New Choice of HK and US Stock Brokerage Firms! Tianfeng Securities comprehensive review and account opening graphic guide

Tianfeng Securities is a wholly owned subsidiary of Tianfeng Securities established in Hong Kong, holding a full license of SFC, providing HK and US stocks 0 commission trading services, low account opening threshold, 2025 new users exclusive benefits giveaway. In this article, we will explain the account opening process in detail, and compare the cost of mainstream brokerage firms such as Fidelity, Tiger, Longbridge, etc., to help you understand “Tianfeng Securities how, whether it is safe, how to open an account”.

With the increasingly obvious trend of global asset allocation among mainland Chinese residents, trading in Hong Kong and US stocks has gradually become an important way for investors to diversify risks and pursue returns. From technology giants like Apple and Tesla to Chinese-funded internet leaders and high-dividend blue chips in Hong Kong stocks, more and more investors are turning their attention to overseas markets. However, when choosing a brokerage platform, many investors are still confused by issues such as complex fee structures, platforms with varying levels of security, and relatively high account opening thresholds.

Against this backdrop, a new and emerging brokerage with a strong Chinese-funded background, low fee policies, and full Hong Kong license compliance qualifications has come into the public eye. It is Tianfeng Securities Co., Ltd.. As a wholly-owned subsidiary of A-share listed brokerage Tianfeng Securities in Hong Kong, Tianfeng International has quickly stood out in the market with its core advantages of "zero commission, strong supervision, and fast account opening," becoming a new favorite among Hong Kong and US stock investors.

This article will provide a comprehensive analysis of key issues such as "What about Tianfeng International Securities?", "Is Tianfeng International Securities safe?", and "How to open an account?". At the same time, it will compare the fees of mainstream brokerages, combine the account opening process with pictures and texts, and offer exclusive benefits to help you quickly determine: Is this the Hong Kong and US stock brokerage you are looking for?

Who is Tianfeng International Securities?

Tianfeng International Securities Co., Ltd. was established in 2019 and has its headquarters in Central, Hong Kong. It is a wholly-owned overseas subsidiary established by Tianfeng Securities Co., Ltd. Tianfeng Securities itself is a financial platform controlled by Hubei Hongtai Group, a state-owned enterprise in Hubei Province, China. It is also a national comprehensive financial service institution listed on the main board of the Shanghai Stock Exchange, with a registered capital of 8.666 billion yuan. It has dozens of branches and holding subsidiaries, and has a wide influence and business foundation in the domestic financial circle.

As the core carrier of Tianfeng Securities' "going global" strategy, Tianfeng International Securities shoulders the important task of the group's international expansion, aiming to connect domestic and overseas capital markets and provide a compliant, safe, and diversified investment platform for global investors. Since its establishment in Hong Kong, it has been authorized by the Securities and Futures Commission of Hong Kong (SFC) and obtained licenses covering multiple business areas such as securities, futures, asset management, and financing consulting. It has a complete regulatory qualification, a clear market positioning, and a wide service scope.

As of now, the licensed entities under Tianfeng International Securities include:

-

TFI Securities and Futures Limited(Central Number: BAV573)

-

Holds Licenses for Type 1 (Securities Trading), Type 2 (Futures Contract Trading), and Type 4 (Advising on Securities)

-

-

TFI Asset Management Limited(Central Number: ASFO56)

-

Holds Licenses for Type 4 (Advising on Securities), Type 5 (Advising on Futures Contracts), and Type 9 (Asset Management)

-

-

TFI Capital Limited(Central Number: BPW736)

-

Holds a License for Type 6 (Advising on Corporate Finance)

-

That is to say, whether it is ordinary Hong Kong and US stock trading, institutional investment and financing advisory services, or the asset management and allocation needs of high-net-worth clients, Tianfeng International Securities has full-chain service capabilities and compliance qualifications.

