Tiger Brokers Withdrawal Guide 2025 | Steps, Fees & Processing Time

Step-by-step guide to withdraw funds from Tiger Brokers in 2025. Learn wire transfer process, supported currencies (USD/HKD/SGD), bank setup, fees, and FAQs. Funds arrive in 1–3 business days.

Want to safely and efficiently withdraw your investment earnings from Tiger Brokers? Are you worried about complicated withdrawal processes, opaque fees, or long processing times?

Don't worry! This article brings you the latest and most detailed guide to the entire withdrawal process from Tiger Brokers in 2025, with step-by-step illustrations covering every key环节 from App operation steps, bank account binding, currency selection, fee details to bank arrival time. Whether you're a new user making your first withdrawal or an experienced user looking to optimize withdrawal costs, you'll find practical answers here.

We will also focus on explaining the wire transfer fee structure for different currencies (USD, HKD, SGD, etc.), potential intermediary bank fee traps, and how to avoid failed verifications. Submit your withdrawal application easily in just 5 minutes, and funds can arrive as quickly as 1 business day!

Let's start now and guide you through the process of withdrawing funds from Tiger Brokers step by step 👇

I. How to Withdraw Funds from Tiger Brokers?

Currently, Tiger Brokers only supports wire transfer (i.e., international wire transfer) withdrawals to personal bank accounts, which are divided into two categories: Singapore bank accounts and other overseas banks (banks outside Singapore). It can remit currencies such as USD, HKD, SGD, NZD, AUD, EUR, etc.

Tiger supports withdrawing funds to banks in most countries and regions around the world, as long as you have a personal bank account in that country.

The withdrawal time is 1 to 3 business days for the funds to arrive, depending on the processing bank.

II. Is There a Fee for Withdrawing Funds from Tiger Brokers?

Tiger Brokers does not charge any fees for withdrawals, but during the cross-border remittance process, funds need to go through the remitting bank, intermediary bank, and receiving bank. These banks may charge processing fees according to their respective policies, which are directly deducted from the remitted amount. The actual amount received may therefore vary slightly. The fee standards for different currencies are different; you can refer to the following detailed table for specific fees:

| Remitted Currency | Singapore Domestic Banks (non-DBS/POSB) | Banks in Regions/Countries Outside Singapore |

| SGD | FAST withdrawal (amount ≤ 200,000) 0 fee MEPS withdrawal (amount > 200,000) Bank fee SGD 20 | Bank fee SGD 35 + Intermediary bank fee |

| USD | Bank fee USD 25 + Intermediary bank fee | Bank fee USD 25 + Intermediary bank fee |

| HKD | Bank fee HKD 200 + Intermediary bank fee | Bank fee HKD 200 + Intermediary bank fee |

| NZD | Bank fee NZD 35 + Intermediary bank fee | Bank fee NZD 35 + Intermediary bank fee |

| AUD | Bank fee AUD 35 + Intermediary bank fee | Bank fee AUD 35 + Intermediary bank fee |

| EUR | Bank fee EUR 25 + Intermediary bank fee | Bank fee EUR 25 + Intermediary bank fee |

Note: Withdrawing any currency to a DBS/POSB account incurs 0 fees, and the arrival time is also 1 to 3 business days. However, generally, non-Singapore users do not have a DBS/POSB bank account, and non-Singapore users cannot open a DBS/POSB bank account.

Tiger Brokers Official Communication Group

Welcome to join our group chat! You can get the latest preferential activities, professional consultations, and event notifications in the first place.

III.Tiger Brokers Withdrawal Tutorial (Flowchart Explanation)

The following will demonstrate in detail the operation steps for withdrawing funds via wire transfer with a combination of text and images. Although Tiger Brokers supports multiple operation methods on the web and App, this tutorial will take the mobile Tiger Trade App as an example, with the interface in traditional Chinese, and the entire process can be completed in about 5 minutes. You can freely switch to the simplified Chinese or English interface in the App according to your personal preference, and the operation is equally convenient and smooth.

Operation steps: Mine > Settings in the upper right corner > General > Language settings > App display language > Select the desired language and click save.

