Trump's words changed the world's investment logic again.

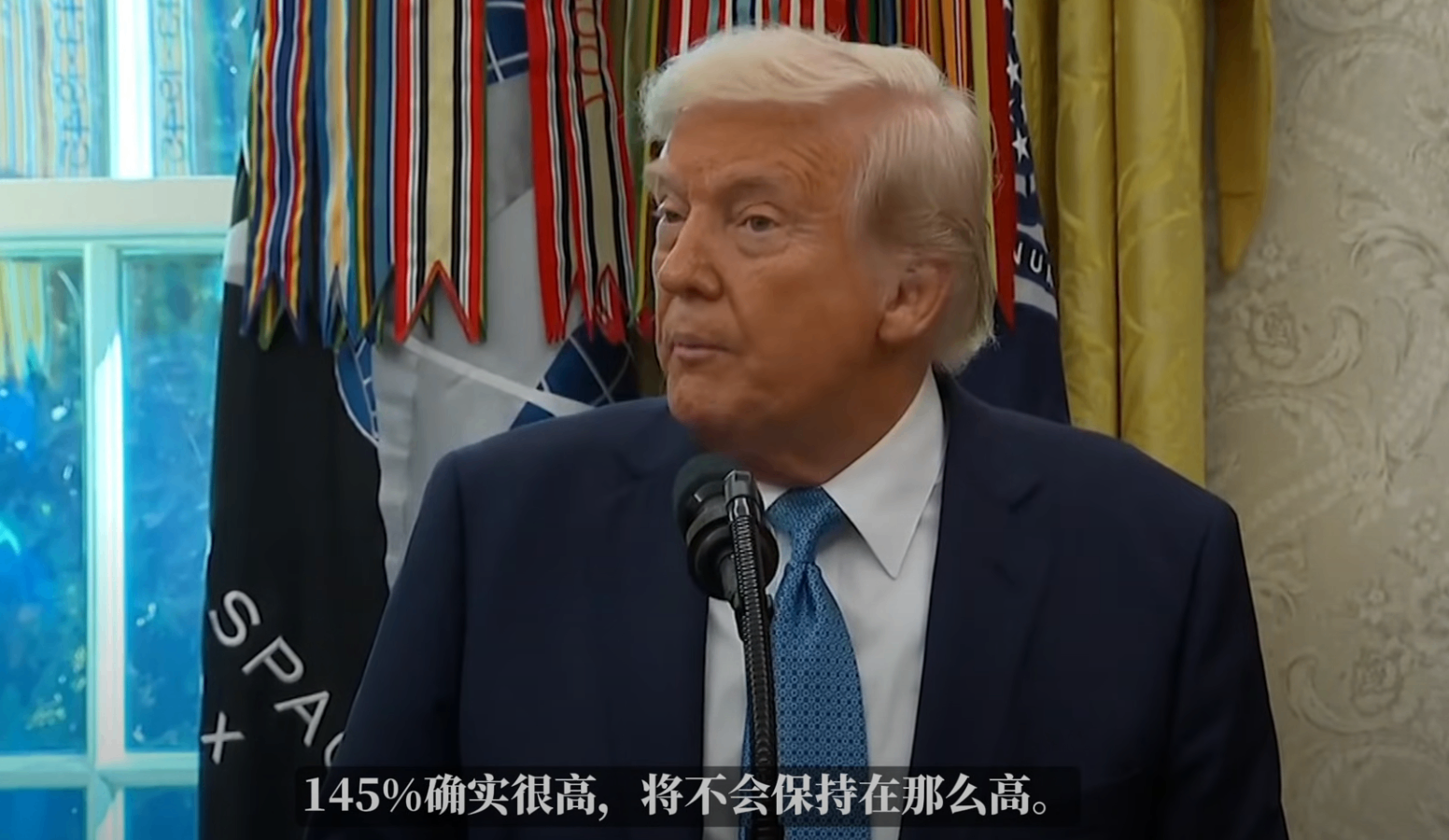

On April 22, first, U.S. Treasury Secretary Bessant, a good friend of Wall Street and an early acquaintance in the investment circle, hinted at a private forum at JPMorgan Chase that high tariffs on China were unsustainable-this was a milestone signal, indicating for the first time that the United States has relaxed its attitude towards tariffs.

