Is Proof of Existing Holdings No Longer Required for Tiger Brokers Account Opening? Latest Policy Interpretation & Alternatives

Hong Kong's financial regulation has tightened, with Futu Securities, Longbridge Securities, Valuable Capital and other major brokers refusing account opening for existing mainland users. Tiger Brokers, a leading Hong Kong broker, has updated its requirements. This article analyzes its latest compliance rules in detail, with the most up-to-date visual account opening guide.

Since June 2025, leading Hong Kong brokerage firms including Futu Securities, Tiger Brokers, Longbridge Securities, and Valuable Capital have comprehensively tightened account opening policies for mainland residents, completely abolishing the existing holdings proof channel and shifting to requiring overseas employment/residency proof. This adjustment stems from the China Securities Regulatory Commission's ongoing rectification of cross-border securities business, aiming to curb gray practices such as intermediaries forging documents and conducting illegal lead generation. Under the latest policy, mainland users must provide documents such as overseas utility bills, salary statements, and rental contracts issued within the past 3 months to replace the previous existing holdings proof. Failure to provide compliant proof may result in account opening failure or account freezing.

This change has directly impacted the Hong Kong IPO subscription market. According to EY's report, Hong Kong's IPO fundraising in the first half of 2025 surged 711% year-on-year, yet cases of intermediaries assisting unqualified clients in opening accounts remain rampant.

I. What is Tiger Brokers?

1. Qualifications and Licenses

Tiger Brokers holds 77 global qualifications, including Type 1/2/4/5/9 licenses from the Hong Kong Securities and Futures Commission, FINRA investment banking licenses in the US, covering full-category trading of US stocks, Hong Kong stocks, futures, etc. Its US subsidiary holds 15 licenses including brokerage, investment banking, and clearing, forming a complete business closed loop from private equity financing to clearing.

2. Platform Advantages

- Full Chinese Services: Interface and 7×24-hour customer service support mainland users; account opening only requires an ID card, no need for a Hong Kong-Macau Travel Permit.

- Low Transaction Costs: 0 commission + 0 platform fee for Hong Kong stocks, 0 commission for US stock options; eDDA bank-securities transfer arrives instantly with no handling fees.

- Professional Tools: Features such as smart wealth management and option combination strategies, suitable for investors at all levels from beginners to high-net-worth users.

II. Latest Account Opening Policies of Tiger Brokers

1. Overview of New Hong Kong Stock Account Opening Rules

According to the latest regulations, mainland users must submit overseas employment or residency proof when using Hong Kong brokerage services. This marks the end of the traditional "existing holdings proof" method.

2. Updates to Tiger Brokers' Account Opening Requirements

Despite the new policy environment, Tiger Brokers still provides a convenient account opening process for eligible users. Now, you only need to prepare identification documents and address proof materials to start the account opening process. It is worth noting that all materials must be clear and legible and meet the specific requirements of the official.

Documents that can be used to prove overseas employment or residency are mainly divided into the following categories:

| Financial Category | Residential Category | Official and Other Proofs |

|---|---|---|

| Electronic Statements/Notices | Utility Bills | Insurance Policies |

| Credit Card Statements | Telephone Bills | Tax Bills or Documents Issued by Other Government Agencies |

| Pay Stubs | Overseas Housing Lease Agreements | Hong Kong Driving Licenses, Driving Licenses from Other Overseas Countries/Regions |

| Overseas Housing Ownership Certificates | Hong Kong-Macau Travel Permit with Stay Visa | |

| Labor/Service Contracts | ||

| Employment Certificates | ||

| Kind Reminder: All proof documents must be issued within three months and clearly show the name in Chinese or English, overseas address information, issue date of the proof document, and the full name of the issuing institution. Only image formats are supported for documents. | ||

Attachment: Examples of Valid Proof Images

III. Tiger Brokers Account Opening Full Process with Images and Text Guide

Step 1: Prepare Required Materials

- Personal Identification Documents:

- Hong Kong Permanent Identity Card (must include both front and back sides, ensuring the border is complete, text is clear, no reflection or obstruction; for reference, see the "Hong Kong Permanent Identity Card" sample in the document, which must show key information such as name, date of birth, and issue date);

- Hong Kong Non-Permanent Identity Card + Supplementary Documents (must provide a mainland Chinese ID card, Hong Kong-Macau Travel Permit, or passport from other countries/regions at the same time; the non-permanent identity card sample must include information such as name, date of birth, and issue date; supplementary documents must clearly show the personal information page).