Step 1: Log in to Your Account and Start Withdrawing Funds

Log in to the Tiger Trade App > Click "Trading" > More functions > Withdraw funds to start this withdrawal application.

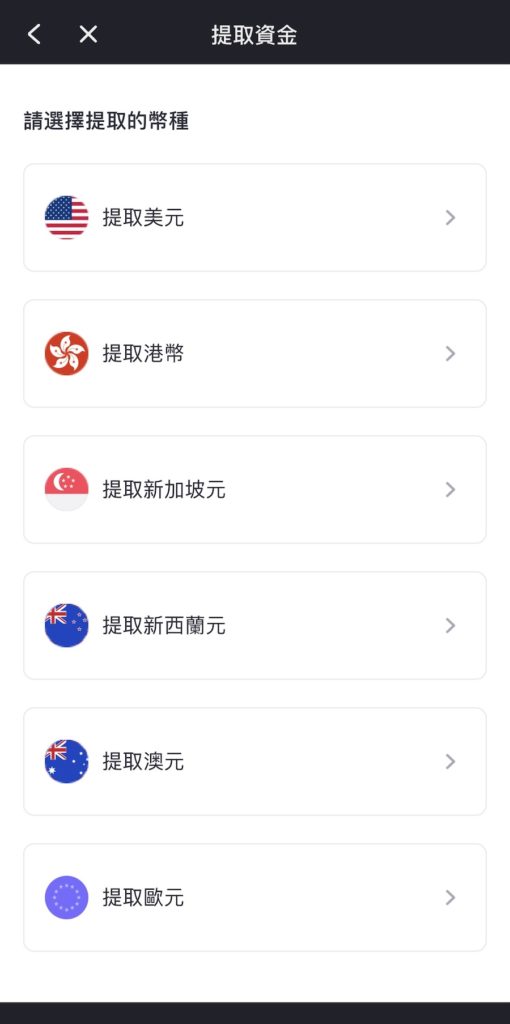

Step 2: Select the Withdrawal Currency

It supports remitting currencies such as USD, HKD, SGD, NZD, AUD, EUR, etc., which can be selected according to needs.

It should be noted here that the withdrawable currency must be consistent with the cash asset type in the Tiger account. For example, if the Tiger account holds USD, you can only withdraw USD (the bank account must support USD arrival). If you want to withdraw HKD, you must first convert USD to HKD. Therefore, when withdrawing funds, be sure to ensure that there are assets of that currency in the Tiger account.

You can use the currency exchange function in the Tiger APP to convert currencies in advance, so that you can successfully withdraw funds.

