The transaction coincides with a periodic peak in the stock price.

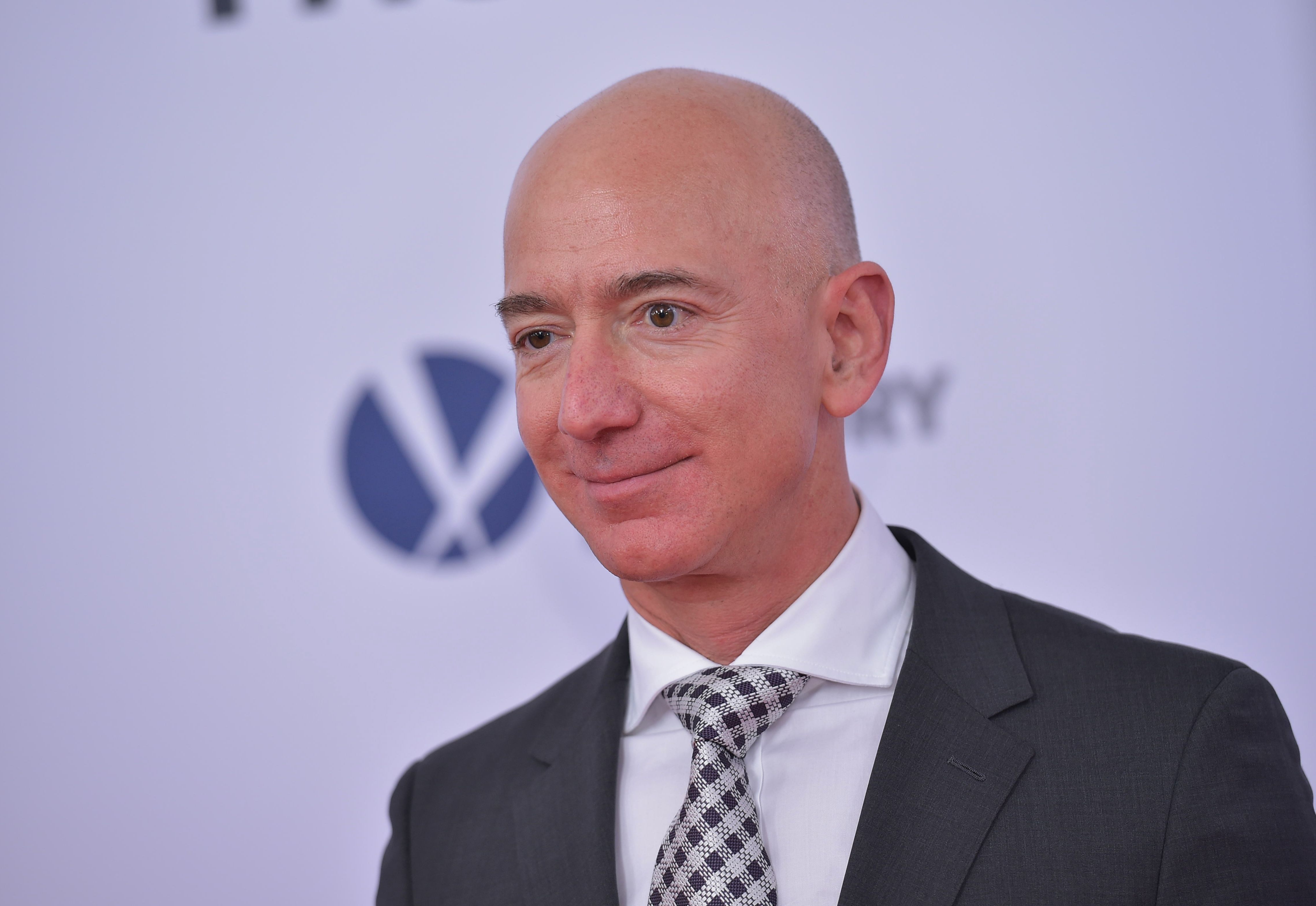

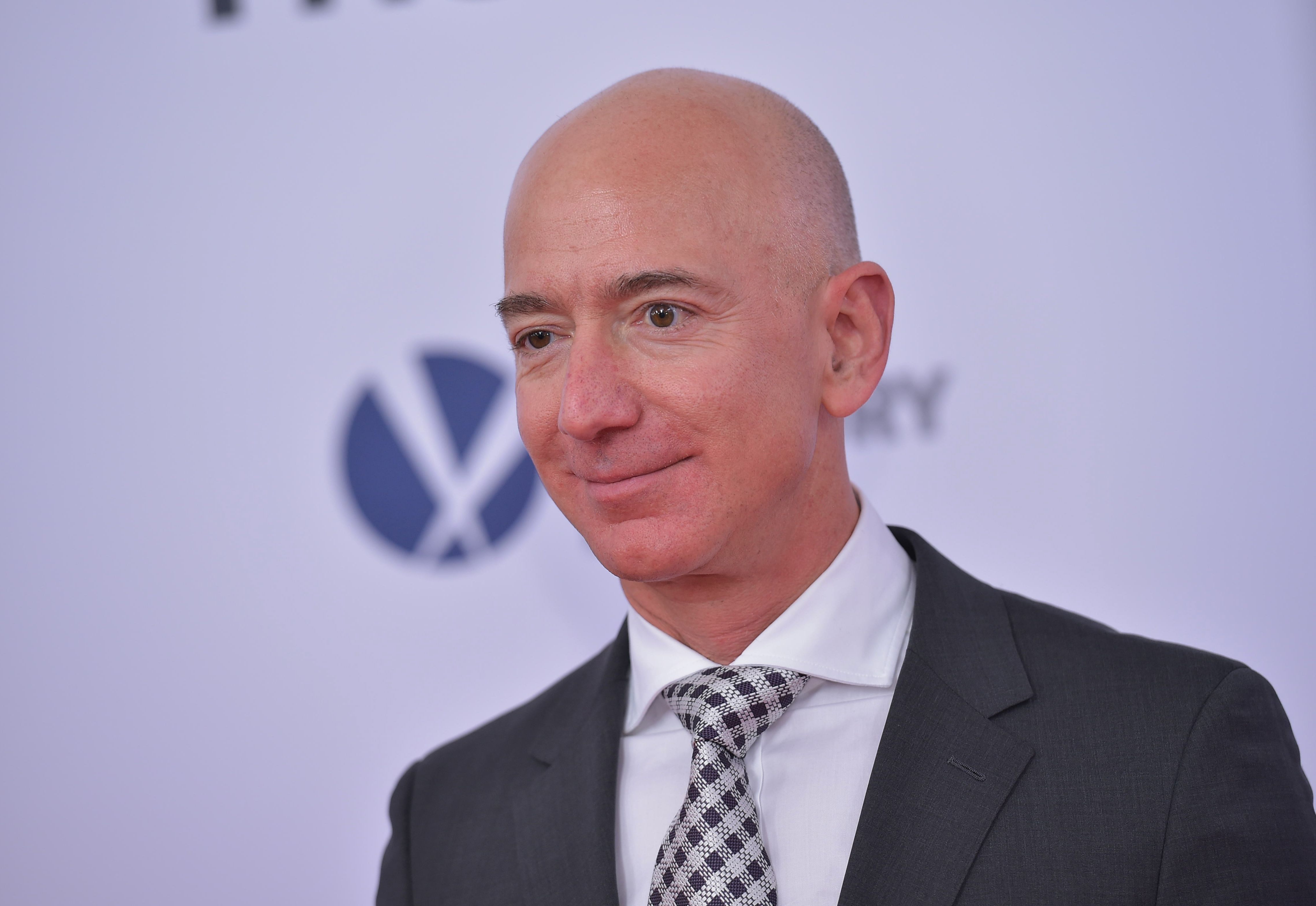

On July 1, according to the 10b5 -1 trading plan submitted by Bezos in March, he recently completed the first Amazon stock sale of the year, transferring 3.3 million shares for US$737 million.