Trump then confirmed this statement in the Oval Office of the White House, saying that tariffs on China would drop significantly: "There won't be tariffs that high, it will drop significantly, but it won't be zero.Later, after the hours, Trump once again reversed and said that he had no plans to fire Powell. Although procedurally speaking, even firing Powell would not guarantee that the Federal Reserve would cut interest rates, Trump's remarks will definitely ease the recent wave of selling U.S. stocks.

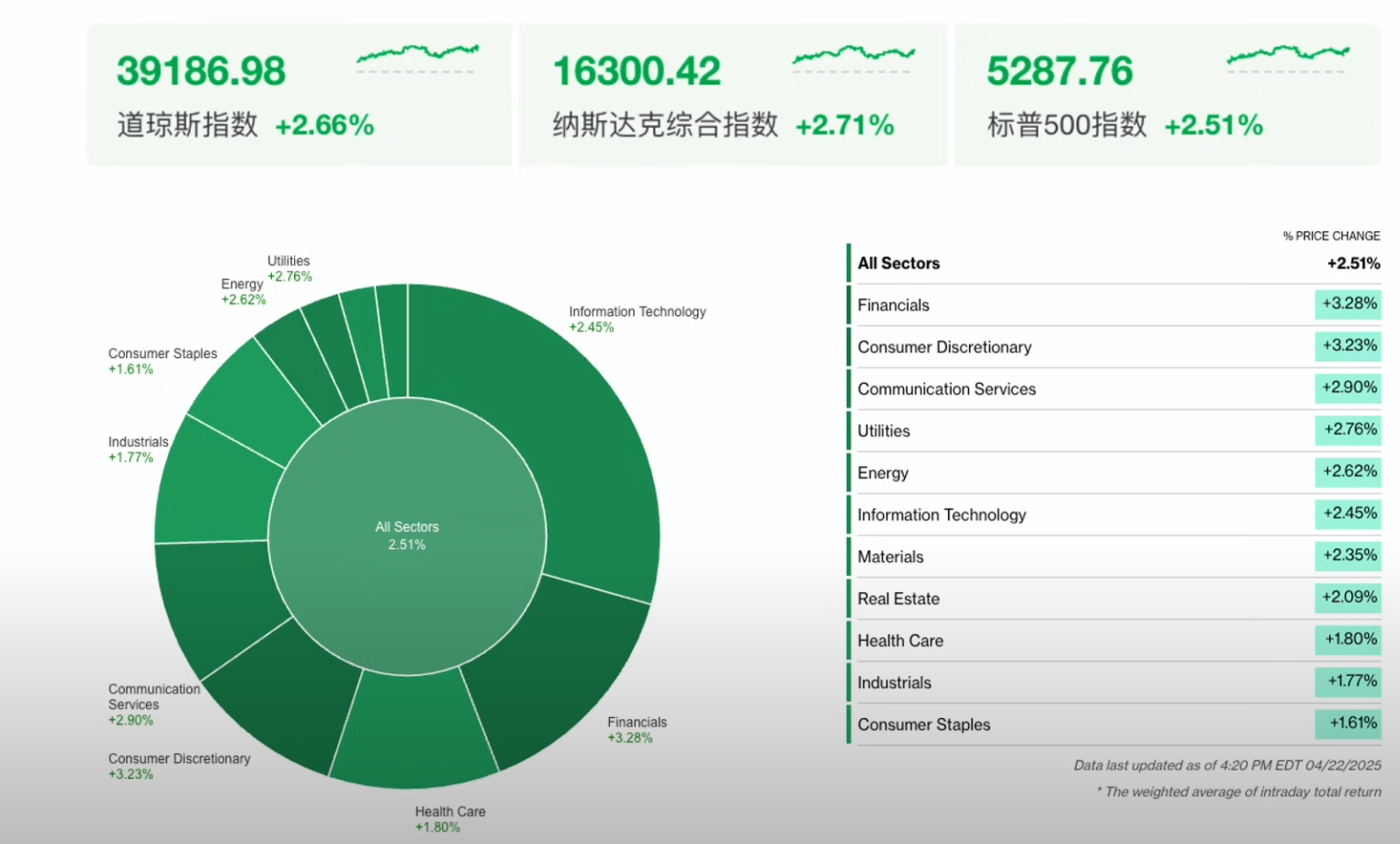

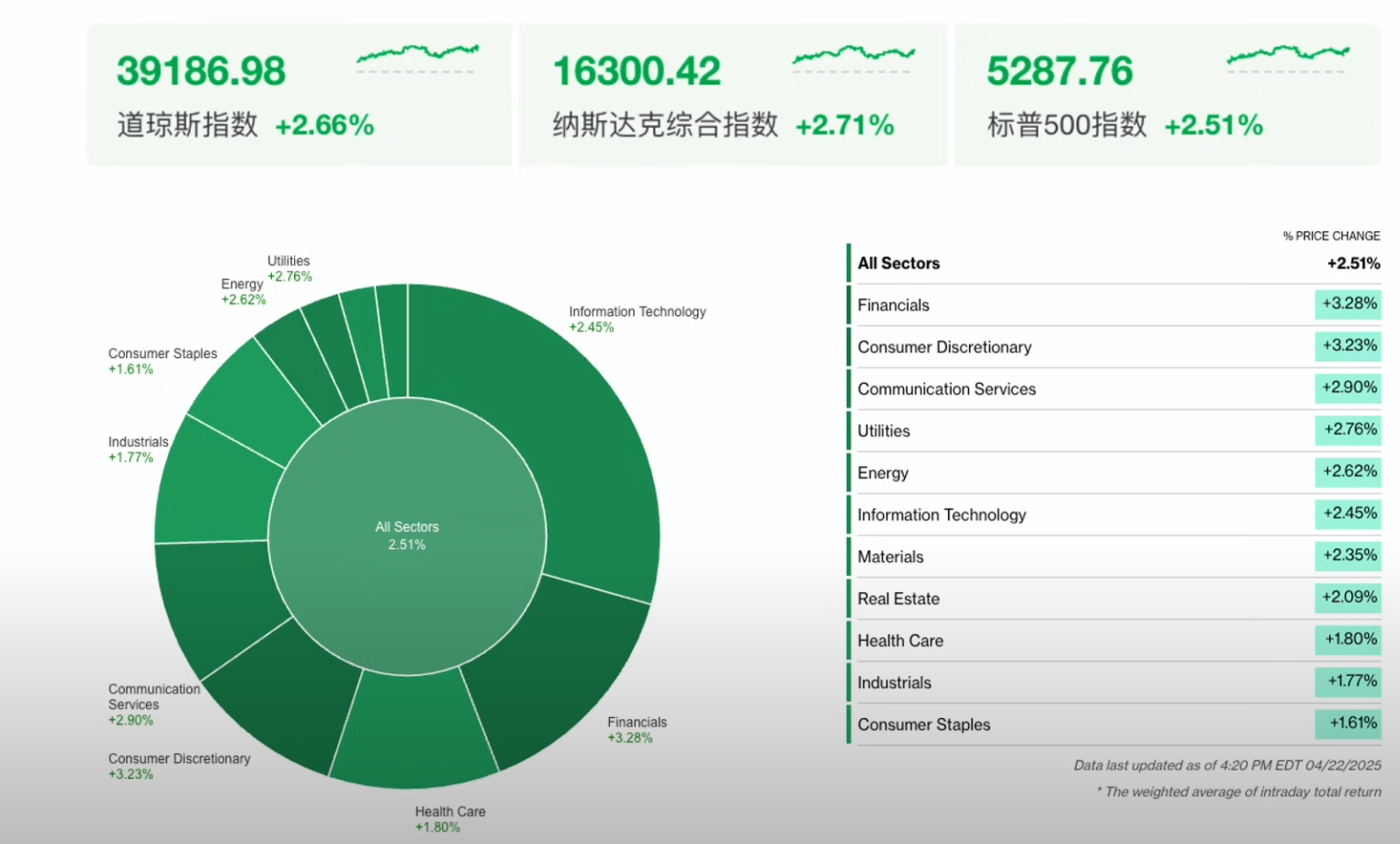

As soon as the news came out, U.S. stocks rose across the board last night, with all three major indexes rising more than 2%.The financial and non-essential goods sectors led the gains by more than 3%, with the essential goods and industrial sectors having the smallest gains, at 1.61% and 1.77% respectively.

At the opening of today, Southeast Asian stock markets were the first to rebound, and the stock markets of Vietnam and Thailand, which had suffered heavy losses in the previous period, recovered.Japanese stocks, known as the beta of the United States, also opened higher and went higher. Later, the Hong Kong A stock market relayed, but the Big A obviously did not respond to Trump's "goodwill"-the Shanghai Composite Index closed down 0.1%, and the Shenzhen Stock Exchange Index rose slightly by 0.67%.

The golden "mad cow" that had been rushing all the way before was diving off the cliff.In early Asian trading, spot gold opened nearly US$40 lower and once touched US$3,313.51 per ounce, down nearly US$200 from the all-time high of 3500 hit on Tuesday.COMEX gold futures reported at US$3,344.6 per ounce, down 2.19% during the day.

