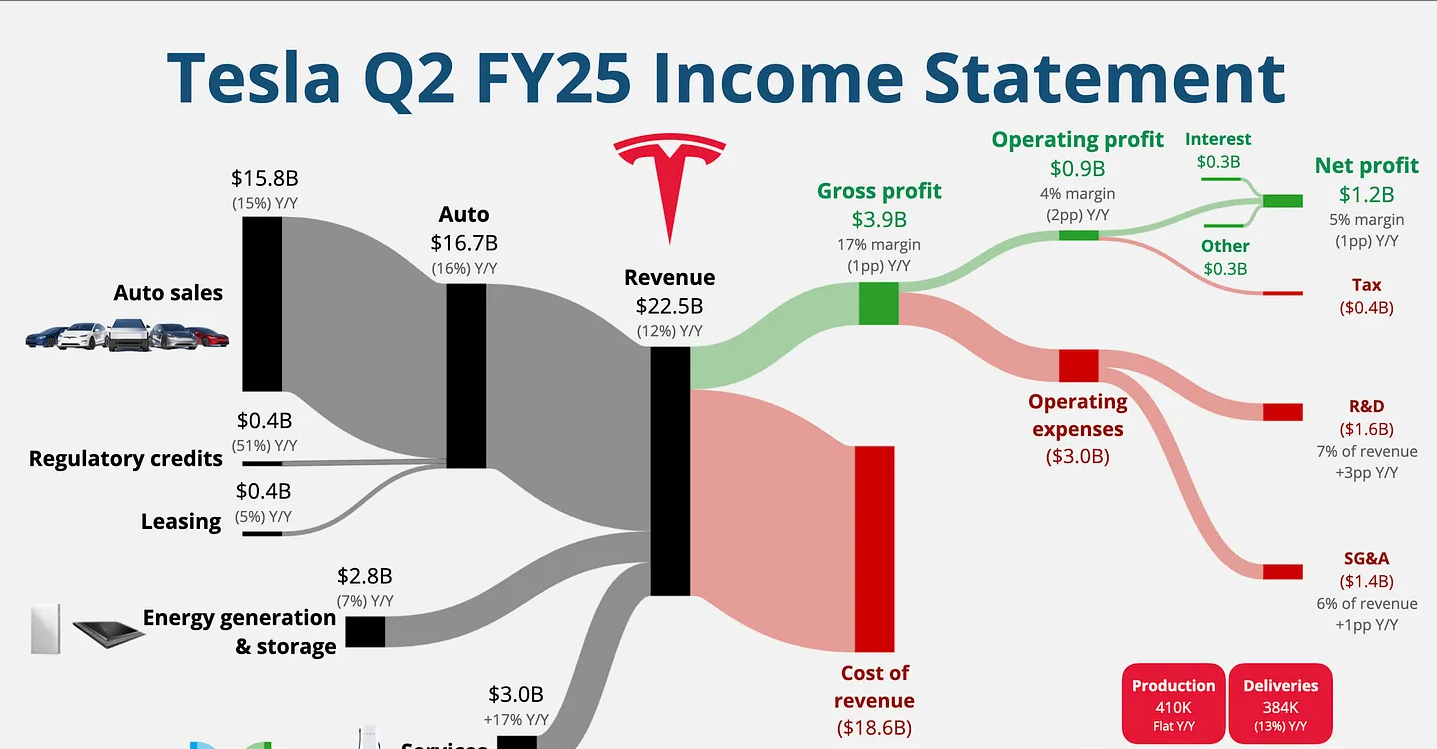

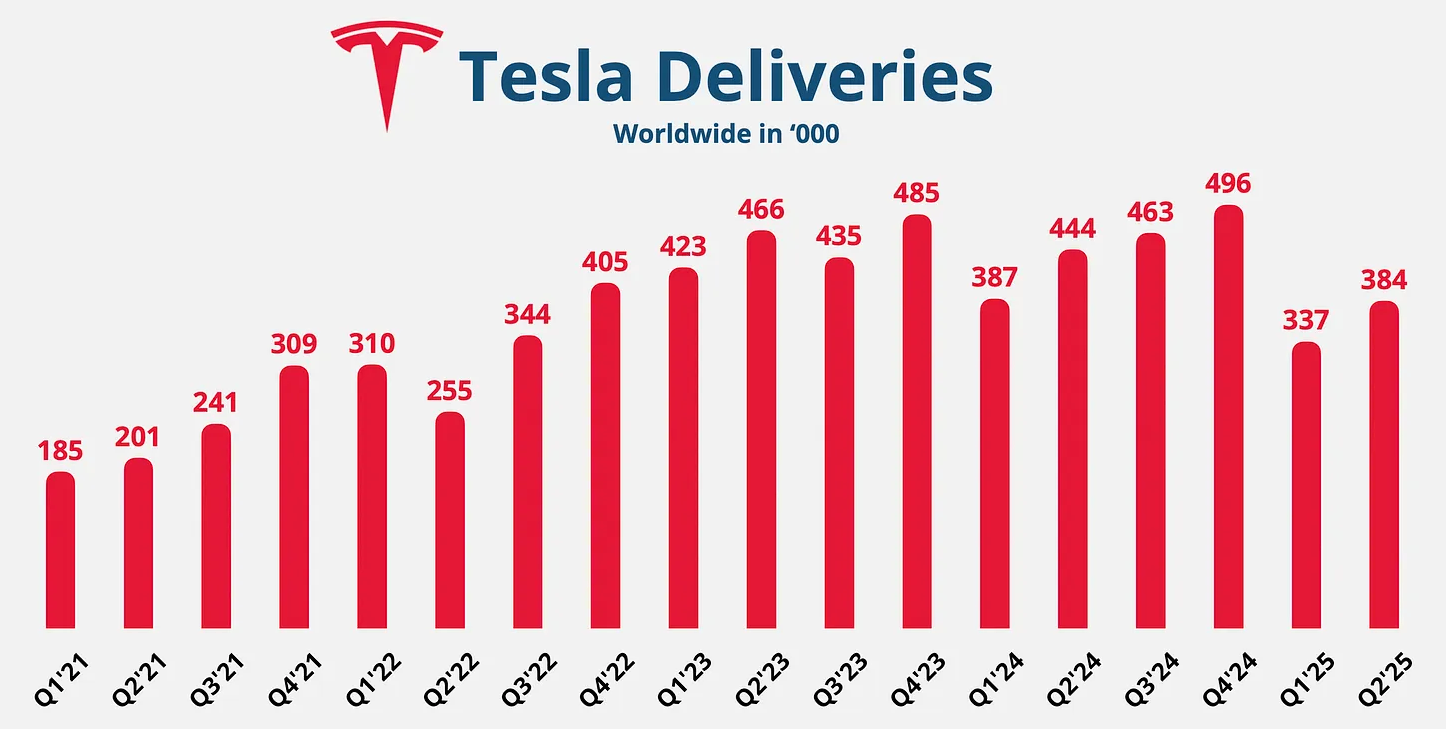

On July 23, American electric vehicle giant Tesla delivered the worst financial report in the decade: in the second quarter of 2025, Tesla's revenue plummeted 12% year-on-year to US$22.5 billion, and its automotive business revenue plummeted 16%, global deliveries fell 13.5% to 384,000 units, and operating profit was halved by 42%.