The deal was not a temporary idea, but was part of a systematic reduction plan disclosed in March-under a pre-set 10b5 -1 trading arrangement, he will sell up to 25 million shares in an orderly manner over the next year.Amid the overall rise in U.S. stocks, Amazon's share price has risen more than 8% since the plan was announced, and this transaction coincides with a periodic high.

Since 2002, he has sold a total of about US$44 billion in Amazon shares, but he has few purchases. The most recent purchase of his own shares dates back to two years ago.

Bezos's "burning money" direction

Bezos's wealth migration map clearly points in two major directions.

Blue Origin, as the carrier of its space dream, consumes more than US$2 billion in operating capital every year.Although the New Glenn rocket successfully made its first flight in January this year, the company announced a layoff of 10%(about 1400 people) the next month, focusing on improving rocket manufacturing and launch efficiency to catch up with SpaceX.Some of the funds cashed out this time will continue to fill this "money-burning black hole"-as the sole shareholder of Blue Origin, Bezos needs to continue to transfuse blood to make up for the funding gap outside the federal government contract.

Another path leads to charity: From March to June 2025, he sent approximately US$190 million in value to non-profit organizations through stock donations, including injecting capital into existing charitable channels such as the Bezos Earth Foundation and the First Day Fund.This dual-track capital allocation reflects the shift in focus of his life in the post-Amazon era-gradually withdrawing from the e-commerce empire he was founded for 30 years, and towards space exploration and social influence investment.

It is worth noting that the disclosure of this reduction plan is thought-provoking-coinciding with a critical moment when Amazon warned of the impact of the trade war on performance.The company made it clear that the Trump administration's tariff policy has led to increased supply chain costs and reduced profit margins, and expects net sales and operating profit to be lower than Wall Street expectations.Geopolitical risks and founder sales have created dual pressures, although Amazon's fundamentals are still resilient: AWS cloud services 'annualized revenue reached US$117 billion, advertising business grew 19% year-on-year, and a new generation of artificial intelligence-driven warehousing robots are improving by 75% Order processing efficiency-but the market seems to have chosen to ignore these benefits, and the stock price is still 7.8% lower than its historical high in February.

Amazon grew slowly in the first quarter

In the first quarter of this year, Amazon's profits were generally stable, with net sales of US$155.67 billion, a year-on-year increase of 8.6%. Analysts expected US$155.16 billion, an increase of approximately 10% in the fourth quarter; diluted earnings per share (EPS) in the first quarter was US$1.59, a year-on-year increase of approximately 62.2%. Analysts expected US$1.36, an increase of 86% in the fourth quarter; Capital expenditure was US$25.02 billion, a year-on-year increase of approximately 67.6%, and an increase of 90.8% in the fourth quarter.; Operating profit was US$18.405 billion, a year-on-year increase of 20.2%. Analysts expected US$17.51 billion, an increase of 61% in the fourth quarter; operating profit margin in the first quarter was 11.8%, analysts expected 11.2%, and 11.3% in the fourth quarter.

The financial report showed that Amazon's revenue growth in the first quarter was the slowest since the fourth quarter of 2020, and EPS's earnings growth slowed down compared with the previous quarter, but both were stronger than analysts 'expectations.But second-quarter guidance suggests operating profit may fall far short of expectations.

Analysts said that products on Amazon's platform mainly come from China. Faced with the impact of tariffs on retail performance, Amazon is clearly ready for a slowdown in business in the next few months, although "tariffs" were not mentioned when the first-quarter guidance was released in early February.Investors may be disappointed with this profit guidance, which may raise concerns about Amazon's cost of absorbing tariffs.