The unexpected rebound in the U.S. market has become a key engine of growth.

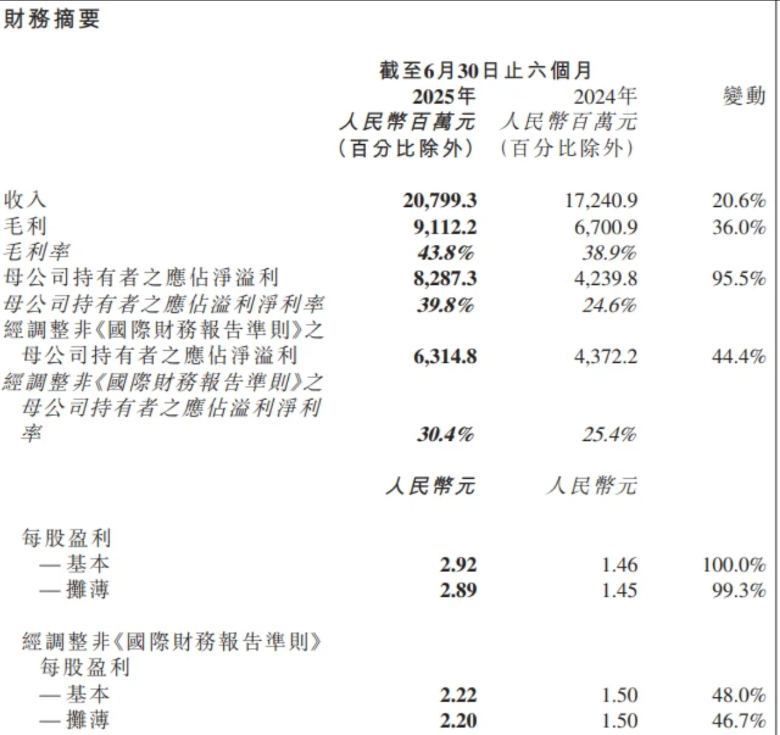

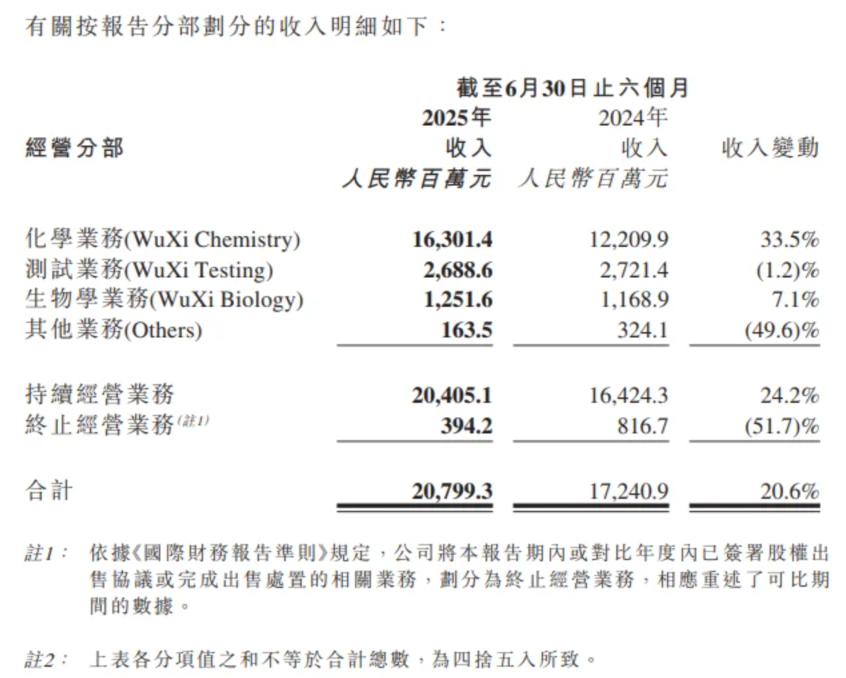

On July 28, WuXi AppTec announced its first half of 2025 results.Financial report data showed that during the reporting period, the company's operating income reached 20.799 billion yuan (RMB, the same below), a year-on-year increase of 20.64%. Among them, single-quarter revenue in the second quarter exceeded the 10 billion mark for the first time, reaching 11.14 billion yuan; What is even more surprising is that attributable net profit soared 101.92% year-on-year to 8.561 billion yuan, far exceeding industry expectations; gross profit margin increased by 5.5 percentage points year-on-year, reflecting a substantial improvement in production capacity efficiency in post-clinical and commercial projects.Based on this, management decisively raised its annual revenue guidance to 42.5 - 43.5 billion yuan, raised its forecast for the growth rate of continuing operations from 10-15% to 13-17%, and simultaneously raised the free cash flow target to 5 - 6 billion yuan.

In the first half of the year, the unexpected rebound in the U.S. market became a key engine of growth.During the reporting period, the company's revenue from U.S. customers reached 14.03 billion yuan, a year-on-year surge of 38.4%, and the proportion of continuing operating income climbed to 68.7%.This data is of great significance. It not only reversed the stagnation of growth caused by geopolitical factors last year, but also significantly offset the negative impact of a 5.2% decline in market revenue in China.Combined with the forward-looking indicator that orders on hand increased by 37.2% year-on-year to 56.69 billion yuan, U.S. biomedical R & D demand is accelerating to return to leading CXO companies in China.In the past 12 months, the company has synthesized and delivered more than 440,000 new compounds to customers around the world. In the first half of the year alone, it achieved 158 R-to-D conversion molecules, reserving abundant pipelines for back-end commercial production.