- Personal Hong Kong Bank Account (must be in the same name as the account opener, used for subsequent fund deposit and transfer).

Step 2: Download and Register the Tiger Trade APP or Visit the Official Website

- Online Registration: You can choose to register through the Tiger Trade APP (Invitation Code: HAKW8888) or directly visit the Tiger Brokers Official Website. Click on "Open Account Now" on the page to enter the account opening process.

Step 3: Fill in and Upload Personal Information

a. Select Document Type and Upload Document Photos

- Enter the "Upload Identification Documents" page and select "Hong Kong Permanent Identity Card" or "Hong Kong Non-Permanent Identity Card + Supplementary Documents" according to your situation;

- When uploading document photos, note that:

- Ensure the ID card border is complete, text and numbers are clearly legible, no reflection, obstruction, or blurriness (avoid issues such as "blurred front window number", "strong reflection", "missing corners"; refer to the standards in the sample images in the document);

- For non-permanent identity cards, supplementary documents must be uploaded at the same time (e.g., mainland Chinese ID cards must upload both front and back sides; Hong Kong-Macau Travel Permits must upload the personal information page and valid visa page);

- If upload is unresponsive, check if camera permissions are enabled on your phone.

|

|

Standard Example |

|

|

b. Fill in Identity Information (System Prefills Automatically, Need to Verify)

- After uploading the documents, the system will automatically recognize and fill in identity information, including name (Chinese and pinyin/English), gender, date of birth (must match the document, in "YYYY-MM-DD" format), document type and number;

- Carefully check the information, confirm it is correct, and click "Continue".

c. Fill in Hong Kong Residential Address

- Enter the "Address Information" page and fill in the local Hong Kong residential address, including:

- Select the district (e.g., Hong Kong Island, Kowloon, New Territories, etc.);

- Enter the street name and number, building name/estate name;

- Optionally fill in block, floor, and unit information (if any);

- The address must be true and valid to avoid review failure due to vague information.

d. Fill in Occupation Information

- Enter the "Occupation Information" page and fill in as prompted:

- Employment status (e.g., "employed", "self-employed", etc.);

- Company industry (select from the drop-down menu, e.g., finance, education, technology, etc.);

- Job position (select from the drop-down menu, must match the actual occupation);

- Company name (fill in the full name of the company, no abbreviations);

- Detailed company address (must include complete information such as street name, building, floor, etc.);

- Education level (select from the drop-down menu, e.g., undergraduate, master's, etc.);

- Information must be described in detail to avoid review failure due to vagueness.