Unlike some lightweight platforms that only provide trading channel functions, behind Tianfeng International is not only a state-owned background, but also the comprehensive support of an A-share listed company in terms of capital, risk control, IT systems, research capabilities, etc. This enables it to meet the cross-border trading needs of individual users while also serving more high-end users and corporate clients with global asset allocation needs.

Precisely because of this background and positioning, Tianfeng International Securities is becoming the preferred choice for investors who "want to save fees and also value compliance and safety".

👉 Official Website Address: https://www.tfisec.com

Is Tianfeng International Securities safe? Reliable?

When choosing a Hong Kong and US stock brokerage, "safety" is undoubtedly one of the most core considerations. Especially against the backdrop of frequent industry chaos such as platform跑路 and frozen funds, investors have become extremely sensitive to elements such as the platform's background, regulatory situation, and fund segregation system.

So, as a new Hong Kong and US stock brokerage, Is Tianfeng International Securities really safe? Reliable?

This is one of the most concerned questions for everyone. The answer is: Very reliable!

1. Strong Background: State-owned Capital Holding, Wholly-owned Subsidiary of an A-share Listed Company

The parent company of Tianfeng International Securities is Tianfeng Securities Co., Ltd.. This is an A-share main board listed brokerage established in 2000 (Stock Code: 601162), with a registered capital of up to 8.666 billion yuan. Its controlling shareholder is Hubei Hongtai Group Co., Ltd., which is the only provincial-level financial service enterprise in Hubei Province.

Tianfeng Securities not only has a wide business layout and regulatory qualifications in China, but also has dozens of branches and more than 3,000 employees. Such a strong background means that Tianfeng International is not a grassroots entrepreneurial platform, but a professional institution incubated by a large state-owned financial group, with formal financial licenses and capital strength.

For investors, such a background means:

-

A more stringent risk control system;

-

Stronger risk resistance;

-

More guaranteed customer rights and interests.

2. Regulatory Compliance: A Licensed Institution with a Full License from the Securities and Futures Commission of Hong Kong (SFC)

The three companies under Tianfeng International Securities are all Securities and Futures Commission of Hong Kong (SFC) Registered Licensed Companies, and the types of licenses they hold cover:

-

Type 1 (Securities Trading)

-

Type 2 (Futures Contract Trading)

-

Type 4 (Advising on Securities)

-

Type 5 (Advising on Futures Contracts)

-

Type 6 (Advising on Corporate Finance)

-

Type 9 (Asset Management)

This means that Tianfeng International can legally and compliantly carry out various financial services, including Hong Kong stocks, U.S. stock trading, asset management, institutional investment and financing advisers.

In Hong Kong, the SFC's supervision is extremely strict. All licensed brokerages must comply with a series of regulatory requirements such as capital adequacy ratios, anti-money laundering, client asset segregation, and regular audits. Once they violate the regulations, they will face severe penalties or even the revocation of their licenses.

You can publicly query the license information of the three subsidiaries of Tianfeng International through the official website of the Securities and Futures Commission of Hong Kong. This public and transparent regulatory framework greatly enhances investors' confidence.

3. Customer Funds Segregation System: Ensuring the Independent and Secure Assets of Investors

According to relevant Hong Kong regulations, licensed brokerages must separate the management of customer funds from their own funds, and Tianfeng International Securities also strictly implements this system. Customers' trading funds will be deposited in a designated account of a third-party entrusted bank, and the platform itself has no right to use the funds without authorization.

This means:

-

Even if the platform has operational problems, customers' funds will not be misappropriated or liquidated by the platform;

-

Investors always have full control over the assets in their own accounts.

This funds segregation system is one of the institutional safeguards of the Hong Kong financial system, and it is also the core standard for measuring whether a platform is "reliable".

Choosing a brokerage is not just about choosing trading functions, but also about choosing a trustworthy custodian for your assets. From the three dimensions of regulatory transparency, funds segregation, and background strength, Tianfeng International Securities is a compliant, safe, and reliable Hong Kong and US stock brokerage, especially suitable for investors who value funds security and hope to trade in the long term.