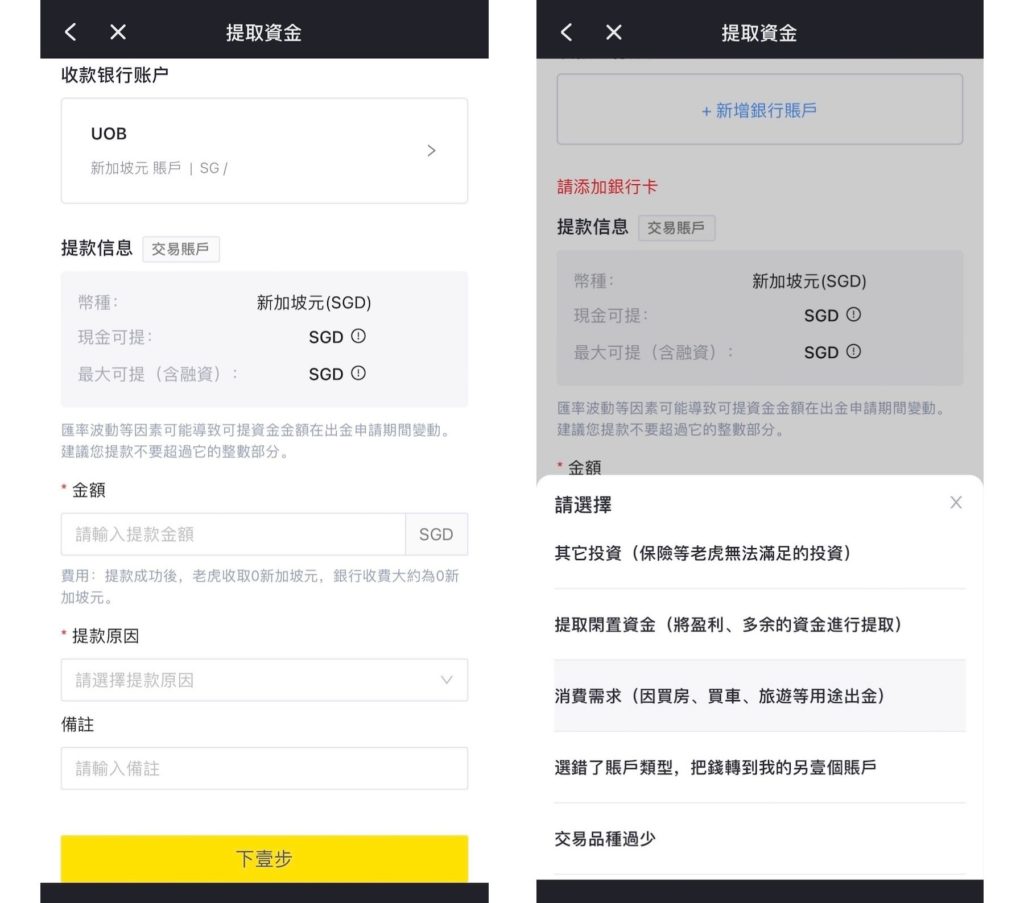

Step 3: For the First Withdrawal, You Must Bind a Bank Card

Please note that if it is your first withdrawal from Tiger Brokers, you must bind a bank card first.

On the page for filling in withdrawal information, the first item is the receiving bank account, that is, the bank account to which the funds for this withdrawal will be transferred. Click "+ Add Bank Account" to fill in the bank account information, including:

- Country/Region where the bank is located, such as Malaysia

- Bank name, such as Maybank

- Bank account number

- Bank account type, divided into: single currency, multi-currency, select according to the bank account type

- Bank account currency, divided into: USD, HKD, NZD, SGD, AUD, EUR, select according to the currency supported by the account

- Bank SWIFT Code, which can be found on the bank's official website or by consulting customer service

- Local bank code, optional

- Contact address, the contact address registered when opening the account

After filling in, click "Save" to save the bank account information.

It should be noted here that the receiving bank account must support the currency of this withdrawal. For example, if you want to withdraw SGD, the receiving bank account must be able to receive SGD; if you withdraw USD, the receiving bank account must be able to receive USD. Therefore, it is recommended that before withdrawing funds, confirm with your receiving bank whether it can receive the foreign currency funds.

|

|

|

|

There are also several important points to note:

1. Bank account name: This field is automatically filled in by the system. Check that the pinyin of the name is the same as the name registered on the bank card to avoid failed verification. If they are different, you can contact Tiger Brokers' customer service to make changes.

2. Remember that I can only remit funds to a bank account in my own name.

3. The withdrawal currency must be consistent with the currency supported by the bank card.

Step 4: Fill in Withdrawal Information

After successfully binding the bank card, proceed to the next step and fill in the withdrawal information, including the withdrawal amount and reason.

The system will display the selected withdrawal currency for your country/region, the available cash for withdrawal, and the maximum withdrawable amount. Available cash for withdrawal represents the amount of cash that can be withdrawn from the account. When withdrawing, users can only withdraw settled cash. The system will prompt the estimated fee for this withdrawal.

Just fill in according to your personal needs. Click "Next" to continue.

It should be noted here that the settlement of funds for the trading of financial products and currency exchange takes T+0, T+1, or T+2 trading days. If you include unsettled funds when withdrawing and proceed with the withdrawal, financing interest will be incurred, similar to the concept of borrowing money from Tiger Bank for withdrawal.