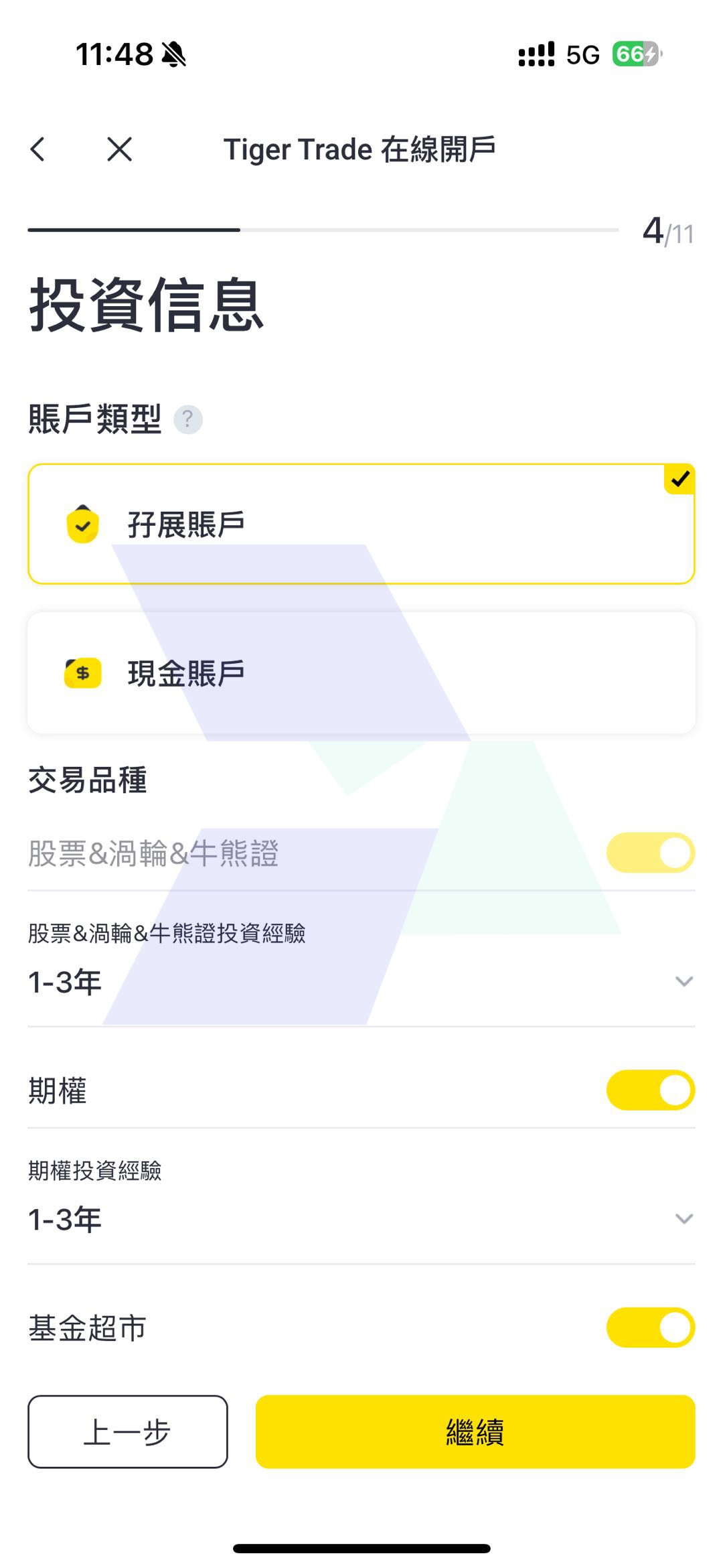

e. Select Account Type and Trading Experience

- Enter the "Investment Information" page and select the account type and trading products:

- Account type: You can choose "Margin Account" (supports margin trading) or "Cash Account" (only supports cash trading, no margin function);

- Trading products: You can choose "Stocks & Warrants & CBBCs", "Options", "Fund Supermarket", etc., and fill in the corresponding trading experience (e.g., "1-3 years", "3-5 years", etc.);

- After selection, click "Continue".

f. Fill in Asset Information

- Enter the "Asset Information" page and fill in truthfully:

- Total net assets (in HKD, select from options, e.g., "800K-2M", "above 2M", etc.);

- Annual income (in HKD, select from options, e.g., "0-320K", "320K-800K", etc.);

- Asset items (multiple selections allowed, e.g., real estate, deposits, securities, bonds/funds, etc.);

- Source of funds (multiple selections allowed, e.g., salary income, savings, rent, investment income, etc.);

- Information must be true to avoid review failure due to discrepancies.