Comparison of Trading Fees: Is It Really "0 Commission"?

Yes, it's truly 0 commission, and the platform fee is also waived!

Yes, it's truly 0 commission, and the platform fee is also waived!

| Platform | Type of Fee | Fee | Single Order of 10,000 Yuan | Single Order of 100,000 Yuan |

| Futu | Commission | 0.03% * Transaction Amount (Minimum 3HKD per Order) | 3 | 30 |

| Platform Fee | 15HKD per Order | 15 | 15 | |

| Total | 18 | 45 | ||

| Tiger | Commission | 0.029% * Total Transaction Amount | 2.9 | 29 |

| Platform Fee | 15HKD per Order | 15 | 15 | |

| Total | 17.9 | 44 | ||

| Tianfeng Securities | Commission | Permanently Commission-free | 0 | 0 |

| Platform Fee | Permanently Waived Platform Fee | 0 | 0 | |

| Total | 0 | 0 | ||

| Valuable Capital | Commission | 0.03% * Transaction Amount (Minimum 3HKD per Order) | 3 | 30 |

| Platform Fee | 15HKD per Order | 15 | 15 | |

| Total | 18 | 45 | ||

| Longbridge | Commission | 永久免佣 | 0 | 0 |

| Platform Fee | 15HKD / 笔 | 15 | 15 | |

| Total | 15 | 15 | ||

| IBKR | Commission | 月交易额≤1500 万,0.05%* 交易额 | 5 | 50 |

| Platform Fee | 月交易额≤1500 万,18HKD / 笔 | 18 | 18 | |

| Total | 23 | 68 | ||

| Stamp duty 0.1%, settlement fee, trading fee, SFC levy and HKMA levy are not shown above. | ||||

For ordinary investors, Tianfeng Securities is one of the few brokerage firms in the current market that offers the combination of "truly commission-free + waived platform fee".

New User Benefits in April 2025 (Exclusive to Hawk Insight)

🔥 Activity Period: April 1, 2025 - April 30, 2025

Benefit 1: Deposit Gift

-

First deposit of ≥HKD 10,000 (or equivalent in US dollars) and make one transaction → Commission-free for Hong Kong stocks

-

First deposit of ≥HKD 50,000 (or equivalent in US dollars) → Waived platform fee for Hong Kong stocks + platform fee for US stocks

Benefit 2: IPO Subscription Gift

-

Zero subscription fee for cash IPO subscriptions, suitable for investors seeking stable returns!

🔥 Exclusive Registration Link (Hawk Insight):Open an account now to enjoy exclusive benefits

Illustrated Explanation of the Account Opening Process of Tianfeng Securities

Tianfeng Securities supports online account opening for users from the Chinese mainland. The whole process can be operated on a mobile device. There is no need for a Hong Kong identity card, and there is no need to go to Hong Kong to handle it. Just prepare the basic materials, and you can complete the account opening process within 15 minutes through your mobile phone. After the verification is passed, you can trade Hong Kong stocks and US stocks.

Account Opening Method: Online Account Opening via Mobile Phone, Mainland Chinese Identity Card is Supported

Enter through the exclusive registration link and complete the account opening according to the instructions:

👉Click the registration link to open an account quickly (Exclusive benefits for the Hawk Insight channel)

Preparation of Account Opening Documents

Before starting, please prepare the following materials:

| Document Item | Explanation |

| Mainland Chinese Identity Card | The second-generation identity card. You need to upload photos of both the front and back or take photos. |

| Mainland Chinese Bank Card | It is only used for identity verification and will not be bound to the account. |

| Hong Kong Bank Card/Statement (Can be supplemented later) | It is not a mandatory item. If you don't have it for now, you can upload it later. |

| Valid Email Address | To receive account opening progress and notifications. |

| Network and Mobile Device | A stable network and a smartphone with a front camera are required for facial recognition. |

Illustrated Explanation of the Account Opening Process: A Detailed Explanation in 14 Steps (Illustrated)

The following is the standard account opening process for Tianfeng International Securities, illustrated below:

Step 1:Access to the registration linkVisit the exclusive registration link or scan the QR code to enter the account opening guidance interface. Click on “Start Account Opening”. |

|

|

Step 2:Select personal identificationSelect “Mainland China Resident” and click “Start to fill in the information”. |

|

|

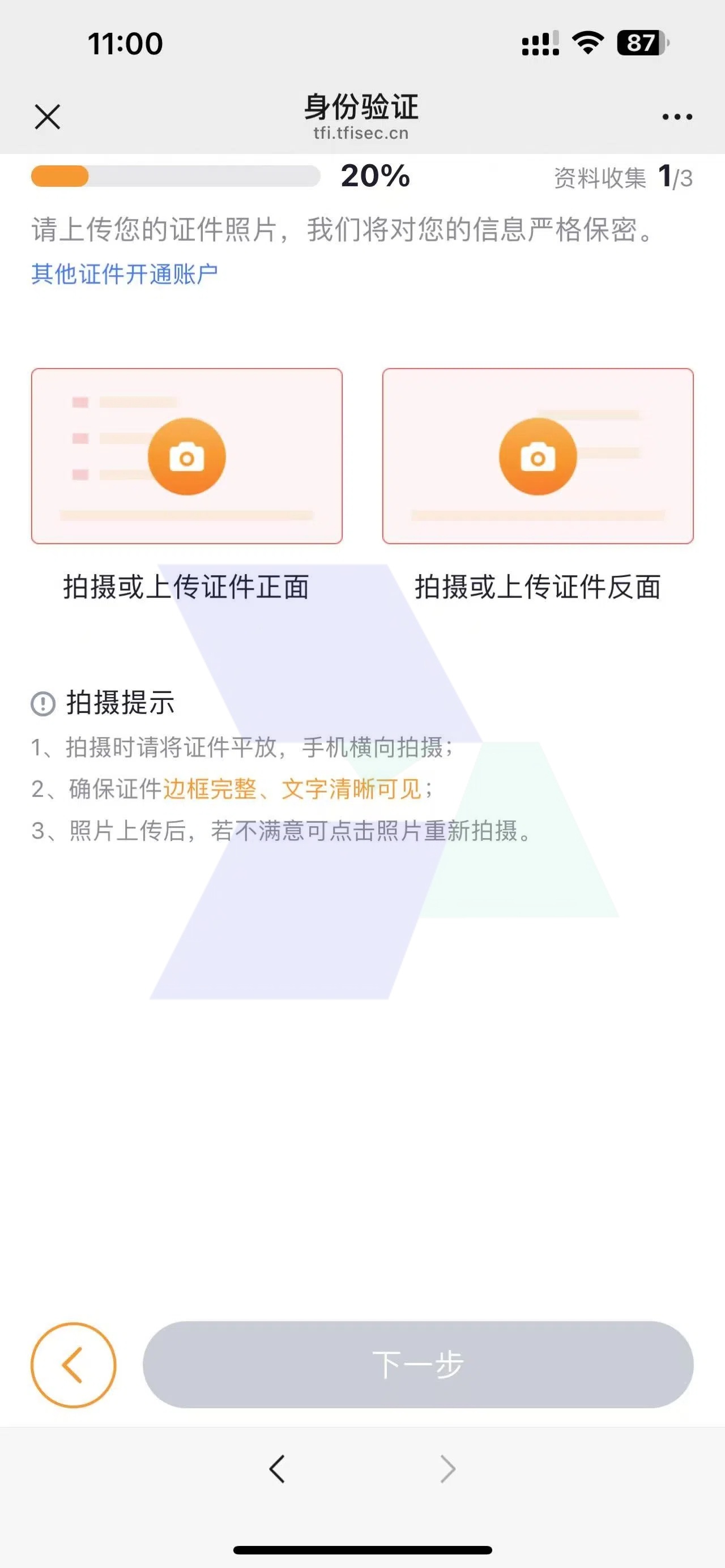

Step 3:Upload ID cardUpload or take photos of the front and back of the second-generation ID card (portrait side and national emblem side). |

