How is Webull Securities? Comprehensive Review & Account Opening Guide | Recommended Hong Kong & US Stock Broker

Looking for a reliable Hong Kong & US stock broker? This article offers an in-depth review of Webull Securities, covering regulatory qualifications, account opening steps (including documents for beginners), trading fees, and fund security. It also includes a US stock account guide to help beginners easily start investing in Hong Kong & US stocks.

Investing is one of the important ways to achieve personal financial freedom. However, for beginners, facing numerous investment channels and tools, they often feel confused. Especially when you plan to enter the Hong Kong and US stock markets, choosing a reliable broker is particularly important. Today, we will introduce in detail a platform designed specifically for Hong Kong and US stock investors—Webull Securities, helping you understand how to start your investment journey.

I. What is a Hong Kong and US Stock Broker?

Hong Kong and US stock brokers refer to financial institutions that can provide stock trading services for the Hong Kong stock market (such as Hang Seng Index constituent stocks) and the US stock market (including NYSE, NASDAQ, etc.). These brokers not only provide investors with convenient trading platforms but also help investors better manage their asset portfolios through various value-added services. Among numerous options, Webull Securities has attracted widespread attention due to its low commissions and extensive market coverage.

Why Choose the Hong Kong and US Stock Markets?

For novice investors, the Hong Kong and US stock markets offer two core values:

- High-quality asset pool: Hong Kong stocks gather China's core internet companies (such as Tencent, Meituan), while US stocks include global tech giants (such as Apple, Tesla)

- Flexible trading mechanisms: T+0 trading, no price limit, support for multiple types of derivatives