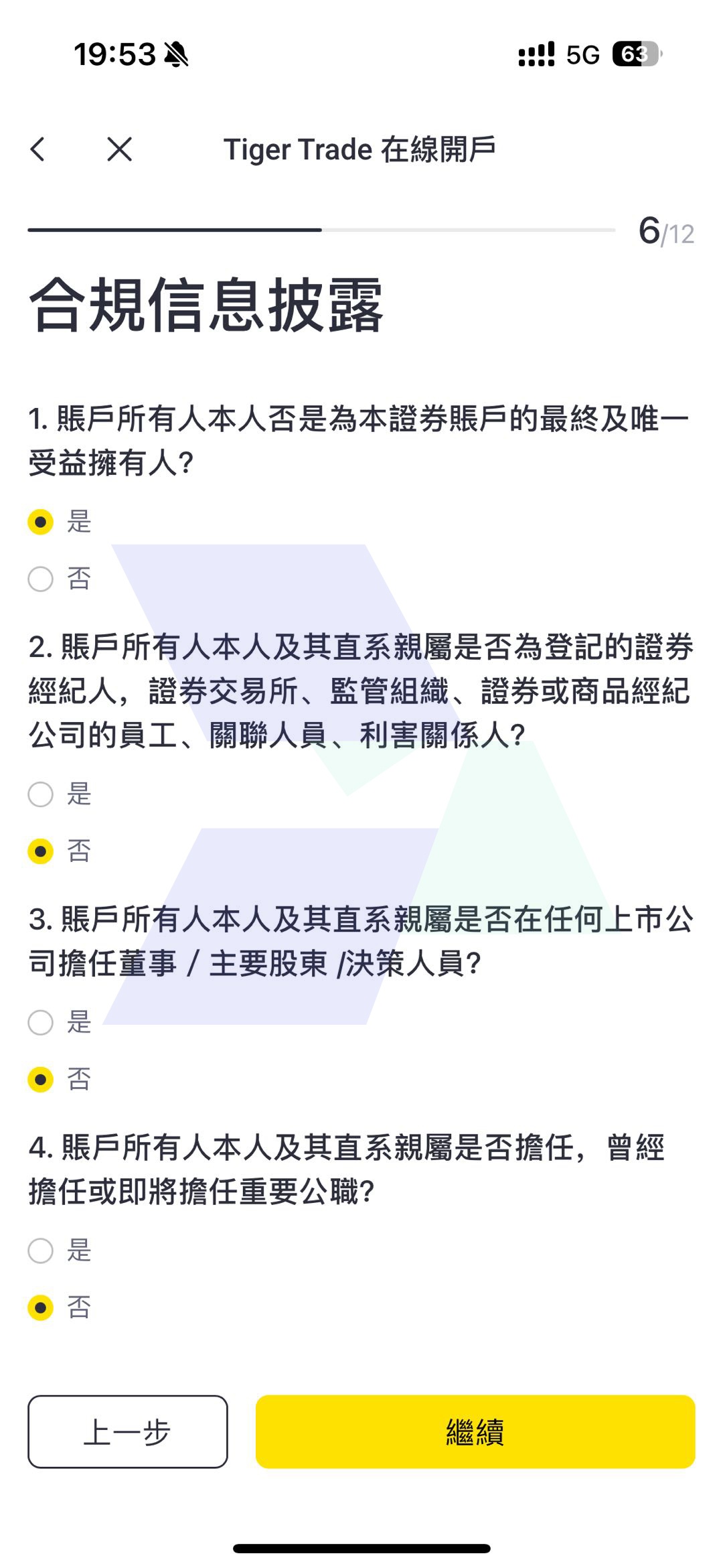

g. Confirm Compliance Information Disclosure

- Enter the "Compliance Information Disclosure" page and answer the following questions (select "Yes" or "No" according to the actual situation):

- Is the account holder the ultimate and sole beneficial owner of this securities account?

- Is the account holder or their immediate family members registered securities brokers, employees, associated persons, or interested parties of stock exchanges, regulatory organizations, or securities/commodity brokerage companies?

- Is the account holder or their immediate family members directors, major shareholders, or decision-makers of any listed company?

- Is the account holder or their immediate family members holding, having held, or about to hold important public positions?

- After selection, click "Continue".

h. Listen to Risk Disclosure Instructions

- Enter the "Risk Disclosure" page, where a licensed representative (e.g., "Lui Siu Hong, license number ALY654" in the document) will verbally explain the trading risks of the selected account, including:

- Investment decisions must be based on one's own experience, risk tolerance, and financial situation;

- Securities prices may fluctuate, which may lead to losses; past performance does not represent future returns;

- Carefully listen and confirm that you "understand, comprehend, and fully accept the disclosed content", then click "Continue".