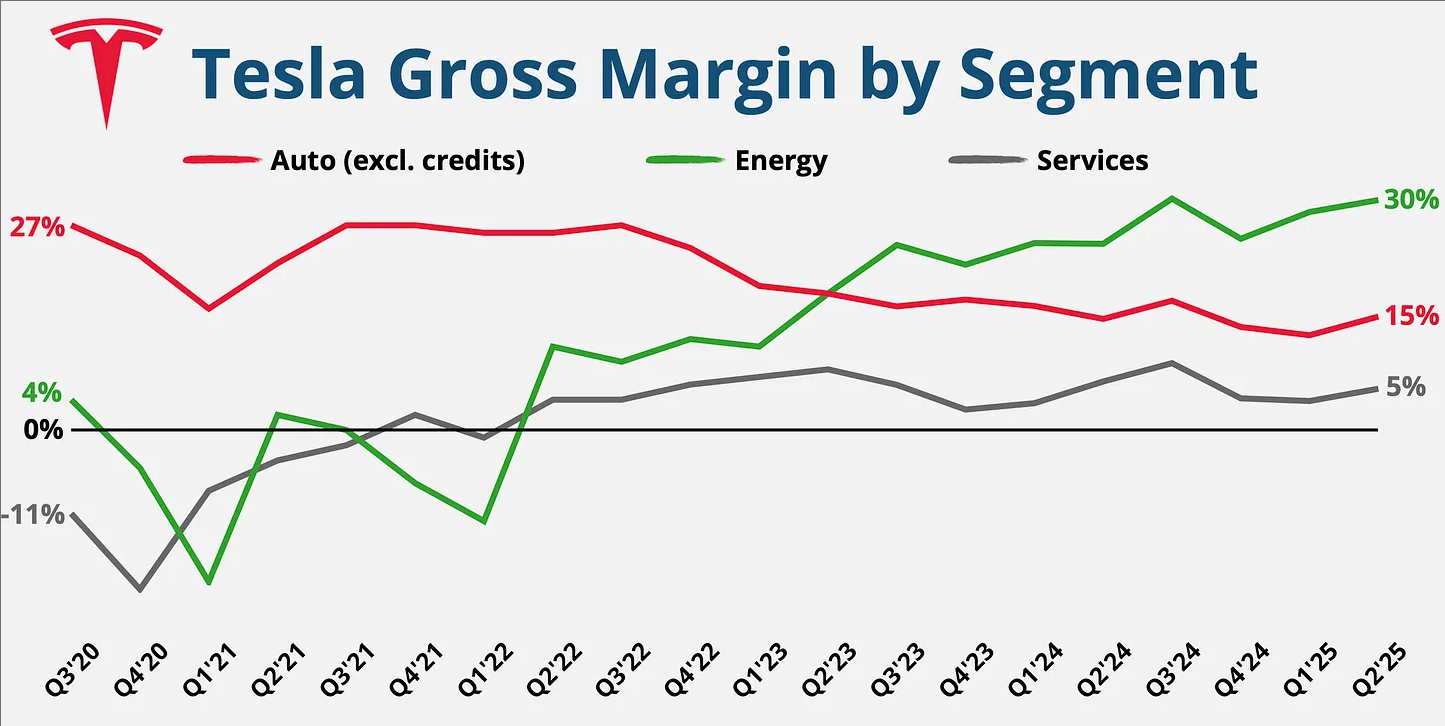

In terms of regions, in California, Tesla's "Heart of Faith", sales fell for the seventh consecutive quarter, shrinking by 21% year-on-year. Its market share was overtaken by traditional luxury brands such as BMW and Mercedes-Benz.The European battlefield was also defeated: sales in Germany plunged 15% as Musk publicly supported right-wing parties triggered a consumer boycott.Cybertruck, which was once highly expected, is now mired in a production capacity quagmire-the bottleneck of stainless steel body technology has resulted in a weekly production of only 1,000 vehicles, orders are scheduled until 2025, and even spawned a deformed market where scalpers have speculated to US$290,000.What is even more fatal is that the main Model 3/Y models have been besieged by brands such as BYD and NIO in China: the latter forced Tesla to offer interest-free installments and free FSD subscriptions with affordable models equipped with high-end autonomous driving, further eroding its gross profit margin, which has already narrowed to 17.2%.InvalidParameterValue

The deterioration of the financial structure suggests systemic risks.Regulatory credit income (i.e."selling carbon") halved to US$439 million year-on-year. Coupled with the US $7500 electric vehicle tax credit policy, the two major cash flow pillars collapsed simultaneously.Although the energy storage business has become a rare highlight-the commissioning of Megapack's Shanghai plant has boosted energy storage revenue to US$2.8 billion, and its gross profit has reached a single-quarter high, its scale is not yet enough to fill the US$16.6 billion revenue gap in the automotive business.More alarming is the 89% plunge in free cash flow to $146 million, while $36.8 billion in cash reserves looks strong, but in fact faces huge consumption from AI R & D and Robotaxi expansion: Q2 capital expenditure alone reached $2.4 billion, up 5% year-on-year.InvalidParameterValue

Musk's "escape from the car" strategy reveals extreme contradictions.

In the financial report,"AI" and "robot" were mentioned 27 times, while "car" was only 12 times. This kind of discourse weight replacement corresponds to a substantial resource tilt: in June, Robotaxi was piloted in Austin, claiming to be "pure vision solution" Reduce operating costs by 30%"and announced that the exclusive model Cybercab will be mass-produced in 2026;Optimus robot production line deployment will be accelerated and the target will be mass produced the next year-however, the reality is bony: Robotaxi's goal of "less than 30 cents per mile" costs has not yet been verified, and expansion requires global regulatory approval, contrary to Musk's earlier declaration that there are "no regulatory obstacles."What's even more ironic is that although the affordable model (US$25,000) claimed to be "trial production completed," it was revealed that mass production was delayed for several months, while competing products had seized a gap in the mid-end market during the same period.InvalidParameterValue

The biggest crisis comes from Musk, whose funding for Trump and forming a new political party has led to Tesla being labeled a "toxic brand" in the blue state.Management turmoil has intensified simultaneously: sales chiefs in North America and Europe have left, and Musk has been distracted by political activities, and investors have questioned whether he is still focused on Tesla.When analysts asked "how to restore consumer trust," the management only prevaricate with "focus on products" but did not give a specific repair plan.InvalidParameterValue

Tesla's survival paradox is that cars are still the only cash cow right now, but resources are being diverted towards future bets.If the new model and Robotaxi cannot realize large-scale benefits before 2026, the cash flow may not support the two-line battle.The time window left by the market for Musk is closing-BYD sold 1.1 million vehicles in the second quarter, 2.8 times more than Tesla, and the profit gap per vehicle narrowed to $1,200.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.