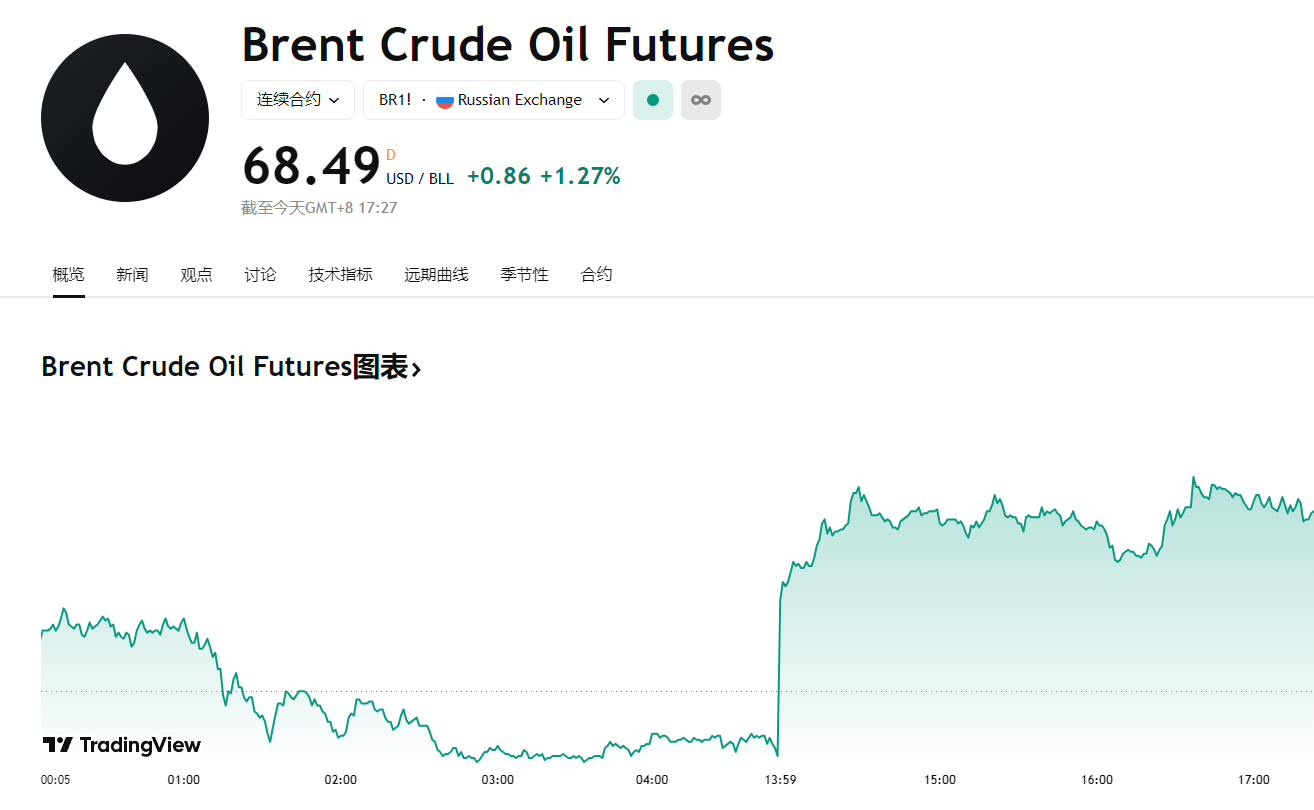

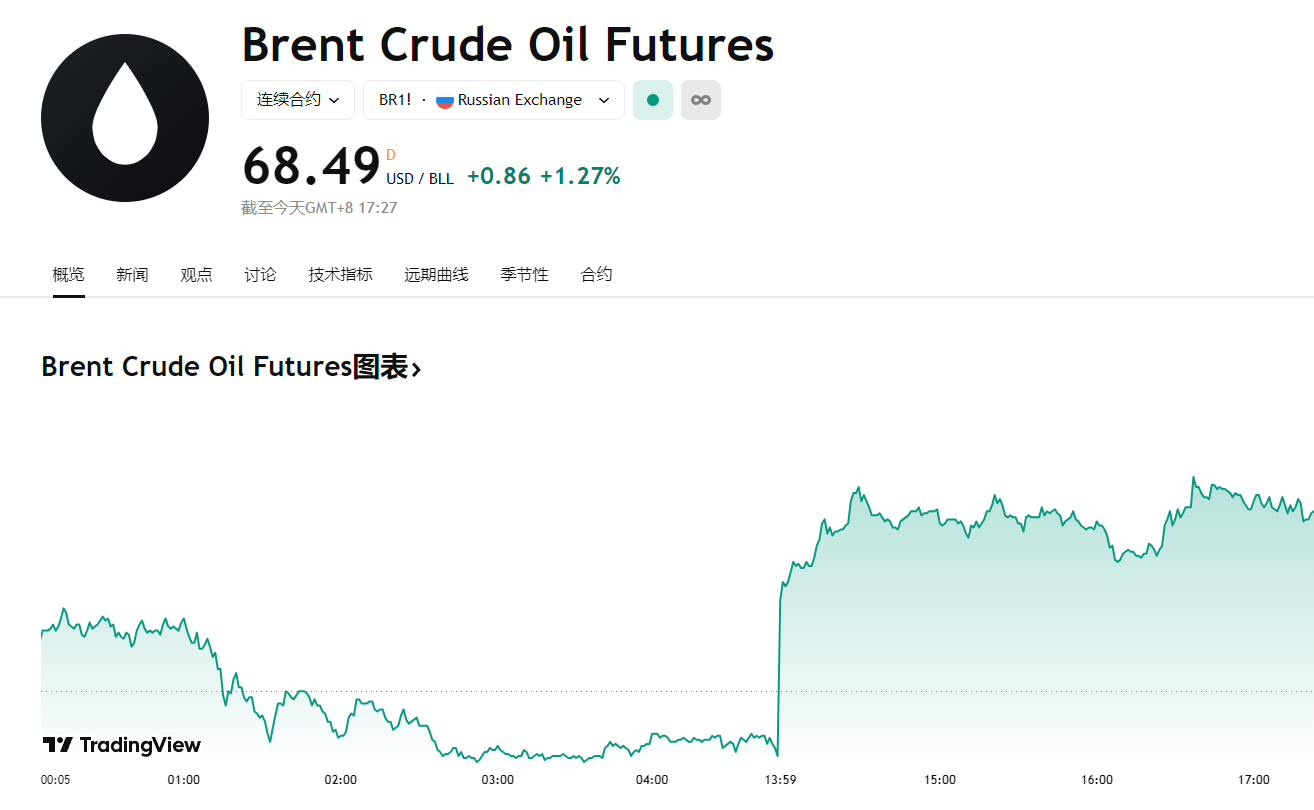

Brent crude oil futures rose 1.27% to US$68.49 per barrel, and U.S. WTI crude oil rose 0.94% to US$64.27 per barrel, continuing the previous trading day's gain-API data showed that U.S. crude oil inventories fell sharply, and inventory data may continue to improve oil prices.

