The demand for "long-term thinking and computing power" caused by inferential AI will be a hundred times greater than that during the training stage.

On July 9, U.S. stocks jumped to an all-time high of US$164.42 in early trading on Wednesday, and its market value broke through the US$4 trillion mark-a figure that exceeded the total market value of stocks in any country in the United Kingdom, France or Germany, equivalent to 70% of the annual GDP of Japan, the world's third-largest economy.

The law of computing power expansion behind DeepSeek's "disenchantment"

At the beginning of the year, China start-up DeepSeek launched the R1 model to achieve high-performance reasoning at extremely low cost, which once triggered market concerns about shrinking demand for NVIDIA GPUs, causing its market value to evaporate by 20% in a single week.However, Huang Renxun's coping strategy reveals a deeper logic: the demand for "long-term thinking and computing power" caused by inferential AI will be a hundred times greater than that during the training stage.When the number of tokens processed by DeepSeek-R1 per query surged to 100 times that of traditional LLM, its economy turned into hunger for hardware performance.

IDC data supports this trend-global AI infrastructure spending will explode from US$50 billion in 2023 to US$350 billion in 2027, with a compound annual growth rate of 60%.Nvidia relies on its Blackwell architecture GB200 system and NVLink 5.0 technology to achieve 1.5TB/s in-rack bandwidth, and a single computing power of 1.2EFLOPS (billions of cycles), becoming the core carrier to undertake this wave of demand.

Nvidia's dominance is most intuitively reflected in its supply chain control.

The GB200 will be mass-produced in Q2 of 2025, with a weekly output of nearly 1,000 NVL72 racks. The next generation GB300 will be put into production in Q4. The price of a single unit will exceed US$300,000. Annual shipments are expected to surpass that of the iPhone-this triggered an East Asian manufacturing earthquake: Foxconn won 60% of orders based on its vertical integration advantage and built a new dedicated factory with an annual output of 500,000 units in Mexico; TSMC's CoWoS packaging production capacity increased by 150% during the year, more than half of which is supplied to Nvidia; Even Samsung was forced to open up its 3nm process to compete for OEM share.

The more far-reaching impact lies in the technical standards-liquid-cooled cooling and CPO (co-encapsulated optical) interfaces have become standard standards for new servers, forcing giants such as Amazon and Google to upgrade their self-developed TPU cooling solutions from air-cooled to liquid-cooled. Broadcom and Marvell's orders for customized chips surged by 10.When the price of a single equipment is comparable to that of a luxury villa, computing power has been upgraded from a technical factor to a strategic asset.

