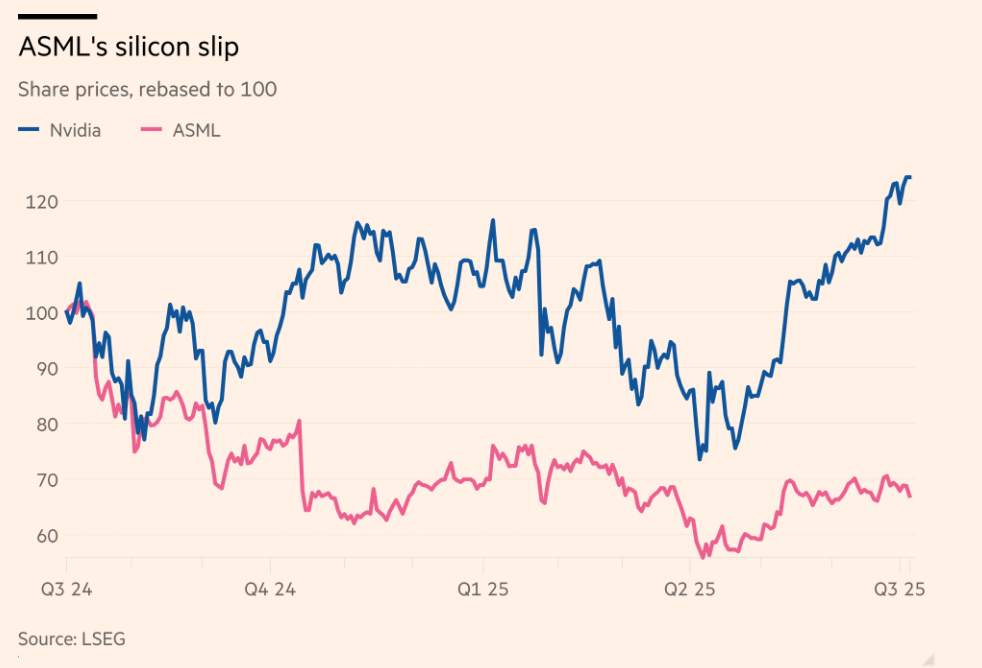

Nvidia Soars Past $4 Trillion, Why Is ASML Falling Behind?

Nvidia made history on Wednesday as its market capitalization surged past $4 trillion, setting a new all-time record for the highest valuation of any publicly traded company. But as Nvidia’s meteoric

Nvidia made history on Wednesday as its market capitalization surged past $4 trillion, setting a new all-time record for the highest valuation of any publicly traded company. But as Nvidia’s meteoric rise continues, one of its most essential chip suppliers—ASML—is noticeably lagging. What’s holding ASML back?

In the world of semiconductors, it’s no exaggeration to say that ASML’s importance is on par with Nvidia’s. Whether it's the high-performance GPUs powering artificial intelligence in data centers or the tiny chips used in household appliances like refrigerators, almost all of them are manufactured using ASML’s lithography equipment. For the lower-end chips in refrigerators and washing machines, Nvidia doesn’t even play a role, but ASML does.

ASML, however, operates a very different business model: high price tags and low sales volumes. Its newest high numerical aperture (NA) extreme ultraviolet (EUV) lithography machines carry a jaw-dropping price of €380 million (about $450 million) each. The revenue from such expensive equipment is highly volatile—if a customer delays just one order, it's equivalent to 8,000 car buyers postponing their purchase of a Tesla.

After several years of aggressive expansion, ASML’s key customers are showing greater caution around capital expenditure. Taiwan Semiconductor Manufacturing Co. (TSMC), one of ASML’s largest clients, is tightening its spending. Intel, in April, slashed its capital expenditure plans by $2 billion, while Samsung Electronics’ capex this year is set to come in below last year's $39 billion.

The political landscape has also become increasingly challenging. Washington is trying to curb China’s technological rise by banning ASML from selling its most advanced machines to Chinese firms. Instead, China has been purchasing less advanced but more profitable deep ultraviolet (DUV) lithography machines, which typically account for around a quarter of ASML’s sales. Last year, additional orders pushed DUV machines’ share of revenue close to 50%. Should the U.S. tighten export restrictions further, ASML could face even greater damage.

At the same time, local competition from Chinese companies is intensifying. For example, Shenzhen government-backed SiCarrier claims to have developed lithography technology capable of producing less advanced chips, eating into ASML’s market share.

The good news for ASML is that its technological lead remains solid—perhaps even more secure than Nvidia’s. That’s because Nvidia’s own customers are increasingly exploring in-house chip development. By contrast, ASML’s customers like TSMC and Samsung are not canceling orders—they are merely delaying them.

ASML’s most advanced machines help customers improve manufacturing efficiency. For instance, Intel estimates that ASML’s cutting-edge systems reduce the number of process steps on a given chip layer from 40 to just 10. Ultimately, customers will return to ASML’s embrace.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.