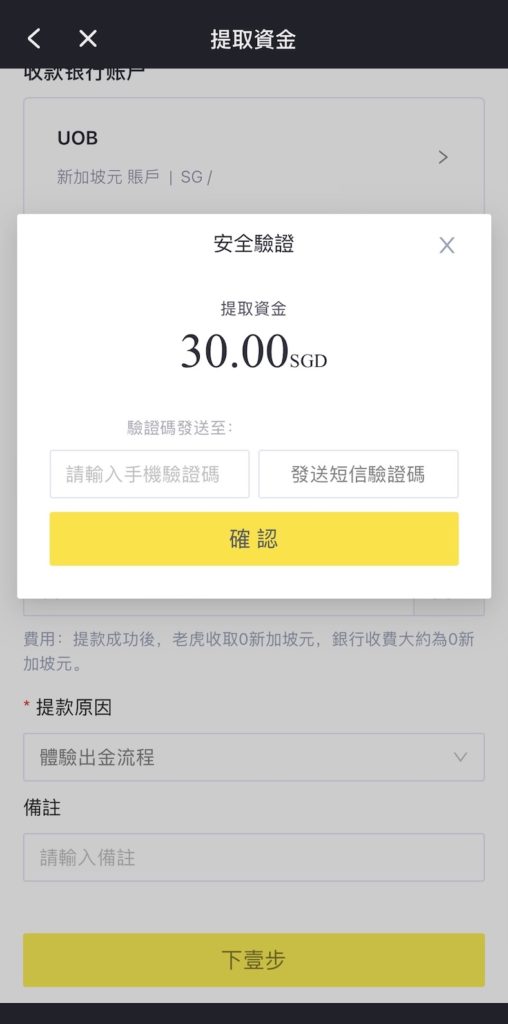

Step 5: Pass Security Verification and Submit Withdrawal Application

Confirm the withdrawal of funds. The system will send a verification code via SMS. After entering the verification code, click "Confirm" to complete the withdrawal.

Step 6: Withdrawal Successful and Receive Notification

The withdrawal time is 1 to 3 business days for the funds to arrive, depending on the processing bank. After a successful withdrawal, you will receive an email notification from the relevant party.

IV. Check Withdrawal Status

If you want to check the withdrawal records, click "Trading" > Functions > Funds > Deposit/Withdrawal Records. On the "Deposit/Withdrawal Records" page, click "Application Records" in the upper right corner to view all withdrawal processing statuses or cancel the withdrawal application.

|

|

The main withdrawal statuses of Tiger Brokers are as follows:

| Pending Review | Review takes 1 to 2 business days. If you want to cancel the withdrawal, you can do so in this status. |

| Rejected | The withdrawal review failed. You can check the reason for rejection on the Tiger Trade App. |

| Pending Withdrawal | The withdrawal review has been approved, and it is waiting for withdrawal. |

| Bank Processing | Funds have been deducted from Tiger Brokers' account, submitted to the bank, and are waiting for bank processing. |

| Withdrawal Failed | The bank cannot remit the money, and the funds have been returned to the securities account. |

| Remitted | Funds have been remitted to the designated personal bank account. |

| Refunded | Funds were returned by the receiving bank, and the funds have been returned to the securities account. |