|

|

Step 4:Fill in the mainland bank card information

Fill in the information of the mainland bank debit card under my name, which is only used to verify my identity, and will not be bound to the account, nor used to enter or exit funds. |

|

|

Step 5:Fill in the contact and basic informationFill in the birthplace, address, e-mail address and other information. |

|

|

Step 6:Educational Background and Occupation InformationSelect education, job nature, employer information, etc.. It is used to determine the risk level of the account. |

|

|

Step 7:Fill in financial statusSelect annual income, net worth, liquid assets and other financial information for compliance reporting. |

|

|

Step 8:Investment Experience and ObjectivesSelect the type of past investment experience, years of experience, investment objectives (e.g., growth, preservation of value, etc.). |

|

|

Step 9:Account Type SelectionWhether to open a financing account or not, and whether to open derivatives trading function, can be selected as needed. |

|

|

Step 10:Risk and Identity DisclosureCheck the default statement to confirm your non-sensitive identity, no political identity, etc. |

|

|

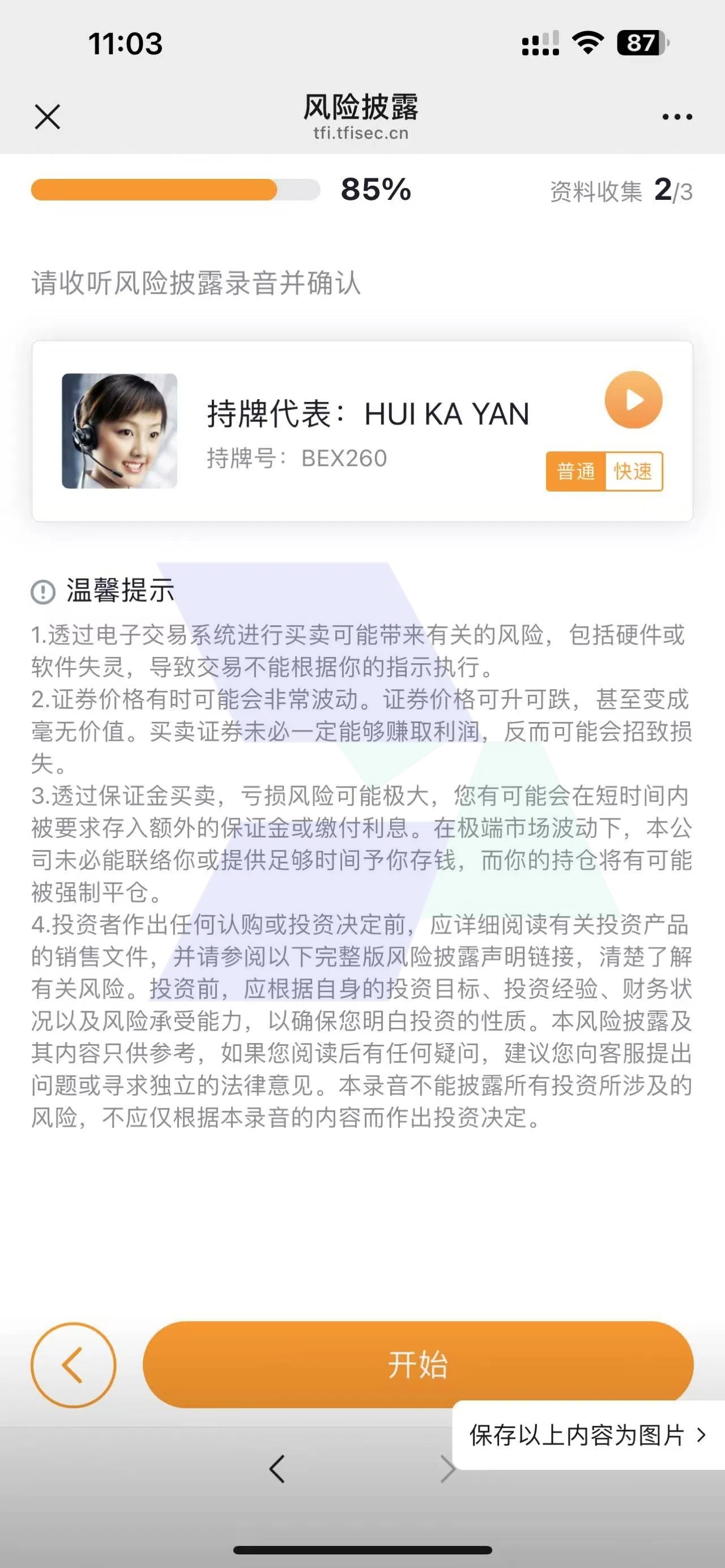

Step 11:Risk DisclosureConfirm to read the risk disclosure content and confirm to agree. |

|

|

Step 12:Face RecognitionFollow the prompts to take face recognition photos, make sure the light is sufficient and the equipment is stable. |