II. Getting to Know Webull Securities: A Safe and Compliant Platform for Hong Kong and US Stock Investments

Introduction to Webull Securities

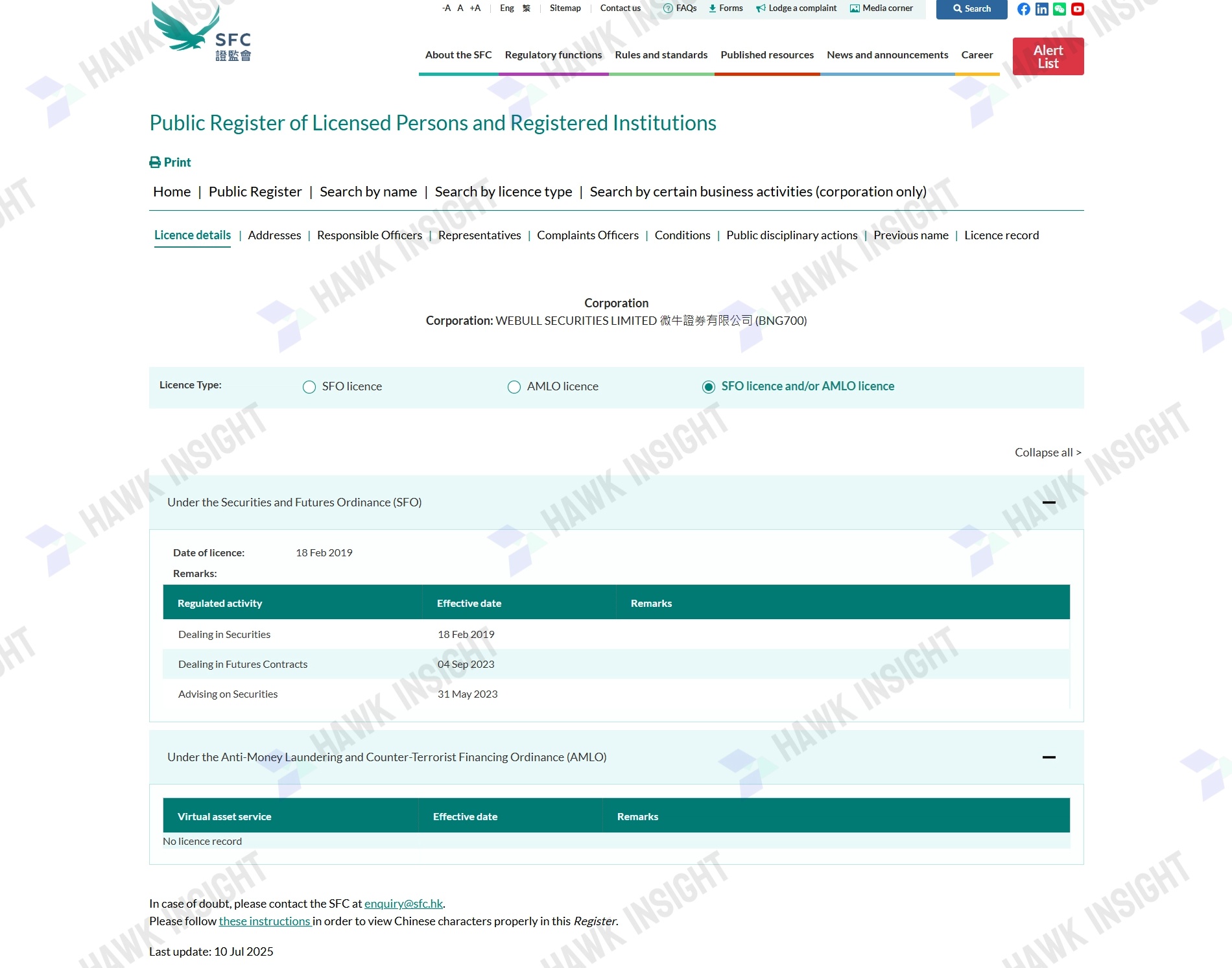

Webull Securities Limited is a licensed corporation regulated by the Securities and Futures Commission (SFC) of Hong Kong, holding Type 1 (Securities Trading), Type 2 (Futures Contracts Trading), and Type 4 (Advising on Securities) licenses. It is committed to providing high-quality investment services to investors. Whether it is Hong Kong stocks or US stocks, Webull can provide you with one-stop solutions.

- Qualifications and Compliance of Webull Securities

- Licensed by the SFC of Hong Kong (Type 1, Type 2, Type 4 licenses, Central Entity Number Central Entity Number BNG700)

- Participant of the Hong Kong Stock Exchange and direct clearing participant of Central Clearing (Numbers 2175 and B02175)

- Fund Security Assurance

- Clients' funds are independently托管于 Citibank, CMB Wing Lung Bank, etc.

- Protected by the Investor Compensation Company Limited, with a maximum compensation of HK$500,000 per account holder

- Covered Markets and Core Advantages

- Supports trading in multiple markets such as Hong Kong stocks, US stocks, A-shares (China Connect), futures, etc.

- Advantage of low commissions (0.02% for Hong Kong stocks, US$0.0045 per share for US stocks, etc.)

- Comprehensive financing services and support for corporate actions

What Can Webull Securities Do?

One of the core advantages of Webull Securities is its extensive market coverage, allowing both novice and experienced investors to find suitable trading instruments:

- Hong Kong stock market: Supports trading of various products such as stocks, ETFs, warrants, bull-bear certificates, and inline warrants, meeting the investment needs of different risk appetites.

- US stock market: Covers stocks, ETFs, options, including night trading sessions, providing convenience for investors who cannot trade during the day.

- A-share market (China Connect): Through Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect channels, investors can conveniently participate in A-share trading without opening a separate A-share account.

- Futures market: Includes Hong Kong futures (such as Hang Seng Index Futures, Mini Hang Seng Index Futures), US futures (such as WTI crude oil, gold futures), and Hong Kong index options and other derivatives, providing hedging tools for professional investors.

In terms of transaction costs, Webull Securities has a significant advantage of low commissions: the commission for Hong Kong stocks through electronic channels is only 0.02% (minimum HK$2), the commission for US stock trading is US$0.0045 per share (minimum US$0.89), and the commission for option trading is US$0.3 per contract. Many fees have preferential periods, greatly reducing the entry cost for beginners.

How is Webull Securities?

Webull Securities is a compliant and reliable Hong Kong and US stock broker, holding Type 1, Type 2, and Type 4 licenses from the SFC of Hong Kong (Central Entity Number BNG700). It is also a participant of the Hong Kong Stock Exchange and a direct clearing participant of Central Clearing, with verifiable qualifications.

Fund security is guaranteed. Clients' funds are independently托管于 Citibank, CMB Wing Lung Bank, etc., segregated from the company's own funds, and protected by the Hong Kong Investor Compensation Fund, with a maximum compensation of HK$500,000 per account holder.

It covers a wide range of trading markets, supporting Hong Kong stocks, US stocks, A-shares (China Connect), futures, etc. It also has cost advantages: the electronic commission for Hong Kong stocks is 0.02% (minimum HK$2), the commission for US stocks is US$0.0045 per share, and the commission for options is US$0.3 per contract, making it suitable for beginners to start with low costs.

Overall, it is highly compliant, secure, and cost-effective, making it a practical choice for beginners investing in Hong Kong and US stocks.