| Cancelled | The withdrawal application has been cancelled. |

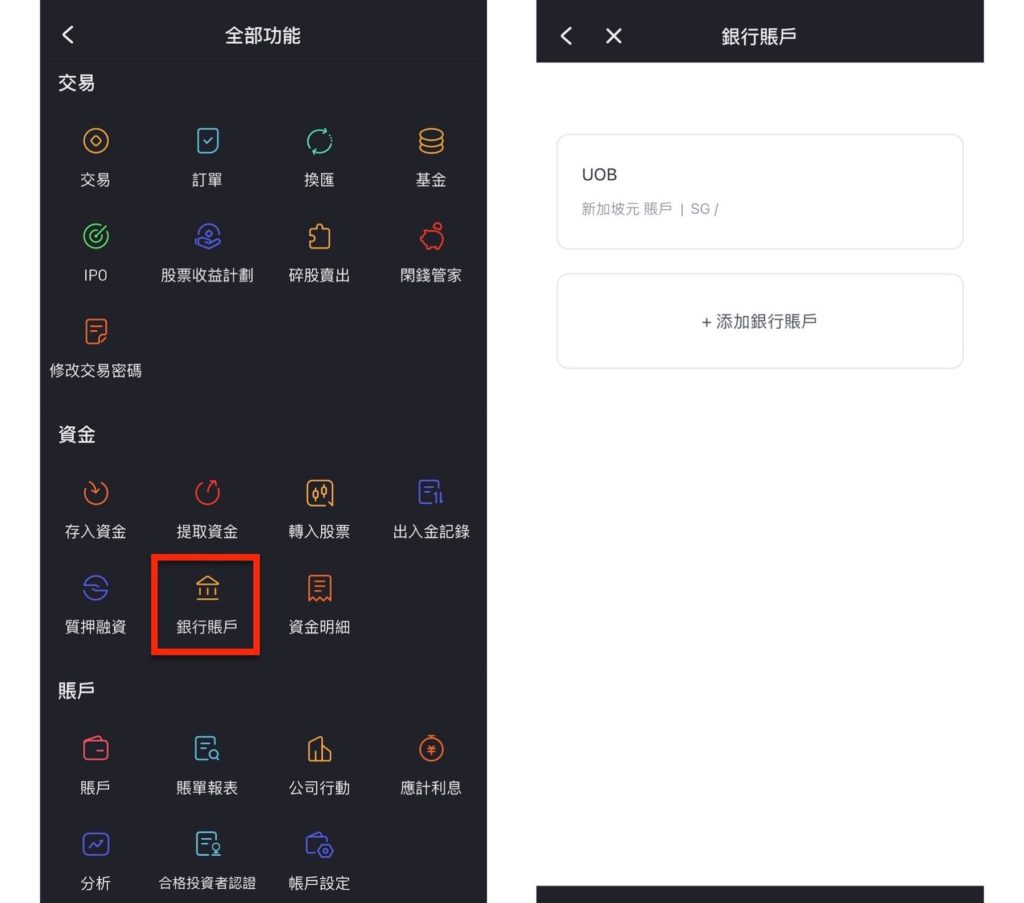

V. How to Add Other Bank Cards for Withdrawal?

If you want to change to a new bank card for withdrawal, the steps are simple:

Log in to the Tiger Trade App > Click "Trading" > More Functions > Funds > Bank Accounts, click "+ Add Bank Account" to add a new bank card for convenient withdrawal next time.

VI. Frequently Asked Questions

1. Is there a minimum or maximum amount limit for withdrawals from Tiger Brokers?

There is no fixed limit. Tiger Brokers currently does not set a minimum or maximum amount limit for a single withdrawal. However, it is recommended to withdraw a larger amount at one time to spread the cost of international wire transfer fees and improve the cost-effectiveness of fund transfer.

⚠️ Note: Some receiving banks may have an entry threshold. It is recommended to consult your bank in advance.

2. Can withdrawals be transferred to someone else's bank account or a third-party platform?

No. Tiger Brokers only supports withdrawals to personal bank accounts in the account holder's own name, and the account name must be completely consistent with the real-name information of the Tiger Brokers account. If the information does not match, the withdrawal application will be rejected.

3. Does Tiger Brokers charge fees for withdrawals?

Tiger Brokers itself does not charge withdrawal fees, but banks involved in the international wire transfer process will charge relevant fees, including:

- Intermediary Bank fee: Usually 15–30 USD

- Receiving Bank incoming fee: Depending on the local bank's policy

- Remitting Bank processing fee: Charged by Tiger's cooperative custodian bank (see the table below for details)

💡 Tip: If you have a Singapore DBS/POSB account, you can enjoy zero-fee and fast arrival, which is suitable for long-term investors to consider opening an account.

4. Which currencies are supported for withdrawal? Can RMB be withdrawn?

The main currencies supported for withdrawal include:

- US Dollar (USD)

- Hong Kong Dollar (HKD)

- Singapore Dollar (SGD)

- Euro (EUR)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

Direct withdrawal of Renminbi (CNY) is not supported for the time being. If you need RMB to arrive, it is recommended to first convert the account assets into USD or other foreign currencies for withdrawal, and then convert them into RMB through a local bank.

📌 Important Note: The withdrawal currency must be consistent with the available cash asset currency in your Tiger account. For example, if the account only has a USD balance, you can only choose to withdraw USD.