|

|

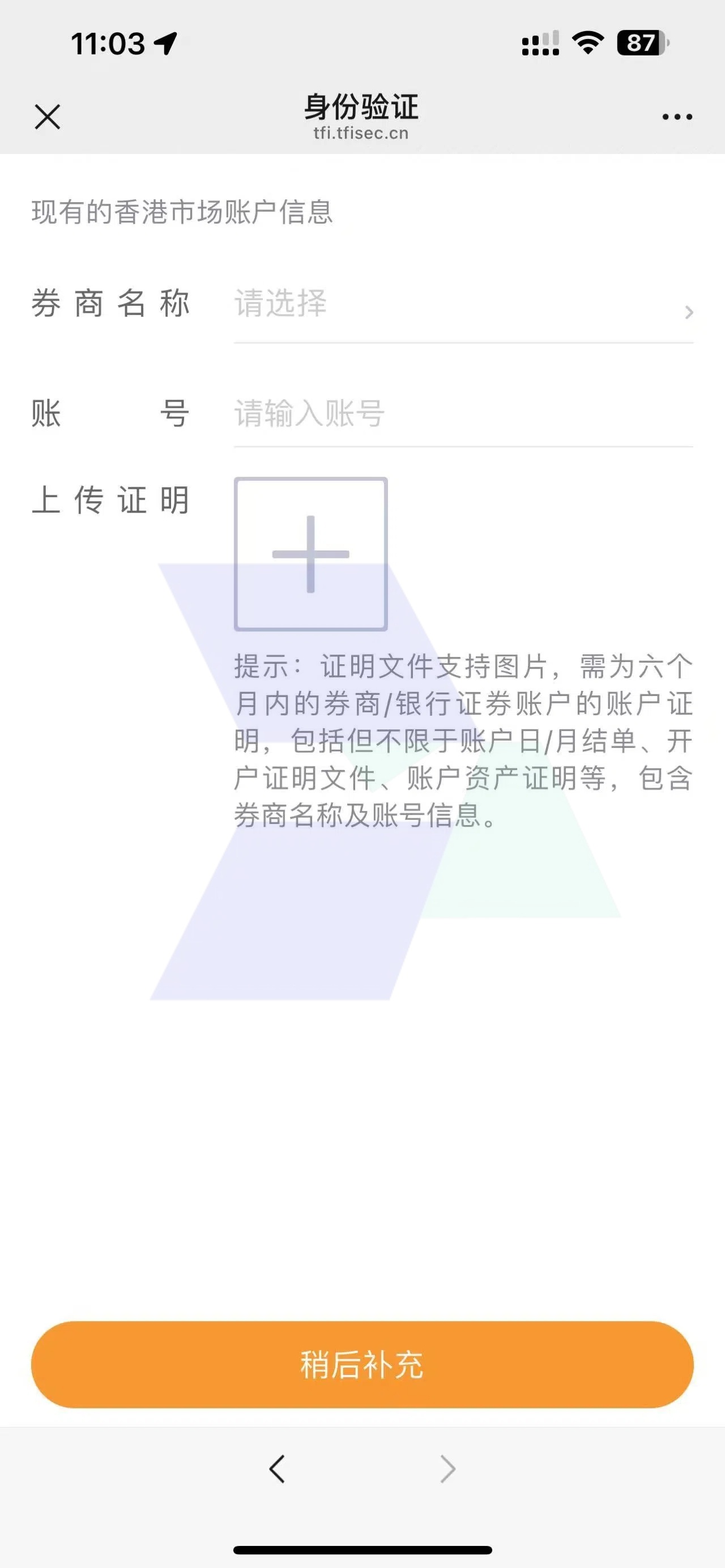

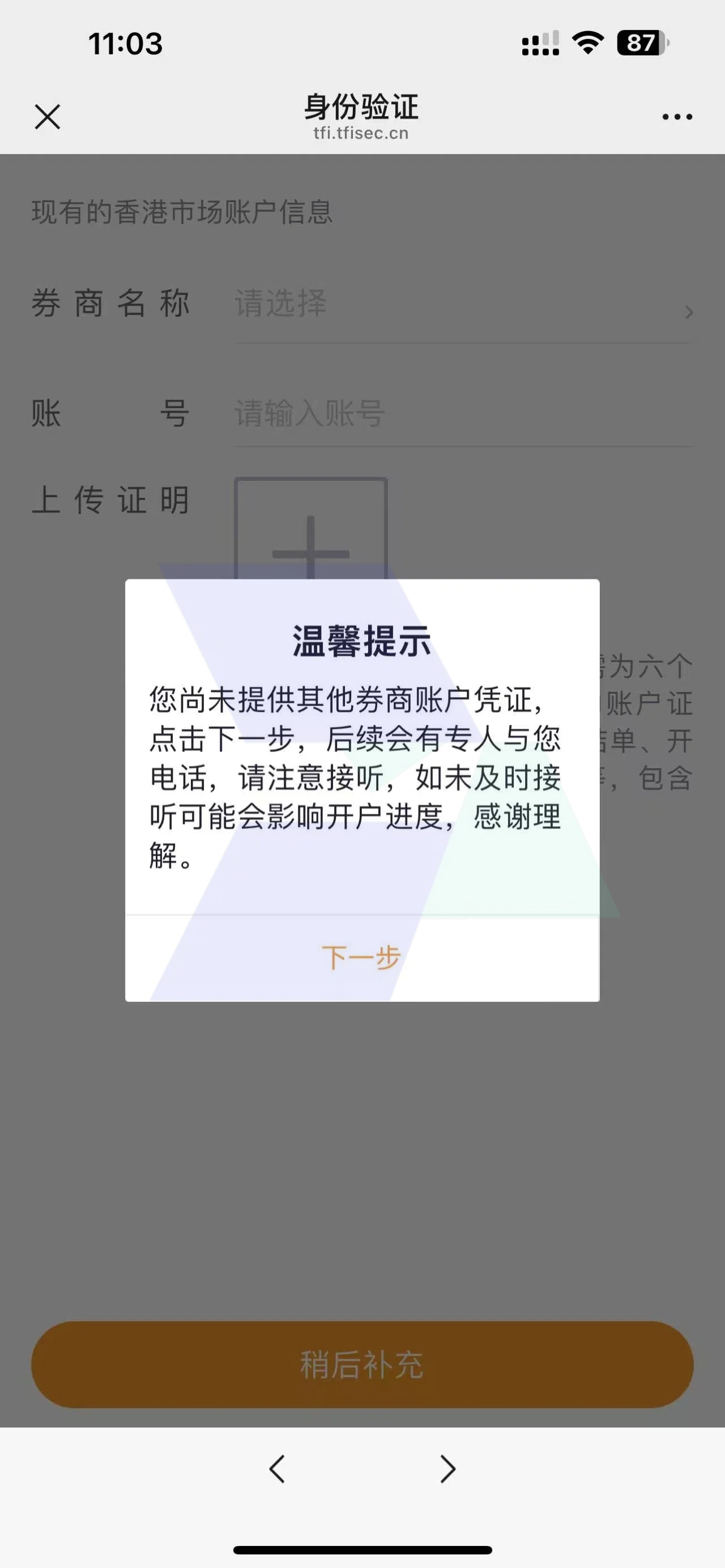

Step 13:Upload Account StatementUpload your Hong Kong bank card or other brokerage statements within the last 6 months. If you don't have them at the moment, you can choose “Upload later”. |

|

|

Step 14:Sign and SubmitSign the online account opening agreement and click the “Submit” button. |

|

Await Review

-

The review time is generally 1-2 working days;

-

You will receive a notification email of successful account opening after the review is passed;

-

Download and log in to the APP, and then you can start trading.

📲APP Download Reminder:

-

Apple users: Please use an overseas Apple ID to access the App Store and search for "TFI Securities"

-

Android users: You can directly scan the code to download it on the official website or the account opening page.

- Official website address: https://www.tfisec.com

Frequently Asked Questions (FAQ) about Account Opening

Q1. What should I do if I don't have a Hong Kong bank card?

- You can skip the upload first and supplement the materials after opening the account.

Q2. Is a witness required?

- No, the whole process can be completed online.

Q3. How to deposit funds?

- It usually takes 1-2 working days, and it will be postponed on holidays.

Q4. Is it necessary to deposit funds?

- Fund deposit is not mandatory, but you need to complete the first deposit to participate in activities and transactions.