The strong performance of the chemical business has built the second growth pole.Revenue from this segment was 16.3 billion yuan, a year-on-year increase of 33.5%, of which revenue from small molecule CDMO(D&M) business was 8.68 billion yuan, an increase of 17.5%; of more strategic significance, revenue from TIDES business (oligonucleotides and peptides) soared to 5.03 billion yuan, a year-on-year increase of 141.6%, and orders on hand increased by 48.8%.The financial report shows that the total number of WuXi AppTec small molecule D&M pipelines currently reaches 3,409, including 76 commercial projects and 84 clinical Phase III projects; while the number of TIDES service molecules increased by 16% year-on-year, and the number of customers increased by 12%.Changzhou and Taixing API bases have passed FDA inspections with zero defects. It is expected that by the end of 2025, the volume of the small molecule API reaction vessel will exceed 4,000 kL, and the volume of the polypeptide solid phase synthesis reaction vessel will expand to exceed 100,000 L.

In terms of regions, although the shadow of the U.S. Biosecurity Act still hangs, WuXi AppTec has effectively dispersed risks through diversification of its customer structure-revenue in Europe increased by 9.2%, and in other regions increased by 7.6%.What is more noteworthy is that the company has adjusted its regional business management structure and split the original American region into North America and Latin America. This move can not only refine the operation of the U.S. market, but also reserve interfaces for emerging markets to expand.

On the financial front, the company is entering a cycle of improving earnings quality.The mid-term dividend payment plan plans to pay 3.5 yuan for every 10 shares, for a total distribution of 1.003 billion yuan, a record high for the same period in history.

Zhongtai Securities pointed out in its latest research report that global pharmaceutical R & D demand continues to improve, and multiple factors at home and abroad are driving the industry's recovery.The first is the improvement of global demand: Under the overseas interest rate cut cycle, global pharmaceutical investment and financing expectations are expected to improve.Overseas clinical CRO leaders Medpace, CDMO giant Lonza, Samsung Biotech and Bachem have all raised their annual growth guidelines.Secondly, there is domestic marginal improvement: domestic RRR cuts and interest rates, the implementation of large-scale BD transactions for innovative drugs and the improvement of the financing environment are expected to drive domestic investment, financing and CRO demand to pick up.