|

|

|

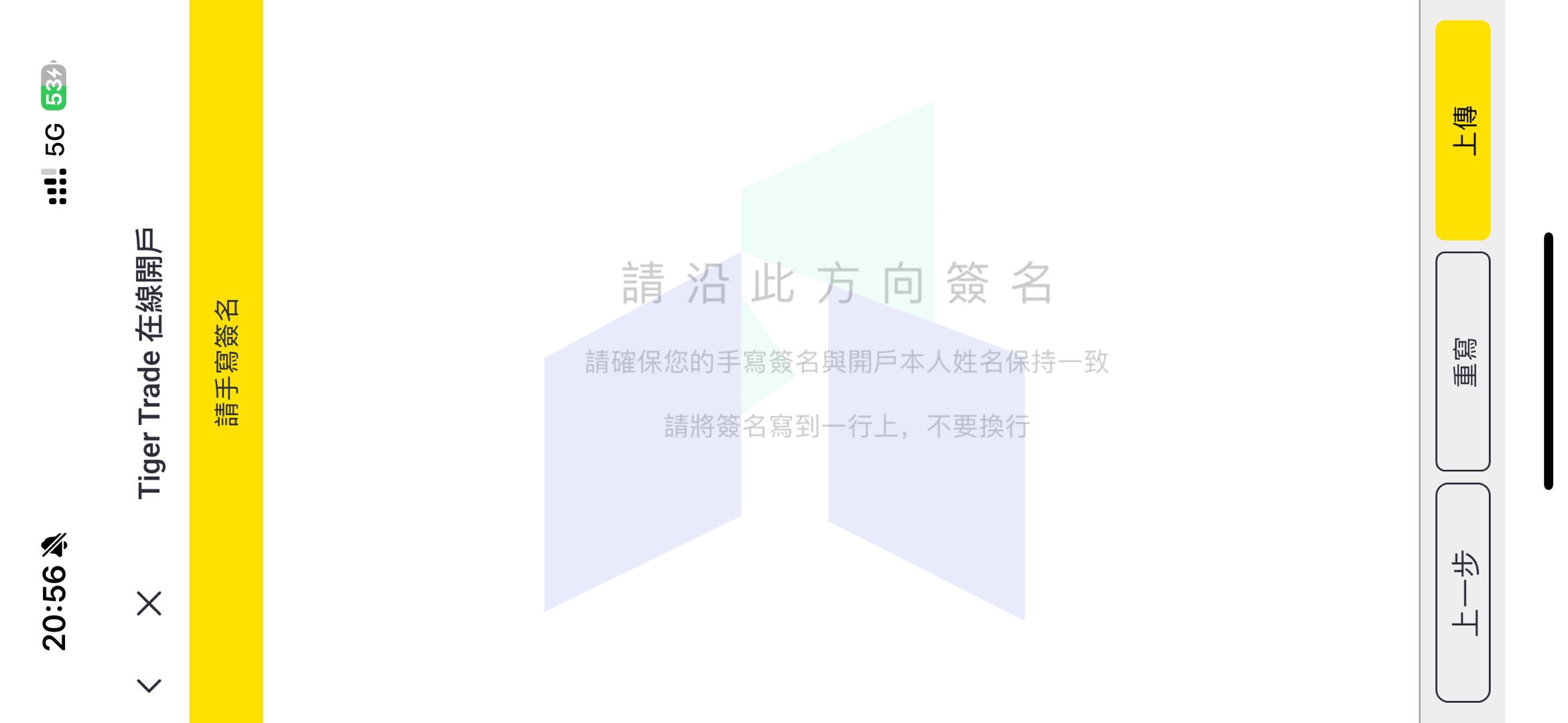

i. Complete Handwritten Signature

- Enter the "Handwritten Signature" page and sign by hand in the designated area:

- The signature must be exactly the same as the account opener's name (Chinese or pinyin must match the document);

- The signature must be written in one line, no line breaks or scribbles;

- Confirm the signature is clear and submit.