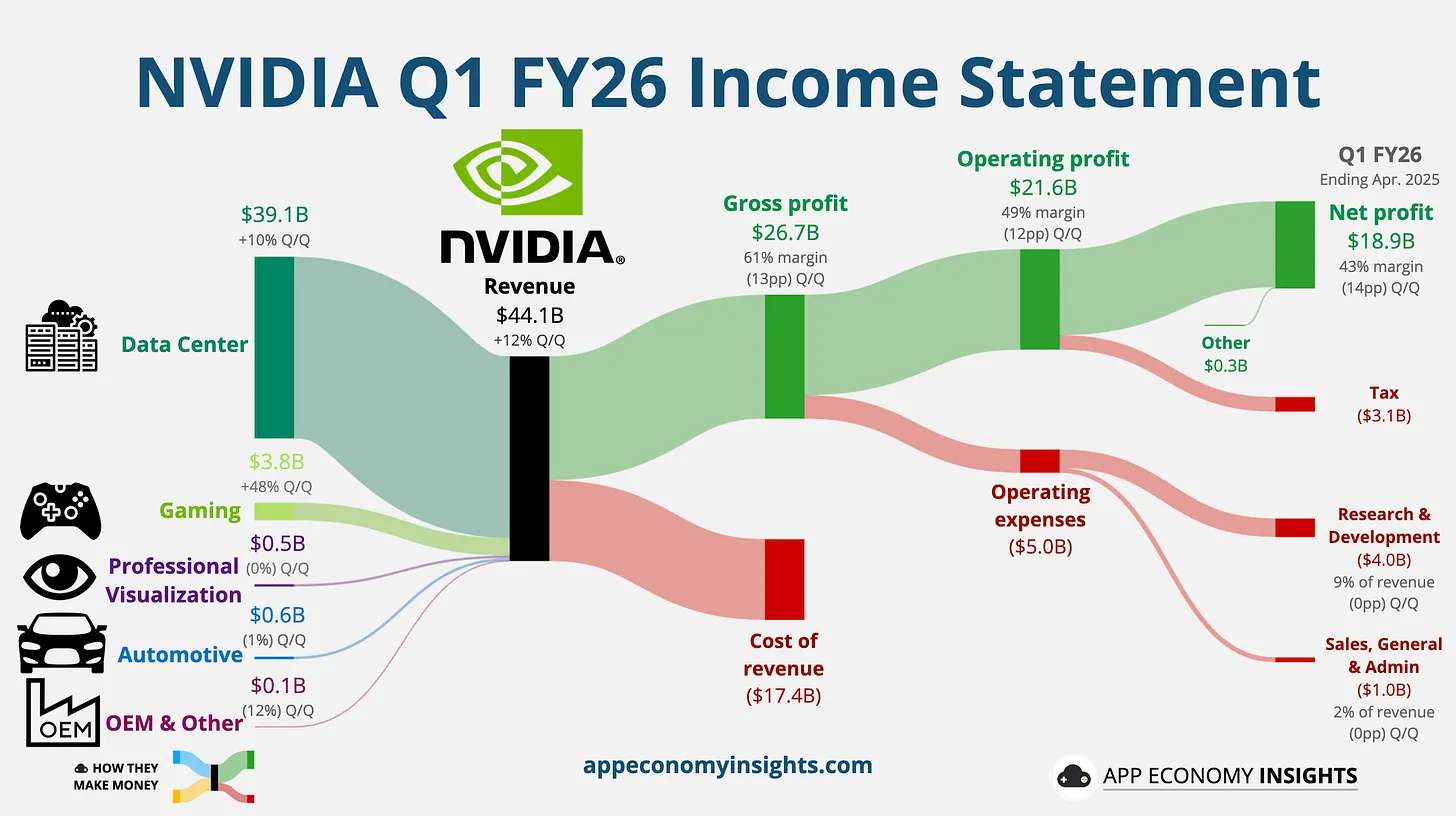

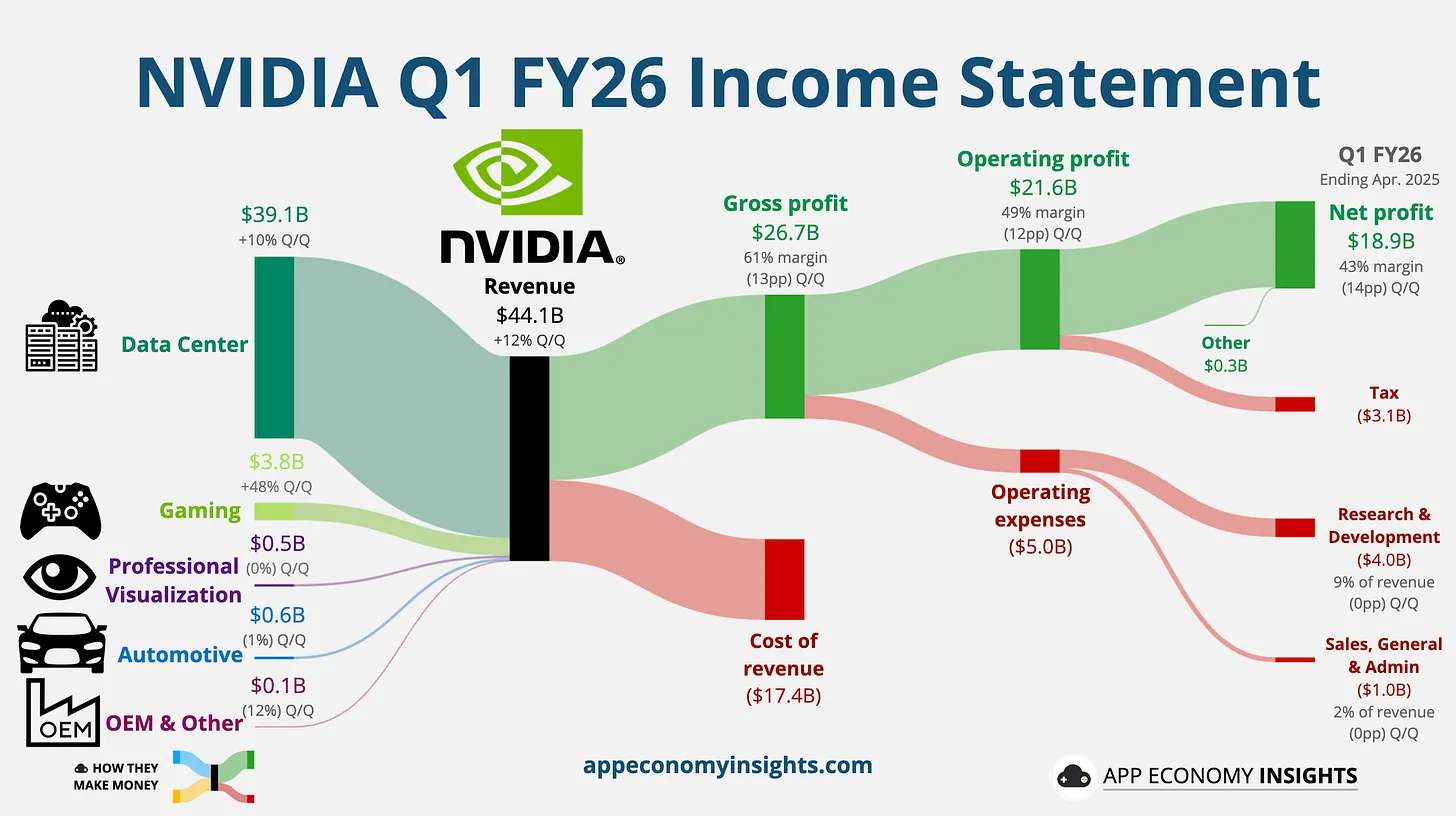

Data centers become strong support for fundamentals

Nvidia's ability to transform the intergenerational advantages of AI technology into the efficiency of financial data is amazing.

Revenue from its data center business soared from US$7.2 billion in fiscal year 2023 to US$39.1 billion in the first quarter of fiscal year 2026, an increase of more than five times in three years, and its share of total revenue jumped from 45% to 89%.

This exponential growth stems from the "chip-software-ecosystem" trinity model it has built: the 4 million developers accumulated by the CUDA platform form a technical barrier, the Tensor Core programmable architecture achieves a balance of versatility and high performance, and the Blackwell supercomputing system achieves a bandwidth of 1.5TB/s through NVLink 5.0 interconnection technology, allowing GPU memory sharing within a single rack to achieve extreme efficiency.

IDC predicts that by 2027, global AI infrastructure spending will surge from US$50 billion in 2023 to US$350 billion, with a compound annual growth rate of 60%.More critical is the rise of demand for sovereign AI: Germany's "AI factory" deploys 10,000 Blackwell GPUs, the Japanese government allocates 2 trillion yen to purchase AI chips, orders from Saudi Arabia and United Arab Emirates have filled the gap in the China market, and Citi predicts that the scale of this field will reach US$563 billion in 2028.

With its 90% AI training market share, Nvidia has become the biggest reaper of this feast.

The next earnings season may be a catalyst

Ken Mahoney, president of Mahoney Asset Management, believes that the next catalyst that may push Nvidia's share price further is the upcoming U.S. stock earnings season.

Mahoney said that everyone will see whether Nvidia will exceed expectations and raise its performance guidance as it has in the past.Nvidia currently trades at about 33 times forward earnings.Mahoney pointed out that Nvidia's valuation is currently below its ten-year average, indicating there is still room for growth."Given their revenue growth, you don't actually think it's that expensive.In fact, stock prices should strive to keep up with earnings growth.”

The second-quarter earnings season for U.S. stocks will officially kick off on July 15.Goldman Sachs expects that the S & P 500 earnings growth will slow significantly in the second quarter from 12% in the first quarter to only 4%, hitting a two-year low, mainly due to shrinking profit margins.The decline in earnings in cyclical industries is expected to be among the top, but the strong performance of technology giants will offset some of the negative impact.

Goldman Sachs expects that the information technology (IT) industry, where Nvidia, Apple and Microsoft are located, are expected to grow by 18%, and the communications services industry, where Alphabet and Meta are located, is expected to grow by 28%, which will support the overall profit growth of the S & P 500.