The US dollar index, which the market is concerned about, rose 0.7% on Tuesday to close at 98.97. In early trading in Sanya City this week, the US dollar index continued its rebound trend, hitting a high of 99.89, a new high in the past week, with an increase of about 0.93%, making gold more expensive for holders of other currencies.

U.S. Treasury yields have not fallen significantly either-indicating that the world's crisis of confidence in U.S. assets still exists.Trump is panicked that markets are plummeting and Treasury yields are still high.

Large asset classes seem to have reached a crossroads.

The US dollar, US debt, and US stocks have strengthened, gold and British pound have plunged high, and the market's risk aversion has weakened.

Besant and Trump played a duet and used a combination of "behind the scenes" and "on the stage" strategies to ensure that the market fully absorbed positive signals.

Despite this, Brother Zhang believes that the risk of intervening in the market is still very high now, because all markets are driven by news, and the stage of destroying valuation is basically over. Strict information asymmetry is the unsolved investment barrier.

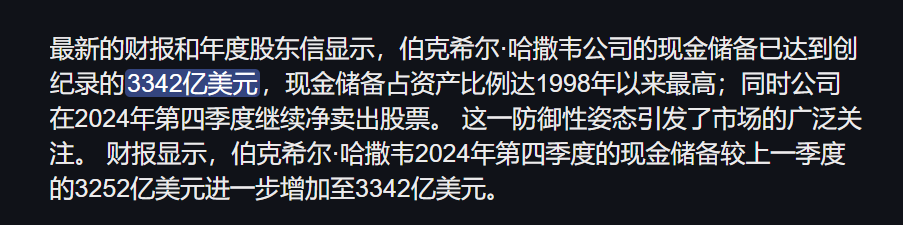

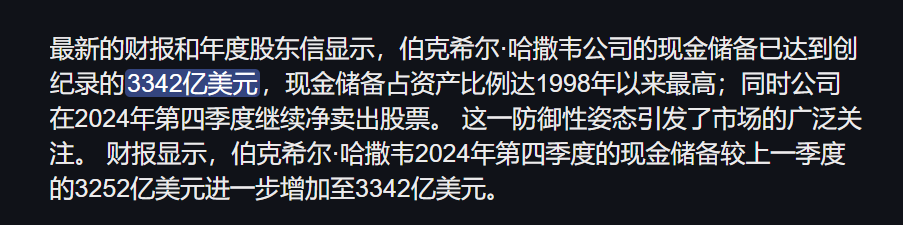

Even Buffett now has a lot of cash and short-term treasury bonds in his hands. His cash reserves of more than 300 billion yuan are constantly setting new highs for Berkshire.

As ordinary people, we do not have Buffett's infinite bullets, nor do we have the ability to immediately and indefinitely purchase short-term U.S. bonds. How to manage short-term idle funds?Choosing a purse with strong liquidity and high carry-based returns is a top priority.

The money bag currently launched by Tiger has low barriers, high returns and strong liquidity.Brother Zhang took a look and found that the income per 10,000 shares was more than 1 yuan, which was already comparable to some head debt bases and much higher than some living money platforms currently on the market.

More importantly, the liquidity of the Tiger Money Bag is also very objective. Users can turn the positions of the Tiger Money Bag into available purchasing power by activating the "automatic redemption" function, which can be used to purchase stocks, options, other non-purse funds and participate in IPOs.

Interested friends, hurry up and get on the bus ~

Recently, there are new stocks in Hong Kong and the United States, or friends who want to exchange accounts in Hong Kong and the United States can add a small WeChat account to communicateˇ