Cybersecurity Firm Netskope IPOs Today With Appealing Valuation: What You Need to Know

WATCH: Former OpenAI Exec: The SHOCKING Truth About AINetskope is set to debut on the Nasdaq Thursday under the ticker “NTSK,” after pricing its IPO shares at $19 — the top of its expected range — val

Netskope is set to debut on the Nasdaq Thursday under the ticker “NTSK,” after pricing its IPO shares at $19 — the top of its expected range — valuing the firm at about $7.3 billion. The share sale raised $908.2 million, making it one of the year’s most closely watched listings in the software sector.

Founded in 2012 and headquartered in Santa Clara, California, the company is led by co-founder and CEO Sanjay Beri, a former Juniper Networks executive. Netskope employs nearly 3,000 people and serves over 4,300 customers across 90 countries, including more than 30% of the Fortune 100 and about 18% of the Forbes Global 2000.

The company has built strong partnerships with tech leaders such as Amazon, CrowdStrike, Google, Microsoft, Okta, Telstra, and MetTel. Its flagship product, Netskope One, is a cloud-based platform that leverages artificial intelligence to detect and control sensitive data, allowing enterprises to prevent risky actions — such as employees inputting corporate data into personal AI tools like ChatGPT — and redirect them to secure, corporate-approved systems.

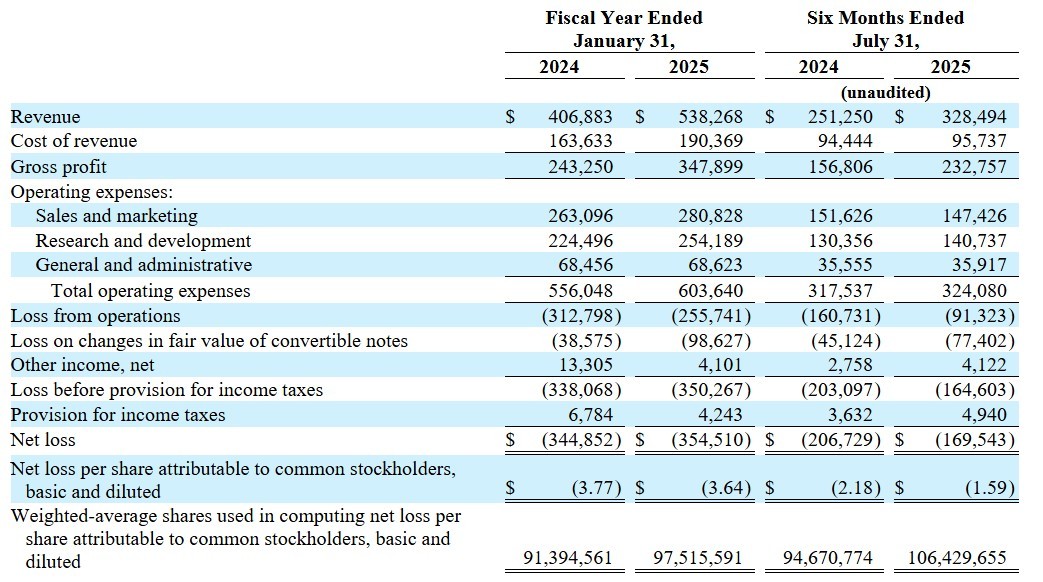

Netskope’s annual recurring revenue rose 33% year-over-year to $707 million as of July 31, with a net retention rate of 118% — highlighting strong customer satisfaction and upsell momentum. Revenue for the six months ended July 31 increased 31% to $328 million, with gross margins of 70.7%, in line with leading SaaS peers.

Still, the company is unprofitable. Netskope reported a net loss of $170 million in the latest six-month period, narrower than the $207 million loss a year earlier. Its IPO filing also highlighted an operating cash flow margin of 3% and an incremental operating margin of 74% in its latest quarter, underscoring efficiency gains.

Investor enthusiasm for Netskope comes amid growing fears that artificial intelligence will both accelerate cyberattacks and drive greater spending on security software. According to Morgan Stanley, security-focused software stocks have outperformed the broader software sector this year, with analysts expecting cybersecurity budgets to grow faster than overall IT spending.

“Investors continue to favor security as a safe haven in software,” Morgan Stanley analysts wrote in a report. The bank, alongside JPMorgan Chase and others, is leading Netskope’s IPO.

At a $7.3 billion valuation, Netskope trades at roughly 11 times sales — a discount compared with security peer CrowdStrike, which commands a price-to-sales ratio of about 24. That relative value, combined with its growth trajectory, positions Netskope as a potentially attractive play on the accelerating demand for AI-driven cybersecurity solutions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.