Insider Buying Surge: A Bullish Signal for Stocks?

Corporate Insiders Buy Stocks in Bulk! Bottom-Fishing Signal?The trade war has caused setbacks for U.S. stock market bulls. So, what should investors do next? Perhaps take a look at the actions of cor

Corporate Insiders Buy Stocks in Bulk! Bottom-Fishing Signal?

The trade war has caused setbacks for U.S. stock market bulls. So, what should investors do next? Perhaps take a look at the actions of corporate insiders, who are often referred to as smart money. After all, insiders know their companies better than anyone.

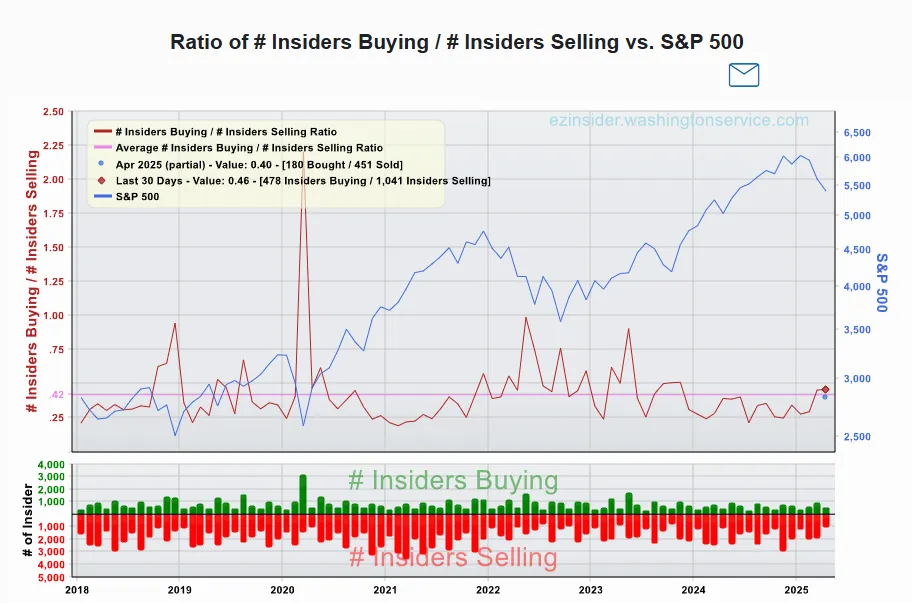

Data shows that company insiders are buying stocks at the fastest pace in 16 months, with this trend accelerating since April. According to data compiled by Washington Service, in the first two weeks of April, around 180 company insiders bought their own company stock, pushing the buy-to-sell ratio to 0.40, a high not seen since the end of 2023. This suggests that insiders are confident in their companies, offering reassurance to investors who have been hit hard by market volatility.

This is a positive signal, said Matt Lloyd, Chief Investment Strategist at Advisors Asset Management. Given the uncertainty around trade and the economy, investors remain trapped in a negative feedback loop. Therefore, the continuation of this trend is critical as the market attempts to find its footing.

Insider buying and selling behavior has historically been seen as an early signal of market direction. In August 2015 and late 2018, the insiders' buy-to-sell ratio spiked, with the former indicating a market bottom and the latter occurring simultaneously with one. In March 2020, insider buying correctly signaled the bottom of the bear market plunge. Typically, corporate insiders net-sell stocks because executives need to cash out to support their personal lives.

This time, cash levels have shown their largest two-month increase since the height of the pandemic, according to bank of america, which could bode well for stocks when sentiment turns around. The money they're sitting on could be used to buy stocks, and Patrick Armstrong, Chief Investment Officer at Plurimi Wealth, argues that now is precisely the time to build equity exposure. "The fact that insiders are scooping up their shares, cash levels are climbing, and sentiment is extremely bearish is an early indicator that the market selloff is starting to make stocks more attractive," Armstrong said.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.