Q5. How long does the review take?

- It usually takes 1-2 working days, and it will be postponed on holidays.

Experience of the Tianfeng Securities APP

-

Supports real-time trading of Hong Kong stocks and US stocks

-

Simple interface and complete functions

-

Supports IPO subscription, asset allocation, and one-click transfer

-

Provides professional research reports and real-time information

Is Tianfeng Securities Suitable for You?

Suitable for the following investors:

-

Investors who want to layout Hong Kong and US stocks but are worried about high commissions

-

Those who hope to use a formal platform and ensure the security of their funds

-

Those who want to participate in IPO subscription but don't want to be discouraged by high platform fees

-

Those who like a simple process and can complete account opening and trading with just one mobile phone

📌 Whether you are a Hong Kong stock IPO subscription user, a value investor, or a US stock trader who wants to reduce trading costs, Tianfeng Securities is a brokerage choice worth considering!

📥 Open an account now: Enjoy exclusive benefits & trade Hong Kong and US stocks with permanent 0 commission 👉 Click to open an account →

Conclusion

Today, with the increasingly fierce competition among Hong Kong and US stock brokerages, investors are no longer satisfied with just "being able to trade", but rather place more emphasis on the security, compliance, cost transparency, and service quality of the platform. Relying on its state-owned background, full license supervision by the Hong Kong Securities and Futures Commission, a truly 0 commission trading strategy, a clear and convenient account opening process, and exclusive benefits for new users, Tianfeng Securities is becoming one of the preferred platforms for Hong Kong and US stock investors.

Compared with the high platform fees and complex account opening processes of traditional brokerages, Tianfeng Securities provides a low-threshold, highly secure, and low-cost international investment entrance for a large number of investors. Especially for users who hope to participate in Hong Kong stock IPO subscription, make medium- and long-term layouts of US stocks, and conduct global asset allocation, it provides not just a trading account, but also a trustworthy wealth entrance.

If you are looking for a truly compliant, secure, and cost-friendly Hong Kong and US stock brokerage, Tianfeng Securities is undoubtedly a choice worth trying. Now, by opening an account through the exclusive channel of Hawk Insight, you can also enjoy limited-time benefits and easily start your global asset allocation journey.

Click the link below now to open an account with 0 commission and say goodbye to high costs from now on.

👉 Open an account now and enjoy exclusive new customer benefits

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.