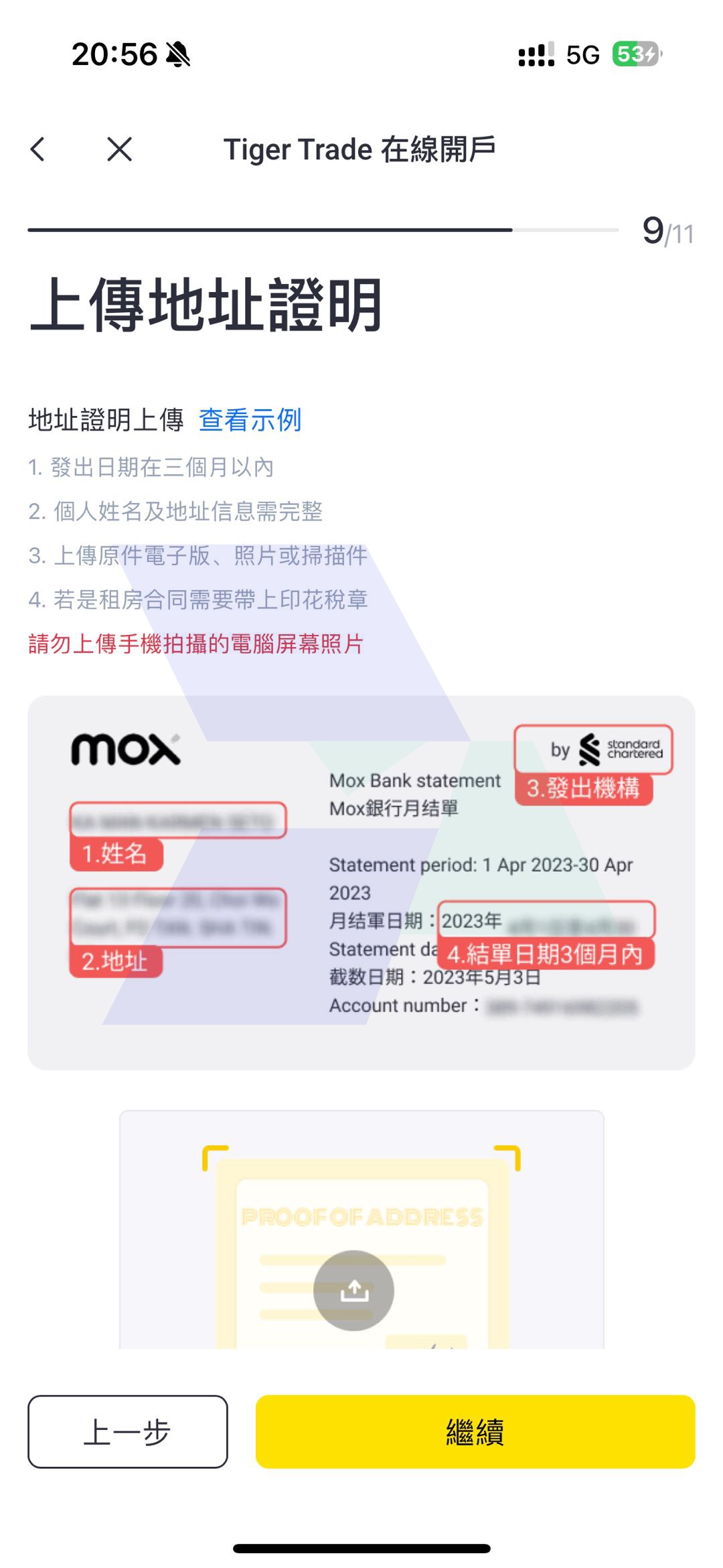

j. Upload Address Proof

- Enter the "Upload Address Proof" page and upload valid address proof issued within the past 3 months (for valid proof types, see "Updates to Tiger Brokers' Account Opening Requirements" in Section II of this article):

- The proof document must include the account opener's name, Hong Kong residential address, name of the issuing institution, and official seal (e.g., Hong Kong bank statement; refer to the "Mox bank statement" sample in the document, which must show the "Statement period" within 3 months);

- If it is a rental contract, it must include a stamp duty seal;

- Photos of computer screens taken with mobile phones are not allowed; original electronic versions, photos, or scanned copies must be provided;

- After uploading, click "Continue".