5. What information does the receiving bank need to support? How to check the SWIFT Code?

Before withdrawing funds, please confirm that your receiving bank account meets the following conditions:

- Supports receiving the corresponding foreign currency (e.g., if withdrawing USD, the account must be able to receive USD)

- Provides the correct SWIFT/BIC code

- Provides accurate bank name, branch address, and account number

- If it is a multi-currency account, please clearly indicate the currency type

🔍 How to find the SWIFT Code?

- Log in to online banking and check in "Account Details"

- Call the bank's customer service hotline for inquiry

- Visit the bank's official website and search for "SWIFT Code" or "International Remittance Guide"

📌 Example: The SWIFT Code of Maybank in Malaysia is MBBEMYKL

6. How long does it take for the withdrawn funds to arrive? How to check the status?

It usually takes 1–3 business days to arrive, and the specific time depends on:

- Tiger Brokers' review speed (1–2 business days)

- International bank clearing systems (such as Fedwire, CHAPS)

- Whether there is a delay in the intermediary bank

- Processing efficiency of the receiving bank

📍 Method to check withdrawal progress: Open the Tiger Trade App → "Trading" → "More Functions" → "Funds" → "Deposit/Withdrawal Records" → Click "Application Records" to view the detailed status:

7. What to do if the bank inquires about the source of funds after withdrawal?

This is a normal compliance process! When a large amount of foreign currency is remitted, most banks will call to confirm the source of the funds, which is part of the Anti-Money Laundering (AML) review procedure.

Coping methods:

- Keep the phone accessible

- Explain to the bank that it is "securities investment income"

- Provide screenshots of Tiger Brokers' transaction statements or withdrawal records

How to obtain the statement? Tiger Trade App → "Trading" → "More Functions" → "Account" → "Statement Reports" → Download the PDF statement.

8. Do I need to bind a new bank account for the first withdrawal?

Yes, for the first withdrawal, you must first add and verify the receiving bank account.

📌 Operation path: Tiger Trade App → "Trading" → "More Functions" → "Funds" → "Bank Accounts" → "+ Add Bank Account"

Need to fill in:

- Country where the bank is located

- Bank name

- Bank account number

- Account type (single currency/multi-currency)

- Supported currencies

- SWIFT Code

- Contact address (consistent with the account opening information)

After successful addition, the account will be saved in the list for convenient quick withdrawal next time.

9. Can I replace or delete a bound bank account?

You can add multiple accounts, but cannot directly delete them. You can go to the "Bank Accounts" page:

- Add a new receiving account

- Set the old account as "infrequently used"

- Select the new account for subsequent withdrawals

⚠️ Note: Once a withdrawal record is associated with an account, the system usually does not allow deletion to prevent security risks.

10. Will withdrawal affect positions or transactions?

It will not affect existing positions. Withdrawal only involves the available cash balance in the account and will not automatically close positions or affect the stocks, funds, and other assets you hold.

However, please note:

- The withdrawal amount cannot exceed the "settled funds" (Settled Cash)

- If you withdraw unsettled funds (such as funds from stocks just sold on T+0), it may lead to financing (Cash Advance) and incur interest expenses

It is recommended to withdraw funds after the funds are fully settled to avoid additional costs.

📌 Warm Reminder:

To ensure a smooth withdrawal, please do the following before operation:

- Check that the bank account information is correct

- Confirm that the account supports receiving the corresponding foreign currency

- Keep screenshots of withdrawal records for future reference

If you have any questions, you can contact [Tiger Brokers Customer Service] or join the official communication group for real-time help.

Conclusion

In general, the withdrawal process of Tiger Brokers is simple to operate, and the step-by-step guidance in the Tiger Trade App is clear, allowing you to complete the application in just a few minutes. To improve the efficiency of fund transfer and reduce handling costs, it is recommended that investors choose to withdraw a large amount at one time as much as possible to avoid accumulating high international wire transfer fees due to frequent small withdrawals—after all, banks at each link (such as intermediary banks and receiving banks) may charge corresponding service fees.

If you encounter any problems during the operation, welcome to leave a message below for communication, or directly contact Tiger Brokers' official online customer service for immediate help. Plan your withdrawal strategy reasonably to make your investment returns return to your hands more efficiently and safely.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.