III. Complete Account Opening Process for Webull Securities (with Beginner's Operation Guide)

Preparation Before Account Opening

Before formally opening an account, please prepare the necessary documents, such as identification (ID card or passport), address proof (bills or residence permit issued in the last three months). For non-Hong Kong residents, corresponding address proof materials are also required.

- Basic documents:

- Hong Kong region: Hong Kong permanent/non-permanent identity card;

- Macau region: Macau identity card;

- Other regions: Passport or English version of ID card.

Attachment: Examples of valid proof images

- Address proof: It must be a valid document issued within the past 3 months, containing four elements—your name, residential address (cannot be a commercial or industrial building address), issuing institution (such as bank, water, electricity, gas company), and issue date. Common forms include bank statements, electricity bills, gas bills, credit card statements, etc. If your current address is the same as the address on your ID card, you can directly use your ID card as address proof.

- Special cases: If you are an employee of an SFC-licensed corporation or registered institution (such as a broker, bank), you need to provide an employer's consent letter, which should include personal information, company name, account opening permission instructions, company seal, and date (valid for 1 month).

Detailed Account Opening Steps

- Step 1: Enter the main interface of Webull Securities, click the "Open Account Now" button, and select the account opening region (Hong Kong, Macau, or other regions) according to your documents.

- Step 2: Fill in personal information, including employment status, company name, position, etc. If you are an employee of a licensed institution, select "Yes" and upload the employer's consent letter.

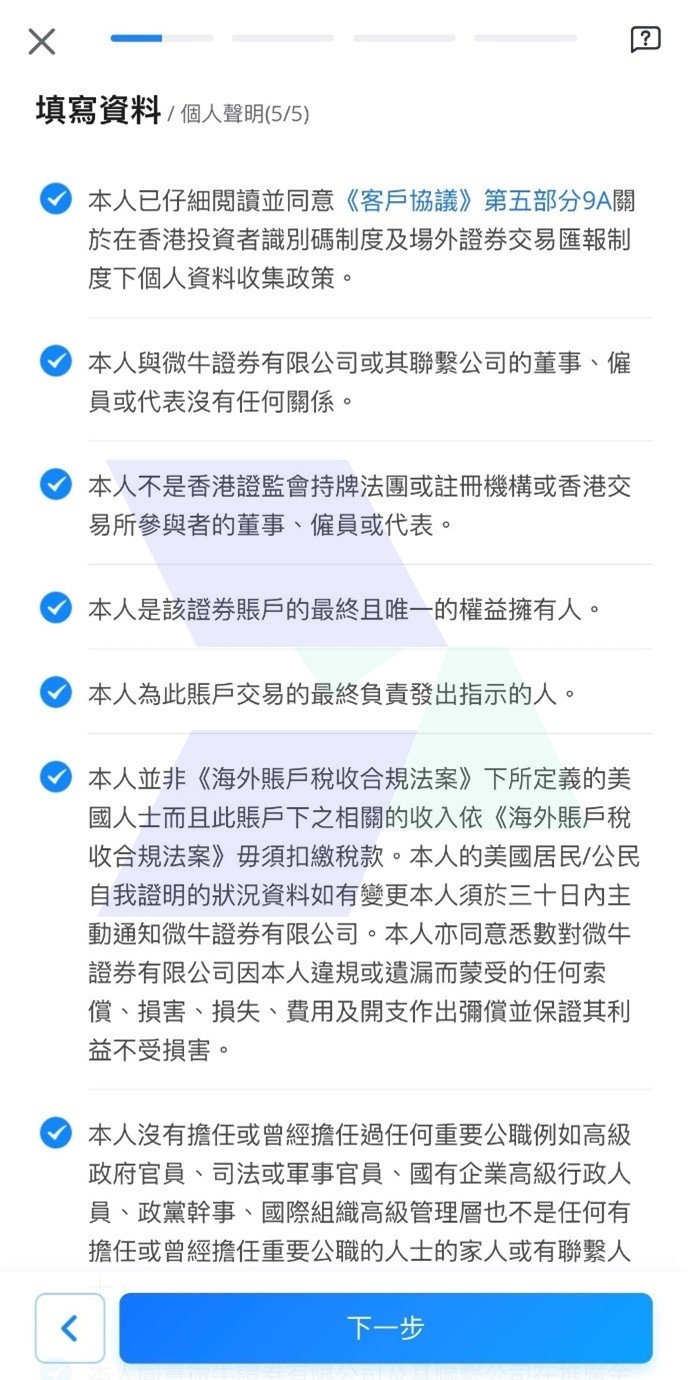

- Step 3: Complete the personal declaration and risk assessment. The personal declaration requires confirmation of having read and agreed to relevant policies, and the risk assessment helps the platform understand the investor's risk tolerance to ensure that investment products match the risk preference.