Step 4: Submit Materials and Complete Fund Deposit

- After submitting the materials, the system will display "Account opening materials under review". The review is expected to be completed within 1-2 working days (results will be notified via email and APP messages);

- As required by the Hong Kong Securities and Futures Commission, fund deposit must be completed through a Hong Kong bank account with the same name, with a single amount of no less than HKD 10,000 (or equivalent currency) for identity verification;

- After depositing funds, you need to link the Hong Kong bank account in the APP to complete the transfer authentication.

|

|

|

Step 5: Wait for Review Result

After submitting the materials and depositing funds, Tiger Brokers will review the completeness and authenticity of the materials. Once approved, you will be notified via email or APP about the account activation. During the review period, you can log in to the APP to check the progress. If there are any issues, you need to supplement materials as prompted.

IV. Frequently Asked Questions (FAQ)

Q: Will existing Tiger Brokers accounts be closed?

A: Existing customers can continue trading, but new fund transfers must comply with foreign exchange regulations. It is recommended to exchange currencies through legal channels (e.g., overseas work income).

Q: Without overseas proof, can I purchase fake materials through intermediaries to open an account?

A: Forging materials is illegal. Tiger Brokers has strengthened risk control in its review system, and such accounts are prone to freezing with no possibility of fund recovery.

Q: Which is more cost-effective: Stock Connect or QDII funds?

A: Stock Connect is suitable for long-term holdings (lower transaction costs), while QDII funds are suitable for diversified investments (lower risk preference). If the fund amount is less than 500,000, QDII funds are preferred.

Q: Is Tiger Brokers' fund safe?

A: Client assets are segregated from the broker's own funds, regulated by multiple authorities such as the Hong Kong Securities and Futures Commission and US FINRA, with no major fund safety incidents in history.

Q: Do overseas proof documents need translation or notarization?

A: Chinese documents do not need translation; English documents must be stamped by a translation company. Some brokers may require notarization (e.g., for opening a Hong Kong bank account).

Q: When opening an account as a Hong Kong non-permanent resident, what supplementary documents can be used? Must it be a mainland Chinese ID card?

A: According to account opening requirements, Hong Kong non-permanent residents need to provide "Hong Kong non-permanent identity card + supplementary documents". Supplementary documents include mainland Chinese ID cards, Hong Kong-Macau Travel Permits, or passports from other countries/regions, not limited to mainland Chinese ID cards. You can choose one according to your situation.

Q: Must the address proof be from Hong Kong? Can mainland utility bills be used as address proof?

A: No. When opening an account, you need to fill in a "Hong Kong residential address", and the corresponding address proof must be a document showing this Hong Kong address (e.g., Hong Kong bank statement, Hong Kong utility bills, etc.), issued within the past 3 months. Mainland address proof does not meet the requirements.

Q: Must I use my own Hong Kong bank account for fund deposit? Can I use a family member's Hong Kong bank account for transfer?

A: You must use your own Hong Kong bank account. The account opening steps clearly require "adding a Hong Kong bank account with the same name", and fund deposit/transfer must be in the same name. Using another person's account may result in deposit failure or review rejection.

Q: How long does the account opening review take? If the review fails, will the specific reason be informed?

A: After submitting materials and completing fund deposit, the review is expected to be completed within 1-2 working days. The review result will be notified via email and APP system messages; if the review fails, the specific reason will be stated in the notification (e.g., blurred documents, expired address proof, etc.), and you can resubmit after supplementing materials as prompted.

Q: What are the main differences in trading between cash accounts and margin accounts (margin accounts)?

A: Cash accounts only support cash trading of stocks, with no restrictions on T+0 trading frequency, but do not support short selling or margin functions; margin accounts support margin trading, can use leveraged financing (up to 5x leverage intraday), and also have no restrictions on T+0 trading frequency, suitable for users with financing needs.

Conclusion

Whether you are a novice trying international investment for the first time or an experienced investor looking to expand investment channels, Tiger Brokers provides you with a simple and safe solution. By preparing the necessary overseas employment or residency proof, you can easily complete the account opening process and enjoy investment opportunities in global markets. Following the detailed steps provided in this article, you can confidently start your investment journey. If you have any questions, you can contact Hawk Insight's professional customer service team immediately for instant help and support.

Start opening your global investment account now! Explore more exciting investment possibilities!

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.