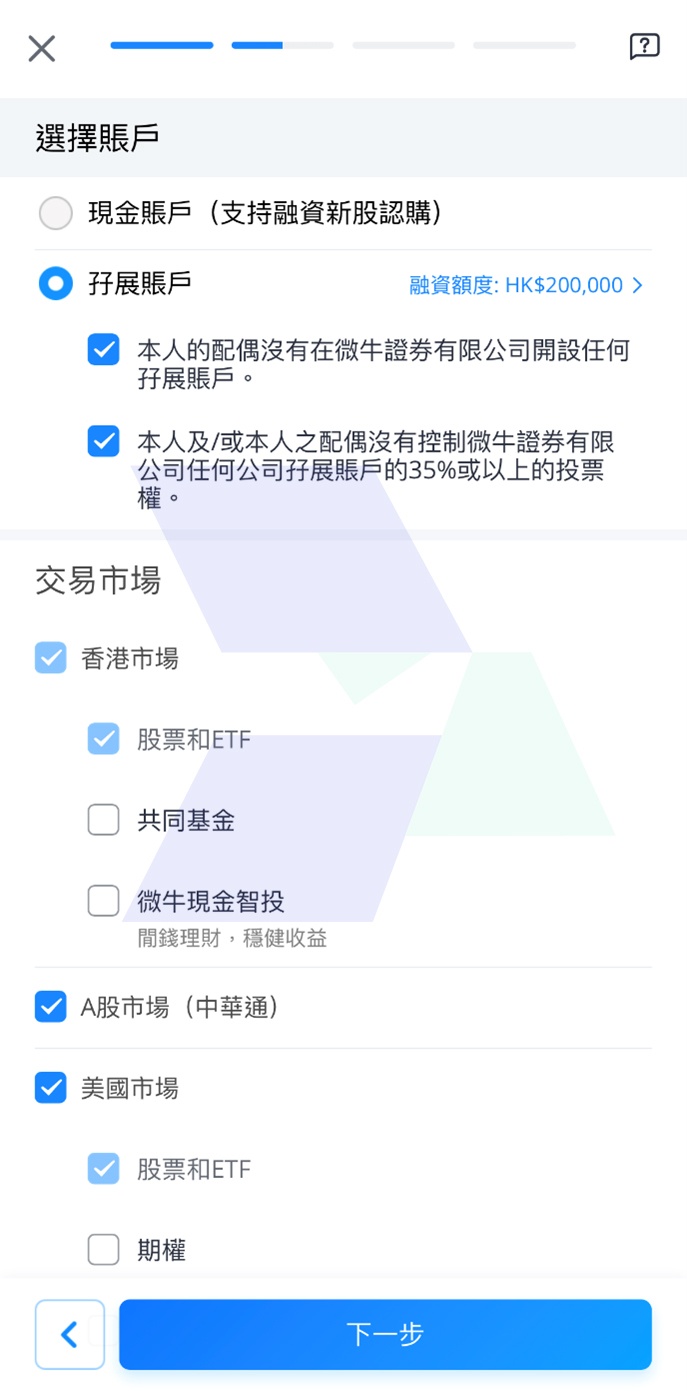

- Step 4: Select the account type and trading market. Webull offers two types of accounts: cash account (supporting margin IPO subscription) and margin account (with a credit limit, such as HK$200,000 in the example). Trading markets can be selected as Hong Kong stocks, US stocks, A-shares (China Connect), etc. Among them, "Hong Kong stocks" is mandatory, and other markets can be checked according to needs.

- Step 5: Identity verification. This is a core step in account opening, which can be completed through one of the following two methods:

- FPS (Fast Payment System) method: Complete identity verification through FPS, following the guidelines.

- Online transfer verification: Use a同名 Hong Kong bank account to transfer at least HK$10,000 / RMB10,000 / US$1,300 to the designated account of Webull. After the transfer, you need to upload the remittance voucher containing the amount, account number, and transaction number. Identity verification is completed after the funds arrive. If the account opening fails, the funds will be returned by the original route.

|

|

|

|

- Step 6: Submit the materials and wait for review. If the materials are complete, the review will be completed within 1-3 working days. You will be notified through in-app notifications, SMS, or email after the account is successfully opened.

Notes for Account Opening

- Transfer verification must use a Hong Kong bank account with the same name as the account opener. Cash, third-party transfers, and transfers through non-Hong Kong local banks are not accepted.

- The address in the address proof must be a valid residential address; commercial addresses or industrial building addresses will be rejected.

- Interbank transfers may incur bank fees. It is necessary to consult the opening bank in advance to avoid insufficient transfer amount due to fees.

- If the account opening review is delayed or rejected, you can submit a question through the "Help Center" in the App, or wait for customer service to contact you via phone/email for supplementary information.

IV. In-depth Review of Webull Securities: Fees, Functions, and User Experience

Analysis of Core Transaction Fees

- Hong Kong stocks: In addition to a 0.02% commission, a platform fee of HK$13 per order is charged, plus government and regulatory fees such as stamp duty (0.1%, some products are exempt), transaction levies, etc.

- US stocks: In addition to commissions for stock trading, a platform fee of US$0.0045 per share is charged; for option trading, a platform fee of US$0.5 per contract is charged, and SEC fees and transaction activity fees are payable when selling.

- A-shares (China Connect): The electronic channel commission is 0.02% (minimum RMB2), a platform fee of RMB15 per order is charged, and a 0.05% stamp duty is charged when selling (ETFs are exempt).

| Example of Hong Kong Stock Transaction Fees (HK$10,000 transaction amount) | ||

| Fee Item | Calculation Method | Actual Fee Charged |

| Commission (electronic channel) | 0.02%*10000=2 | HK$2 |

| Platform Fee | Fixed charge | HK$13 |

| Stamp Duty (when selling) | 0.1%*10000=10 | HK$10 |

| Total Fees | Approximately 0.25% | HK$25 |

Featured Functions

Financing Services:

- The financing rate for Hong Kong stock margin accounts is P+1% (P is Standard Chartered's best lending rate), and the overdraft rate for cash accounts is P+5%.

- The financing rate for US stock margin accounts is BM+4.8% (BM is the US Effective Federal Funds Rate), and the overdraft rate for cash accounts is BM+10.25%.

- The lending rate for A-share related is LPR+6.55% (LPR is China's 1-year Loan Prime Rate).

Deposit and Withdrawal Fees:

- Deposit: FPS transfers arrive instantly, Webull does not charge fees, but banks may charge handling fees.

- Withdrawal: No fee is charged by Webull for withdrawals to local Hong Kong banks; for wire transfers to overseas banks, Webull charges a handling fee of HK$50 per transaction, and bank fees are deducted from the withdrawal amount.

Value-added Services

Webull Securities provides comprehensive agency services, including collecting cash dividends (rate 0.2%, minimum HK$30 / RMB30 / US$30), handling bonus shares, voting at shareholders' meetings (HK$50 per time), etc., ensuring that investors do not miss important corporate actions. For US ADRs (American Depositary Receipts), it also provides custodian fee payment services, with a rate of US$0.01-0.05 per share.

Suitable for

- Novice investors (low threshold, simple process)

- Users with multi-market allocation needs (one-stop trading for Hong Kong stocks, US stocks, A-shares)

- Investors who value fund security and compliance

V. Frequently Asked Questions (FAQ)

- How long does it take to open an account with Webull Securities?

- With complete materials, the review is completed within 1-3 working days

- Which markets can I trade after opening an account with Webull Securities?

- Supports Hong Kong stocks, US stocks, A-shares (China Connect), futures, options, etc.

- How to deposit and withdraw funds with Webull Securities?

- Deposit: FPS transfers arrive in as fast as 1 minute, no fee charged by Webull

- Withdrawal: No fee charged by Webull for local banks; overseas wire transfers are charged HK$50 per transaction

- Can an ID card be used as address proof?

- If the current residence address is the same as the address on the ID card, the ID card can be used as address proof

- Which account type is recommended for beginners opening an account for the first time?

- It is recommended to choose a cash account (supports margin IPO subscription), and you can upgrade to a margin account after getting familiar with it

- Is there a time limit for transaction commission discounts?

- The 0 commission discount has a time limit, subject to platform notifications

Conclusion: Choose Webull to Start Your Hong Kong and US Stock Investment Journey

For beginners, the first step in investing in Hong Kong and US stocks is to choose a compliant, low-cost, and easy-to-operate platform. With its full licenses from the SFC of Hong Kong, fund segregation and custody mechanism, low commission advantages, and convenient account opening process, Webull Securities has become an ideal choice for beginners.

Of course, investment involves risks. Regardless of the platform chosen, rational decisions must be made on the basis of fully understanding market rules and one's own risk tolerance. It is hoped that the analysis in this article can help you smoothly start your Hong Kong and US stock investment journey and move forward steadily in global asset allocation.

Recommended Reading

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.